Main Takeaways

Thanks to Binance Research, you can take advantage of industry-grade analyses of the processes shaping Web3. By sharing these insights, we hope to empower our community with the latest knowledge from the field of crypto research.

This blog explores key Web3 developments in February 2025 to provide an overview of the ecosystem’s current state. We analyze the performance of crypto, DeFi, and $NFT markets before previewing major events to look out for in March.Crypto Market Performance in February 2025

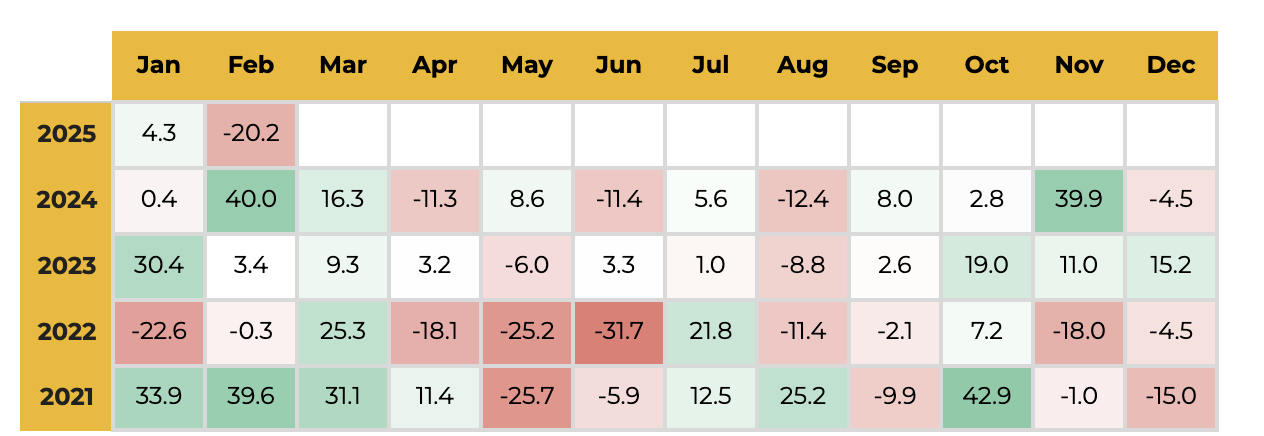

In February 2025, the cryptocurrency market saw a sharp 20.2% decline from the previous month. This was largely driven by the largest digital hack in history, where Bybit suffered losses exceeding US$1.5 billion, alongside a broader bearish sentiment in global financial markets. The memecoin sector was particularly affected, with investor confidence plummeting after the fallout of $LIBRA, a cryptocurrency previously endorsed by high-profile figures.

The downturn in crypto mirrored weakening confidence in traditional markets, where concerns over tech stock overvaluations and macroeconomic uncertainties fueled a risk-off sentiment. Despite strong earnings forecasts, major tech stocks such as NVDA, GOOGL, and AMZN faced notable declines, while the S&P 500’s consumer discretionary and information technology sectors dropped 6% and 3%, respectively. Further dampening sentiment, President Trump confirmed 25% tariffs on Canadian and Mexican imports, effective from March, leading to a surge in U.S. Treasury prices and a decline in yields, pushing crypto liquidity into stablecoins and real-world assets (RWAs).

