Worldcoin and Hyperliquid rank among the top two cryptocurrencies by weekly gains. CoinGecko data shows that $WLD and $HYPE gained nearly 35% in the past week. The two tokens could extend their price rally next week.

Worldcoin ($WLD) has rallied for seven consecutive weeks, seen in the $WLD/$USDT weekly price chart. In the last 24 hours, $WLD gained nearly 2% and nearly 35% in the last seven days. Worldcoin’s rally is likely driven by a series of announcements from the Sam Altman-led AI firm regarding the project’s expansion plans.

Hyperliquid ($HYPE) added 7% to its value on the day, up nearly 35% in the last seven days. The project’s recent gains are attributed to $HYPE accumulation and demand from crypto elites like Arthur Hayes, former BitMEX CEO and co-founder of Maelstrom.

Table of Contents

Worldcoin and Hyperliquid price forecast

Worldcoin posted seven consecutive weeks of gains, and the rally continued this week. $WLD price could extend its rally according to technical indicators on the weekly timeframe. A 32% increase could push $WLD to test psychologically important resistance at $2.

RSI reads 51, crossing above the neutral level at 50 and MACD flashes consecutively green histogram bars, signaling a positive underlying momentum in $WLD price trend.

In the event of a flashcrash or market-wide correction, $WLD could slip to support at $0.914.

$HYPE">

$HYPE"> The daily price chart supports a similar thesis with $WLD targeting resistance at $1.641, the lower boundary of an FVG. This marks nearly 8% climb for $WLD from the current price level of $1.538.

The $0.835 support is key to $WLD as the AI token continues its upward trend. RSI has crossed above 70, into the “overbought” zone and MACD signals positive underlying momentum in $WLD price trend.

$WLD faces resistance at $2, marked as R2 on the $WLD/$USDT daily price chart.

$HYPE is 13% away from its closest resistance, at R1, marked by $40 on the daily timeframe. $HYPE started its upward trend on April 7, 2025. The token could find support at $32 in the event of a correction.

Momentum indicators on the daily timeframe support further gains in $HYPE, RSI climbed towards 83 and is sloping upwards. MACD is flashing green histogram bars above the neutral line, signaling the underlying positive momentum in $HYPE price trend.

The 2024 peak of $42.252 is a key target for $HYPE, it comes into play once the token flips resistance at $40 into support.

