This week, we examine Ethereum, Ripple, Cardano, Solana, and Hype in greater detail.

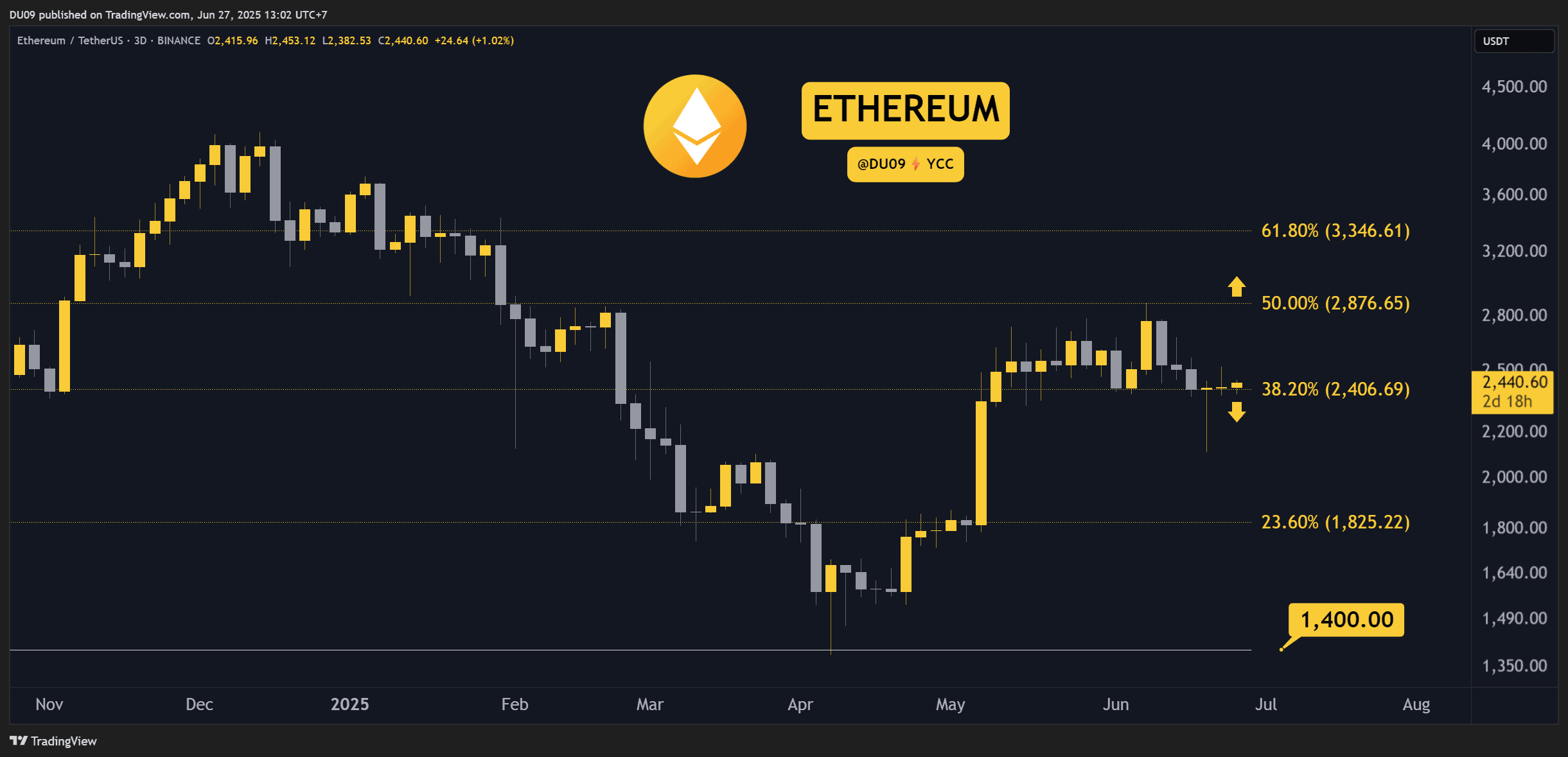

Ethereum ($ETH)

Ethereum closed the week with a 5% loss, but it managed to stay above the $2,400 support after a volatile period. This puts it back into a range that has been ongoing since early May, despite a brief visit to $2,100 recently.

On the daily timeframe, the MACD is about to create a bullish cross. If confirmed later, this could serve as a catalyst for higher price levels. The current resistance is found at $2,800, and buyers have to break above it if they want $ETH to enter a sustained rally.

With Bitcoin sitting comfortably above $100K, the market remains optimistic. Ethereum could be a good performer in the second half of 2025, considering it has already completed a major correction between January and April of this year.

