Peter Brandt has identified a complex head and shoulders top for XRP, suggesting a drop to November 2024 lows except a recovery ensues.

The market veteran’s recent analysis follows a previous disclosure from him regarding XRP’s current price position. For context, XRP has not set out a clear trend since the start of this month, March. The altcoin has witnessed periods of price slumps and occasional upsurges but maintains the same bearish footing.

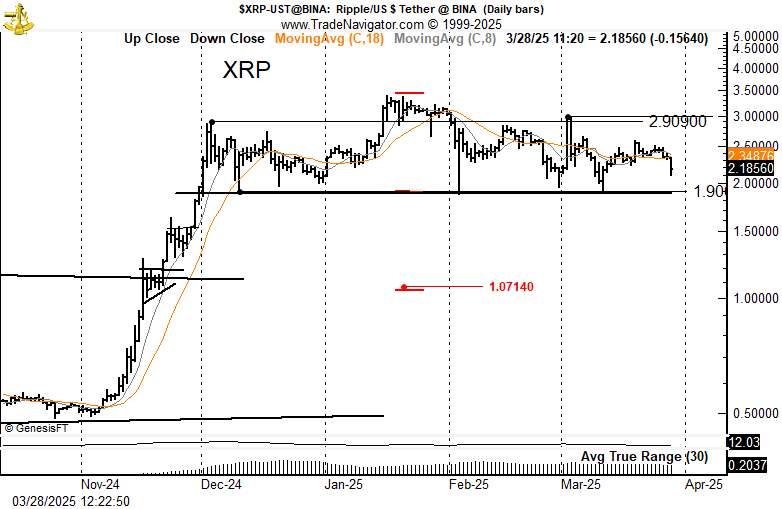

XRP Forms Head and Shoulders Top

Amid this indecisive phase, market veteran Brandt believes the asset has formed a head and shoulders top. For the uninitiated, a head and shoulders structure is a bearish pattern that often signals an imminent downward trend. It typically consists of two lower peaks (left and right shoulders), with a higher peak (the head) between them.

Brandt’s chart suggests that the left shoulder formed when XRP soared to the $2.9 peak in early December 2024. This came up on the back of the uptrend that began in November 2024 following Donald Trump’s victory in the election. XRP rallied from $0.5 in November to $2.9 in December before facing rejection.

After over a month of consolidation, the altcoin recovered, soaring to a new seven-year peak of $3.4 in mid-January 2025. According to the chart, this $3.4 peak represented the head of the pattern. Following the resistance at $3.4, XRP collapsed amid a broader market pullback.

Interestingly, after President Donald Trump’s social media announcement earlier this month that the government plans to include XRP in the nation’s crypto reserve, XRP staged another recovery. The asset hit a peak of $3 on March 2, forming the right shoulder.

Price Levels to Watch

With the formation of both shoulders and the head, data indicates that the the pattern’s neckline stands around the $1.9 to $2 mark. This region is particularly crucial, as it determines if the head and shoulders pattern will take full shape or if XRP will invalidate it.

In his recent analysis, market veteran Brandt branded XRP a “pet rock,” reminiscent of his earlier criticisms of the asset. However, he admitted that if XRP soars above the $3 mark, the bearish connotation would become invalid.

Nonetheless, should the head and shoulders pattern play out, the veteran trader expects a drop to $1.07. The last time XRP saw this price level was in November 2024, during the massive run that saw it recover $2. A drop below $2 and into the $1 range could prove bearish for the asset in the near term.

In his previous disclosure, Brandt suggested that this crash could materialize if XRP drops below $1.9, representing the neckline. Currently, XRP trades for $2.16, down 6.12% over the past 24 hours. A further 12% crash would bring the $1.9 neckline support into play. Previous analyses had suggested that XRP remains bullish as long as it holds $2.

thecryptobasic.com

thecryptobasic.com