Ripple is struggling with the critical 100-day moving average, experiencing low volatility.

However, the price action remains decisive, as a breakout or rejection at this level is likely to trigger a significant move.

XRP Analysis

By Shayan

The Daily Chart

Ripple has been in a bullish retracement but is now encountering a critical resistance at the 100-day moving average ($2.5). The market is currently experiencing low volatility, reflecting an equilibrium between buyers and sellers. This consolidation phase suggests that a surge in demand or supply will likely trigger a significant move.

Given the presence of sellers at this level, a rejection appears more probable. However, if XRP manages a bullish breakout, a short squeeze could propel the price toward the $3 key resistance.

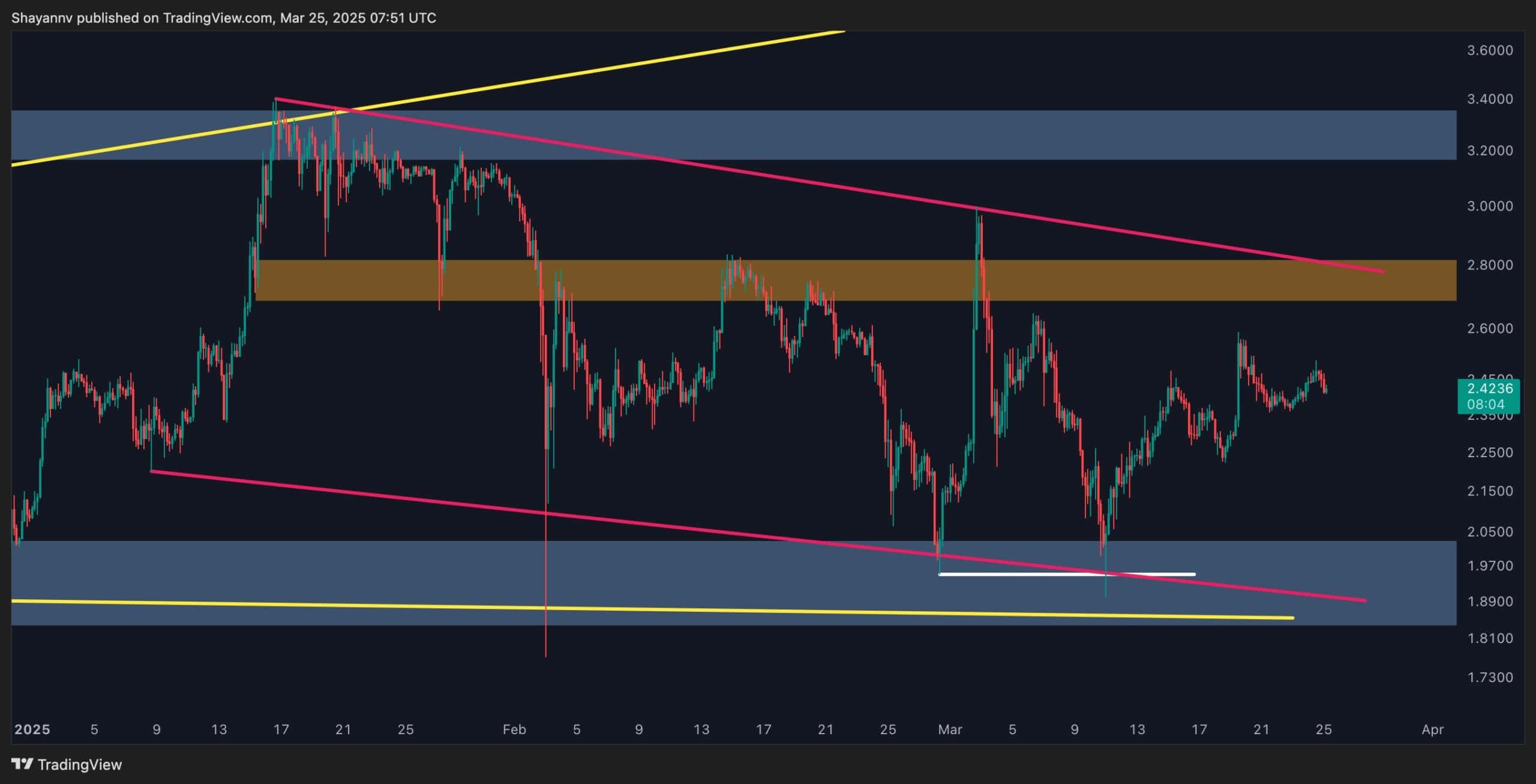

The 4-Hour Chart

On the lower timeframe, XRP’s price has been retracing upward but is now losing momentum, leading to sideways consolidation. The market shows low trading activity and lacks a clear directional bias, reinforcing the idea of a temporary balance between bulls and bears.

Ripple currently faces strong resistance in the $2.5–$2.8 range, likely filled with selling pressure that could limit further gains. Given these conditions, further consolidation within the $2–$2.8 zone seems more plausible in the mid-term, with an eventual breakout determining the next major trend.

cryptopotato.com

cryptopotato.com