Shiba Inu boasts a higher percentage of long-term holders than market leaders Bitcoin and Ethereum, according to on-chain data.

The direction of the crypto market has long been dictated by Bitcoin (BTC), being the pioneering crypto asset. As a result, assets such as Shiba Inu (SHIB) have continued to follow in Bitcoin’s footsteps, which seems to lead in most major market metrics.

However, it appears SHIB, which bears the lowly meme coin branding, decisively beats Bitcoin and other market leaders in a crucial metric. Particularly, Shiba Inu boasts a higher percentage of long-term holders than Bitcoin and even the altcoin market leader Ethereum.

Shiba Inu Boasts a 76% LTH Ratio

Data from IntoTheBlock confirms this surprising trend. Notably, IntoTheBlock revealed on March 21 that Shiba Inu has the third-highest percentage of long-term holders among the assets it currently supports. Notably, in this bullish metric, SHIB is only behind Litecoin (LTC) and Chainlink (LINK).

For context, long-term holders are addresses that have held onto their tokens for at least a year. A higher percentage of long-term holders indicates that investors are more confident in an asset’s potential and most of its holders have continued to HODL their bag amid the prevalent optimism.

At the time of the disclosure days back, about 75.8% of Shiba Inu holders were long-term holders. This beats the ratios from Ethereum and Bitcoin, which respectively stood at 74.2% and 73.3%.

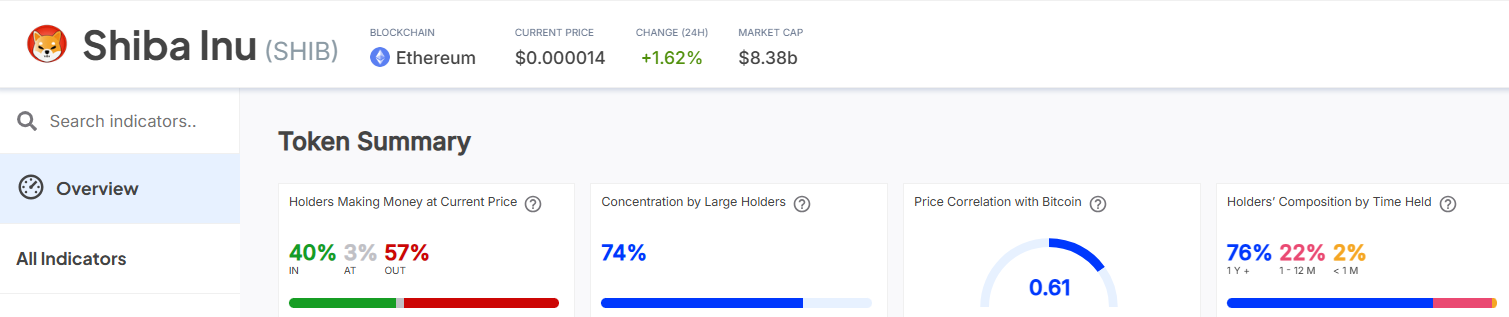

Interestingly, current data suggests Shiba Inu’s metrics have improved since March 21, while Ethereum has observed declines. Currently, SHIB long-term holders have increased to 76% of its total addresses. Meanwhile, 22% have held onto their tokens for 1 to 12 months, and only 2% have for less than a month.

Bitcoin and Ethereum

The share of Bitcoin’s long-term holders has also increased but remains below Shiba Inu at 74%. For the premier crypto asset, 22% of its holders have also held between 1 and 12 months. Meanwhile, about 5%, significantly higher than Shiba Inu, have held for less than 1 month. This indicates BTC has more tourists than SHIB.

Contrasting the trend observed with Bitcoin and Shiba Inu, Ethereum’s long-term holders appear to have reduced since March 21, currently representing 74% of the total wallets. However, more addresses, about 23%, have held for 1 to 12 months, while about 3% have been in the market for less than a month.

Interestingly, data also shows that Shiba Inu beats Ethereum in the average holding time of tokens by an address despite launching five years later. The meme coin’s average holding time stands at 2.6 years, while Ethereum’s average holding time is 2.4 years. BTC, which has existed for over a decade, boasts an average holding time of 4.4 years.

thecryptobasic.com

thecryptobasic.com