The U.S. Securities and Exchange Commission (SEC) has officially dropped its lawsuit against Ripple today, fueling a sharp 14.4% surge in XRP’s price to $2.56, with a market capitalization of $149.35 billion and a 24-hour trading volume of $7.62 billion, while price action fluctuated between $2.23 and $2.592 intraday. At press time, XRP stands at $2.516 per unit on Bitstamp.

XRP

On the one-hour chart, XRP exhibited strong bullish momentum, with a sharp rally from approximately $2.22 to $2.59. Buying pressure accelerated as volume spiked, confirming demand at higher levels. Immediate support was identified in the $2.30 to $2.40 range, reinforcing a potential accumulation zone for short-term traders. The $2.60 resistance level emerged as the key barrier, with a successful breach likely propelling XRP toward $2.70 to $2.80. However, if selling pressure intensifies, a pullback to $2.40 remains a possibility before further upside continuation.

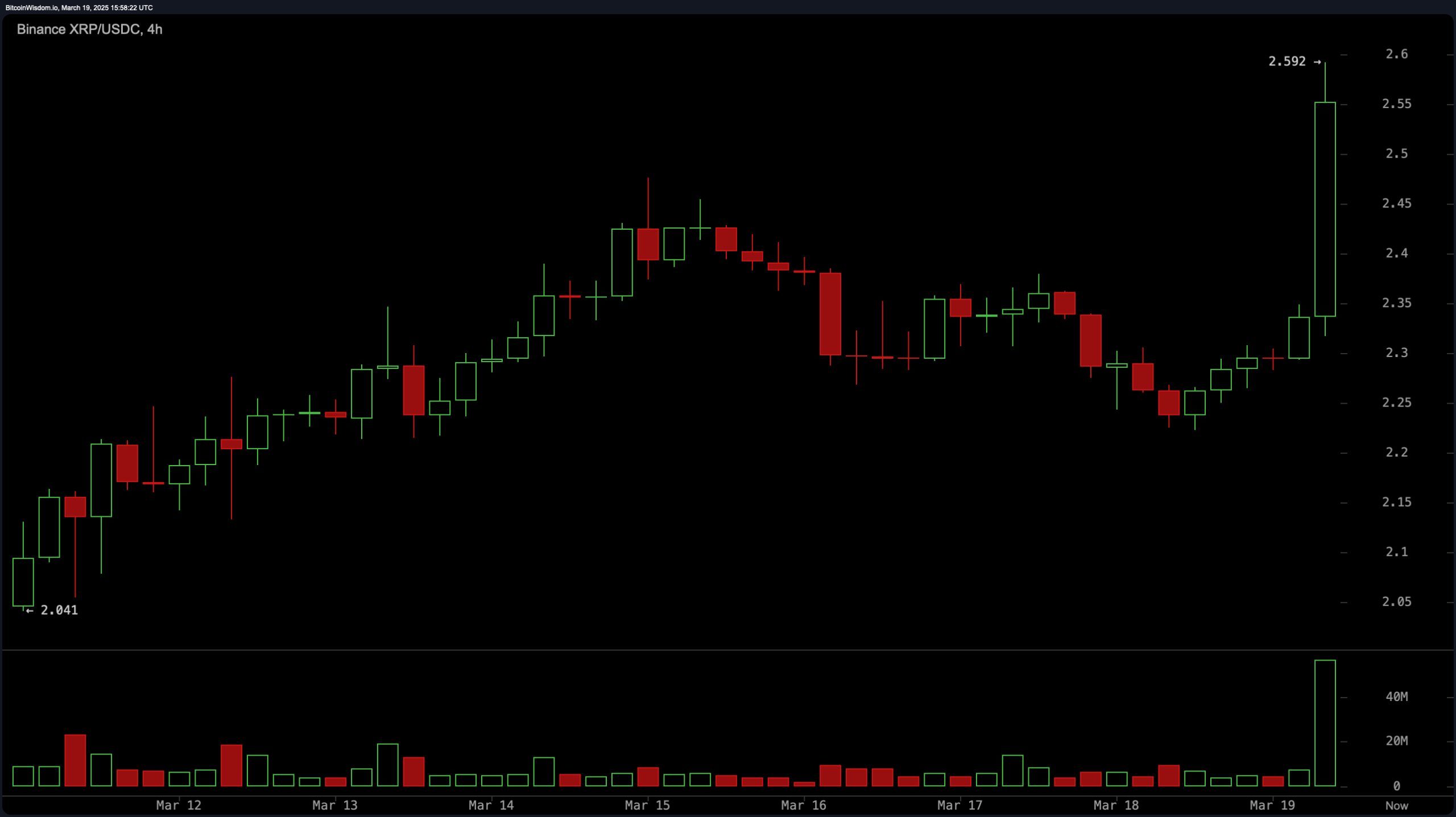

The four-hour chart reflected a confirmed breakout past the $2.50 level, with price action consolidating near $2.59. Support at $2.30 to $2.40 remains crucial for sustaining the bullish trend, as a drop below this range could signal a potential retracement. If buyers maintain momentum, XRP could target the $2.75 to $2.80 region in the short term. Volume dynamics suggest heightened interest from market participants, with increased activity reinforcing positive sentiment. A sustained close above $2.60 would indicate further bullish continuation, while failure to hold this level might introduce volatility.

The daily chart reaffirmed the overall uptrend, as XRP recovered from recent lows around $1.78 to approach key resistance levels near $3.21. The asset is consolidating above strong support at $2.10 to $2.30, suggesting a stable foundation for further gains. A decisive breakout above $3.20 could open the door for a test of the $3.50 region. The volume profile highlighted significant buying interest, though traders should remain cautious of potential consolidations before a more definitive move materializes.

Oscillators signaled mixed conditions, with the relative strength index (RSI) at 55.6 remaining neutral, along with the Stochastic at 66.5, commodity channel index (CCI) at 66.4, average directional index (ADX) at 17.8, and awesome oscillator at -0.06. Momentum at 0.42 and moving average convergence divergence (MACD) at -0.03 both indicated a bullish signal, suggesting underlying strength in the market.

Moving averages further reinforced the bullish sentiment, as the exponential moving averages (EMA) and simple moving averages (SMA) across all key periods—10, 20, 30, 50, 100, and 200—generated positive signals. The 10-period EMA and SMA at $2.35 and $2.29, respectively, confirmed short-term strength, while the longer-term 200-period EMA at $1.89 and SMA at $1.69 illustrated sustained bullish structure. With all technical indicators aligning in favor of further upside, XRP remains poised for continued price appreciation, contingent on volume support and resistance breakouts.

Bull Verdict:

XRP’s strong bullish momentum, backed by a breakout on all key timeframes, buy signals from both the moving averages and oscillators, and a favorable macro event with the SEC dropping its lawsuit, suggests continued upside potential. If buying pressure sustains and resistance levels are breached, XRP could target the $3.20 to $3.50 range in the near term.

Bear Verdict:

Despite the current surge, XRP faces strong resistance near $2.60 and $3.20, and momentum indicators show neutral readings, suggesting possible exhaustion. If volume declines and price fails to hold support at $2.30, a pullback toward $2.10 or lower could occur, signaling a temporary reversal before further bullish continuation.

news.bitcoin.com

news.bitcoin.com