Monthly crypto market capitalization decreased by 20.2% in February

Source: CoinGeckoAs of February 28, 2025

Source: CoinGeckoAs of February 28, 2025

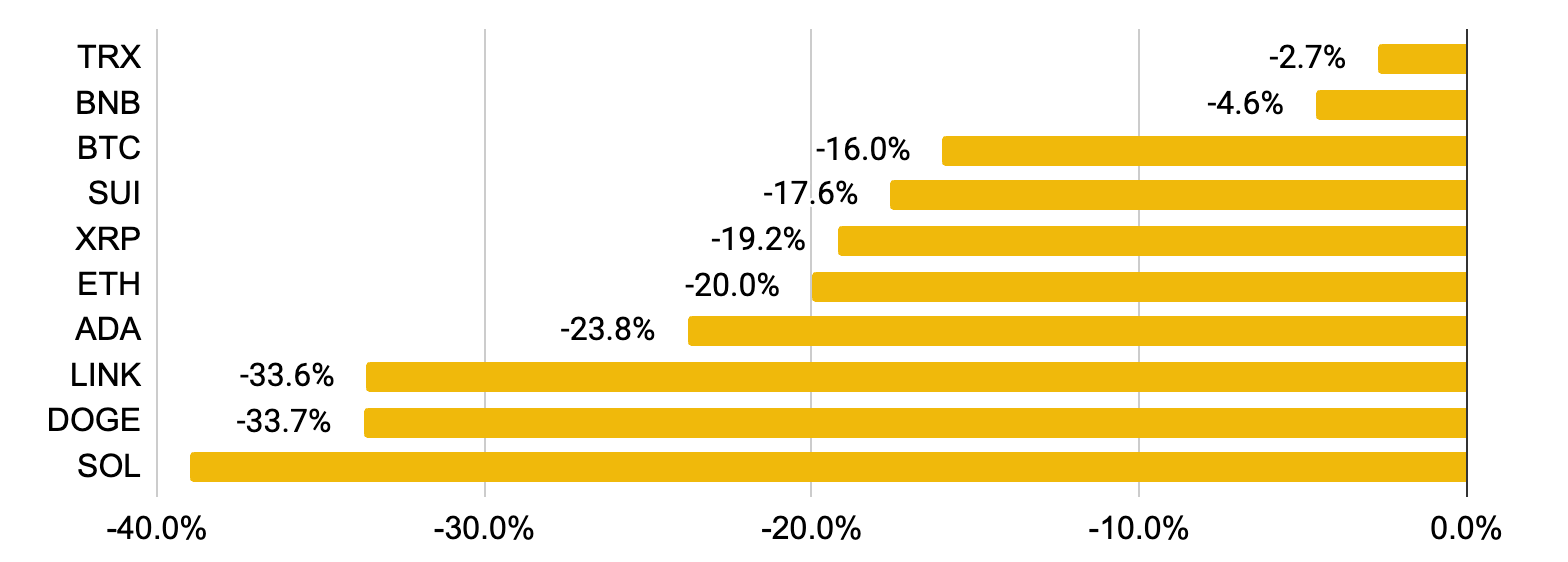

Monthly price performance of the top 10 coins by market capitalization

Source: CoinMarketCapAs of February 28, 2025

While Tron’s $TRX declined 2.7%, the network announced a major update: starting in March, $USDT transactions will be fee-free. This “Gas Free” feature allows $USDT to cover transaction costs, removing the need for $TRX payments and accelerating Tron’s Q4 2024 plan to simplify stablecoin transfers. With US$824M in $USDT and USDC inflows in February and over US$2B in revenue last year, Tron’s scalability continues to grow. Meanwhile, $BNB dropped 4.6%, yet $BNB Chain revealed an ambitious 2025 roadmap centered on mass adoption, featuring sub-second block times, AI-driven smart wallets, and a goal of processing 100 million transactions daily.

$BTC saw a steep 16.0% decline, largely due to broader equity market weakness and a lack of catalysts to sustain momentum. Extreme volatility hit between February 24-26, with nearly US$3B in liquidations marking Bitcoin’s largest price drop since the FTX collapse in 2022. The downturn was exacerbated by tightening fiat liquidity conditions and delays in the Trump administration’s prospective national $BTC reserve. Meanwhile, SUI and XRP fell 17.6% and 19.2% respectively, as investors rotated liquidity into stablecoins amid rising market uncertainty.

