This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

When Trump said “tariff” was the most beautiful word in the dictionary, he neglected to mention that beauty is subjective.

Since Trump’s “reciprocal” tariff announcements on April 2, the S&P 500 is down about 10.6%.

Even gold, typically considered to be uncorrelated with equities, took about a 6.4% dive on the tariff news.

Crypto markets held up over the weekend, much to everyone’s surprise.

Many theories were offered for explanation.

Some suggested crypto assets showed resistance on anticipated rate cuts and quantitative easing; some said the equities selloff on Friday was simply institutional outflows; and Galaxy’s Alex Thorn posited that $BTC was simply “tariff-proof.”

Yet, after this brief flirtation with the idea that crypto assets would decouple from equity markets, it turned out to be pure hopium.

As the weekend drew to a close, bitcoin took a 6% nosedive on noon Sunday from $82.5k to its current trading levels of $77.2k. In the same time period, $ETH took a harder tumble of 15.7%.

Down, but not a panic yet, according to CF Benchmarks’ head of product Thomas Erdösi. He notes that “CME basis remains firm above 6%, and the demand for downside protection, as seen in the 25-delta skew, underscores cautious sentiment without signaling panic.”

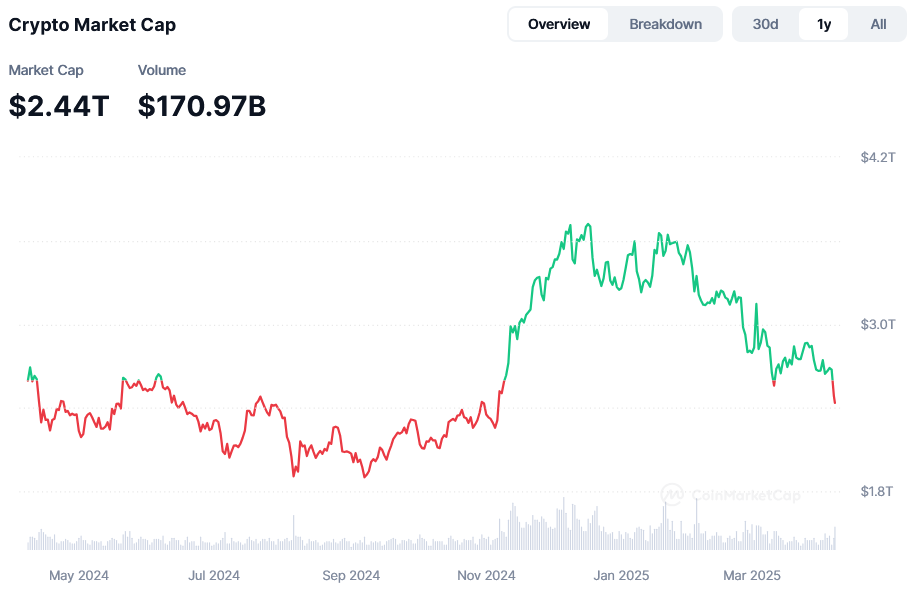

Total crypto market cap wiped thus far? About $0.23 trillion, or 8.6%.

At bitcoin’s current price of $77k, that is about a steep 27.2% drawdown from January’s all time-highs of $106k, but still a relatively light drawdown compared to past years. The pink part of the Glassnode chart demonstrates yesterday’s drawdown relative to the last cycle.

