Chainlink ($LINK) has established a strong position in the market. Its recent partnerships and technical indicators suggest the potential for a breakout to new highs.

Market analysts predict $LINK price will hit $50 after Chainlink’s Cross-Chain Interoperability Protocol (CCIP) integrates with Hedera’s mainnet together with Libre Capital’s partnership.

CCIP Boosts Cross-Chain DeFi Potential

The most important update for Chainlink has been that its CCIP has been successfully integrated on Hedera’s mainnet.

The integration here unlocks new use cases for tokenized assets and cross chain applications.

Seamless token transfers, messaging and actions happen across all blockchain networks in CCIP. This is a turning point for the DeFi space.

Furthermore, Chainlink’s partnership with Libre Capital further boosts it in the institutional segment.

With the use of Chainlink CCIP, Libre Capital facilitates tokenizing funds on one of the most widely used platforms, which serves the world’s largest asset managers and wealth advisors.

This is adopted to improve liquidity between blockchains. That would ensure secure and transparent transactions as DeFi applications are required for continued growth.

Through this partnership, integration on Chainlink will facilitate Proof of Reserve and NAVLink to provide real time transparency on backing assets thereby playing a role in proper collateralization of tokenized funds that is a key criteria for building trust in decentralized markets.

The technology stack provided by Chainlink enables institutions to move between traditional and decentralized finance in a seamless manner, and provides the foundation for future growth.

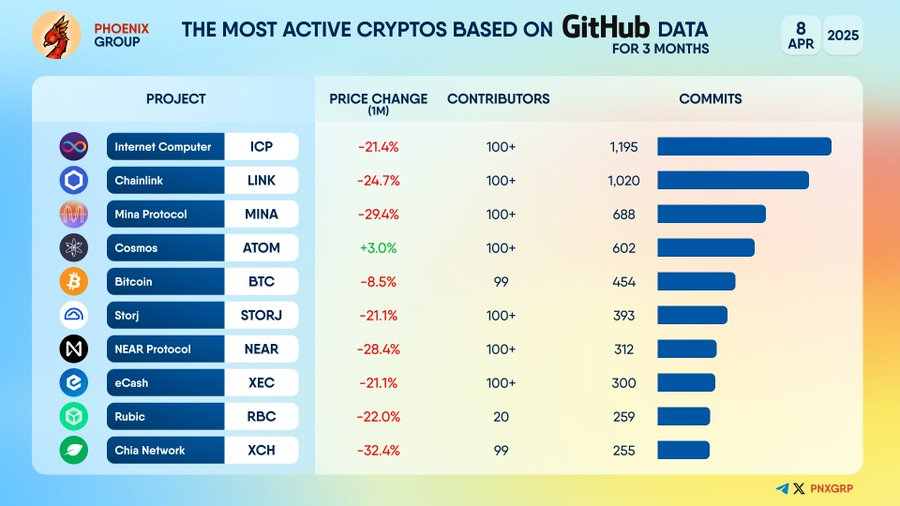

The sustained lead position of Chainlink in developer activity stands as a key marker for ongoing successful development.

The GitHub project activity shows Chainlink as one of the highly engaged projects because it attracts many contributors who implement regular upgrades.

Strong fundamentals are associated with high developer activity and Chainlink demonstrates these strengths through its recent scalability and security and interoperability improvements.

Technical Setup Indicates Potential Bullish Move for Chainlink

Daily trading chart has displayed a bullish reversal pattern, falling wedge that predicts that Chainlink is about to surge once the pattern is confirmed.

The Relative Strength Index (RSI) is at 30.68 signaling that the market is bearish and nearing oversold level.

A move above the midline at 50 level could suggest weakening bearish movement and potential increase before the market becomes overbought.

Also, the Cumulative Volume Delta (CVD) does sit at -243.34K, meaning selling pressure has been greater than buying activity in the past few sessions.

Signaling that there has been more selling than buying in the market, indicating a bearish market.

The Moving Average Convergence Divergence indicator shows a current bearish trend because its MACD line stays below its signal line.

A MACD line crossing above the signal line reveals a bullish directional change in the market for Chailink.

Market Analyst Predicts $50 Target for Chainlink Amid Growing DeFi Adoption

Analyst LLuciano_BTC says $LINK could see a rally towards a $50 target as adoption grows, with its technical indicators supporting it.

Recently, the price broke out of a descending channel, indicating the possibility of shifting the trend and move towards the upside.

Historically, the $9.28–$12.00 demand zone has served as a launchpad for upward momentum and has now picked up that support.

As resistance lines are set at $18.84 and $26.48, the price of $LINK could head up further. A $50 target is still in play if momentum persists.

Nevertheless, the increasing acceptance of Chainlink’s DeFi infrastructure and its partnerships further boost the bullish anticipation for Chainlink, with the DeFi sector predicted to rise to $30–50 trillion by 2026.

thecoinrepublic.com

thecoinrepublic.com