ETH plunged 20%, impacted by the record-breaking US$1.5 billion Bybit hack and a sharp decline in gas fees – down 98.5% from last year’s peak – as users shifted to alternative L1s like Solana. Despite this, Ethereum saw a threefold increase in daily contract deployments since February 1, signaling renewed developer activity. However, ADA (-23.8%), LINK (-33.6%), DOGE (-33.7%), and SOL (-39%) were among the biggest losers. Solana, in particular, suffered from uncertainty around its 11.2 million token unlock and the LIBRA memecoin fallout. Its TVL plunged by over 30% to its lowest level since November 2024, as traders bridged nearly US$500M to Ethereum, Sonic, and Arbitrum.

Decentralized Finance (DeFi)

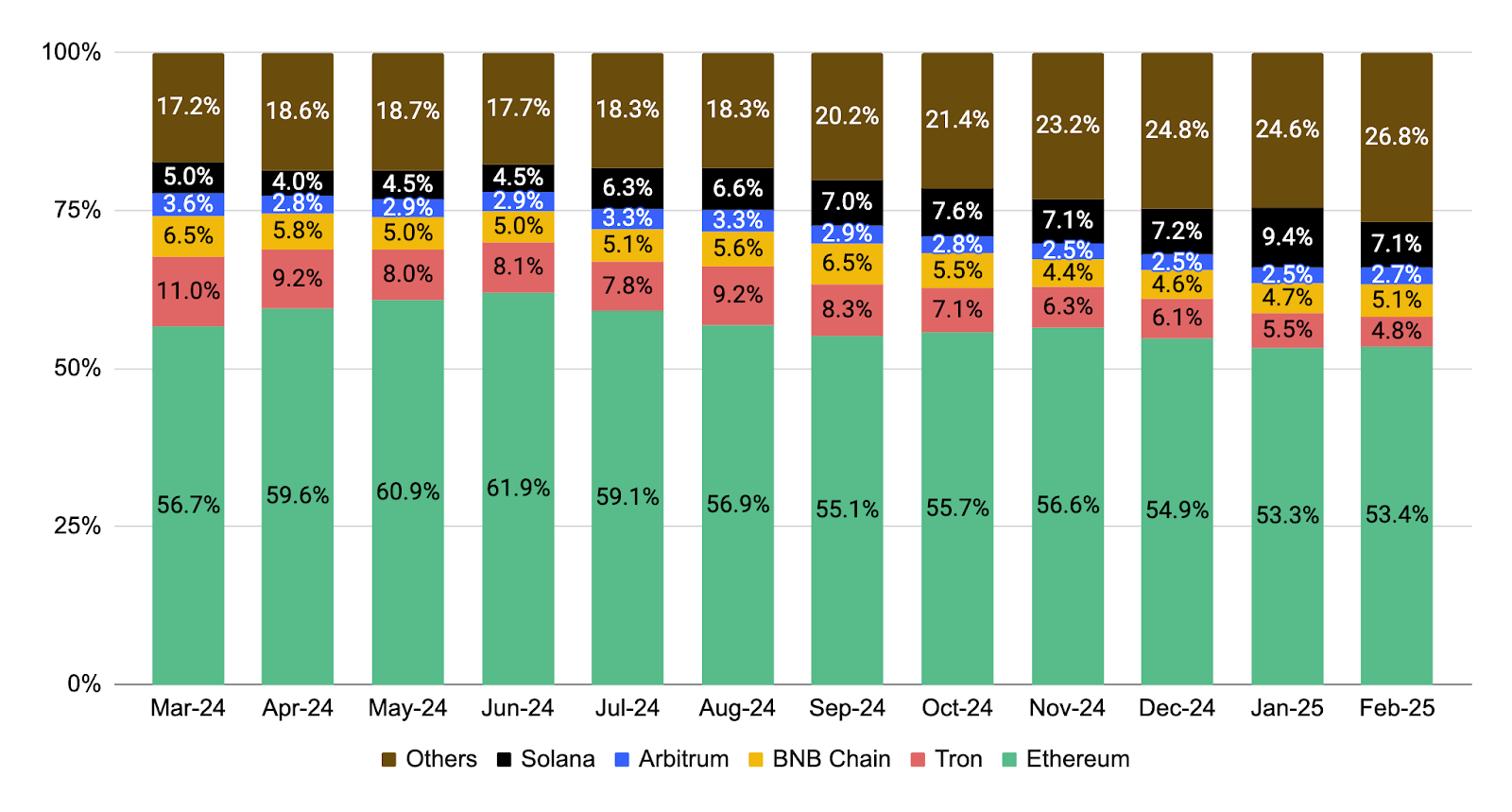

In February 2025, DeFi’s Total Value Locked (TVL) declined by 14.6%, reflecting broader market turbulence. A major regulatory shift occurred as the U.S. SEC withdrew its appeal against a Texas federal court ruling that struck down its broker-dealer rule, which aimed to classify DeFi platforms and liquidity providers as securities dealers. This rule would have imposed stringent compliance requirements, including know-your-customer (KYC) and anti-money-laundering (AML) regulations, but its removal signals a regulatory reprieve for the DeFi sector. Meanwhile, the stablecoin market cap rose by 3.5% to US$224.9B, with stablecoin dominance increasing by 1.4%. This shift suggests that investors are moving liquidity into stable assets, likely as a precautionary measure amid market uncertainty.

Solana’s TVL saw a significant 30% drop, hitting its lowest level since November as memecoin activity collapsed. Data from Dune Analytics highlighted that memecoin trading volume on Pump.fun plummeted by 74.5% in a single day (February 24), with most tokens losing 80–90% of their value since launch. Among the top 10 largest blockchains by DeFi TVL, $BNB Chain was the only gainer, rising by 0.2%. Its resilience stands out in the current downturn, driven by ongoing and announced technological advancements, including sub-second block times, AI-powered smart wallets, and a goal of processing 100 million transactions per day in its 2025 roadmap.

TVL share of top blockchains

Source: DeFiLlamaAs of February 28, 2025

Non-Fungible Tokens (NFTs)

