Shiba Inu ($SHIB) price has been teetering on the edge lately, with price action growing weaker each week. Traders and investors alike are beginning to wonder: could $SHIB price be heading toward a total collapse? June 2025 has started on a cautious note for the meme coin, and the charts are signaling danger ahead.

Shiba Inu Price Crash: Is $SHIB Showing Signs of Weakness Already?

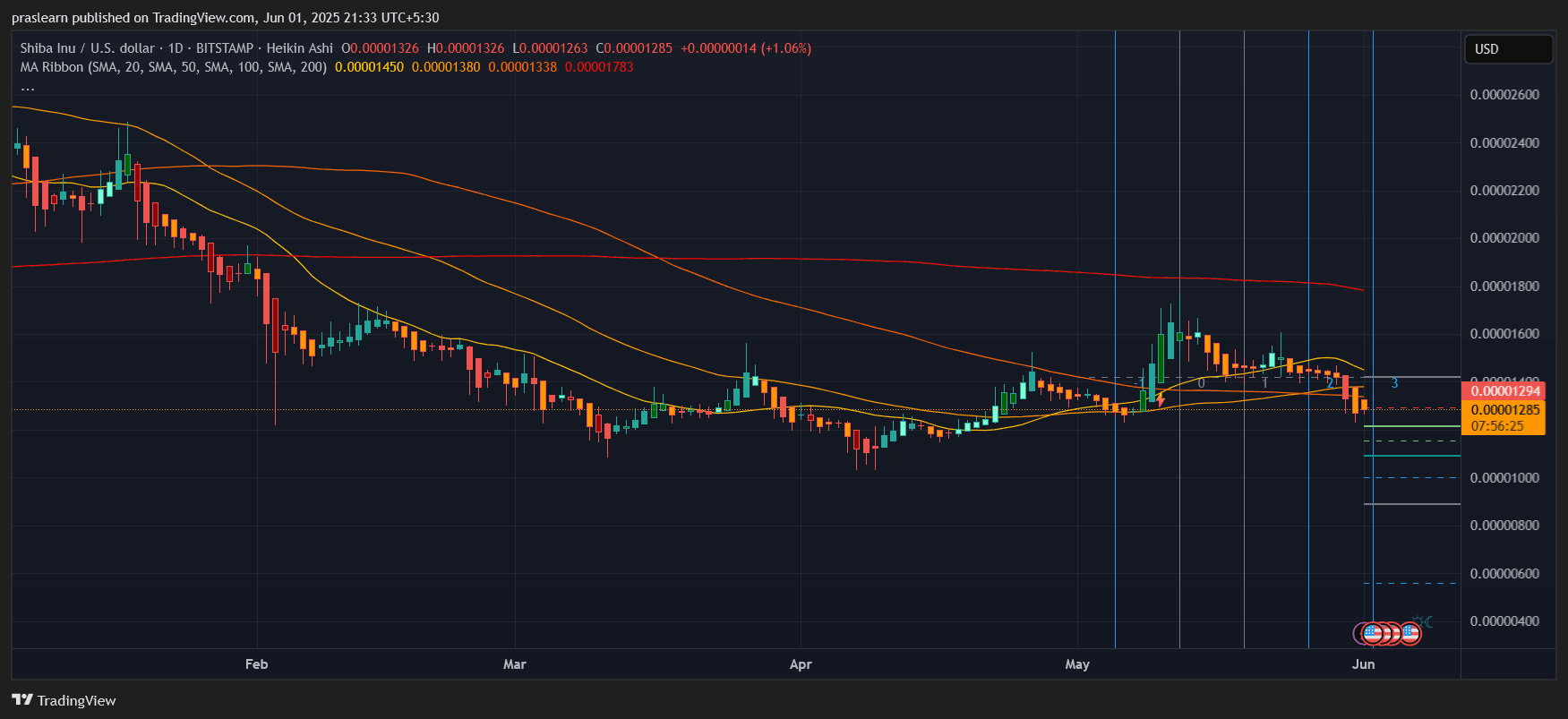

Looking at the daily chart, Shiba Inu price has lost critical support near the $0.00001500 region and is now trading around $0.00001285, with a bearish Heikin Ashi candle structure confirming continued downside pressure. The price is now well below the 20-day, 50-day, and 100-day moving averages, which sit around $0.00001380 to $0.00001450. This confirms that $SHIB is entrenched in a bearish trend.

A notable concern is the death cross formation that occurred weeks ago when the 50-day MA crossed below the 200-day MA, currently around $0.00001783. Historically, such a setup precedes prolonged downturns unless invalidated by sharp breakouts. Given current volume levels and momentum, a reversal appears unlikely in the near term.

