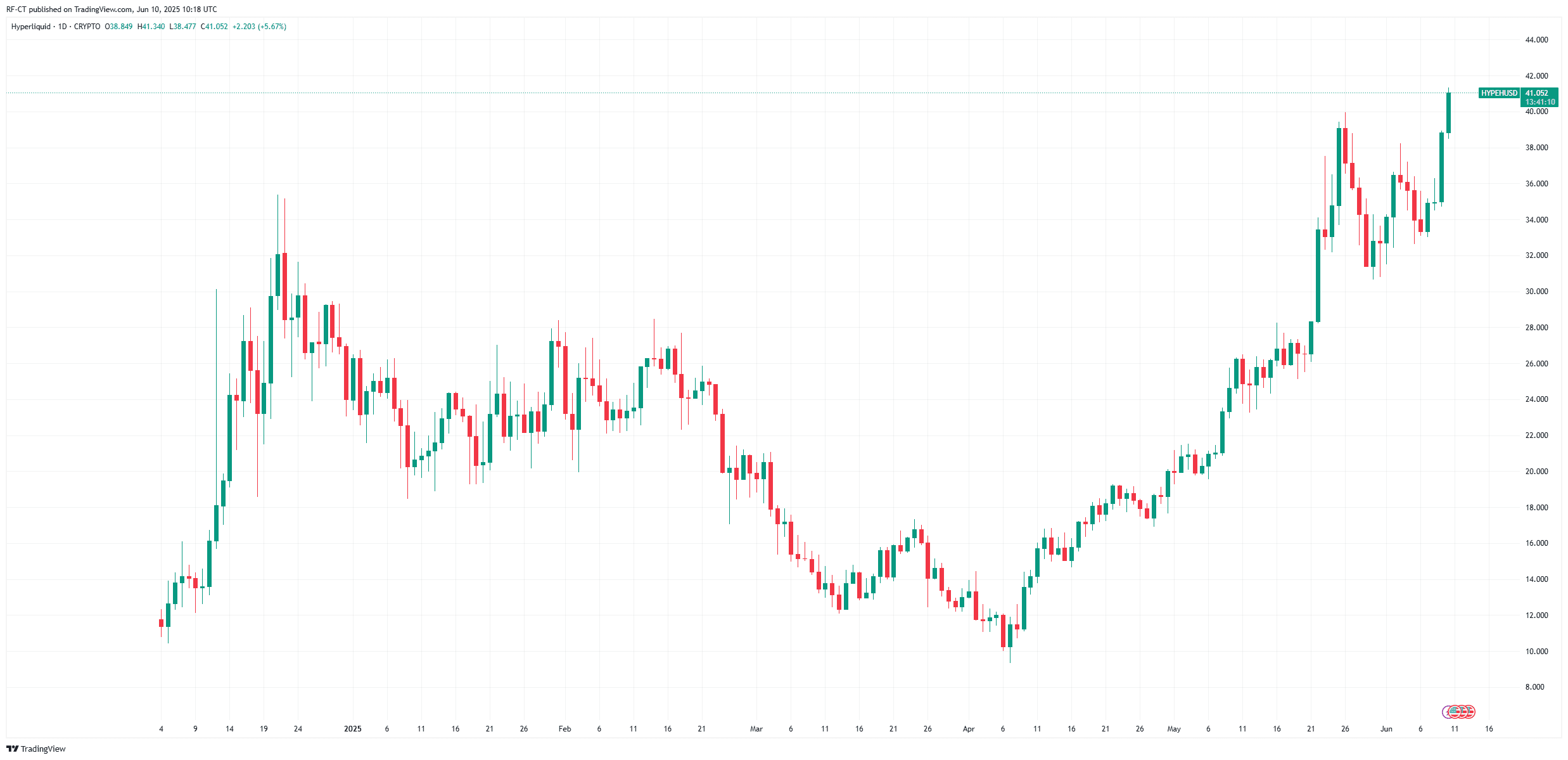

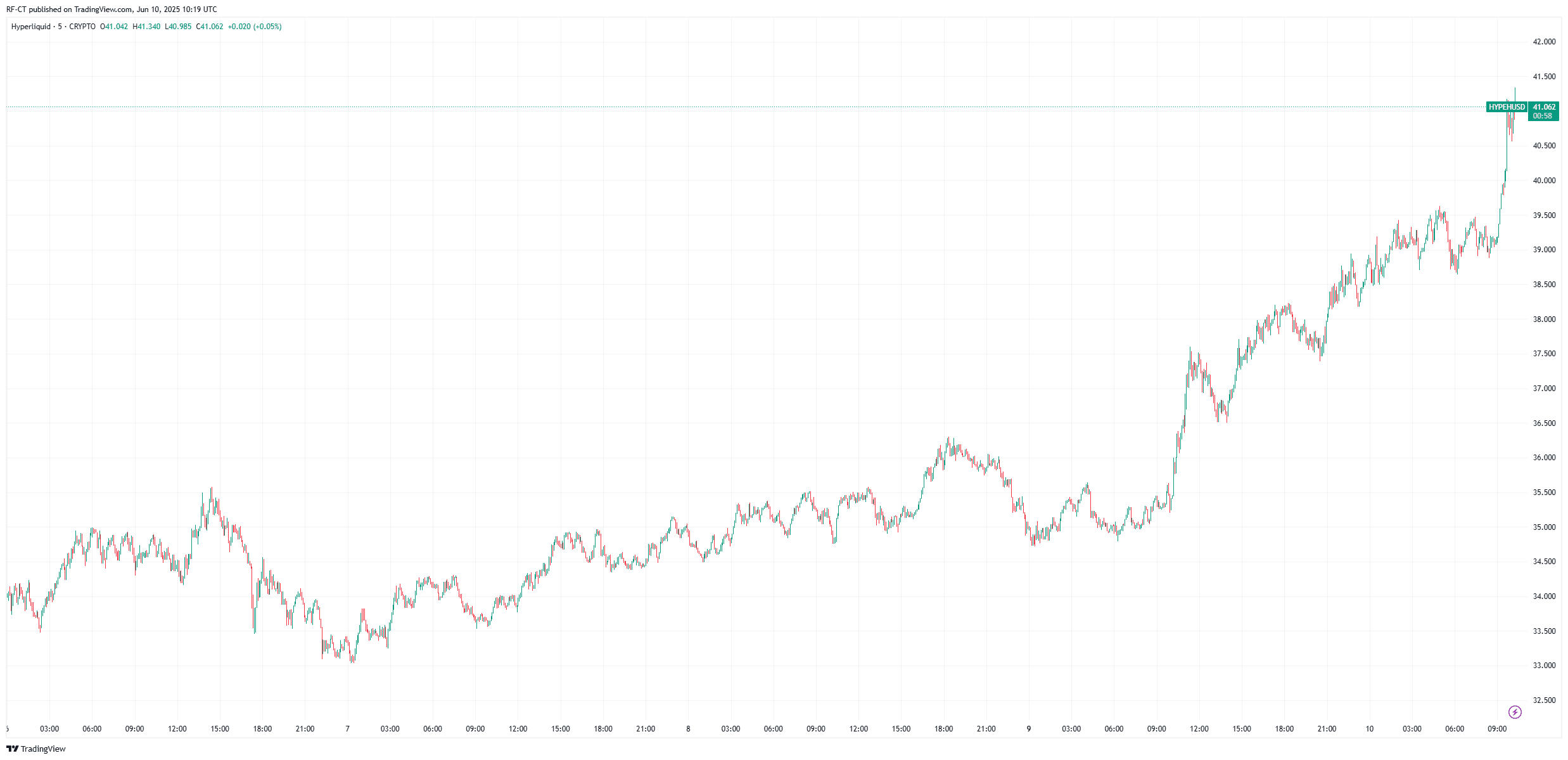

$HYPE Price Explodes to New Highs

Hyperliquid ($HYPE) is grabbing headlines today as it trades around $40.86, reaching an intraday high of $40.99. The surge marks a new all-time high ($ATH) and comes amid intense market speculation and rising institutional interest. $HYPE has gained over 12% in the last 24 hours, with over $430 million in trading volume, putting it firmly on the radar of crypto investors.

On-Chain Metrics Signal Explosive Growth

Hyperliquid’s fundamentals look as bullish as its chart:

- Total Value Locked (TVL) is estimated between $560 million and $1.46 billion, reflecting growing platform adoption.

- Futures Open Interest has hit over $1.7 billion, showing serious trader commitment to the platform.

- Stablecoin reserves exceed $3.6 billion, ensuring high liquidity and platform scalability.

These numbers paint a picture of a rapidly expanding Layer-1 ecosystem designed for high-throughput on-chain perpetual trading.

Whales Fueling the Fire

Institutional and whale activity is playing a major role in the recent price action:

- A single whale recently bought around 259,000 $HYPE (worth nearly $10 million) at an average price of $38.46.

- The top 20 wallets hold approximately 24% of the platform’s open interest, currently totaling over $2.1 billion across more than 300,000 traders.

While this boosts momentum, it also introduces the risk of price swings if large holders begin offloading.

Buybacks and Tokenomics: A Unique Strategy

Hyperliquid stands out with its aggressive buyback strategy:

- The protocol uses ~97% of daily trading revenue to buy back $HYPE tokens from the market—roughly $1 million daily.

