Solana struggles below $140 as bearish momentum grows. Can Solana bulls hold the $130 support, or will the $SOL price slide toward $65?

With the total crypto market cap falling to $2.87 trillion, altcoins are struggling to find crucial support. Amid the declining market conditions, Solana is trading under $140.

Currently, the $SOL token trades at $139, with an intraday pullback of 3.05%. Will the bearish trend in Solana reach the $125 support level? Let’s find out.

Fear Spikes Among Solana Investors

As the decline continues, Solana investors have entered a state of fear. According to a recent tweet by crypto analyst Ali Martinez, the net unrealized profit and loss (NUPL) indicator by Santiment reveals that Solana is in the “Fear” zone and approaching “Capitulation.”

#Solana $SOL investors appear to be in a state of "fear." pic.twitter.com/SpGTL3knNX

— Ali (@ali_charts) February 26, 2025

Furthermore, Solana’s transfer volume has plummeted from $1.99 billion in November 2024 to just $14.57 million today. This reveals a massive decline over the past three months, increasing the possibility of a bearish continuation.

Solana Price Analysis: A Bearish Outlook

In the daily chart, the $SOL price trend reveals a massive crash after failing to surpass the $260 supply zone. The pullback has dropped Solana’s market price by nearly 47% from its $280 peak.

Furthermore, the bearish crossover in the 50-day and 100-day EMA lines increases the possibility of a death cross between the 50-day and 200-day EMAs. With the ongoing bearish trend, the daily RSI line has plunged into the oversold territory, reflecting increased selling momentum.

Derivatives Market: Optimism Despite the Drop

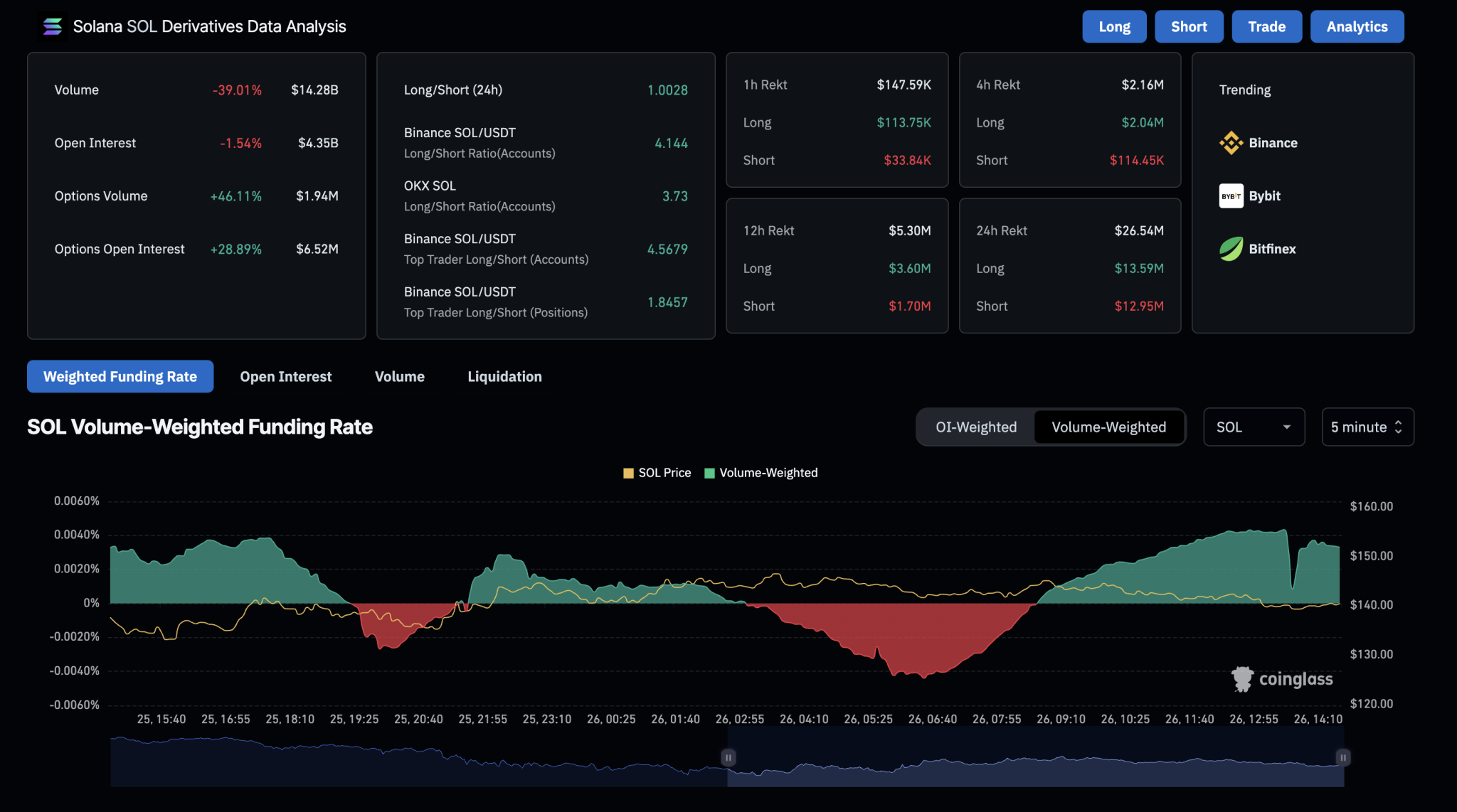

Despite the downfall in Solana prices, the short-term struggle near $140 has fueled minor optimism in the derivatives market. The long-to-short ratio in Solana derivatives has equalized, reflecting an equal number of bullish and bearish players in the market.

Furthermore, the Solana volume-weighted funding rate has turned positive, reaching 0.0033%, indicating traders’ willingness to pay a premium for long positions. Over the past 24 hours, liquidations have also nearly equalized, with long positions accounting for $13.59 million, while short liquidations have risen to $12.95 million.

Overall, the Solana derivatives market has witnessed a minor drop in open interest by 1.54%, bringing it down to $4.35 billion.

Crucial Support Level at $130

Analyst Ali Martinez highlights a right-angled ascending broadening formation on Solana’s 3-day chart. Currently, the price within this formation is approaching crucial support near $130.

If bulls fail to defend the $130 level, the downtrend may continue toward $65, according to Martinez.

#Solana $SOL appears to be forming a right-angled ascending broadening pattern. A break below $130 could open the door for a drop to $65! pic.twitter.com/iNPjrgbBNH

— Ali (@ali_charts) February 25, 2025

thecryptobasic.com

thecryptobasic.com