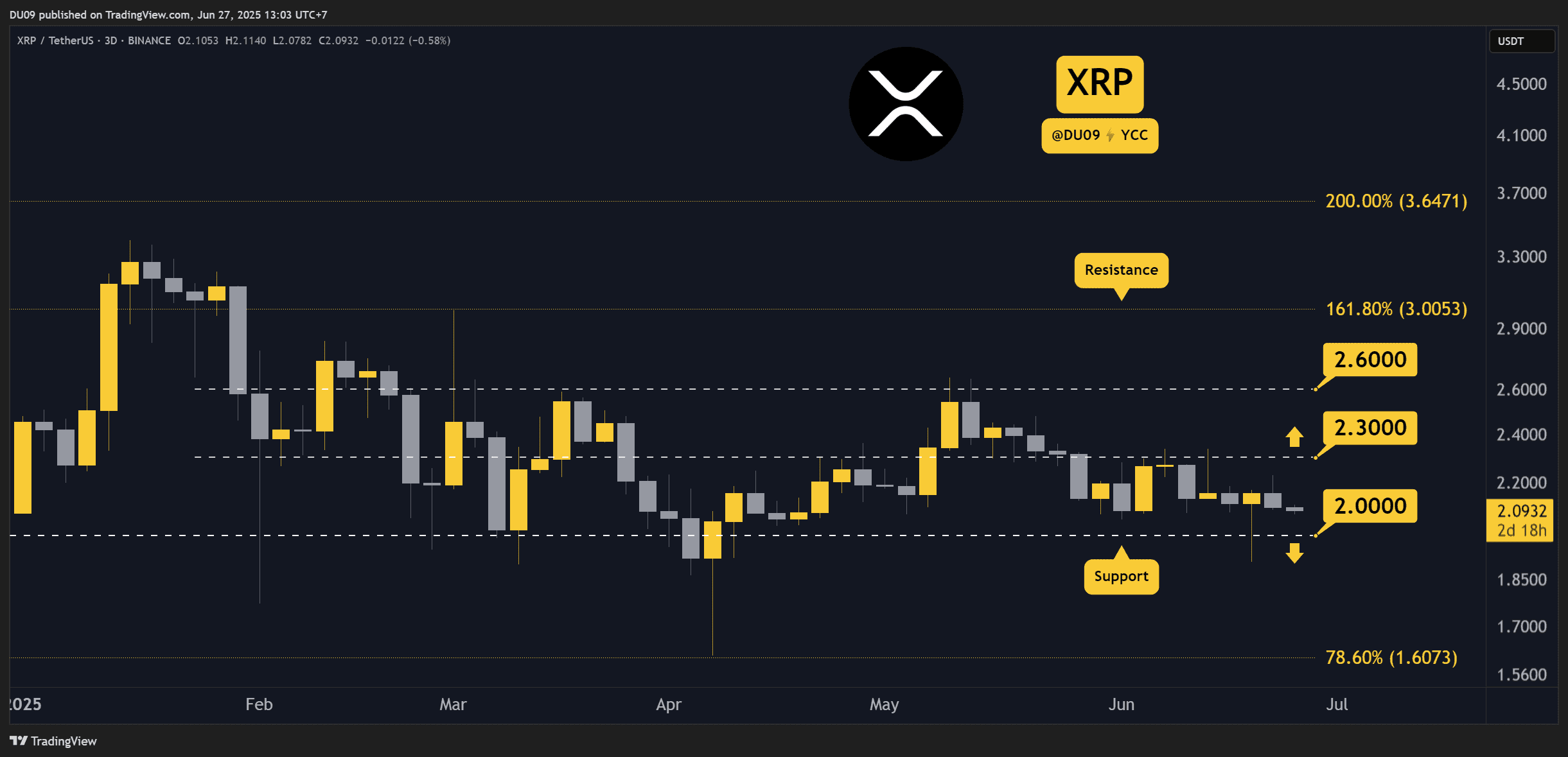

Ripple ($XRP)

$XRP is starting to resemble a stablecoin after its price has been hovering around $2 for months. Despite closing the week with a 4% loss, buyers continue to defend the support at $2 well.

In light of this flat trend, the momentum indicators are not very helpful in assessing direction. A much better indicator in such situations is the volume, which has been in decline since the $ATH from December 2024. A falling volume is usually bearish, but unless the key support breaks, it’s too early to call it.

Historically, $XRP has never stayed above $2 for this long. While this is encouraging, its 2024 rally from $0.5 to $3 happened in one month. This has left a huge gap on the weekly chart, which could be filled later. This hints at a drop under $2 as a likely possibility.