$WLD and $HYPE on-chain analysis

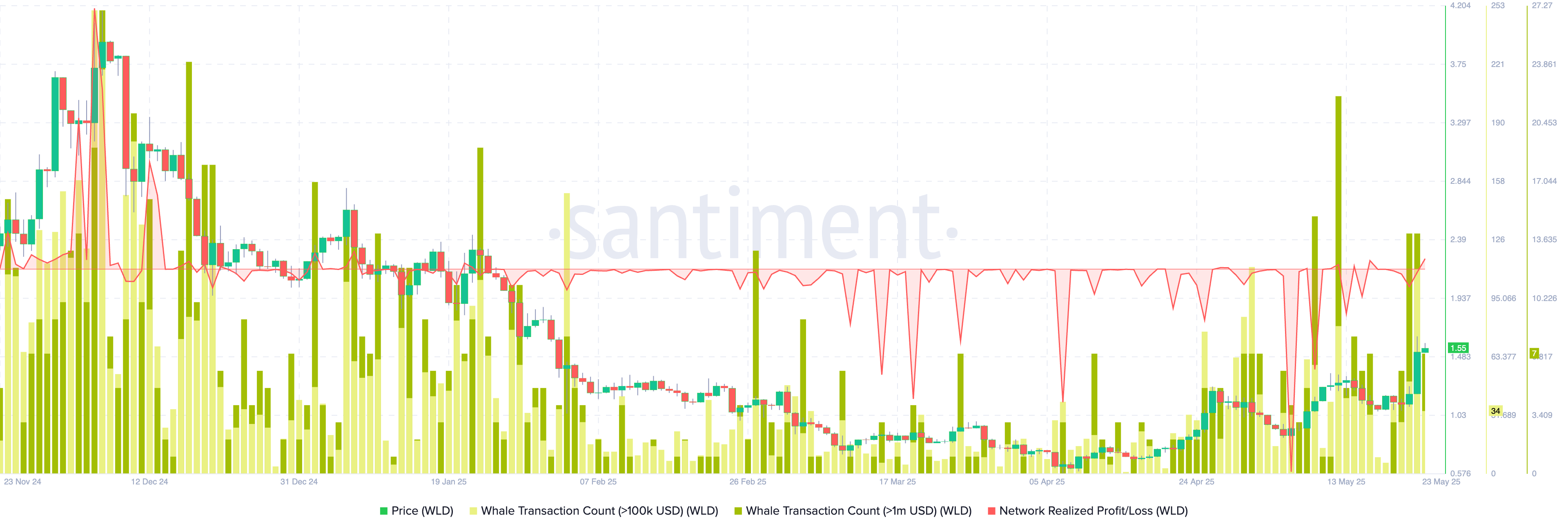

Worldcoin’s on-chain indicators support a bullish thesis for $WLD in the coming weeks. Network realized profit and loss, a metric that identifies the net profit/loss of all tokens moved on a given day shows consistent loss realization from traders throughout the first part of 2025.

NPL shows likely capitulation in $WLD, typically followed by an increase in a token’s price. The whale transaction count in two segments, valued at $100,000 and $1 million and higher shows spikes this week.

Large wallet investors moved their $WLD tokens realizing gains on their holdings, in a relatively small volume compared to the count of traders taking losses in the past few weeks. This shows selling pressure on $WLD is relatively low and there is scope for price gain next week.

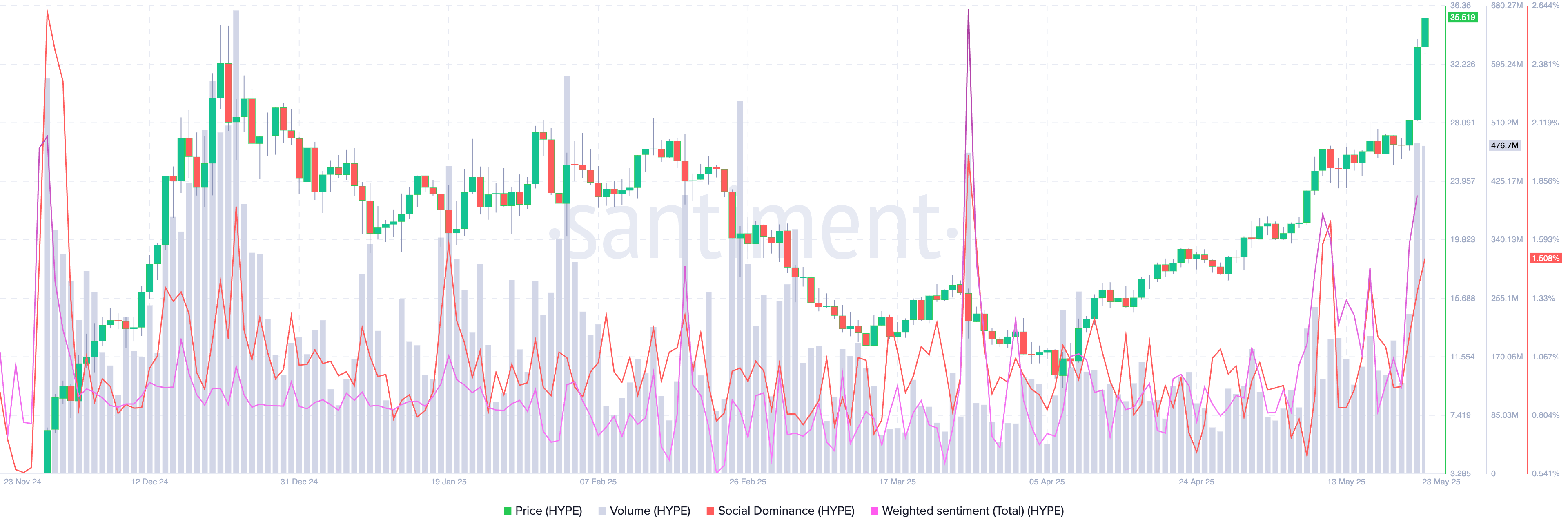

Hyperliquid’s on-chain metrics show a spike in trade volume, weighted sentiment and social dominance alongside the rally. $HYPE price rallied this week, driving up the share of $HYPE’s mentions across social media platforms and weighted sentiment turned increasingly positive.

While a spike is noted in social dominance and weighted sentiment, it remains relatively low when compared to the large positive spike observed in March 2025. This was followed by a correction in $HYPE and the token started its upward trend in the second week of April 2025.

