- Ethena-linked wallets deposited $11.52M in $ENA to Binance, signaling possible sell pressure despite holdings of early allocations.

- A whale moved $3.5M in $ENA after staking instead of selling at $1, highlighting shifting investor strategies amid price declines.

- $ENA trades in a demand zone, forming a falling wedge. A breakout could push it toward $1.95 if market conditions improve.

Ethena Labs-linked wallets have made significant moves in the past 24 hours. Two wallets jointly deposited 29.87 million $ENA, worth $11.52 million, to Binance at an average price of $0.386. These wallets initially received $ENA from Ethena Labs’ multi-signature addresses on July 20, 2024, when the token was valued at $0.487. One wallet still holds 53.6 million $ENA, currently worth $20.2 million. This suggests that a portion of early allocations is still being held despite recent sell-offs.

Whale Activity and Market Sentiment

Another notable transaction was recorded six hours ago. A whale, identified as 0x9E3 and possibly an early investor in Ethena, deposited 10 million $ENA, valued at approximately $3.5 million, into Binance and Bybit. When initially receiving the tokens at around $1, this investor chose to stake them in Mellow Finance rather than sell. Presently, the whale still holds 9.75 million $ENA, valued at roughly $3.49 million.

Market sentiment remains mixed. While $ENA has entered a demand zone, recent large unlocks have injected uncertainty. However, many traders believe that unlock fears are priced in and expect a rebound. Analysts predict a potential rally towards the 1.618 Fibonacci extension at $1.95 if market conditions stabilize.

Source: X

Source: X

Technical Analysis and Price Outlook

Currently, $ENA is trading at $0.3693, marking a 3.65% decline. The price action reveals a prolonged downtrend forming a falling wedge pattern. Buyers have shown interest in the demand zone between $0.16 and $0.40. However, the token is still below the 200-day EMA at $0.6570, indicating bearish conditions.

The stochastic RSI, at 44.11 and 59.38, reflects moderate momentum. It does not indicate overbought or oversold conditions. If a breakout occurs, the first resistance level is expected at $0.65. A further rally could drive $ENA towards the Fibonacci target of $1.944.

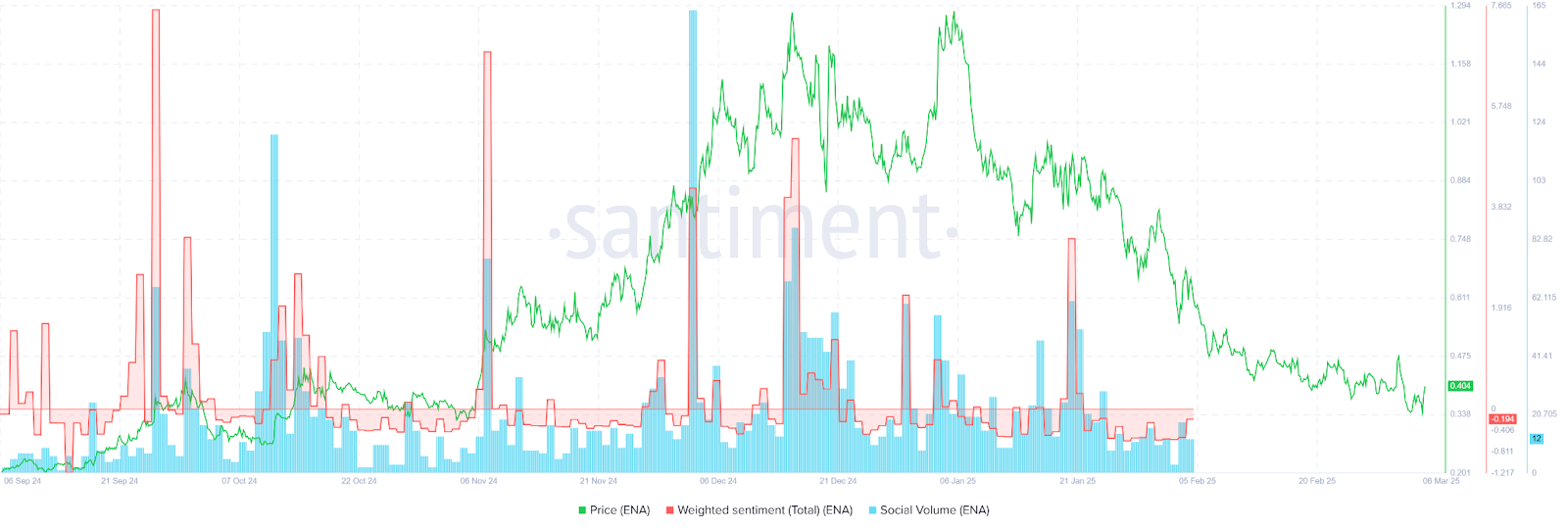

Social volume has shown cyclical spikes, correlating with price fluctuations.

Source: Santiment

Source: Santiment

Weighted sentiment remains negative, aligning with the recent downtrend. A shift in sentiment and increased engagement could drive a reversal.