Bitcoin endured a sharp decline this weekend, plunging to a session low of $81,629 per coin on Saturday. The broader digital asset market retreated by 2.14% over the preceding 24 hours, settling at $2.66 trillion as of 4 p.m. ET on March 29.

Fear Grips Crypto Markets

Crypto markets are grappling with significant turbulence, and the leading ten cryptocurrencies by market capitalization have similarly declined in value relative to the U.S. dollar this weekend. Bitcoin has dipped 1.7%, while ethereum has shed 3.2%, and XRP has slipped 2.5% in today’s trading.

BNB has also retreated 2.5%, solana has slumped 3.6%, and Dogecoin has plummeted a steep 6%. Bitcoin is currently priced at $82,612, following a retreat to a session low of $81,629 per coin.

The top digital asset’s market capitalization has contracted to $1.63 trillion, accompanied by $17.92 billion in global trading volume over the past day. While BTC has declined 1.7% over the past 24 hours, it has lost 2.3% against the dollar on a week-over-week basis.

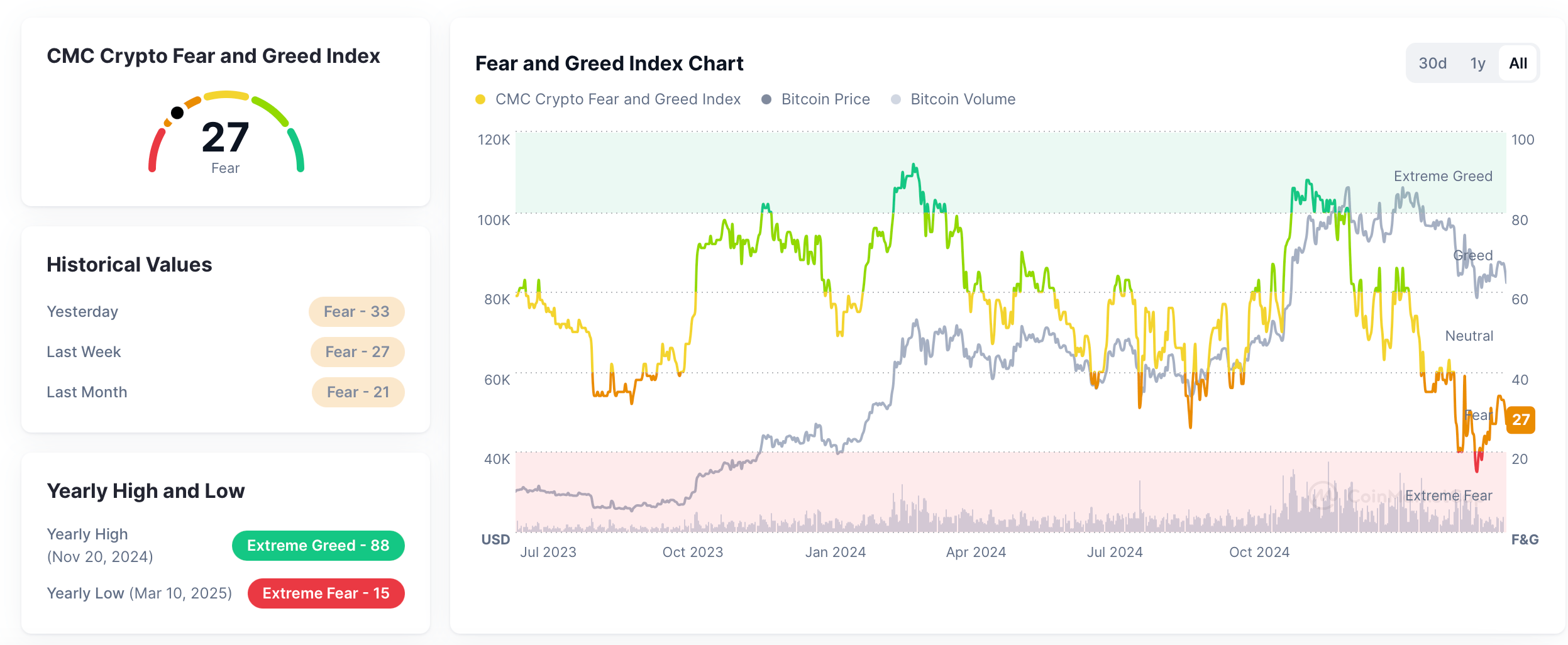

Current indicators suggest decidedly bearish market dynamics, with the critical support level at $75,000–$70,000 likely to be tested should sentiment remain unchanged. While not yet reaching the “extreme fear” threshold, the Crypto Fear and Greed Index (CFGI) has registered a score of 27 out of 100—a notable decline from the 33 recorded the prior day.

Nevertheless, market sentiment persists in the “fear” category per the latest CFGI data. In cryptocurrency derivatives markets, $347.26 million in positions were erased today. Coinglass metrics reveal 139,263 traders faced liquidations over the past 24 hours, with $78.78 million attributed to bitcoin long positions and $72.37 million tied to ethereum long contracts.

Broadly, the sector exhibits subdued activity, and crypto exchange-traded funds (ETFs), particularly those focused on bitcoin, experienced outflows on Friday, halting a streak of ten straight days of inflows.

news.bitcoin.com

news.bitcoin.com