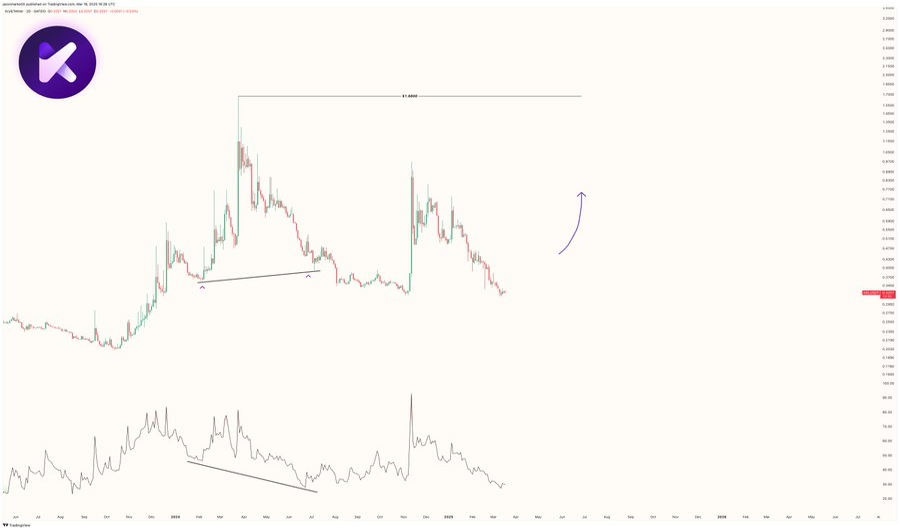

- Kryll (KRL) formed a hidden bull divergence, which is a likely trend reversal.

- Volume spikes confirm key price moves, but declining interest suggests market consolidation.

- KRL’s price action aligns with classic cycles, indicating a markdown phase before potential recovery.

Prices pulled back further as Kryll (KRL) formed a textbook Hidden Bull Divergence pattern. This setup has historically led to major rallies, with projected targets ranging between $1.10 and $1.50 in the coming sessions.

Market Structure and Momentum Trends

Kryll’s price history displays a high of $4.40 before a steep drop, which signals a change in market sentiment. During its initial stages, the asset remained relatively stable with low volatility followed by a slow trend upwards. With the price rising, decreasing buying pressure was seen as the momentum indicator moved downwards.

KRL broke out, then experienced a sudden increase in the price, which resulted in a parabolic rally. The move was accompanied by a sudden surge in the momentum, showing heightened market activity and participation.

Having reached its peak, KRL entered its corrective phase, leading to a sharp decline. Recovery attempts were not able to reclaim old highs, leading to prolonged bearish trends that pushed the price down.

Hidden Bullish Divergence and Future Outlook

A market analyst, Javon Marks, analyzed the hidden bullish divergence in KRL, noting that the asset recently formed higher lows while the momentum indicator printed lower lows. He emphasized that this divergence is a key technical signal that often precedes potential reversals or trend continuations. Currently, KRL remains in a downtrend with reduced volatility, forming a potential base for recovery.

Source: Javon Marks

Volume activity has shown notable spikes during major price movements, confirming increased participation in key phases of the cycle. Javon Marks highlighted that recent volume patterns indicate declining market interest, suggesting a period of consolidation. The overall price structure aligns with classic market cycles, suggesting that KRL is currently in a markdown phase after its previous significant rally.

According to Javon Marks, KRL’s next move depends on demand levels at the current price range. If buying pressure increases, a potential rebound toward resistance zones could materialize. However, if demand remains weak, the downtrend may persist until a strong support level is established, confirming whether accumulation is taking place.