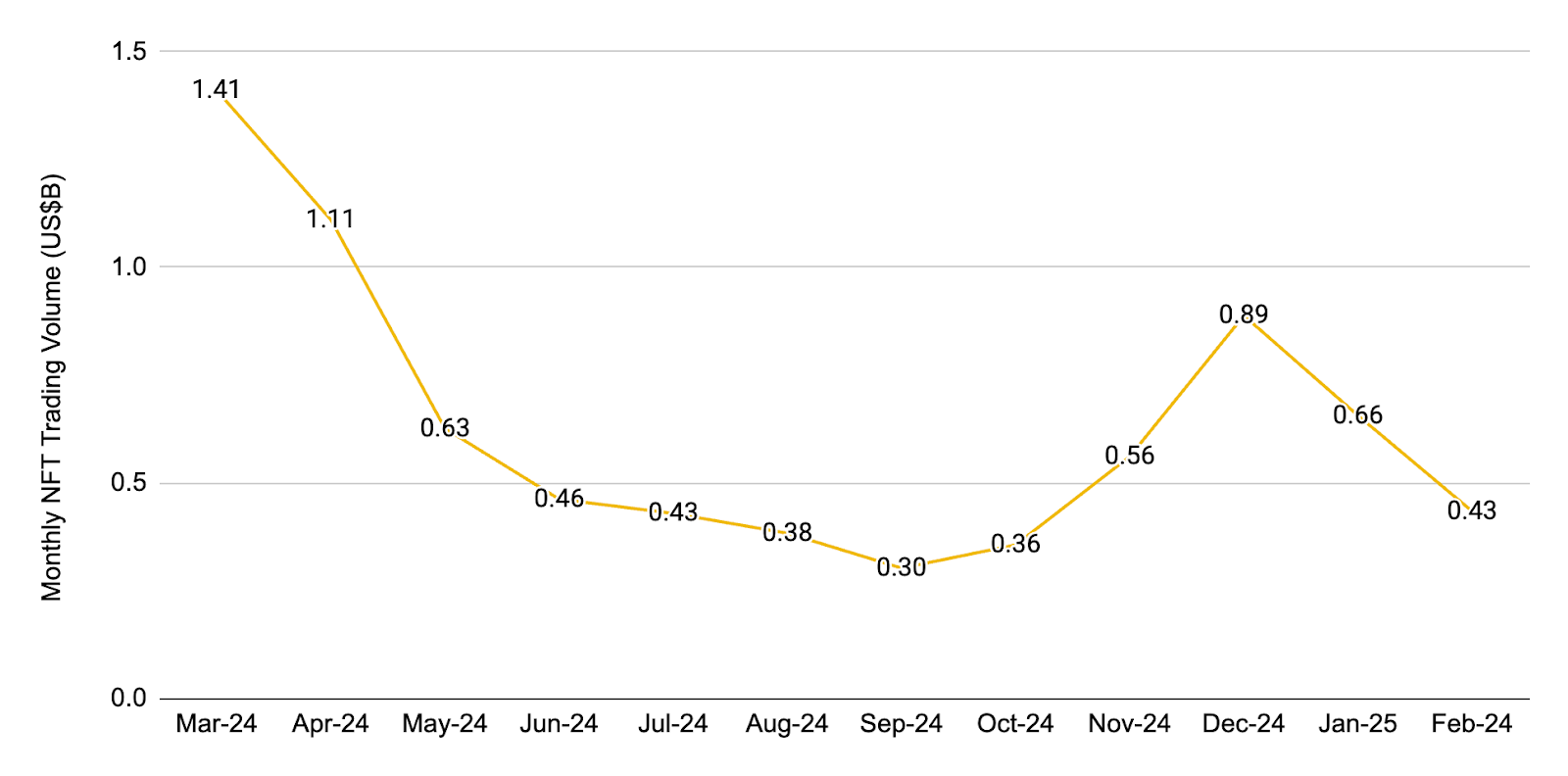

Monthly $NFT trading volume

Source: CryptoSlam As of February 28, 2025

In February 2025, the $NFT market saw a sharp 41.2% decline in total sales volume across the top 25 chains, with unique buyers reaching their lowest level since April 2021. This downturn was driven by economic uncertainty, inflation concerns, and a pullback from speculative assets. However, OpenSea’s market share surged to 71.5% from 25.5% in just four weeks, buoyed by the announcement of its native token, SEA, and the launch of its OS2 trading platform. A regulatory boost followed, as the SEC closed its investigation into OpenSea, confirming that NFTs would not be classified as securities, which significantly eases compliance burden on issuers. Ethereum-based $NFT sales volume dropped 38.2%, with legacy projects like Pudgy Penguins, Azuki, and Cryptopunks seeing declines. However, despite lower sales volume, transaction activity increased for most top 10 $NFT projects by market cap, signaling continued engagement from collectors.

Upcoming Events and Token Unlocks

To help users stay updated on the latest Web3 news, the Binance Research team has summarized notable events and token unlocks for the month to come. Keep an eye on these upcoming developments in the blockchain space.

