The U.S. Federal Reserve’s preferred inflation measure elevated sharply in February, with the core personal consumption expenditures price index climbing 0.4%—the largest monthly spike since January 2024—while consumer spending growth fell short of expectations, the Commerce Department reported Friday.

Fed’s Inflation Fight Faces Setback With Surging PCE Data

The core PCE price index, which excludes volatile food and energy costs, pushed the annual inflation rate to 2.8%, remaining stubbornly above the Fed’s 2% target. Overall, PCE prices rose 0.3% for the month and 2.5% year-over-year, driven by persistent increases in services and goods costs, including health care, financial services, and recreational goods. The data shows ongoing inflationary pressures complicating the central bank’s path to rate cuts.

Consumer spending, a key driver of economic activity, grew just 0.4% in February to $87.8 billion, below analyst projections. Gains were led by spending on goods ($56.3 billion), particularly motor vehicles and recreational items, while services outlays rose $31.5 billion. However, declines in food services, accommodations, and gasoline spending offset some growth. Real PCE, adjusted for inflation, inched up 0.1%, signaling weaker demand amid elevated prices.

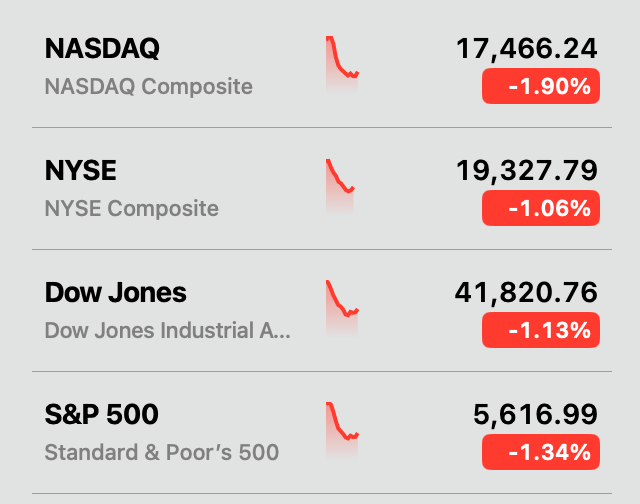

Financial markets reacted sharply to the report, with all major U.S. stock indices falling hard on Friday following the news.