Hourly Chart Confirms Bearish Continuation Pattern

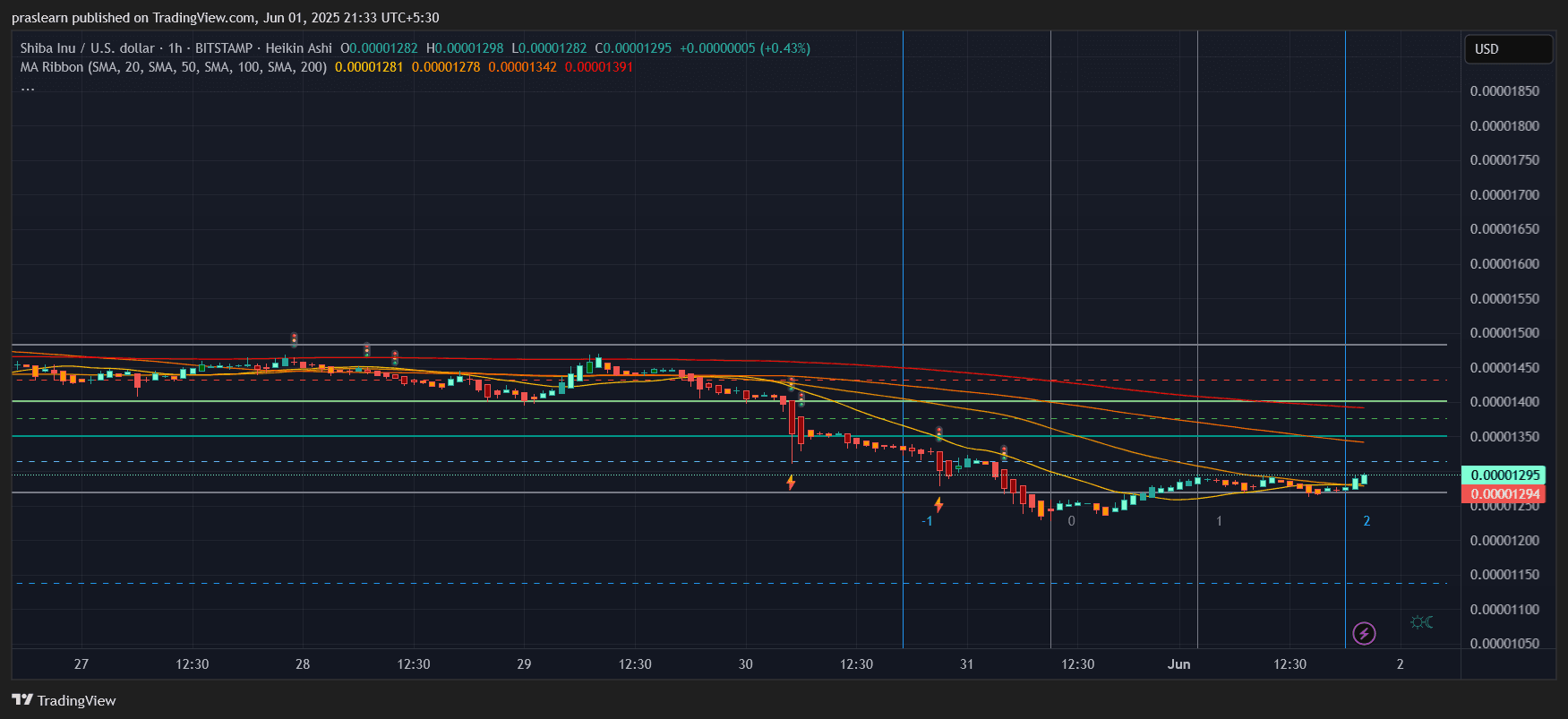

Zooming into the hourly chart, $SHIB’s short-term price action is struggling to reclaim even basic resistances. As of now, the token is barely holding at $0.00001295, while the hourly resistance at $0.00001342 (100-hour SMA) and $0.00001391 (200-hour SMA) are acting as solid rejection points.

There was a recent attempt at a minor rebound, but each uptick was met with strong selling pressure, especially near the MA ribbon. Moreover, a descending wedge structure that briefly broke upward has already failed to sustain momentum. This rejection aligns with the classic "bear flag breakdown", a pattern that typically results in further declines.

If we project the breakdown target using the flagpole method:

- Height of the previous flagpole: $0.00001550 – $0.00001200 = $0.00000350

- Breakdown point: ~$0.00001200

- Measured move target: $0.00001200 – $0.00000350 = $0.00000850

This suggests that $SHIB price could fall to $0.00000850 in the coming weeks unless a major reversal invalidates the pattern.

What Price Levels Could Trigger a Panic Sell-Off?

The key support to watch is $0.00001200. If this level is lost, there is virtually no significant horizontal support until $0.00000950, which served as the last major accumulation range back in early 2024. A breach below this could activate automated stop losses and lead to panic selling.

Even more alarming is the possibility of $SHIB price entering a “capitulation zone” between $0.00000700 and $0.00000500, where long-term holders might also start exiting. These zones align with historical volume nodes seen on volume profile analysis.

Shiba Inu Price Prediction: Could Shiba Inu Go to Zero? Let’s Do the Math

Let’s break down what it would take for $SHIB price to hit zero. Currently, $SHIB’s supply is around 589 trillion tokens. With a current price of $0.00001285, that gives a market cap of around $7.58 billion. For $SHIB to crash to $0.00000001, the market cap would need to drop to under $6 million — a 99.99% collapse. That’s highly improbable without a complete failure of the ecosystem or total market exit from all meme coins.

So while crashing to absolute zero is more theoretical than likely, the realistic danger is a price collapse to sub-$0.000007 levels, which still means a 45%–60% drawdown from current prices.

Shiba Inu Price Crash: What Could Trigger the Collapse?

Several factors could act as catalysts:

- Bitcoin weakness: If BTC drops below $60,000 again, meme coins like $SHIB will bleed harder.

- Lack of utility narrative: Shibarium has not delivered ecosystem traction to counteract the hype cycle downturn.

- Whale exits: Any major wallet unloading positions will spook retail investors.

- Macro pressure: Rising interest rates or a U.S. recession could drain liquidity from speculative assets.

Shiba Inu Price Prediction: What’s the Verdict for June 2025?

While a literal crash to zero is highly unlikely due to exchange delisting safeguards and whale holdings, the charts clearly show a breakdown structure with more room to fall. If Shiba Inu fails to hold the $0.00001200 level in the first week of June, we could very well see it spiral toward $0.00000850 or lower.

Investors should brace for volatility and be cautious of fakeouts. The momentum, trend indicators, and volume behavior all currently support a bearish bias for Shiba Inu in June 2025.

cryptoticker.io

cryptoticker.io