With the weekend crypto trading in sight, crypto traders are bracing for volatility. Bitcoin remains range-bound, but shows subtle signs of accumulation. Meanwhile, major altcoins like Chainlink, $XRP, $SHIB, Toncoin, and Worldcoin appear to be clinging to support levels. Let's break down where these charts are headed and what smart weekend traders should watch.

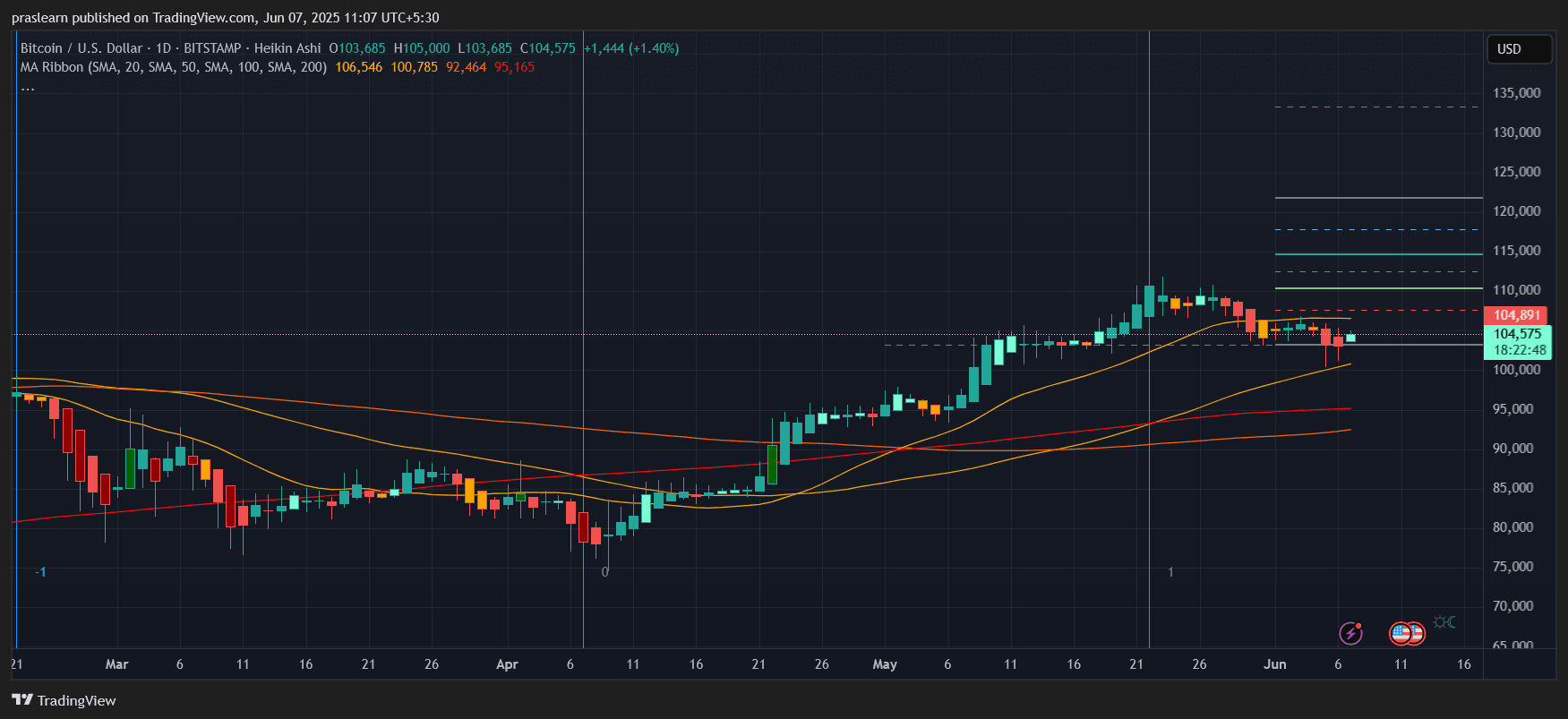

Weekend Crypto Trading: Is Bitcoin Poised for a Weekend Breakout?