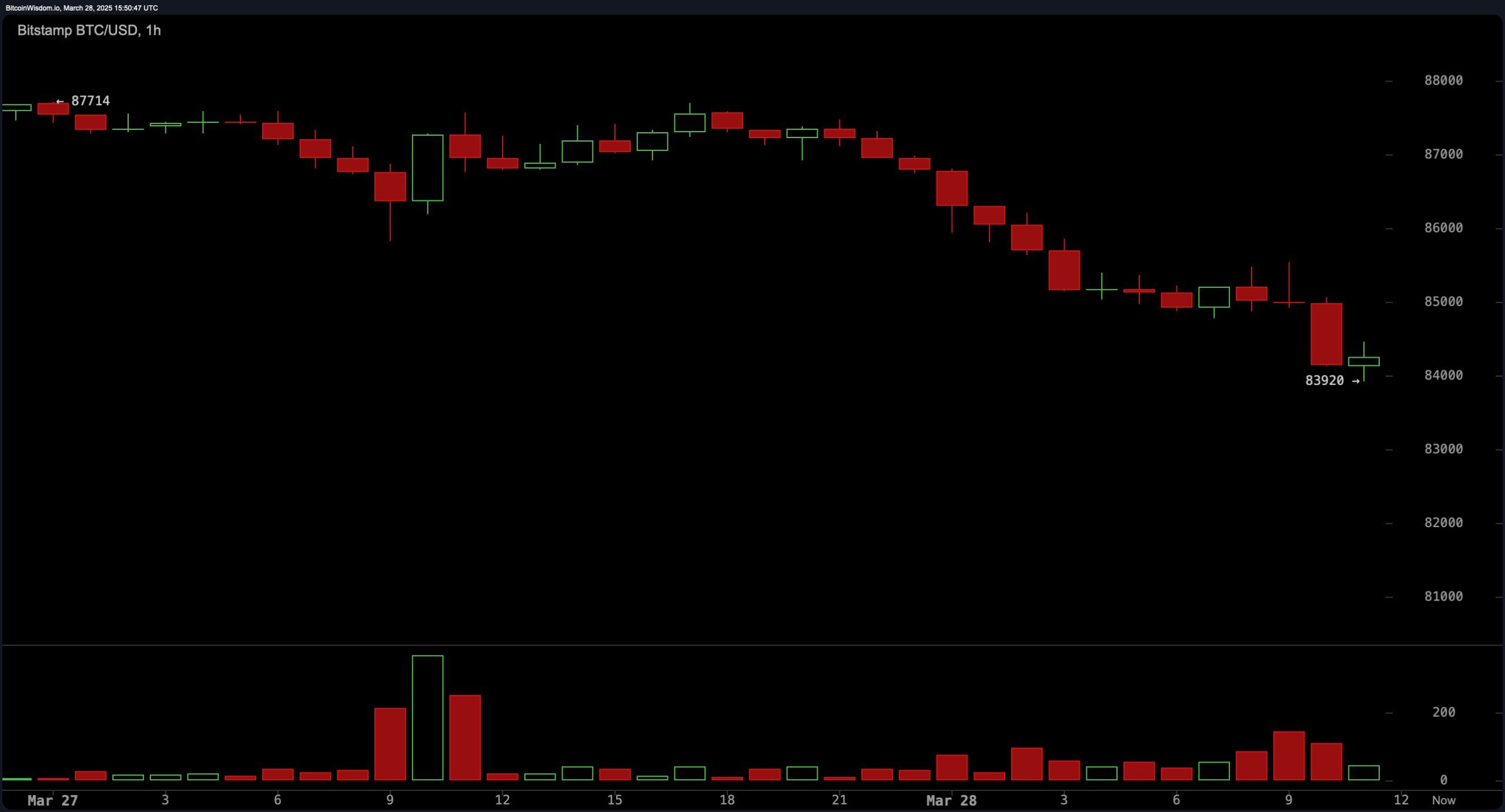

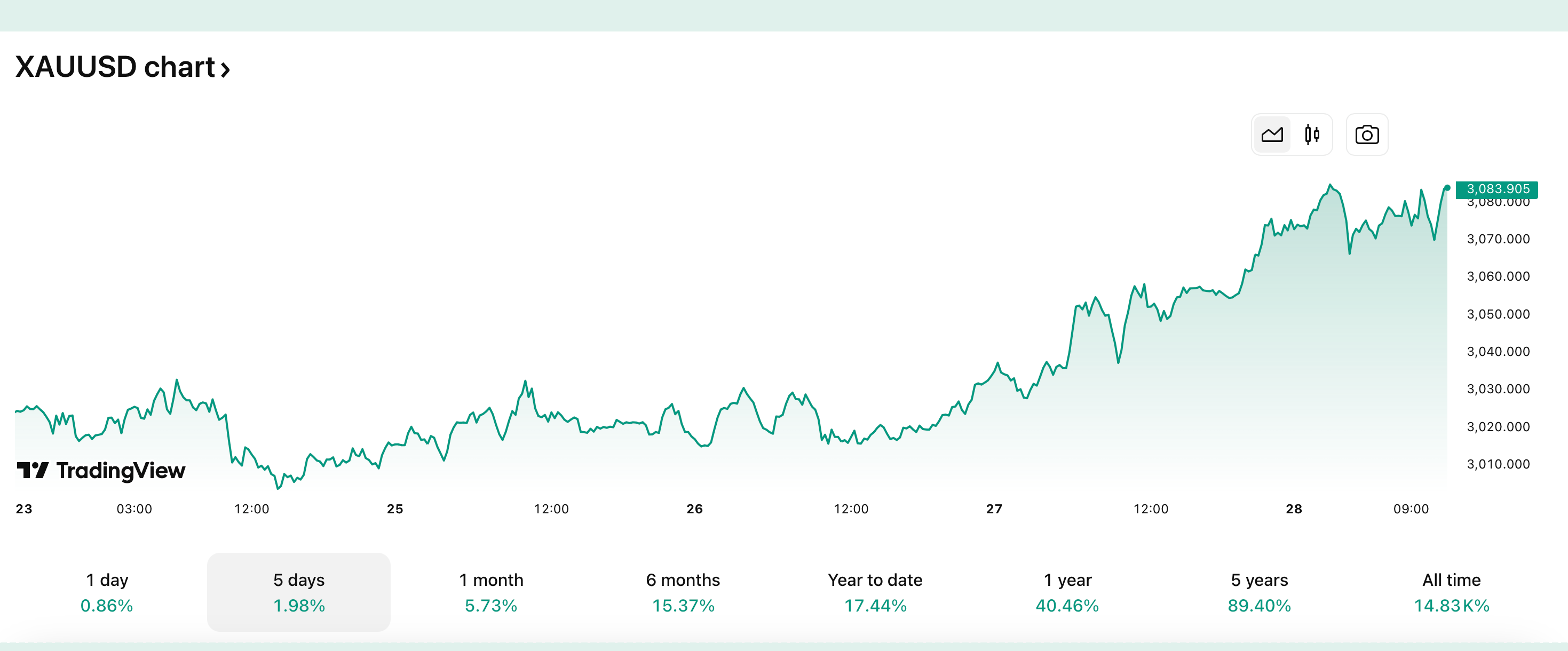

Bitcoin ( BTC) plunged to an intraday low of $83,920 per unit, as investors retreated from crypto assets. Gold, a traditional inflation hedge, remained firm at $3,071 per ounce at 11:30 a.m. ET on Friday, reflecting heightened economic uncertainty.