- More than $850 million worth of tokens have already been repurchased and effectively removed from circulation.

- This tightens supply while demand increases, reinforcing $HYPE’s bullish structure.

The token has a max supply of 1 billion, with ~333 million currently circulating. There’s also an active burn mechanism, and emissions are scheduled to taper through 2027–28.

Real Utility: Beyond the Speculation

$HYPE isn’t just a speculative asset—it powers the Hyperliquid Layer-1 blockchain, a high-performance decentralized exchange (DEX) offering on-chain order books for perpetual futures trading.

Token use cases include:

- Staking and governance

- Fee reduction and rewards

- Liquidity incentives for ecosystem dApps

Its infrastructure is designed to process over 100,000 orders per second, with finality times under 1 second—making it one of the fastest DEX systems currently available.

$HYPE Price Outlook: Bullish but Cautious

After breaking its $ATH, $HYPE appears to be entering price discovery mode, with traders eyeing $46 as the next key psychological level. Support levels sit around $32–$35, and any retracement into this zone could offer new entry points.

However, reliance on whale behavior and sustained trading volume makes it sensitive to external shifts.

Key Risks to Watch

- High concentration of holdings could lead to volatility if whales exit positions.

- Revenue-driven buybacks mean token strength is closely tied to platform usage—any volume drop could dampen price support.

$HYPE has lived up to its name—rising on strong fundamentals, smart tokenomics, and major trader interest. Whether you’re a momentum trader or a long-term believer in on-chain futures infrastructure, Hyperliquid is a project worth watching.

$HYPE, $Hyperliquid

cryptoticker.io

cryptoticker.io