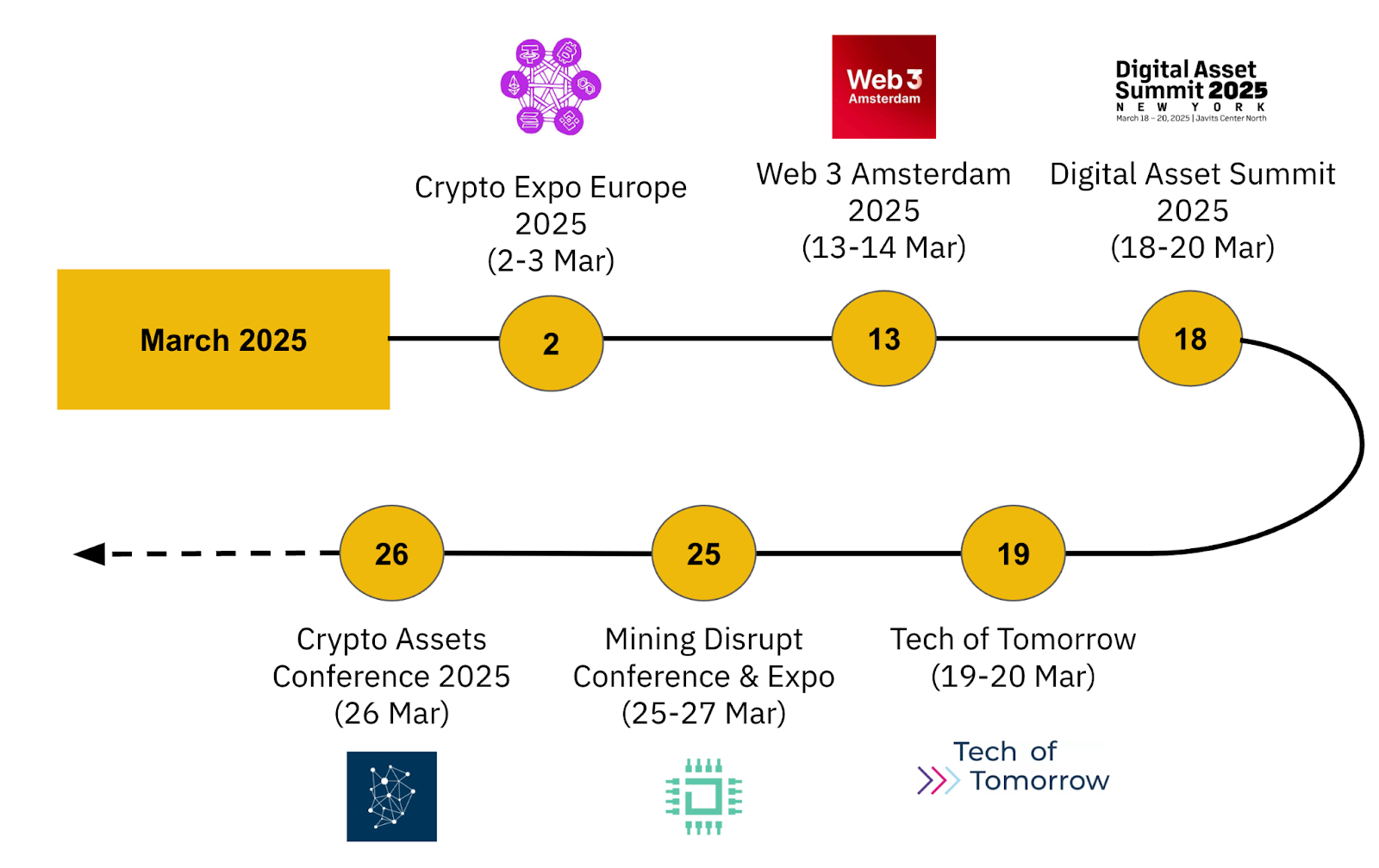

Notable Events in March 2025

Source: Cryptoevents, Binance Research

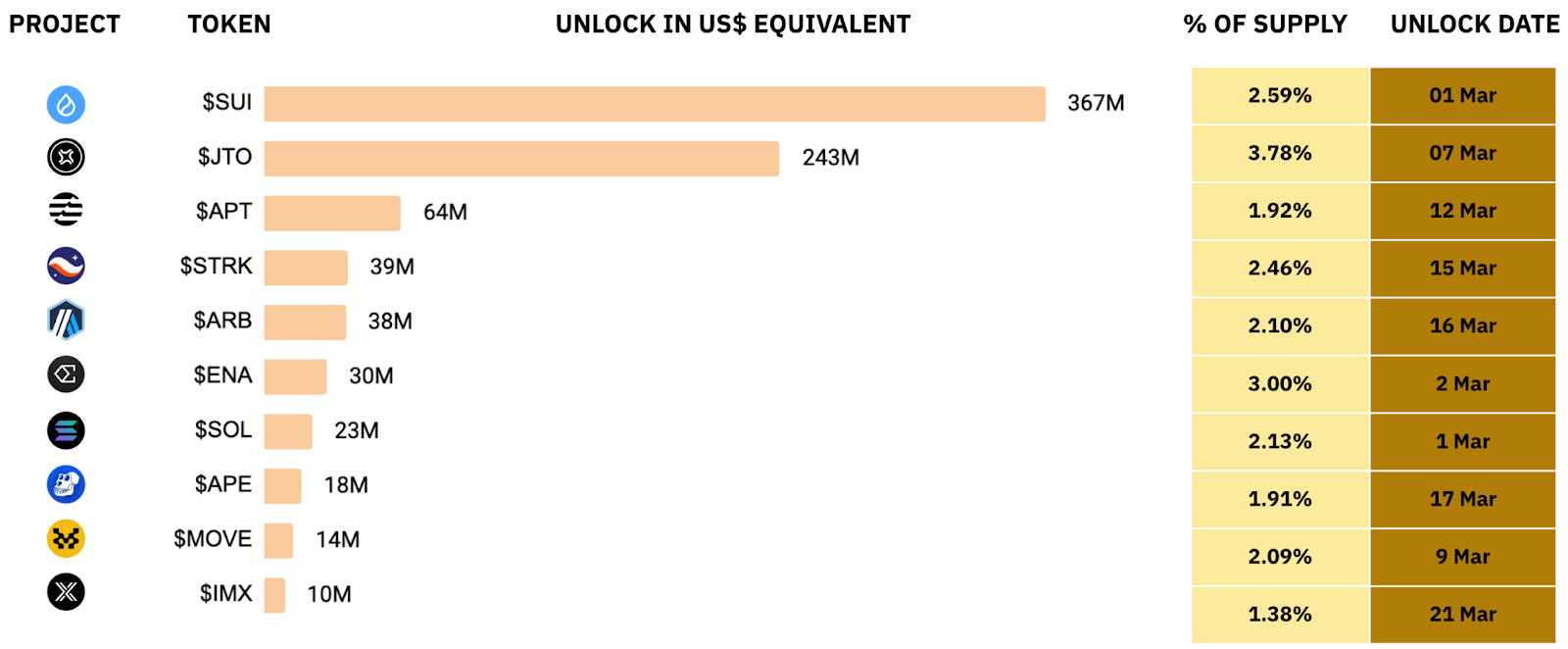

Largest token unlocks in US$ terms

Source: CryptoRank, Binance Research

Binance Research

The Binance Research team is committed to delivering objective, independent, and comprehensive analyses of the crypto space. We publish insightful takes on Web3 topics, including but not limited to the crypto ecosystem, blockchain applications, and the latest market developments.

This article is only a snapshot of the full report, which contains further analyses of the most important charts from the past month. The full report also dives into explaining the impact of US tariffs on market turbulence, the plummet in Solana’s outflows, activity, and TVL, the all-time high performance of stablecoins and real-world assets, as well as Bybit security breach.

Read the full version of this Binance Research report here.

Further Reading

-

Binance Research: Key Trends in Crypto – February 2024

-

Binance Research: Key Trends in Crypto – January 2024

-

Binance Research: Key Trends in Crypto – December 2024

Disclaimer: This material is prepared by Binance Research and is not intended to be relied upon as a forecast or investment advice and is not a recommendation, offer, or solicitation to buy or sell any securities or cryptocurrencies or to adopt any investment strategy. The use of terminology and the views expressed are intended to promote understanding and the responsible development of the sector and should not be interpreted as definitive legal views or those of Binance. The opinions expressed are as of the date shown above and are the opinions of the writer; they may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Binance Research to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given, and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Binance. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, cryptocurrencies, or any investment strategy, nor shall any securities or cryptocurrency be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase, or sale would be unlawful under the laws of such jurisdiction. Investment involves risks.

binance.com

binance.com