Bitcoin ($BTC) is trading at $104,575, still below the short-term resistance at $104,891. Price has been supported firmly by the 50-day SMA at $100,785. The recent candles show a slight bullish bias, and if $BTC closes above $105,000, it could signal a push toward $110,000.

If we take the range between the local high ($115,000) and low ($100,000), that’s a $15,000 range. A 50% retracement puts resistance at $107,500. A breakout above that level could test the previous high at $115,000 this weekend.

However, volume is still thinning. If Bitcoin closes below $100,785, it could test the 100-day SMA around $92,464. Until then, bulls still have the upper hand.

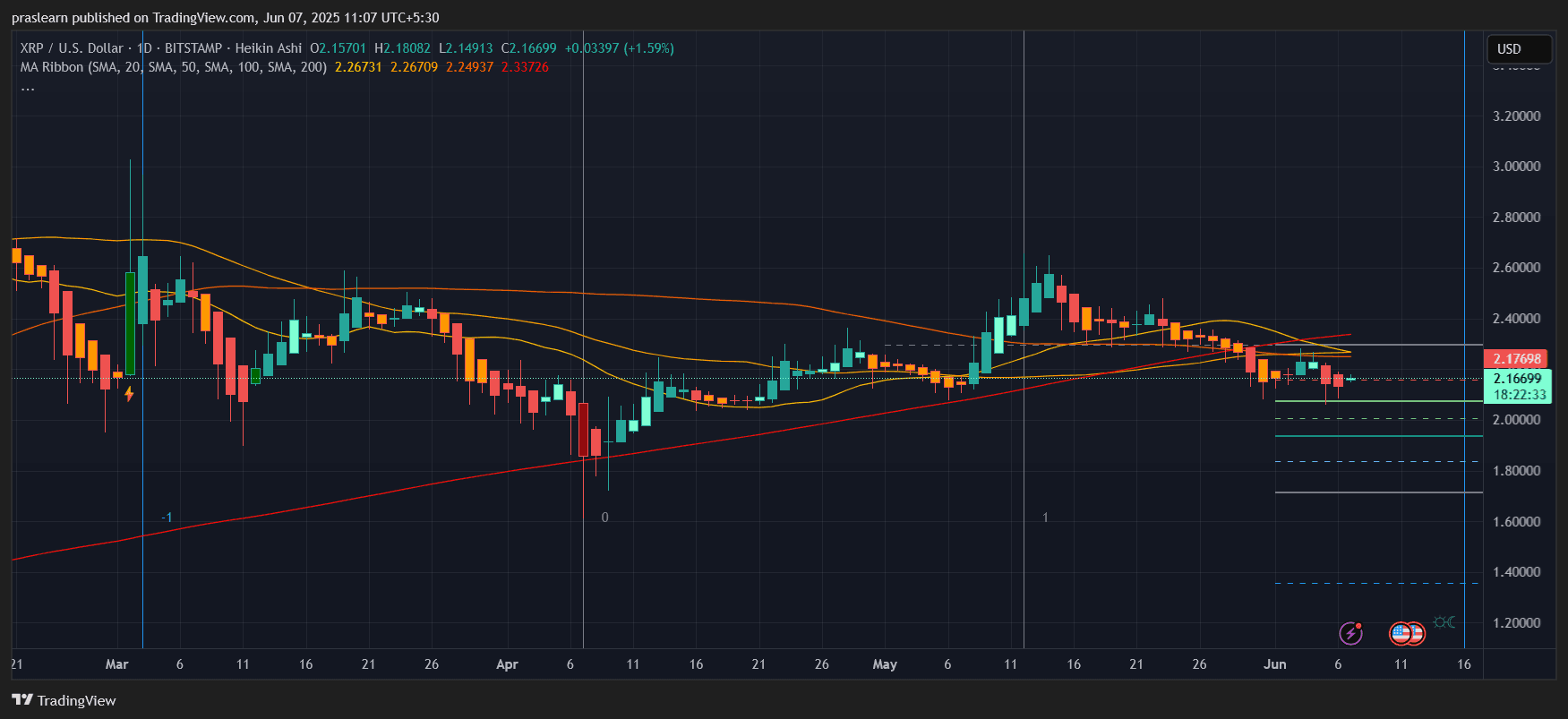

$XRP Weekend Prediction: Will Bulls Defend $2?

$XRP is currently trading at $2.16, holding just above the key support at $2.00. It's sandwiched between the 50-day SMA ($2.26) and the 100-day SMA ($2.24), showing a tight squeeze that typically precedes a breakout.

Price action suggests a descending triangle pattern, with horizontal support at $2.00 and falling highs. If $2 breaks, $XRP could quickly drop to $1.80 or even $1.60, based on Fibonacci extensions.

However, if $XRP manages to break above $2.18, it can attempt a move back to $2.40—a 10% weekend gain is not impossible. But bulls must step up now.

