Crypto investors need to pay attention to Avalanche ($AVAX) price because it had been making progress consistently over a week’s time.

Having crossed its essential $18 multiyear support point, it is now seeing a new high at $22.

This was evident as the the support led to a price hike after rejecting a further sell-off.

Avalanche ($AVAX) Price Action

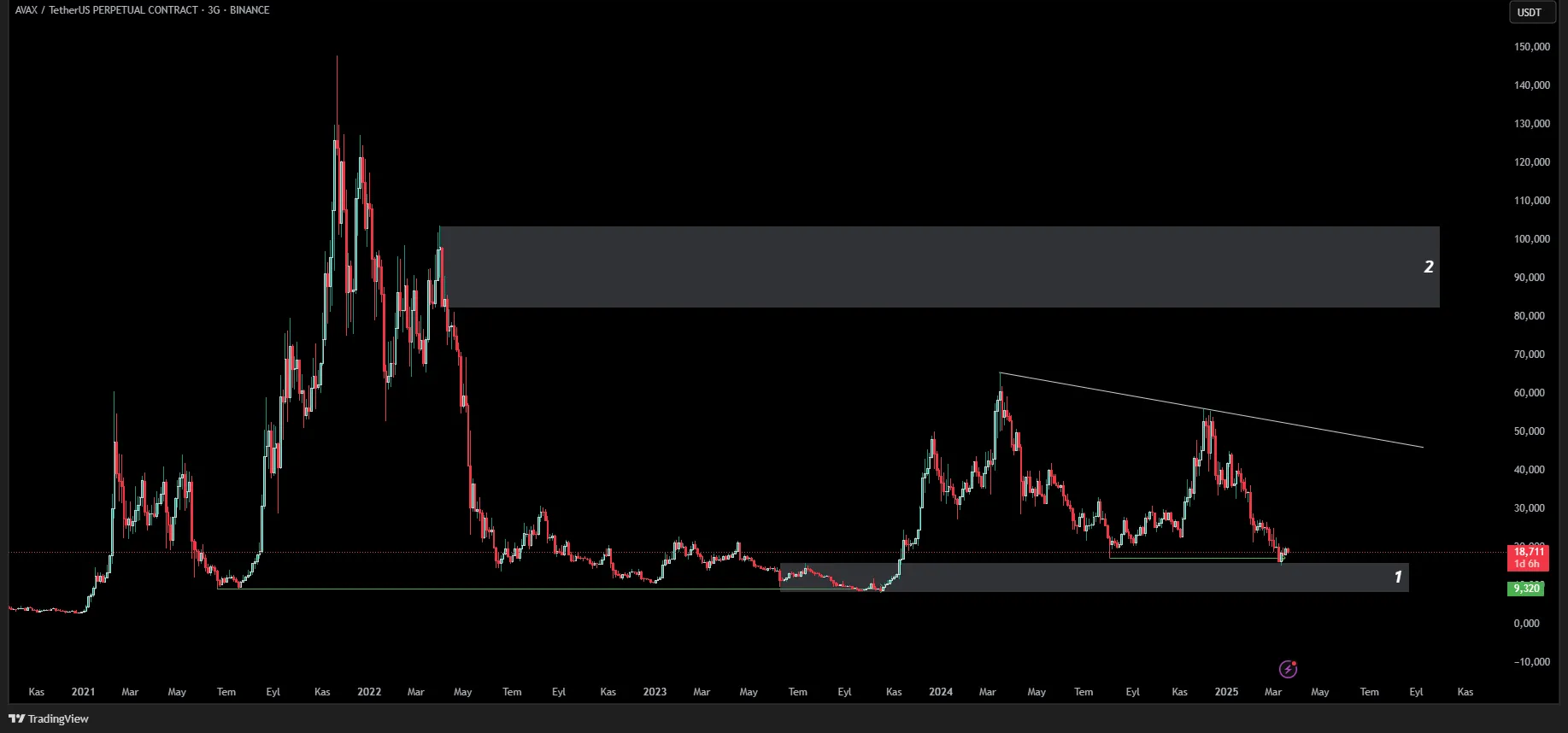

Avalanche price reached $18.71 in March 2025 following its significant price decline from 2022’s $150 yearly peak but managed to evade its essential support area.