Derivatives traders bullish on $HYPE rally, $WLD hype fades

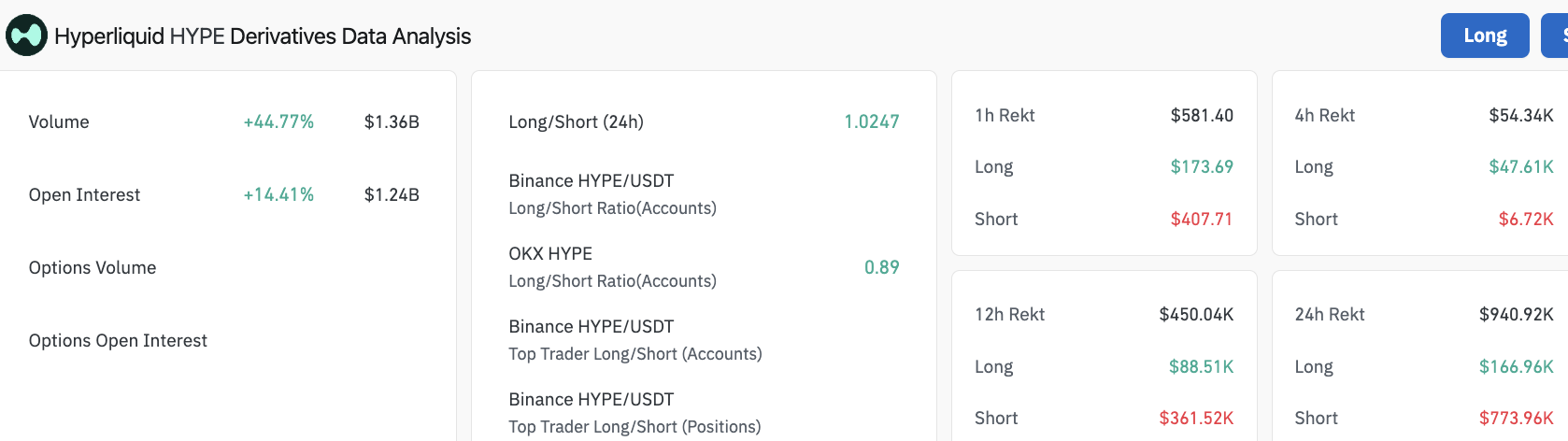

Derivatives data from Coinglass shows that long/short ratio exceeds 1 for $HYPE. This implies traders are bullish on gain in $HYPE price, and short positions dominate liquidations in the 24 hour timeframe.

The total liquidations for the last 24 hours are $940,000, a majority of short positions paid for longs, according to Coinglass data.

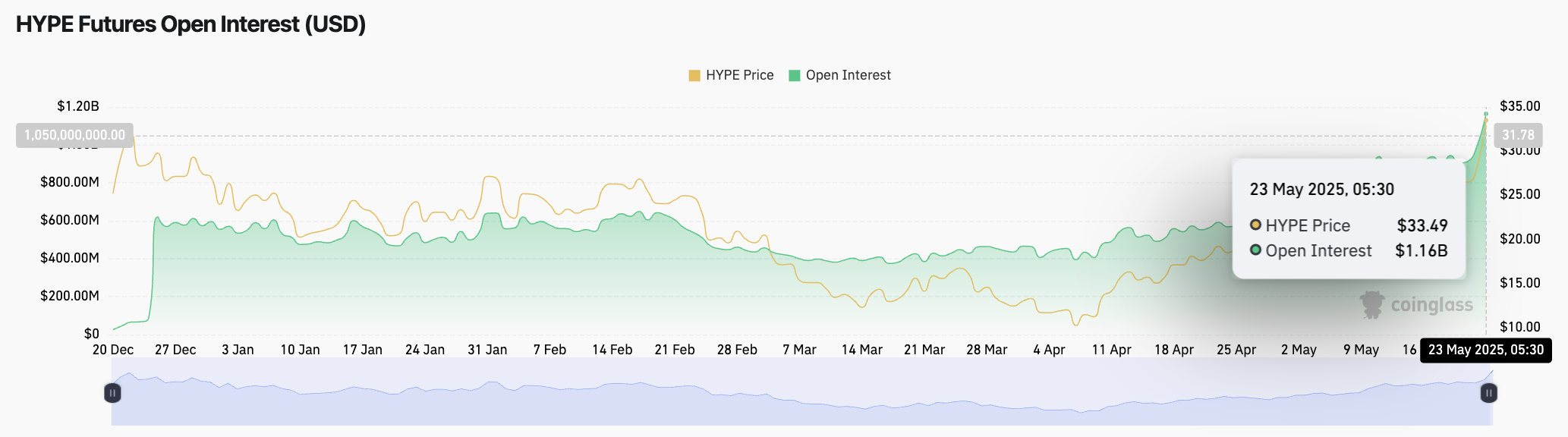

The futures open interest chart for $HYPE shows that OI is at its highest level since December 2024. OI has climbed to $1.16 billion, during the ongoing price rally and this marks the total value of open derivatives contracts in $HYPE.