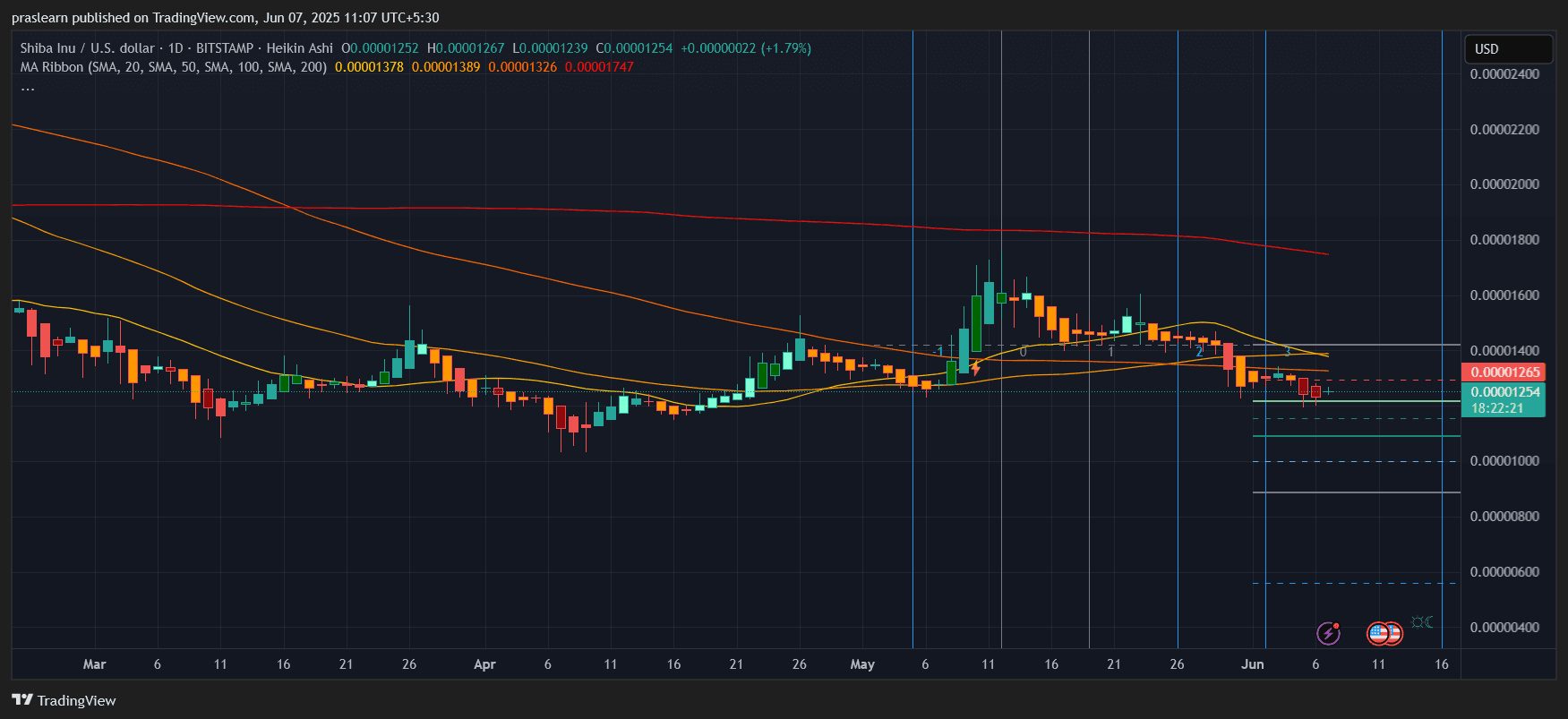

$SHIB Price Prediction: Breakdown Risk Ahead?

Shiba Inu ($SHIB) is stuck at $0.00001254, with visible rejection from the 20-day SMA at $0.00001378. A series of lower highs and a descending wedge formation hints at weakening momentum.

The price is sitting just above major horizontal support. A breakdown below $0.00001200 could trigger a swift 20% drop to $0.00001000. That said, $SHIB is a notoriously volatile meme coin, so a surprise reversal remains on the table if $BTC rallies.

For now, the lack of strong volume and momentum favors a bearish continuation unless bulls reclaim $0.00001350 quickly.

Chainlink Eyes $12.50: Will Weekend Buyers Step In?

Chainlink ($LINK) is currently trading around $13.73, slightly under the 20-day SMA at $14.91. The recent price action has formed a small base, but $LINK is still under pressure from the 50-day SMA at $14.95.

The bearish structure from the May top at $16.50 points toward a correction zone near $12.50, which also aligns with the lower Fibonacci extension. A daily close above $14.00 could invalidate this move, but unless volume picks up, $LINK could drift lower this weekend. If Bitcoin breaks out, expect $LINK to bounce first due to its strong correlation with $BTC.

