This week, the declining crypto market capitalization and large swings in Bitcoin’s price have influenced the top-performing picks: Hyperliquid, Curve DAO, and Fartcoin. These three tokens have rallied between 25% and 100% in the past seven days.

Crypto market capitalization now stands at $2.711 trillion, up 2% in the last 24 hours. Bitcoin’s market cap has climbed 2% since the beginning of April 2025. Bitcoin ($BTC) dominance has been in an upward trend throughout April, likely delaying the onset of an altcoin season in this cycle.

Bitcoin’s flashcrashes failed to influence a few altcoins, Hyperliquid ($HYPE), Curve DAO ($CRV), and Fartcoin ($FARTCOIN) showed resilience in the face of the ongoing market correction.

Table of Contents

Bitcoin performance against $HYPE, $CRV and $FARTCOIN

Bitcoin’s price has experienced multiple harsh selloffs since the U.S. presidential election in November 2024. After nearly five such dips, $BTC recovered each time. The chart below compares Bitcoin’s price performance against $HYPE, $CRV, and $FARTCOIN.

While Bitcoin remained relatively flat over the past seven days, it gained 5.45% on Friday. In the same timeframe, Hyperliquid rose 34% and traded nearly 11% higher on the day. Curve DAO gained 20% in the past week, rallying 11% on April 11.

The chart data clearly shows that these altcoins posted double-digit gains against Bitcoin’s relatively modest move.

$HYPE, $CRV and $FARTCOIN derivatives analysis

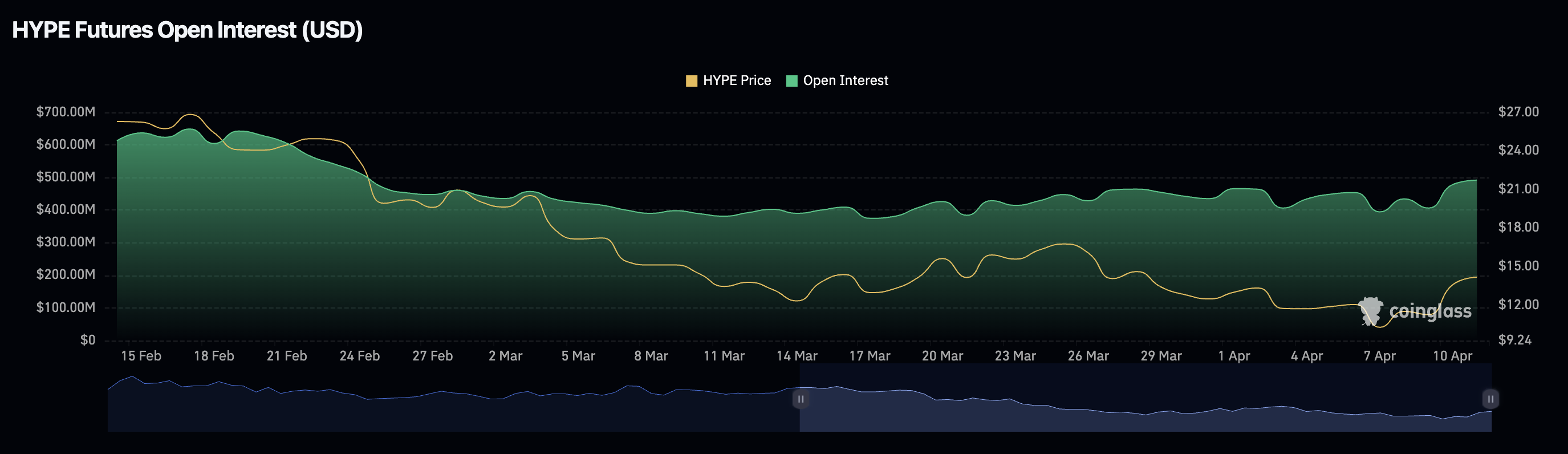

Derivatives traders are betting on further rally in $HYPE price in the coming weeks. The long/short ratio, a key metric used to identify whether derivatives traders are bullish or bearish on a token, reads 1.0799, a value greater than one.

There is a larger volume of long positions against short ones in $HYPE, meaning traders remain bullish on the token. Open Interest climbed 16% to $554.95 million and $193 million in shorts have been liquidated in the last 24 hours, against $19 million in longs.

Traders with short positions are paying for longs as they get liquidated and $HYPE continues its upward trend.

