Avalanche is starting to catch serious attention as fresh capital floods in and technicals begin to flip bullish. Participants are now eyeing a potential 30% rally, with price action heating up around a familiar support zone.

Avalanche Sees Strong Capital Inflows

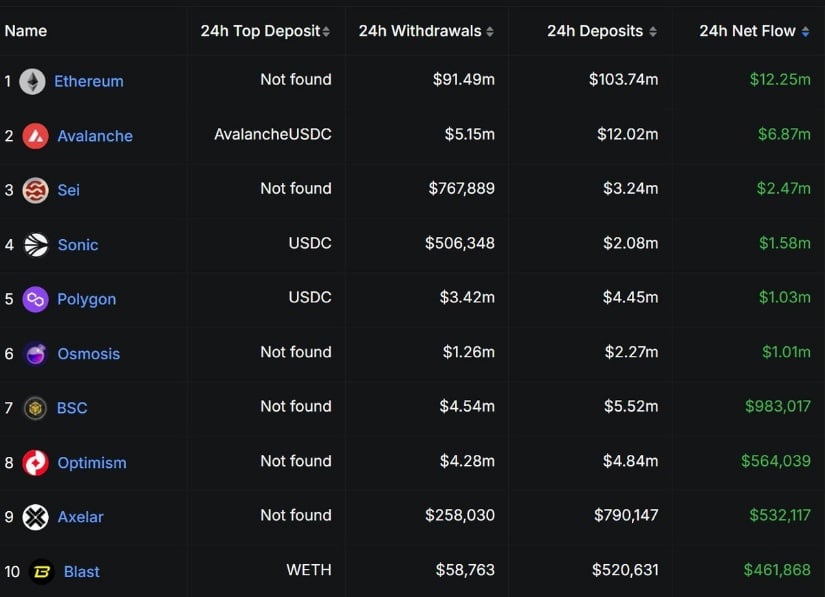

Avalanche is closing out the week with a clear signal of strength, landing second in 24-hour net inflows across all ecosystems. According to The Degen Times, $AVAX recorded $12.02 million in deposits versus just $5.15 million in withdrawals, resulting in a net inflow of $6.87 million. That’s a solid show of confidence, second only to Ethereum’s $12.25 million and well ahead of other L1s.

Avalanche secures the second-highest net inflows among all chains. Source: The Degen Times via X

Avalanche isn’t just sustaining the current market cycle; it’s actively attracting capital while many other chains are struggling. These inflows don’t just reflect sentiment; they can also have a meaningful impact on price action if momentum continues.

Avalanche On-Chains Sees a Record Month

Avalanche just hit another impressive milestone. $AVAX C-Chain hasn’t dipped below 1 million ERC20 token transfers on a single day throughout June. This isn’t just a sign of strength rather a very sustainable consistency shown from the $AVAX network.

Avalanche C-Chain maintains over 1 million daily token transfers throughout June. Source: Token Relations via X

According to Token Relations, the chain averaged around 1.76 million daily transfers by mid-June, reflecting strong user activity that’s rarely seen outside of major network surges.

$AVAX Potentially Lining Up For a 30% Rally

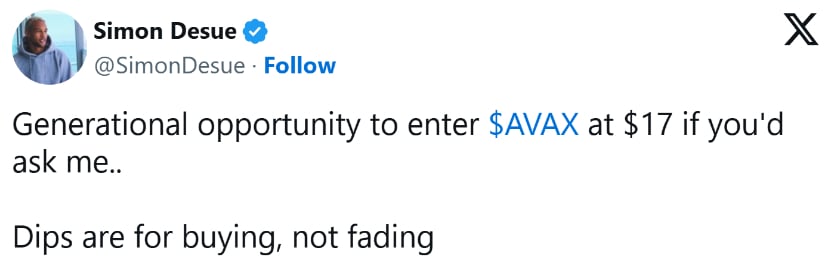

$AVAX just tapped the $17 level again, and it’s starting to get the attention from the $AVAX community. Crypto analyst, Simon Desue, calls this a “generational opportunity”. This is a technically based decision as, $17 to $18 region has acted as a demand zone multiple times over the last six months, often leading to bounces of 20–30%.

$AVAX revisits its key $17 demand zone, with analysts eyeing a potential 30% bounce from support. Source: Simon Desue via X

This area also aligns with the base of a broader symmetrical triangle that $AVAX is currently forming, offering both horizontal and diagonal support at once. Zooming out, $AVAX is still holding higher lows on the daily chart despite the dip, which suggests structural strength is intact. As long as price continues to respect this zone and on-chain momentum remains firm, this pullback might not be a breakdown, but could be a base for the next leg up.

$AVAX Breaks Out of Falling Wedge

Following strong capital inflows and a resilient on-chain profile, Avalanche’s technicals are now lining up with their side of strength. According to AlphaCryptoSign, $AVAX has broken out of a textbook falling wedge on the 4-hour chart. The breakout was accompanied by a solid green candle and a noticeable uptick in volume, which adds credibility to the move. $AVAX is now attempting to flip the former wedge resistance into support, a critical step for confirming the reversal.

Avalanche breaks out of a falling wedge with rising volume, signaling a potential short-term trend reversal. Source: AlphaCryptoSign via X

Technically, the move shifts short-term momentum in $AVAX’s favor. If the price can hold above this wedge breakout level, the next logical target sits around $20, where minor resistance and the 50-day moving average converge. However, failure to hold above the breakout zone could invalidate the setup and send $AVAX back toward the $17 to $17.50 region.

$AVAX Price Prediction Eyes $22.70

Building on its recent falling wedge breakout, $AVAX is now showing early signs of forming a rounded bottom near the $17.50 to $18 region. As seen in TheTrench’s chart, this zone has acted as key horizontal support throughout June, and now the price appears to be curling back up from it.

$AVAX forms a rounded bottom near key support, with eyes set on a breakout toward the $22.70 resistance zone. Source: TheTrench via X

The chart outlines a potential move toward $22.70 if this short-term reversal holds; this level aligns with a prior resistance zone from earlier in the month. If $AVAX can push decisively through the $18.40 to $18.50 mid-range level, the probability of hitting that $22.70 target increases significantly.

Final Thoughts

While the broader market chops sideways, Avalanche is quietly stacking wins both on-chain and on the charts. With consistent capital inflows, rising transfers, and strong technical formations like the falling wedge breakout, $AVAX is showing the kind of resilience that often precedes major moves. The $17 zone has become more than just support. If momentum can emerge here, $AVAX bulls have their eyes on the $22.70 level.

bravenewcoin.com

bravenewcoin.com