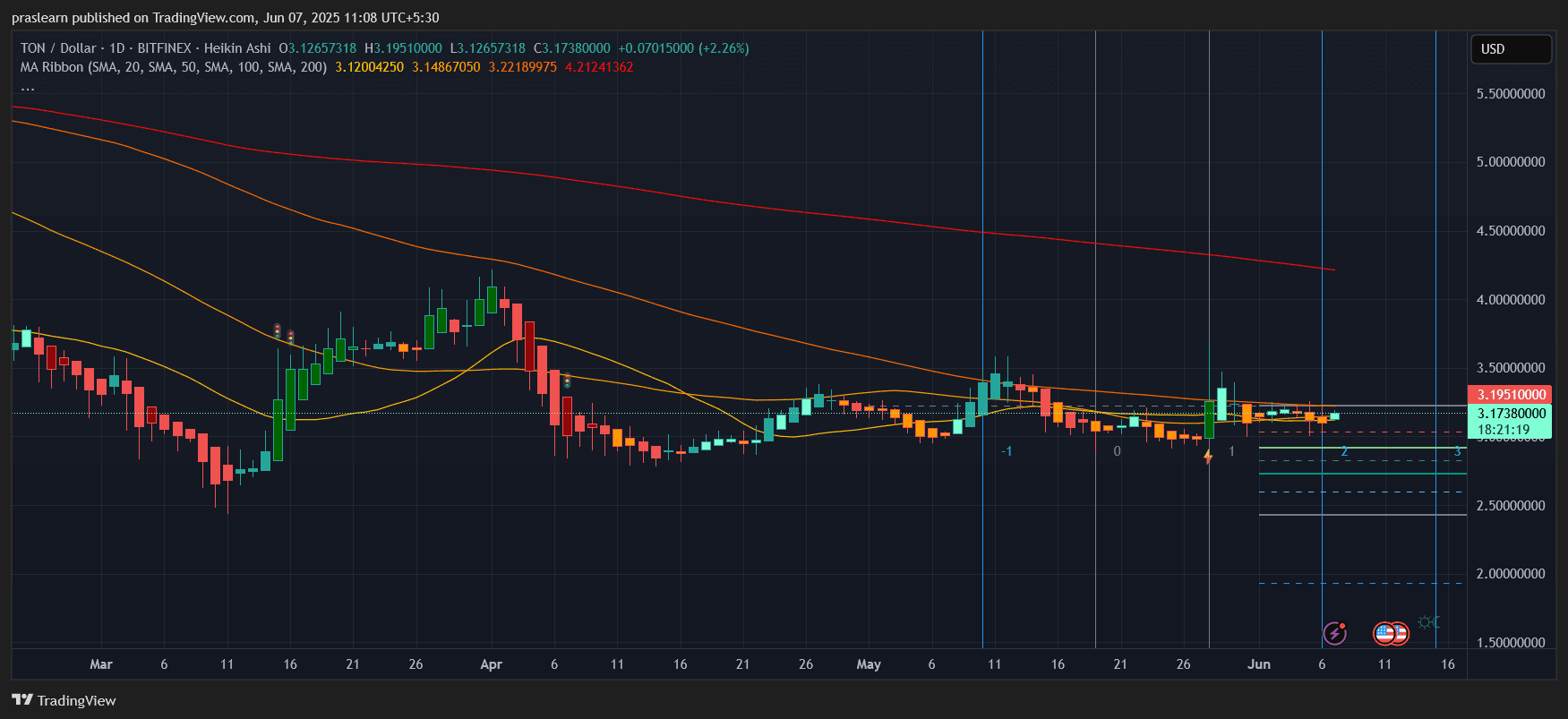

Toncoin ($TON): Stuck in a Tight Range

Toncoin is at $3.17, moving in a horizontal band between $3.00 and $3.20. It’s being compressed by the 20-day SMA at $3.12 and the 50-day SMA at $3.14, while the 200-day SMA looms above at $4.21.

This kind of tight range often ends with a large breakout or breakdown. Based on volatility contraction, we could expect a 10% move soon. That means a breakout above $3.20 could send $TON to $3.50, while a fall below $3.00 drags it down toward $2.70.

Watch this one closely this weekend—it could move fast and hard.

Worldcoin ($WLD): Weak Reversal or Just the Start of a Crash?

Worldcoin has pulled back to $1.08 after peaking near $1.85. The price has dropped nearly 42% in the past few weeks. Now, $WLD sits just below the 20-day SMA at $1.24 and above the 100-day SMA at $0.97.

This range sets up a classic test zone. If $WLD drops below $1.00, the next visible support is around $0.80, which would represent another 25% decline. On the other hand, reclaiming $1.25 would flip the momentum and invite a short squeeze back to $1.50.

Right now, the Heikin Ashi candles still show red momentum, so caution is advised.

Weekend Crypto Trading: Bitcoin Holds the Key

All eyes this weekend are on Bitcoin. If $BTC breaks $105K–$107K, the rest of the market could follow. But if it slips back below $100K, expect more pain across the altcoin board.

Toncoin and $SHIB are sitting at decision points. $XRP and Chainlink are hanging by technical threads. Worldcoin looks like it’s searching for a bottom.

The best trade this weekend? Don’t chase. Watch for confirmed breakouts, especially from Bitcoin. Where $BTC leads, altcoins follow—either into the green or into the abyss.

$BTC, $XRP, $SHIB, $TON, $WLD, $LINK

cryptoticker.io

cryptoticker.io