Summary

⚈ U.S. GDP shrank 0.3% in Q1 2025, missing expectations and fueling market fears.

⚈ Token unlock and ETF delay add to $XRP’s downward pressure and investor uncertainty.

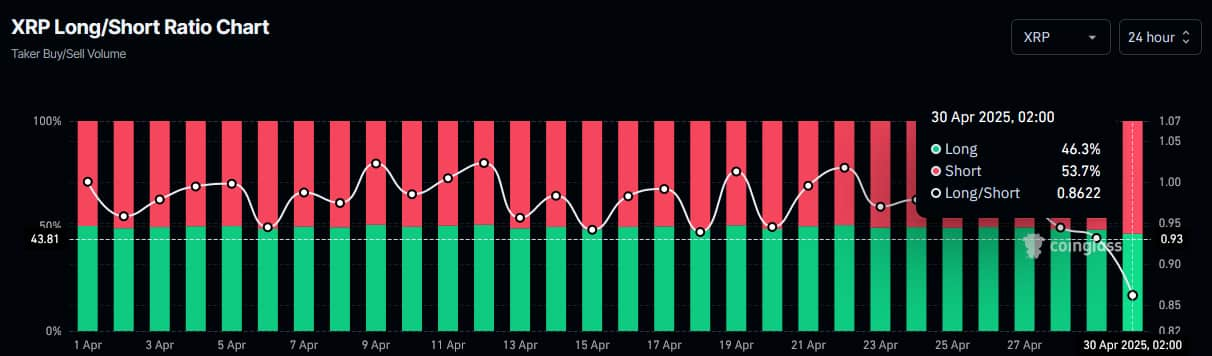

The ratio of long and short $XRP futures positions has reached a 1-month low of 0.8622 on April 30, according to the latest data retrieved by Finbold from crypto intelligence platform CoinGlass.

In other words, $XRP shorts are at a 1-month high, with 53.7% of positions opened within the last 24 hours being short sales.

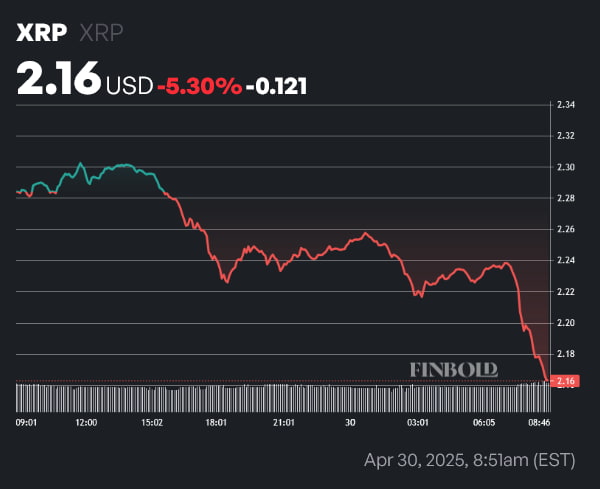

Moreover, the increase in bearish bets is not a reaction to an overextended move to the upside. On the contrary, $XRP has marked a 5.30% decline in price over the past 24 hours, and was last trading at $2.16 at press time on April 30.

$XRP shorts surge following GDP miss, token unlock, and ETF delay

Multiple factors impacting the outlook of derivatives traders are at play.

First and foremost are market-wide dynamics. The gross domestic product (GDP) of the United States contracted by 0.3% in the first quarter of 2025 — marking the first such decline since Q2 2022.

To make matters worse, consensus estimates were pegged at a GDP growth of 0.3% — so the rate of underperformance is quite substantial. Two consecutive quarters of negative GDP growth are the rule of thumb for determining when an economy enters a recession.

In addition, $XRP is expected to face a significant shift in supply and demand dynamics, as 1 billion tokens is set to be unlocked on May 1, potentially increasing sell pressure.

Finally, the Securities and Exchange Commission (SEC) has postponed its decision on a spot $XRP exchange-traded fund (ETF) approval, in a move that will serve to further delay the cryptocurrency’s adoption by institutional investors.

Featured image from Shutterstock

finbold.com

finbold.com