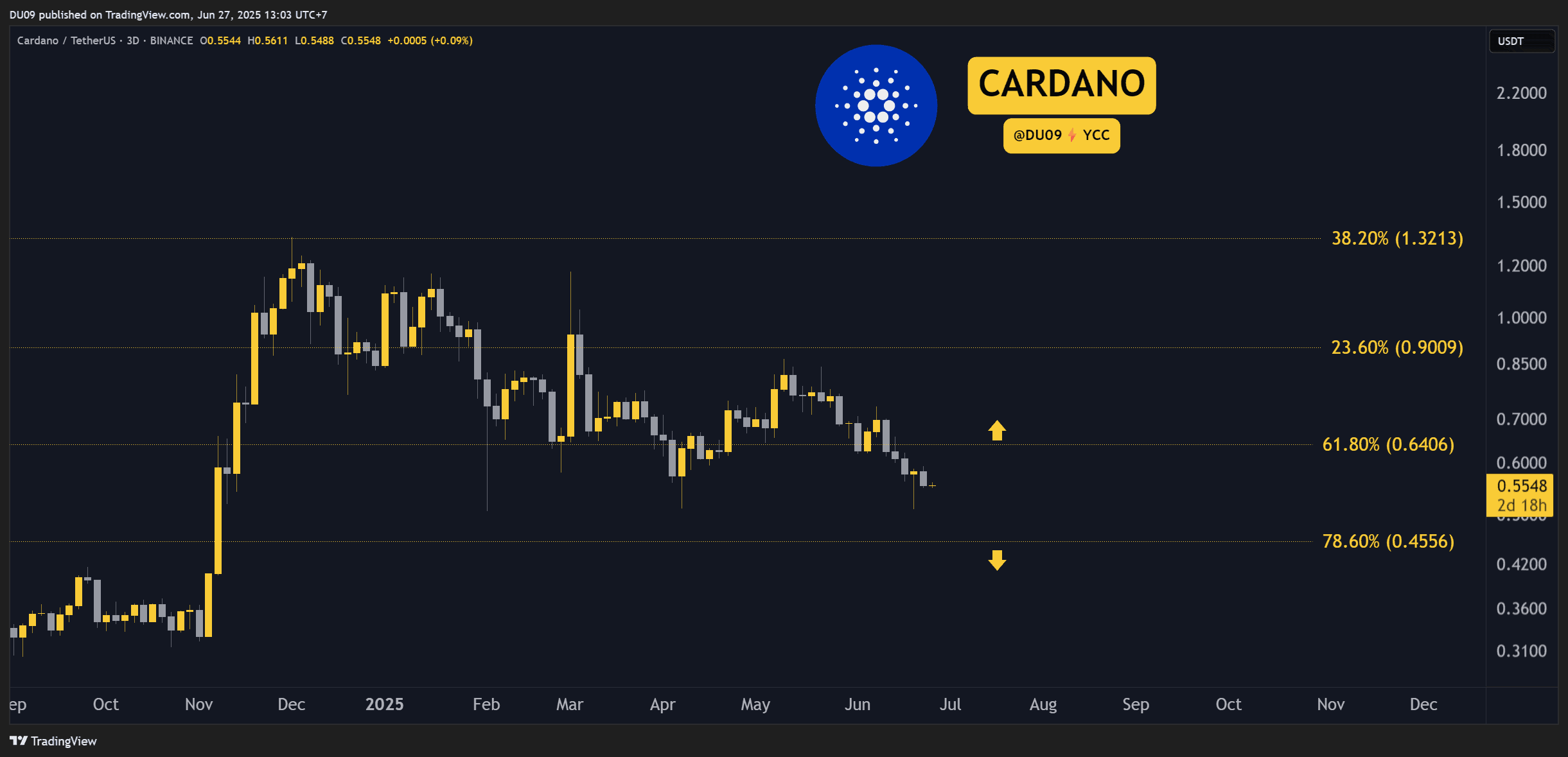

Cardano ($ADA)

There were high hopes for $ADA in 2025 after it ended 2024 with an impressive rally that took it to $1.3. Holders were hoping this price action would continue this year, but they were met with a long and painful downtrend that has been ongoing for six months now.

Only this week, this cryptocurrency fell by 7% which pushed it close to 55 cents. If selling intensifies, then the next key levels of support will be found at $0.50 and $0.45. At this time, bears continue to dominate, which makes lower prices likely.

Looking ahead, Cardano is competing in a very crowded market and struggles to attract much-needed attention. The volume shows selling has intensified lately, which only reinforces a bearish bias at this time.