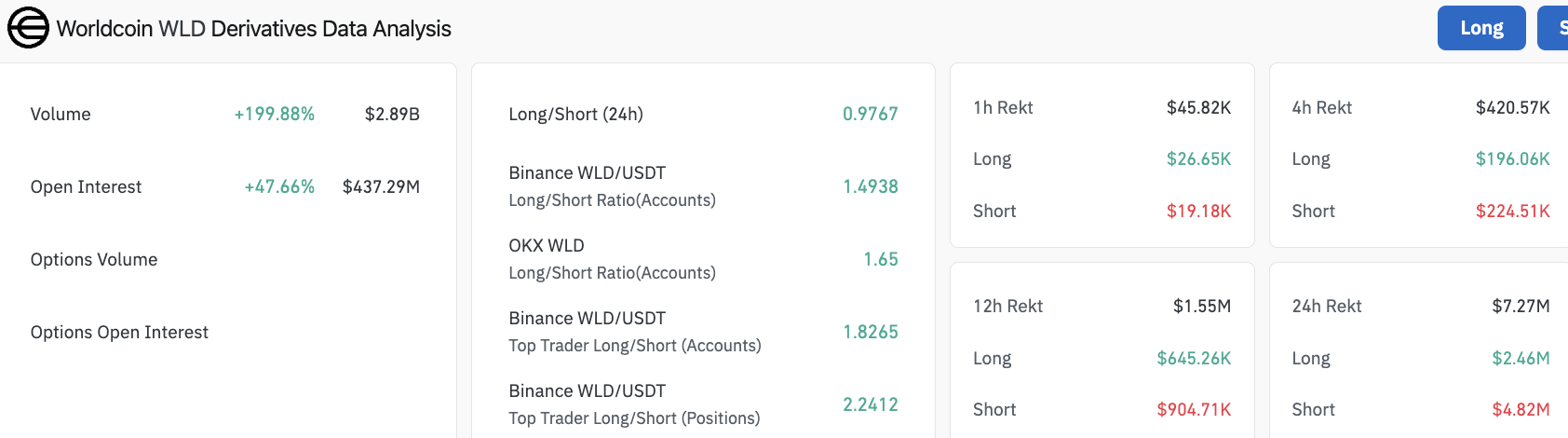

Worldcoin derivatives data analysis shows nearly 50% increase in OI in the last 24 hours. Similar to $HYPE, short liquidations exceed long and the total volume of liquidations stands above $7 million.

The long/short ratio is under 1 and shows derivatives traders may not be as bullish on $WLD price gain and sidelined buyers should exercise caution when opening a trade in the AI token.

Catalysts driving gains in $WLD and $HYPE

For $WLD, one of the largest catalysts is the announcement of Worldcoin’s expansion and the direct token sale to a16z and Bain Capital Crypto. News of a direct purchase of $135 million in $WLD has fueled a bullish sentiment among traders.

Through its official account, the Worldcoin team said that the investment was a direct purchase of non-discounted tokens, by two of the “earliest backers” of the project.

The funding comes from two of World’s earliest backers and long-term holders — a16z and Bain Capital Crypto.

— World (@worldcoin) May 21, 2025

This wasn’t a venture round. It was a direct purchase of non-discounted liquid tokens.

The circulating supply of $WLD has thus increased correspondingly.…

Hyperliquid has made several announcements about bridges built to transfer tokens to the $HYPE ecosystem, new listings and partnerships. However, a recent tweet from Maelstrom co-founder Arthur Hayes has supported the social media mentions of $HYPE.

Early on Friday, Messari Crypto reported that a Hyperliquid short-seller got liquidated for $23 million as the token posted nearly 90% gains.

Hyperliquid short seller liquidated for $23M after $HYPE soars to ATH pic.twitter.com/v3cdZu5DQL

— Messari (@MessariCrypto) May 23, 2025

Tether and its partner Plasma Foundation power zero-fee stablecoin transfers and the initiative was extended to the Hyperliquid exchange, adding to the list of catalysts.

The on-chain perpetual exchange’s new listings, partnerships and the arrival of zero-fee stablecoin transfers in its ecosystem are currently the largest catalysts driving gains in $HYPE token.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.