Whales bought $FET, $LINK, and $WLD amid significant price corrections across the crypto market. Strategic accumulation of these altcoins is occurring even as the broader altcoin market cap fell from $333 billion on January 19 to $245 billion currently.

The notable increase in large addresses holding these tokens suggests major investors see value at current prices. This accumulation pattern across $FET, $LINK, and $WLD could indicate early positioning for potential recovery.

Artificial Superintelligence Alliance ($FET)

$FET is currently undergoing a significant correction. It is down 40% in the last 30 days, and its market cap is now at $1.58 billion. This marks a steep decline from the more than $5 billion it reached in December 2024, reflecting a sharp loss in momentum not only on $FET but also in artificial intelligence cryptos as a whole.

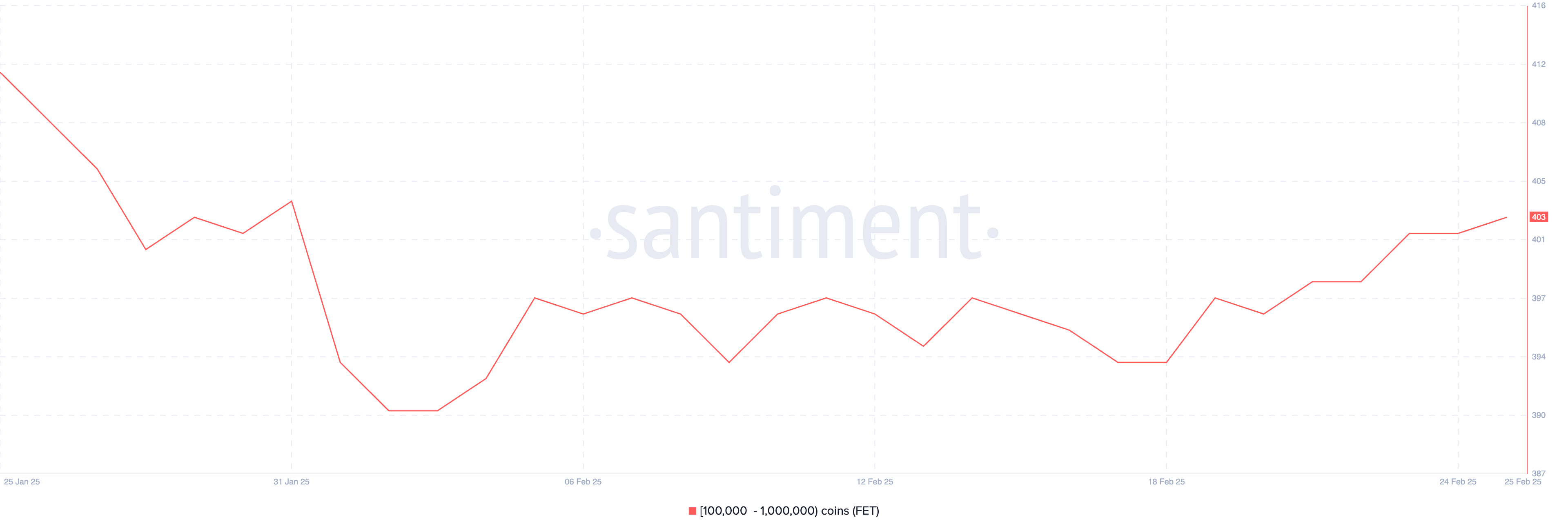

Additionally, $FET has dropped over 9% in the last seven days, coinciding with a noticeable increase in accumulation among $FET whales.

Despite the ongoing correction, this accumulation suggests that whales may be taking advantage of the lower prices, potentially positioning themselves for a future rebound.

The number of addresses holding between 100,000 and 1,000,000 $FET has increased from 394 on February 18 to 403 on February 25, its highest level since January 31.

Whales bought during a period of price decline indicate growing confidence among larger holders, possibly signaling a bottoming-out phase. If this trend continues, it could provide the buying support needed to stabilize $FET’s price and eventually trigger a reversal.

However, until broader market sentiment improves, $FET is likely to remain under pressure, with accumulation patterns serving as a key indicator of potential bullish momentum.

Chainlink ($LINK)