The descending triangle pattern in the chart displayed resistance sloping between $150 and $90 while support stayed flat at $18 which indicated a long-term market consolidation.

The descending triangle formation pointed toward continued bearish activity yet $18 maintained its role as a support which in turn indicated potential price increases.

A sustained price level above $18 has possibly created a bullish turn which might direct $AVAX towards reaching the resistance levels at $30, $50 and beyond.

A bearish continuation in $AVAX price action could become more likely if price moved below $18 since such descending triangle breakdowns usually result in sizeable market losses.

At the time of writing $AVAX price was trading at $22.70, which serves as a vital sign that surpassing the critical $18 level will likely hold.

However, breaking this price might deepen the price decline that had reigned in the first quarter of 2025.

$AVAX Break-Even Price for Holders

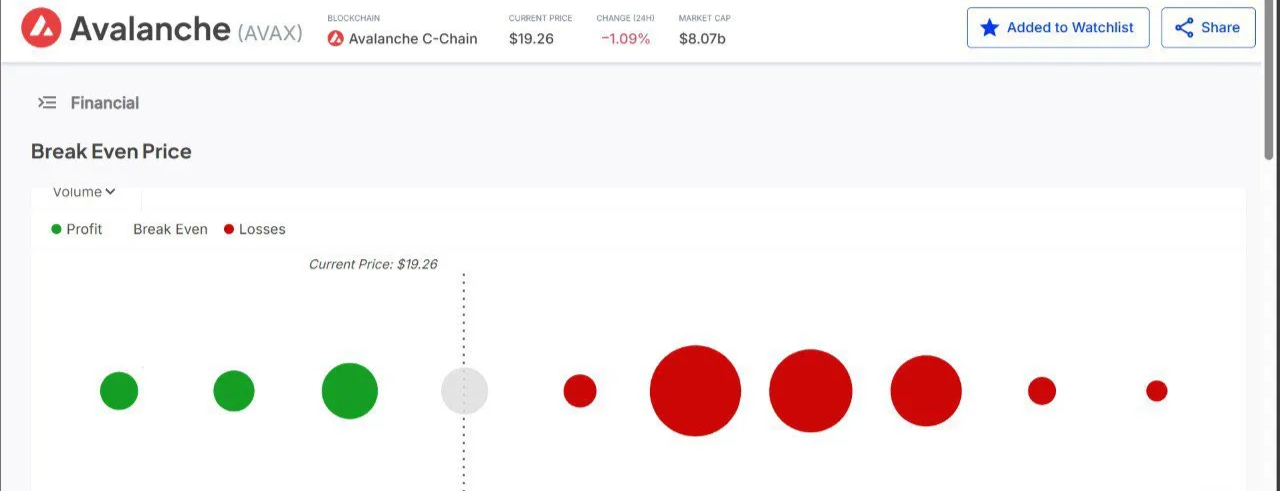

The break-even value of $AVAX at $19 together with holder profitability showed less profitable holding as depicted by the three green circles.

Whereas five red circles indicated unprofitable holders were more, having accumulated above this price level.

$AVAX price has been moving forward in price action from its initial price at $18.71, surpassing $20 as it moved towards the $30 level.

If an Avalanche ETF approval might boost $AVAX prices because institutional investors would enter the market similar to Bitcoin ETFs, thus contributing to its long-term outlook.

Hot and cold wallet liquidity combined with regulatory approvals would establish a steady market price in the long term.

Underwater holder profit-taking operations would, however, limit the potential price increase to $25 if price did not advance.

