Dogecoin (DOGE) whales are “betting on a breakout,” according to prominent crypto analyst Ali Martinez.

After falling over 70% in the past 3 months, it is safe to say that Dogecoin has been severely pummeled in the recent crypto market rout. Despite the beatdown, however, one class of investors appears to be betting on the meme coin to get back up soon.

Dogecoin Whales On a Buying Spree

Dogecoin whales are “betting on a breakout,” according to prominent crypto analyst Ali Martinez. Martinez disclosed this in an X post on Tuesday, March 18, highlighting fresh DOGE buys from these investors.

Specifically, these investors with holdings between 1 million DOGE and 10 million DOGE have added 110 million DOGE worth $18.5 million at current prices to their holdings in the past week, per Santiment Feed data. These purchases follow 1.4 billion DOGE ($224 million) and $1.7 billion (DOGE) buys made last week.

Beyond suggesting Dogecoin whales are betting on a price rebound, the recent whale purchases are a bullish sign hinting at market accumulation.

Meanwhile, this whale buying is not the only positive Dogecoin on-chain signal at the moment.

A “Buzzing” Network

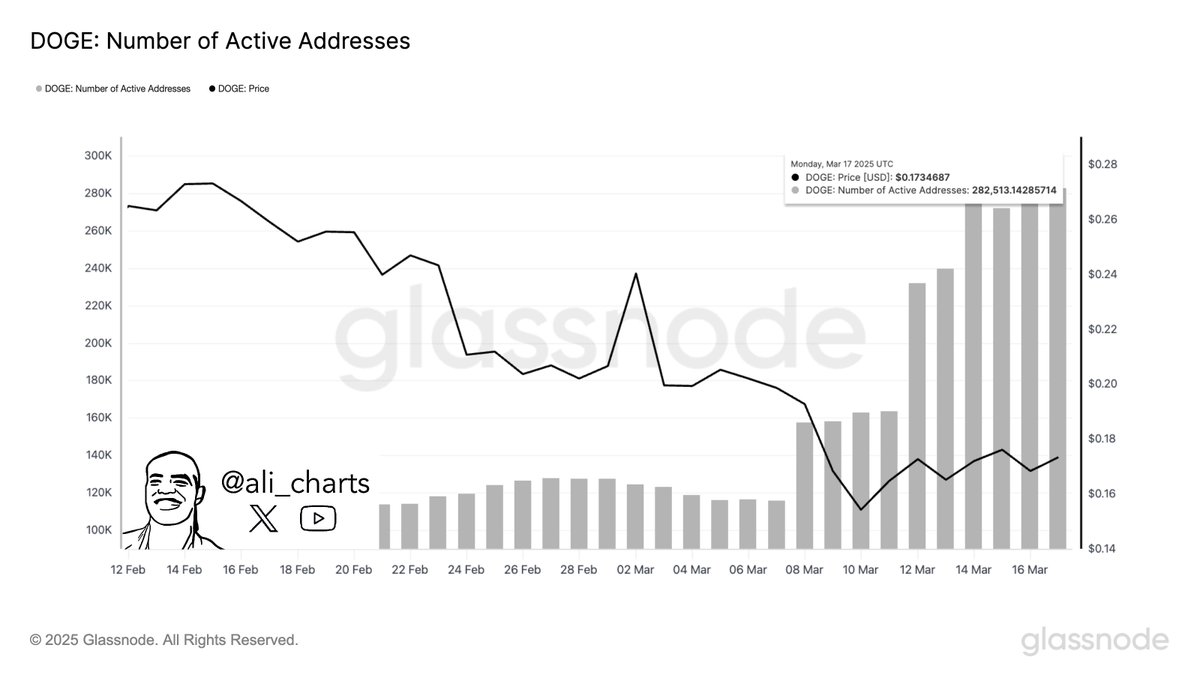

On Wednesday, March 19, Ali Martinez asserted that the Dogecoin network was “buzzing.” He said this, highlighting the recent spike in active network addresses.

This metric jumped over 76% from an average of 160,000 active addresses last week to 282,500 active addresses on Monday, March 17.

A rise in active addresses is typically seen as bullish as it suggests growing network interest, which can translate to increased demand for the native asset.

Amid these positive on-chain signals, Martinez has suggested that a rebound could take the doggy-themed meme coin to a new all-time high at the $2 price point. The analyst made this call citing an ascending channel on the weekly candlestick chart.

In the meantime, however, DOGE continues to idle alongside the broader crypto market, trading at $0.1677, down a negligible 0.29% on the day. The muted price action is likely the result of traders sitting on the fence while they await the Federal Reserve’s interest rate decision, which is expected later today.

thecryptobasic.com

thecryptobasic.com