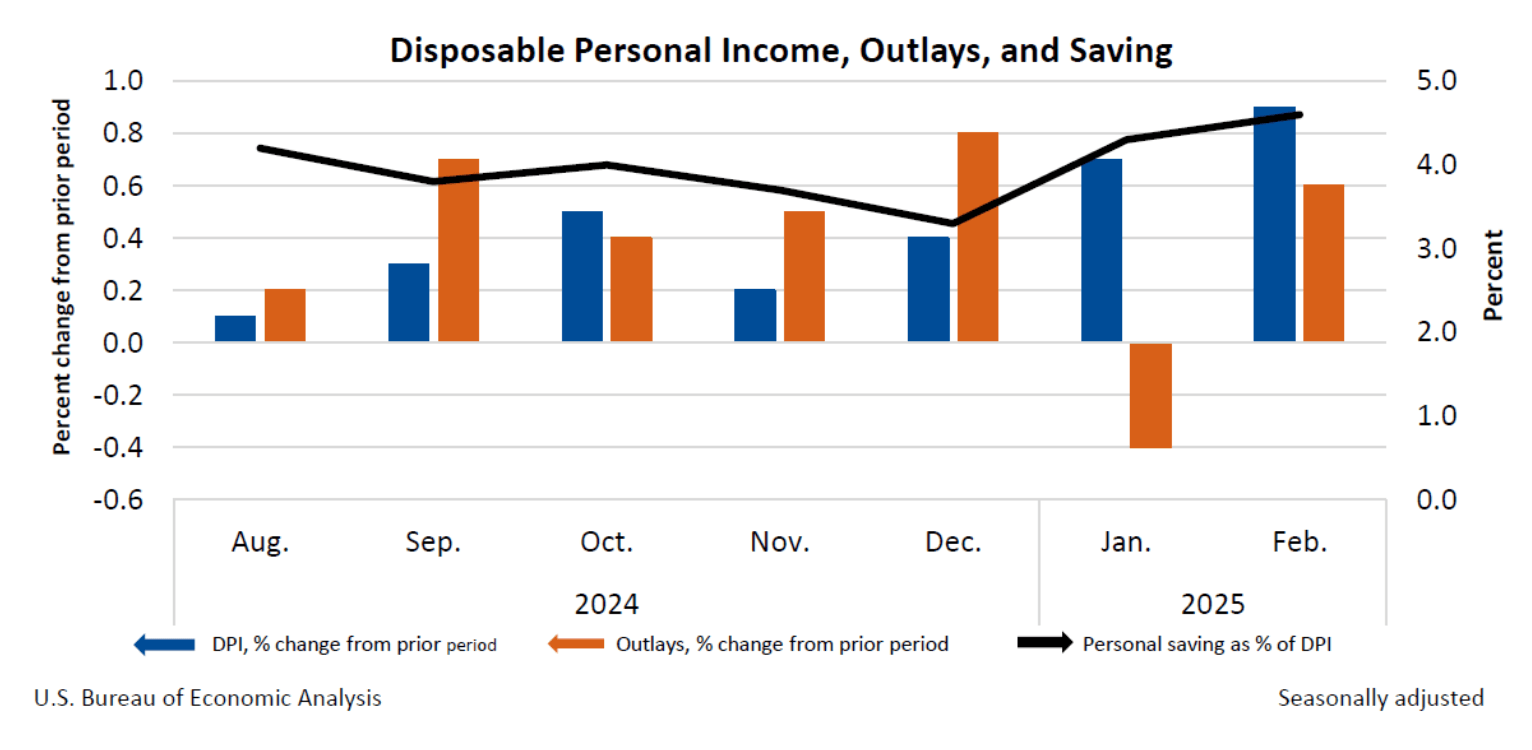

The Commerce Department noted personal income climbed 0.8% in February, bolstered by wage growth and transfer receipts like healthcare subsidies. Disposable income rose 0.9%, though real disposable income—adjusted for inflation—grew just 0.5%. Meanwhile, the personal saving rate held at 4.6%, suggesting households remain cautious.

Revisions to prior data showed weaker income growth in January, with wages revised down to 0.2% and farm proprietors’ income slashed by $33.9 billion due to delayed relief payouts. Federal workforce adjustments stemming from DOGE, including deferred resignation programs, did not impact February’s employment metrics, per the Bureau of Economic Analysis.

The report sets the stage for a tense Fed policy meeting in April as the central bank’s policymakers attempt to balance resilient inflation against signs of moderating consumer momentum. The Commerce Department explained that updated income and spending data for March will be released on April 30.

news.bitcoin.com

news.bitcoin.com