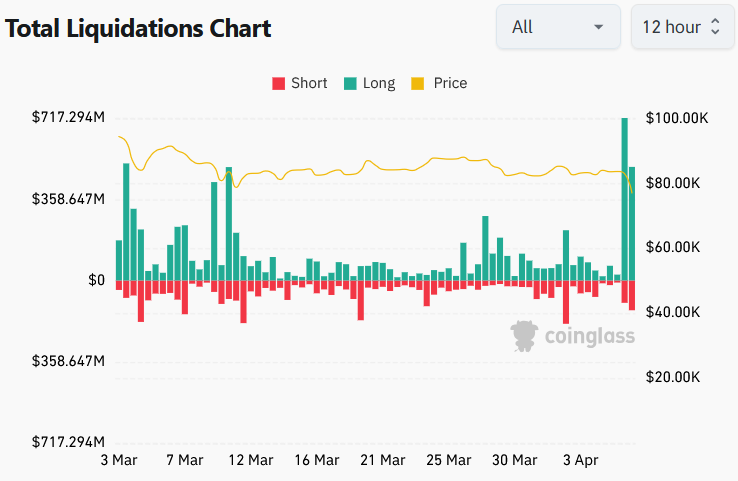

Based on CoinGlass data, total estimated liquidations of crypto assets in the last 24 hours equaled to about $1.42 billion. $BTC saw about $479 million while $ETH saw $418 million in liquidations.

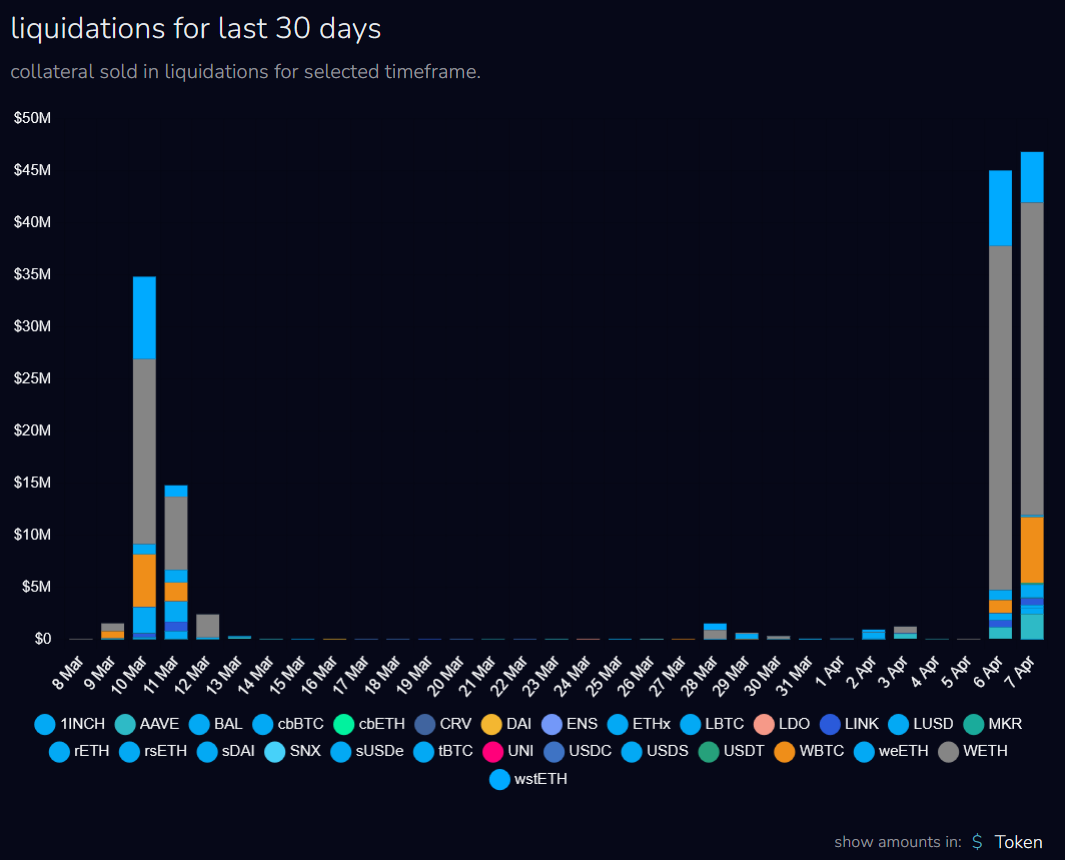

On the April 6 and 7, Aave v3 on Ethereum saw a total $91.85 million in liquidations and accumulated zero bad debt, based on Blockanalitica data.

blockworks.co

blockworks.co