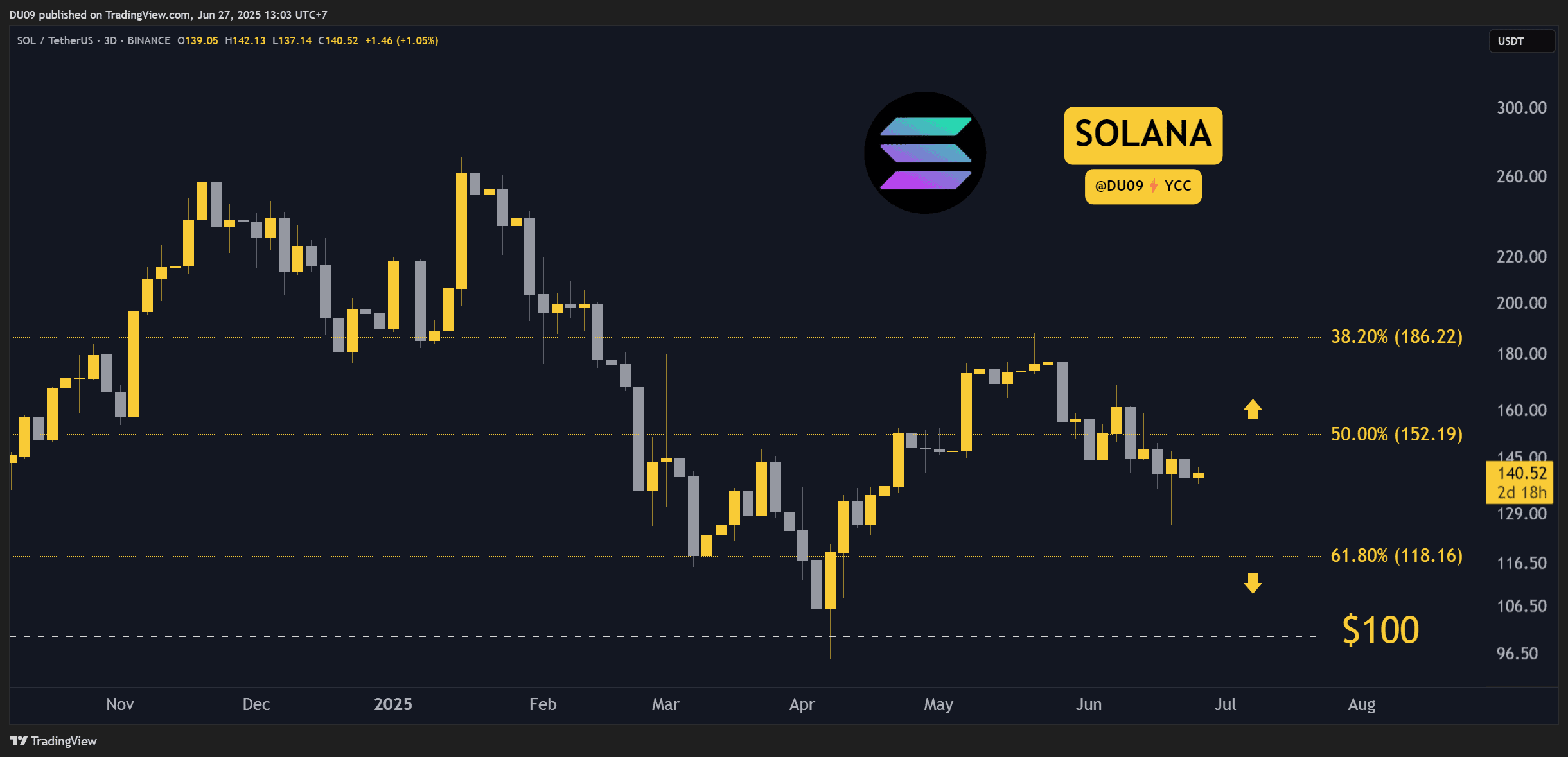

Solana (SOL)

Solana fell by 4% this week, and buyers are currently trying to reclaim the resistance at $152. Their last two attempts were swiftly rejected by sellers who always returned in force, around $150. This shows aggressive selling into any buys, which is bearish.

On the positive side, the daily MACD shows the start of a bullish cross. If confirmed in the coming days, this could give bulls another opportunity to reach $152. Should they fail again, then the support levels at $130 and $118 may stop any sell pressure.

With buyers struggling, Solana remains in a downtrend. To change that, the current resistance has to turn into a support so that it can act as a spring for the price to move higher.