Impact of BlackRock’s BUIDL AUM and WLFi Buy on Avalanche

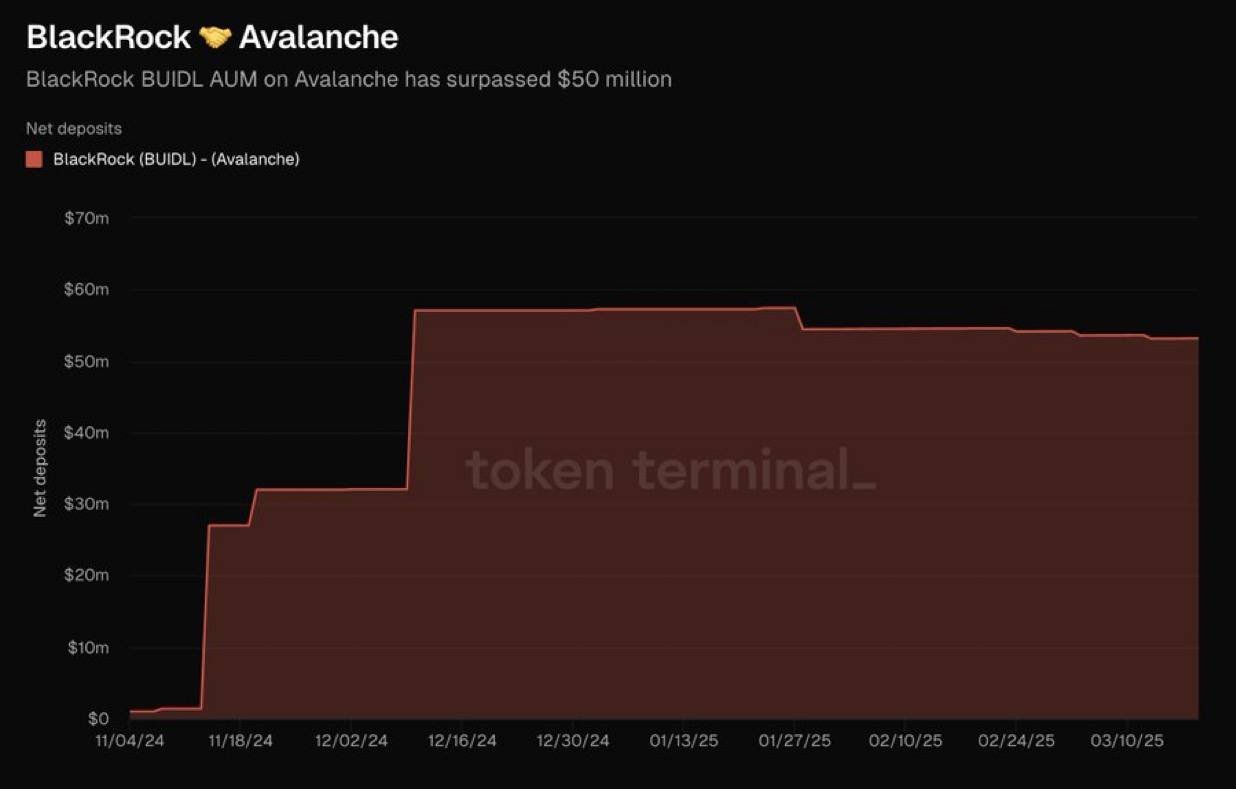

Despite these not having a direct influence on price, institutional investment in Avalanche remained on the move in March 2025 with some positive news from WorldLibertyFi (WLFi) and BlackRock.

BlackRock’s BUIDL fund on Avalanche surpassed $50 Million in Assets Under Management (AUM).

Net BUIDL deposited started at $10M on November 4, 2024, rose above $30M, and climbed to $57M in early December, before dropping back to around $50M as of press time.

This was a milestone that pointed towards growing institutional faith in the $AVAX network, which could contribute, in turn, to the valuation appreciation of Avalanche price value to about $30.

BlackRock’s action signaled other institutions that $AVAX was a suitable platform for tokenized assets and could probably stimulate greater uptake and price growth.

While this was unfolding, Trump’s WorldLibertyFi (WLFi) was also loading on Avalanche’s C-Chain, unifying millions of users to navigate VanEck’s ETF offering.

This could be a master stroke pointing toward WLFi riding on Avalanche blockchain explosion that could propel $AVAX into even greater vigor.

Institutional buy-in by combining forces of BlackRock and WLFi may push $AVAX price to a $50 peak if momentum were sustained, with profit-taking tapping the uptick.

thecoinrepublic.com

thecoinrepublic.com