Litecoin price Resistance formed multiple times around $137–$140, aligning with previous rejection points.

The lower trendline showed support near $130, preventing further downside.

A breakout above $140 could drive bullish momentum toward $150 or beyond, but rejection risks reversal to $120.

Volume remained moderate at 2.01M, indicating cautious participation.

The pattern historically leads to breakdowns, yet $LTC’s recent strength suggested potential divergence.

If buyers sustain momentum, the next attempt at $140 may succeed. Failure to hold $130 could confirm trend exhaustion, accelerating declines.

Traders watched for confirmation signals before positioning aggressively.

Highest $LTC Social Activity Share

$LTC social activity share also crossed 1.9%, reaching its highest recorded level. Social dominance rose 0.35% to 1.45%, reflecting heightened interest.

$LTC price surged 104.52%, touching $136.17, indicating strong correlation with social buzz.

Trading volume spiked 595.4% to $1.63B, supporting increased engagement. If social dominance continues rising, $LTC could break resistance at $140, attracting more buyers.

Market cap climbed confirming capital inflow indicating sustained social traction could fuel bullish momentum.

A decline below 1.5% social dominance could weaken sentiment, leading to price consolidation near $130.

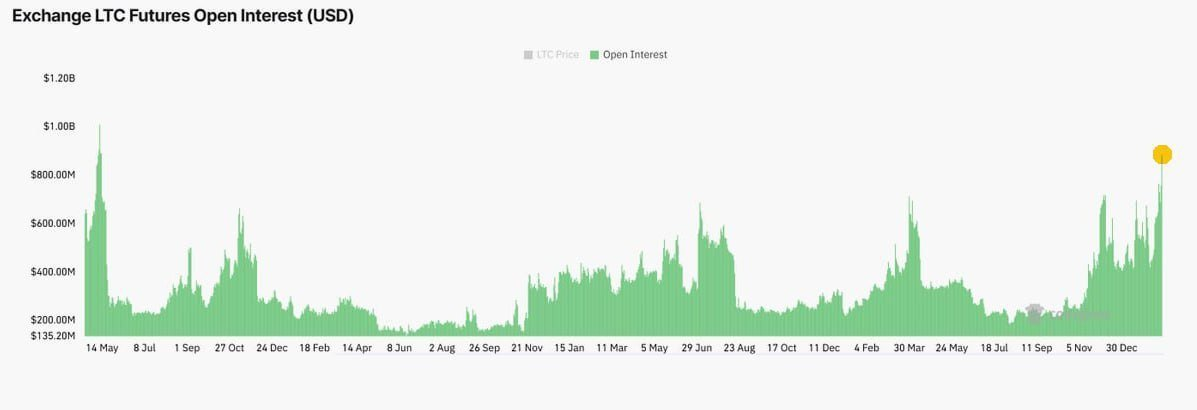

Litecoin Futures Open Interest Soars to a 4-year High

Additionally, Litecoin futures open interest soared to a 4-year high of $758 million, reflecting strong speculative interest.

This surge indicated increased market activity and potential price volatility. $LTC price reached $136.17, rising 104.52%, supported by high leverage.

Trading volume spiked 595.4% to $1.63B, confirming active participation. Market cap climbed $5.3B to $10.29B, reinforcing capital inflows.

The consistent open interest growth signaled rising demand. Increased futures exposure suggested traders anticipated further $LTC price movement, likely testing $140 resistance.

If open interest remains high, $LTC could extend gains past $150. However, excessive leverage might trigger liquidations, forcing a correction toward $130.

Sustained open interest growth indicated confidence in $LTC’s trajectory.

Traders monitored funding rates and liquidation levels to gauge potential breakouts or pullbacks in the coming sessions.

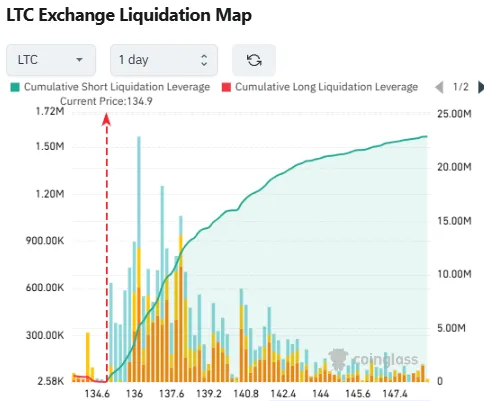

$LTC Cumulative short Over Long Liquidation Leverage

Litecoin’s higher cumulative short liquidations over long liquidations, indicating a short squeeze. $LTC reached $134.9, triggering 1.72M in short liquidations.

Short positions faced aggressive liquidations near $134.6–$137, forcing traders to buy back, fueling upward momentum.

Long liquidations remained significantly lower, reducing immediate downside pressure. This short squeeze contributed to $LTC’s 104.52% rally, lifting the price to $136.17.

Market cap increased $5.3B to $10.29B, reinforcing demand strength. Open interest hit $758M, signaling continued speculative interest in $LTC futures.

If shorts keep liquidating, $LTC could surpass $140, attracting more buyers. However, failing to hold $134 might encourage new short positions.

A sustained imbalance in liquidation pressure could push $LTC toward $150. Traders watched liquidation clusters to assess upcoming volatility and price strength.

thecoinrepublic.com

thecoinrepublic.com