- Litecoin price stabilizes around $85 on Thursday after recovering 6% so far this week.

- On-chain data suggests bearish signals as $LTC profit-taking activity reaches a three-month high.

- Santiment data indicate that a specific whale has offloaded 340,000 $LTC tokens.

Litecoin ($LTC) is stabilizing at around $85 at the time of writing on Thursday, having recovered 6% so far this week. On-chain data indicate early bearish signals for $LTC as holders’ profit-taking activity reaches a three-month high and dormant wallets’ activity increases, signaling growing selling pressure. Additionally, a specific whale has offloaded 340,000 $LTC tokens, signaling a bearish outlook for its price.

Three reasons why $LTC hints at bearish decline

Litecoin’s price started this week on a positive note, recovering nearly 6% on Monday following the announcement of the Iran-Israel ceasefire, which supported the risk-on sentiment. $LTC price consolidated around $85 for the next two days, and at the time of writing on Thursday, it hovers around this level.

Examining its on-chain metrics data provides a clear picture of $LTC and hints at early bearish signs.

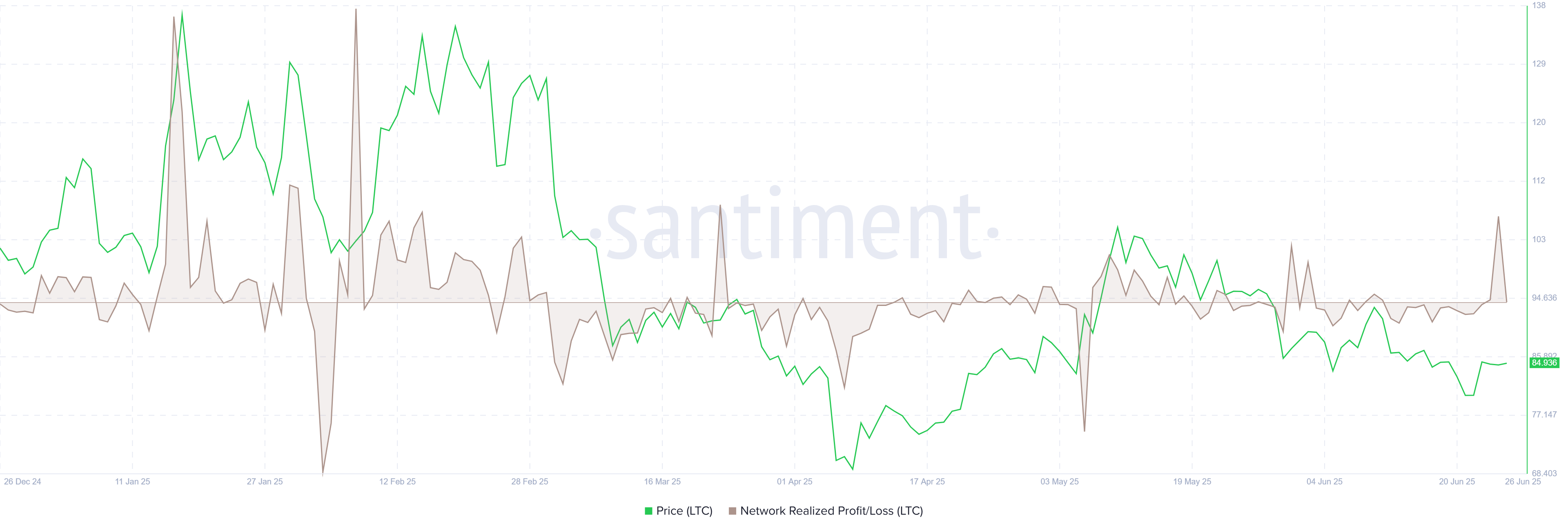

Santiment's Network Realized Profit/Loss (NPL) metric indicates that $LTC holders are booking some profit.

As shown in the graph below, the NPL experienced a significant spike on Wednesday, reaching its highest level since the end of March. This spike indicates that holders are, on average, selling their bags at a significant profit and increasing the selling pressure.

Litecoin NPL chart. Source: Santiment

Santiment's Age Consumed index also shows bearish signs. The spikes in this index suggest dormant tokens (tokens stored in wallets for a long time) are in motion, and it can be used to spot short-term local tops or bottoms. As in the case of Litecoin, history shows that a decline followed the spikes in $LTC’s price as holders moved their tokens from wallets to exchanges, thereby increasing selling pressure. The most recent uptick on Wednesday forecasted that $LTC was ready for a downtrend.

Litecoin Age Consumed chart. Source: Santiment

Santiment’s Supply Distribution shows that a certain whale wallet holding $LTC tokens between 100,000 and 1 million (red line) had offloaded 340,000 $LTC tokens from Tuesday to Thursday, reducing its exposure, which could cause a decline in $LTC prices.

$LTC Supply Distribution chart. Source: Santiment

Litecoin Price Forecast: $LTC bears are taking the lead

Litecoin price declined by 7% last week and retested its weekly support level at $77.19 on Sunday. However, it recovered most of its losses on Monday and hovered around the $85 level for the next two days. At the time of writing on Thursday, it continues to stabilize at around $85.

If $LTC fails to close above the 50% price retracement level at $91.61 and faces a correction, it could extend the decline to retest its weekly support at $77.19.

The Relative Strength Index (RSI) hovers below its neutral level of 50, indicating bearish momentum.

$LTC/USDT daily chart

However, if $LTC closes above the $91.61 resistance level, it could extend the rally toward its next weekly resistance at $96.30.

Related news

- Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – $BTC, ETH and XRP eye key breakouts

- Bitcoin Price Forecast: $BTC extends gains above $106,000 as institutional demand fuels optimism

- Pi Network Price Forecast: PI explodes toward $1.00 on generative AI integration optimism

fxstreet.com

fxstreet.com