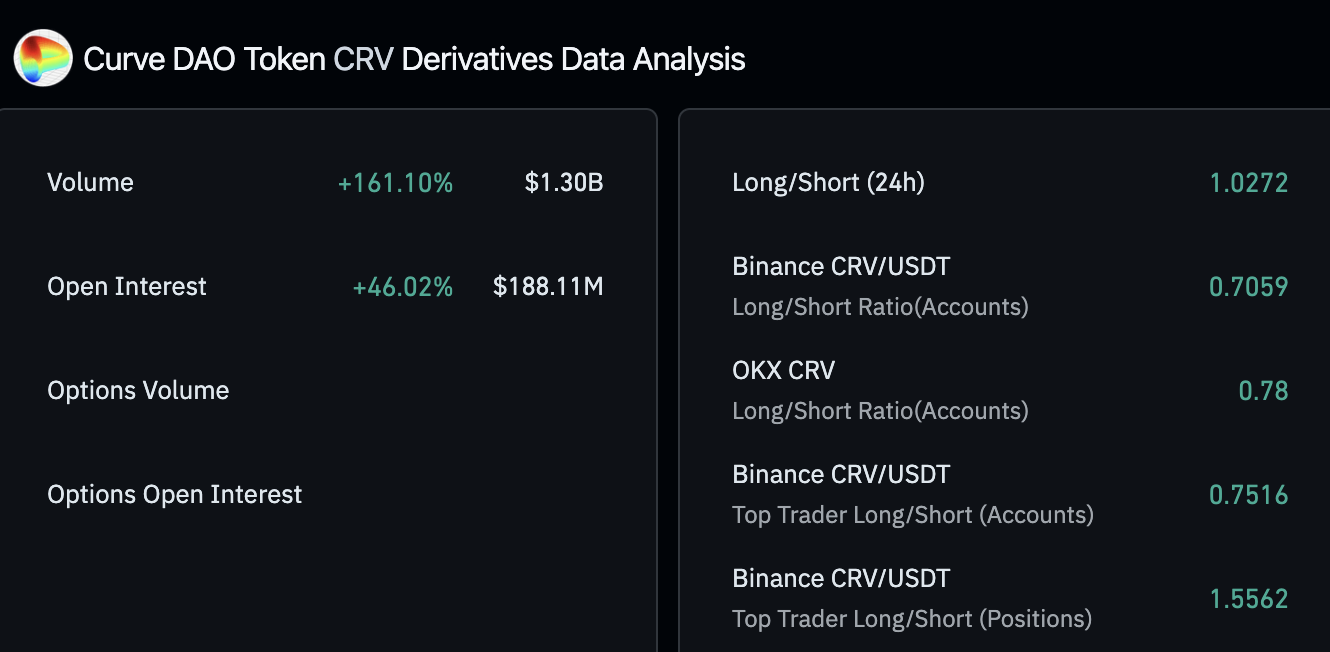

$CRV’s open interest also surged on Friday, climbing from $126.38 million to $155.80 million within 24 hours. Approximately $2.15 million in $CRV shorts were liquidated during this period. The long/short ratio for $CRV is also above one, mirroring $HYPE’s bullish setup.

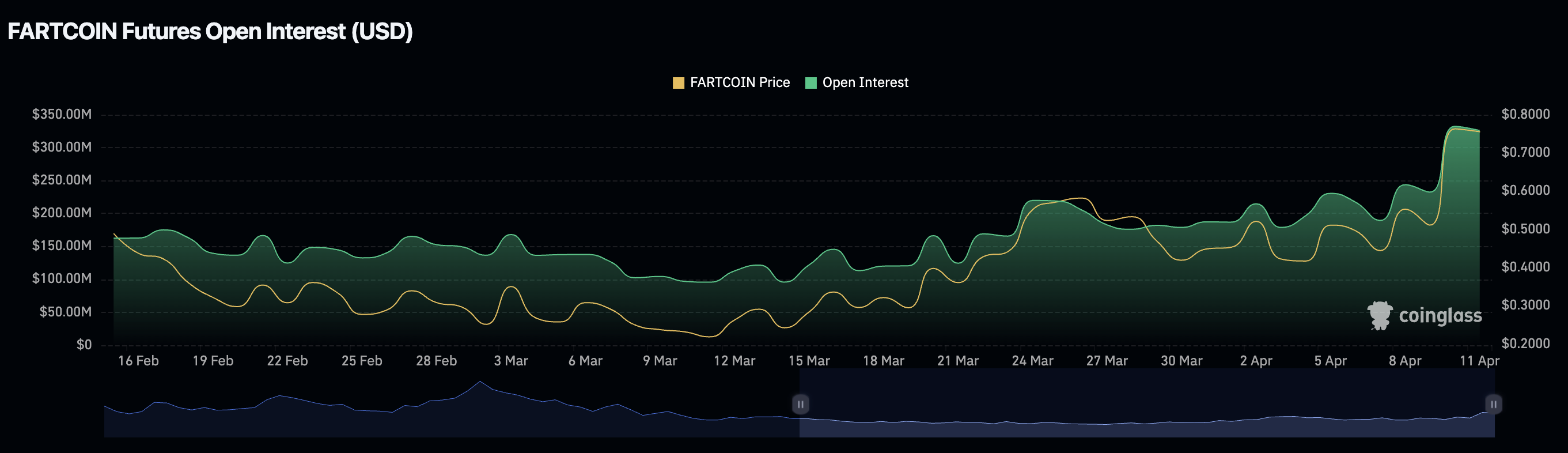

$FARTCOIN saw a 50% increase in open interest over the last day. Although its overall derivatives volume remains lower compared to $HYPE and $CRV, the meme coin saw nearly eight times more short liquidations than long ones in the past 24 hours.

The derivatives analysis outlook is bullish for the Solana-based meme coin, as $FARTCOIN outperforms broadly the entire crypto ecosystem in the month of April 2025.

$HYPE, $CRV and $FARTCOIN price forecast

Hyperliquid could extend its gains by 33% and test resistance at R1, $20.850. This level marks the lower boundary of an FVG on the daily price chart. $HYPE could find support at $13.141, another key level marked by the boundary of an FVG on the $HYPE/$USDT daily price chart.

Technical indicators support this bullish thesis. RSI is at 57 and rising, while MACD is printing green histogram bars above the neutral line, signaling bullish momentum.

$CRV could target resistance at $0.6770, representing a 7.68% upside from current levels. A further resistance zone lies at $0.7083. In the event of a correction, $CRV may find support at $0.5522.

$FARTCOIN could climb another 22% if bullish momentum persists, with a target resistance level at $1.13308. The RSI has entered overbought territory, suggesting a potential short-term pullback. However, MACD remains bullish with green bars above the neutral line.

At the time of writing, $FARTCOIN is trading at $0.92347.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.