Hype ($HYPE)

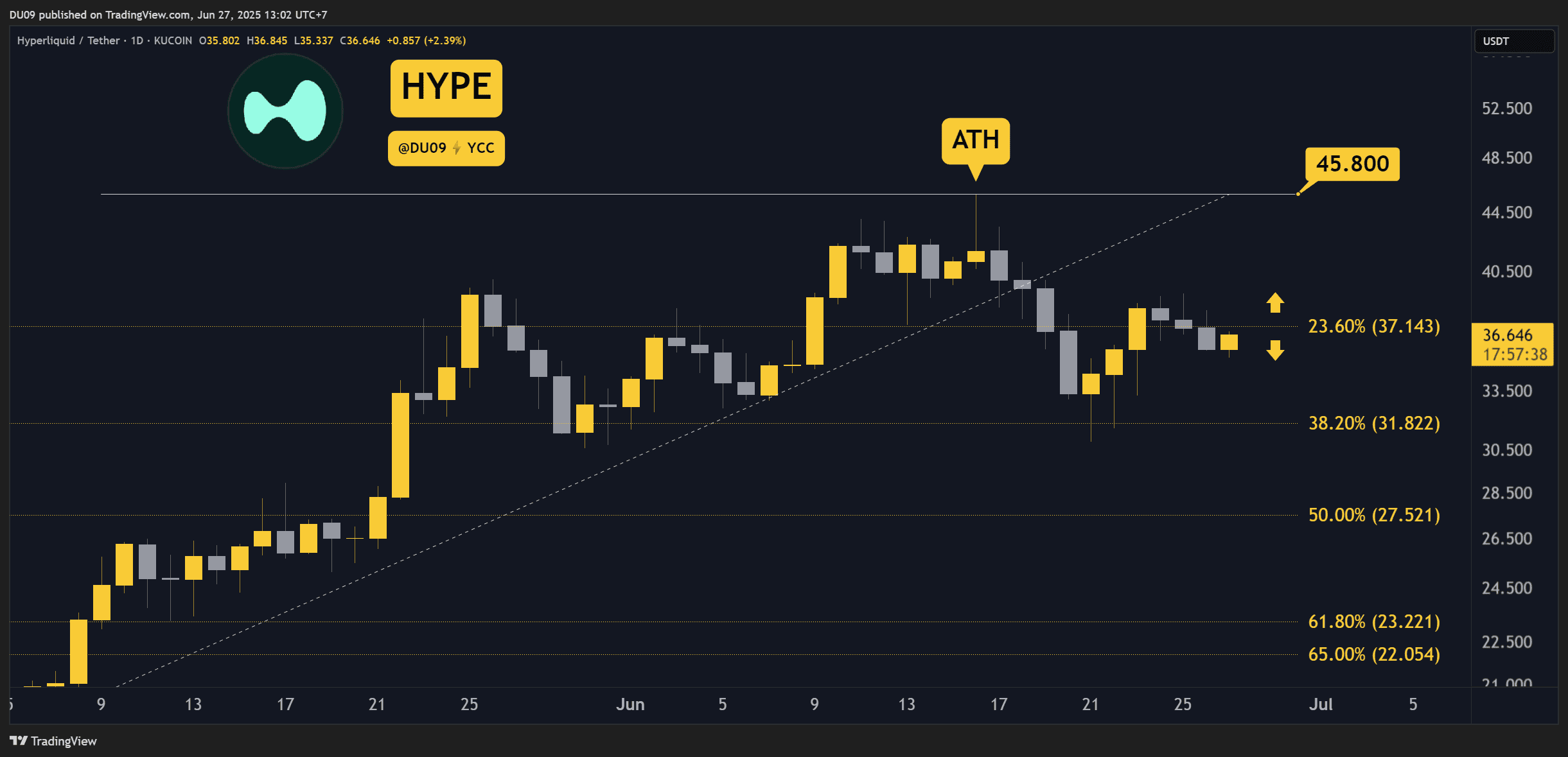

$HYPE closes the week in red with a modest 1% loss. Although this is negligible, the cryptocurrency will likely continue its downtrend if it fails to secure $37 as key support in the near future. This correction comes after $HYPE made an $ATH at $46 in early June.

Should the price revisit its support levels at $35 and $32, that could be an excellent area for buyers to return, like they did in the past. Ideally, $HYPE would make a higher low and then aim to return above $40.

Looking ahead, this cryptocurrency has already corrected by 32% from its $ATH, which is significant. It would be surprising to see it make new lows. If that happens, then this correction will be extended and likely see the price fall under $30.

cryptopotato.com

cryptopotato.com