Solana is trading at $133.55 and has increased 5.75% over the past 24 hours, with a high of $136.08 and a low of $132.81. With a market capitalization of nearly $68.12 billion, SOL is in the top 5 cryptocurrencies despite experiencing a 54% fall from its all-time high of $285.

The sentiment on SOL in the market is still positive as the token consolidates in a symmetrical triangle formation. Recent price action indicates that traders are paying close attention to the $134 level.

SOL Price Analysis

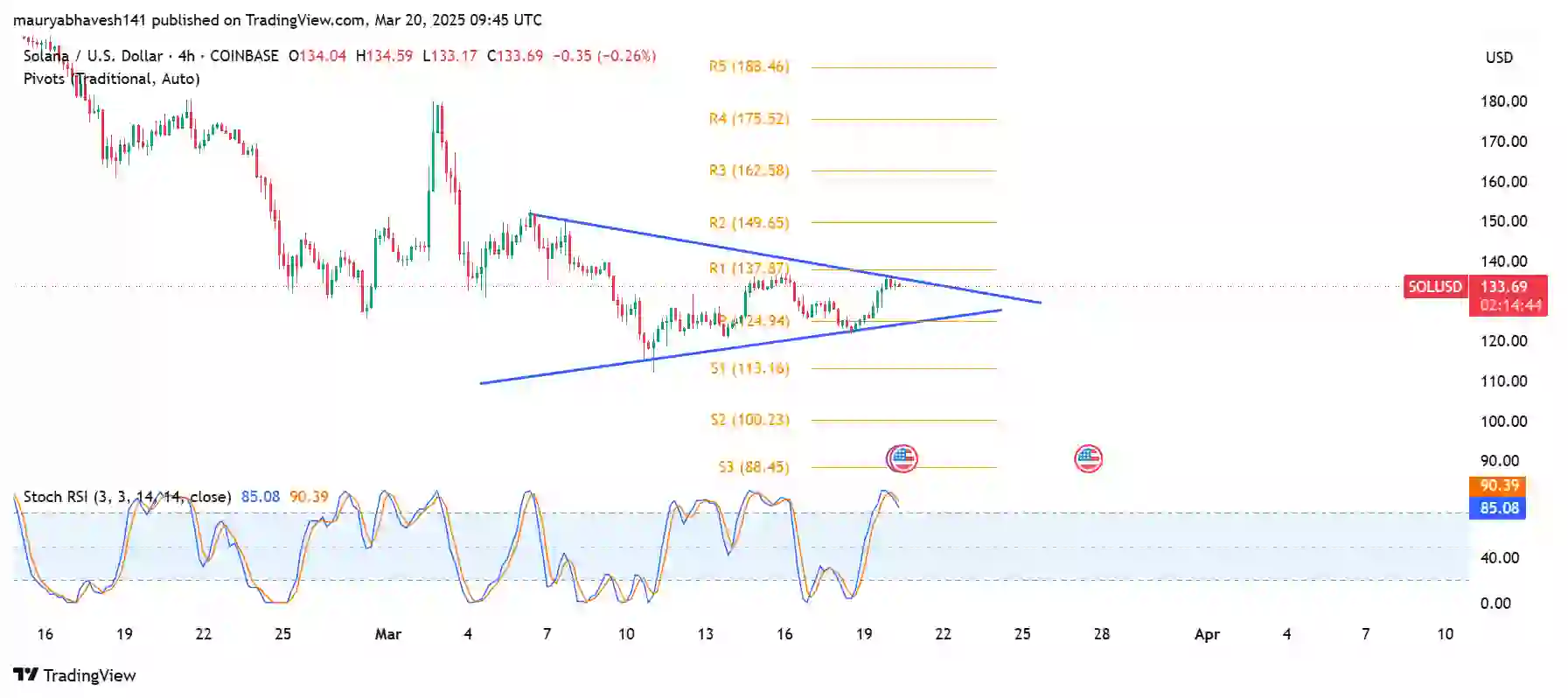

The 4-hour chart clearly indicates SOL has been creating a symmetrical triangle pattern since early March, which reflects a consolidation period after falling from well over $200. The present price action indicates SOL testing the upper edge of this triangle around $134, with volume diminishing as the pattern matures, indicating a forthcoming breakout decision.

Major resistance points are set at $137.87 and $149.65 with near-term resistance at the top trendline. Intraday support is at the lower trendline with further support at $125.94 and more substantial support at $113.16 in case of increased bear pressure.

The pivot points on the chart indicate SOL currently ranging between S1 ($125.94) and R1 ($137.87), with the key $134 level being a make-or-break decision point. The placement of pivot levels also suggests several resistance hurdles in front, with R3 at $162.58 being a key barrier to any extended rally.

The Stochastic RSI indicator is presently recording readings of 90.79/95.36, well into overbought levels. These readings are usually indicative of possible exhaustion in the prevailing trend, and they indicate SOL could face a pullback within the near future.

SOL Price Targets

If SOL crosses over the downtrend line at around $134-135, the initial target would be R1 at $137.87 and then R2 at $149.65. If the move over this level persists, it would target R3 at $162.58.

The triangle’s height of around $30-35 over the chart at the point of the breakout may provide a technical target of around $165-170 for an upward breakout or $100-105 for a downward breakdown.

Solana Futures ETFs To Enter Wall Street

Boosting the bullish pressure surrounding Solana, Florida-based Volatility Shares LLC will debut two ETFs tracking Solana futures on March 20. With its groundbreaking ETF, the altcoin-tracking Solana futures ETFs will come with an expense ratio of 0.95% and 1.85%.

The Volatility Shares Solana ETF (SOLZ) will track Solana futures, and the Volatility Shared 2x Solana futures (SOLT) will offer 2x leverage.

cryptonewsz.com

cryptonewsz.com