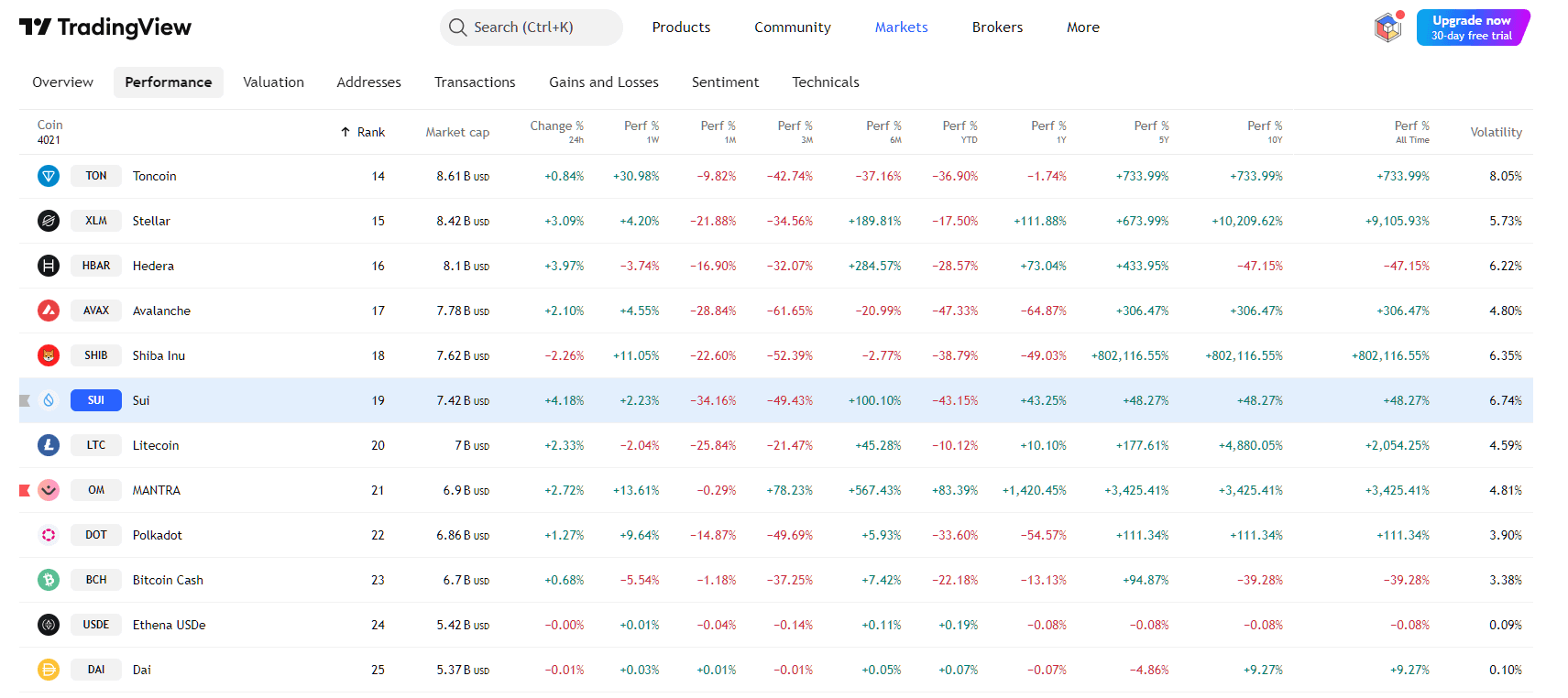

Over the past six months, Sui Network's native token, SUI, has experienced a remarkable 100% price surge. This significant appreciation not only reflects Sui's technological advancements but also highlights growing institutional interest, particularly driven by Canary Capital's recent filing for a spot SUI exchange-traded fund (ETF).

What is Sui Network?

Sui is a Layer 1 blockchain platform designed to enhance digital asset ownership with high-speed transactions and scalability. Built using the Move programming language, Sui's object-centric model allows for parallel transaction processing, sub-second finality, and supports complex on-chain assets. These features position Sui as a versatile platform capable of supporting a wide range of decentralized applications (dApps) with low latency and cost.

Canary Capital's Pursuit of a SUI ETF

On March 17, 2025, Canary Capital submitted an S-1 registration statement to the U.S. Securities and Exchange Commission (SEC) to launch a spot ETF tracking the performance of SUI. This filing followed the establishment of a statutory trust for the SUI ETF in Delaware on March 6, indicating a structured approach toward introducing the ETF to the market.

The proposed ETF aims to provide institutional and retail investors with regulated exposure to SUI without the complexities of directly managing cryptocurrency holdings. If approved, this ETF could significantly enhance SUI's liquidity and market capitalization by attracting a broader investor base.

Impact of the SUI ETF on SUI's Price Surge

The anticipation surrounding a SUI ETF filing has been a key contributor to SUI's recent price surge. Historically, announcements of crypto ETFs have led to increased investor confidence and speculative buying, driving up asset values. Following the partnership announcement between World Liberty Financial (WLFI) and the Sui blockchain, SUI's value jumped by more than 10%, reflecting the market's positive reception.

Broader Implications for the Crypto Market

This initiative to launch a SUI ETF is part of a broader strategy to expand its offerings in the cryptocurrency space. The firm has also filed for ETFs tracking other digital assets, including Axelar (AXL), Litecoin (LTC), XRP, Solana (SOL), and Hedera (HBAR). This diversification underscores a commitment to providing investors with a range of options in the rapidly evolving crypto market.

The convergence of Sui Network's technological strengths and the growing institutional interest, exemplified by Canary Capital's ETF filing, has played a pivotal role in SUI's impressive 100% price surge over the past six months. As the regulatory landscape evolves and traditional financial instruments like ETFs become more integrated with digital assets, SUI's trajectory may serve as a bellwether for the broader adoption and maturation of the cryptocurrency market.

cryptoticker.io

cryptoticker.io