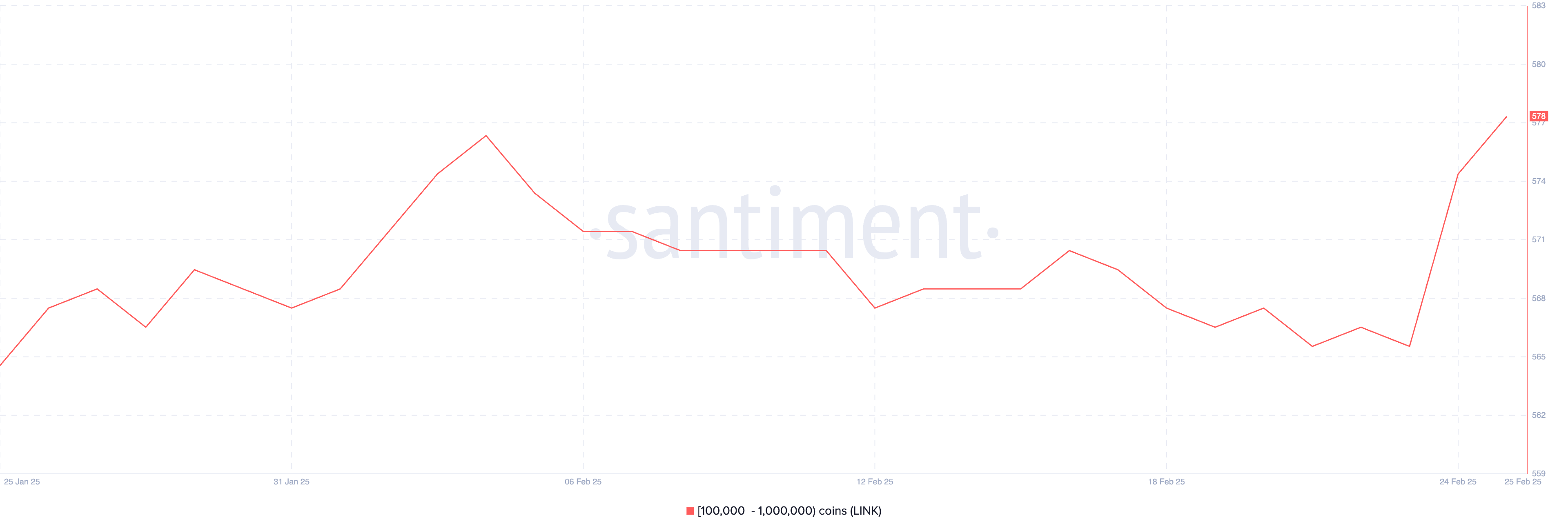

Like other altcoins, Chainlink has faced significant corrections recently, with its value dropping more than 13% over the past week.

This decline has pushed $LINK out of the top 10 cryptos by market cap, with its total value falling below $10 billion.

The pressure on Chainlink price has been persistent. It has remained under $24 for nearly a month, indicating a sustained bearish trend in the market.

Despite this downward momentum, potential signs of recovery are emerging. While the number of $LINK whales – addresses holding between 100,000 and 1,000,000 $LINK – decreased from 577 on February 4 to 566 on February 23, a notable reversal occurred on February 25, when this figure surged to 578 as whales bought $LINK.

This sudden increase in whale accumulation could signal renewed confidence among whales.

If this whale accumulation continues, it might provide the upward pressure needed to break Chainlink price above the $24 resistance level that has capped its performance for weeks.

Worldcoin ($WLD)

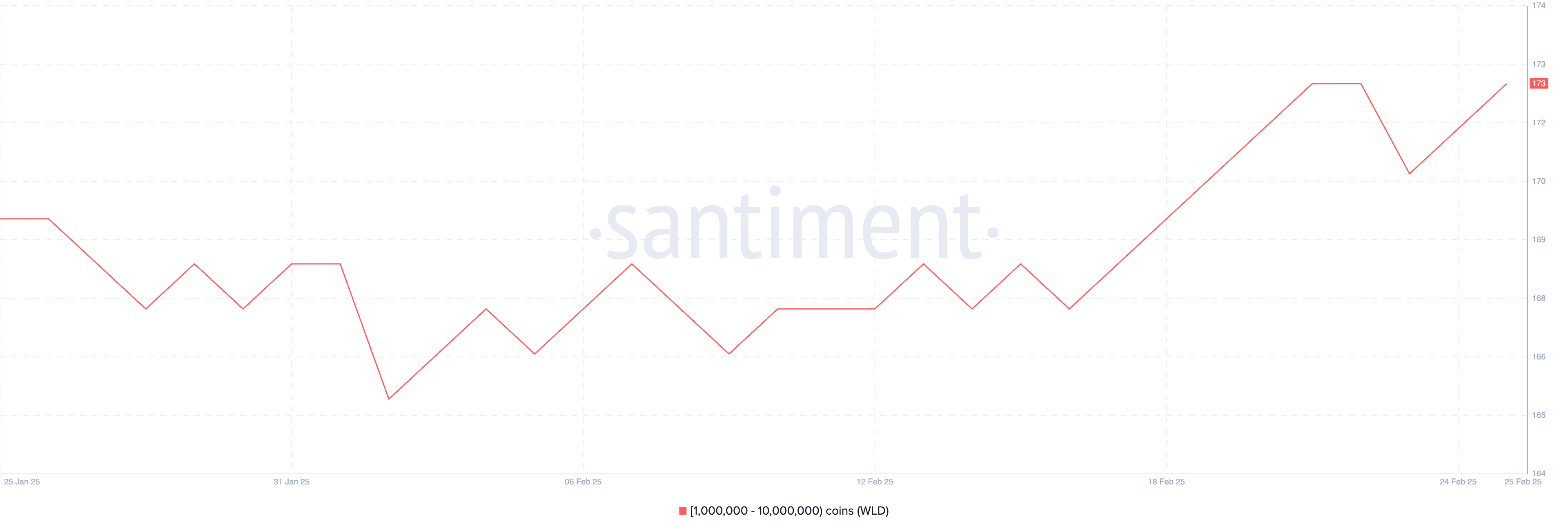

Worldcoin price has experienced a severe market correction over the past month, with its price plummeting more than 41%.

This dramatic decline has significantly impacted its market capitalization, which now stands at $1.17 billion – a substantial drop from its peak of nearly $3 billion in December 2024.

Such a pronounced downtrend reflects considerable selling pressure and potentially waning investor confidence in the Worldcoin project during this period.

Interestingly, despite this sharp price decline, whale behavior suggests a potential shift in market sentiment. While the number of Worldcoin whales remained relatively stable throughout most of the month, fluctuating narrowly between 170 and 166, a notable change occurred on February 16 when large holders began accumulating $WLD again.

The number of addresses holding between 1,000,000 and 10,000,000 $WLD has now increased to 173 – reaching its highest level since December 29, 2024.

This renewed accumulation by major investors could signal that whales view the current price levels as an attractive entry point, potentially anticipating a recovery.

beincrypto.com

beincrypto.com