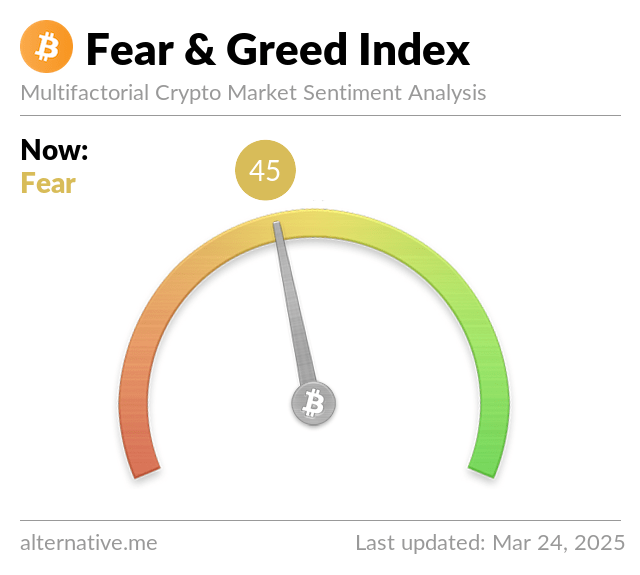

XRP is up 3.5% from its values 24 hours ago, up from its weekend low of $2.37, after weeks of consolidating between $2 and $2.2. A recent surge has pushed the broader crypto market into a slightly neutral sentiment, with the fear and greed index growing to 45 from Sunday’s 30, according to market data trackers.

The token’s community sentiment grew optimistic about its price outlook after Ripple CEO Brad Garlinghouse announced the end of a four-year-long legal clash between the US Securities and Exchange Commission (SEC) and his company, although the latter has yet to give an official statement on the matter.

The push towards a greed index could have been fueled by the possibility of XRP’s price seeing further positives. Investors are waiting for Ripple to make more announcements on partnerships, the Ripple USD stablecoin (RLUSD), and the confirmation of a rumored collaboration with cross-border payments platform SWIFT.

XRP follows historic trend, activity points to bull run

Ripple Ledger’s native token has historically performed well in March, averaging a 19.2% gain over the past 11 years, per data from Cryptorank. But as of Monday, XRP’s price growth for the month has plummeted by 4.72% and is currently changing hands at $2.46, with the final trading week of the month yet to conclude.

According to Coingecko, the token went up by slightly more than 5% intraweek and recovered by 26% from its 30-day lows. Analysts predict that XRP’s upward momentum could continue throughout this business week if it follows its historical patterns, and it could end March 2025 on a positive.

Another reason the token is up today could be the announcement of 21Shares’ listing of three new exchange-traded products (ETPs) on Nasdaq Stockholm. These include the 21Shares Bitcoin Core ETP (CBTC), the 21Shares Solana Staking ETP (ASOL), and the 21Shares XRP ETP (AXRP).

An ETF Express statement said that there is growing interest in crypto investments in the Nordic market. The entity plans to offer digital currency services to investors in Europe as soon as the necessary legal approvals are received.

“This year represents a breakthrough moment for crypto in Europe, with increasing confidence driven by the MiCA regulatory framework and a significant rise in institutional participation,” 21Shares’ Head of Financial Product Development, Mandy Chiu, remarked in a press briefing.

cryptopolitan.com

cryptopolitan.com