-

Due to heavy selling pressure at the $141 level, Litecoin ($LTC) could drop by 25%.

-

Despite $LTC’s bearish outlook, investors and long-term holders appear bulls as they have accumulated $10 million worth of okens.

Amid the ongoing market uncertainty, while the majority of cryptocurrencies are witnessing price recovery, Litecoin ($LTC) is poised for a massive price drop. The potential reason for this bearish speculation is the formation of negative price action and traders’ bearish sentiment, as reported by the on-chain analytics firm Coinglass.

Current Price Momentum

$LTC is currently trading near $127 and has experienced a price drop of over 6% in the past 24 hours. During the same period, its trading volume declined by 23% due to its bearish price momentum, indicating lower participation from traders and investors compared to previous days.

Litecoin ($LTC) Technical Analysis and Price Prediction

According to expert technical analysis, $LTC appears bearish as it has been moving within a parallel channel pattern between $95 and $141 since November 2024. Despite bearish market sentiment in the past few days, $LTC’s price has surged nearly 38%, rising from $95 to $141. However, it is now experiencing selling pressure due to its history of price drops and the current market sentiment.

Based on historical patterns, if $LTC fails to break above the $141 level, there is a strong possibility it could drop by 25% to reach the $95 support level. Currently, the asset is trading above the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating that $LTC is in an uptrend.

Mixed On-Chain Metrics

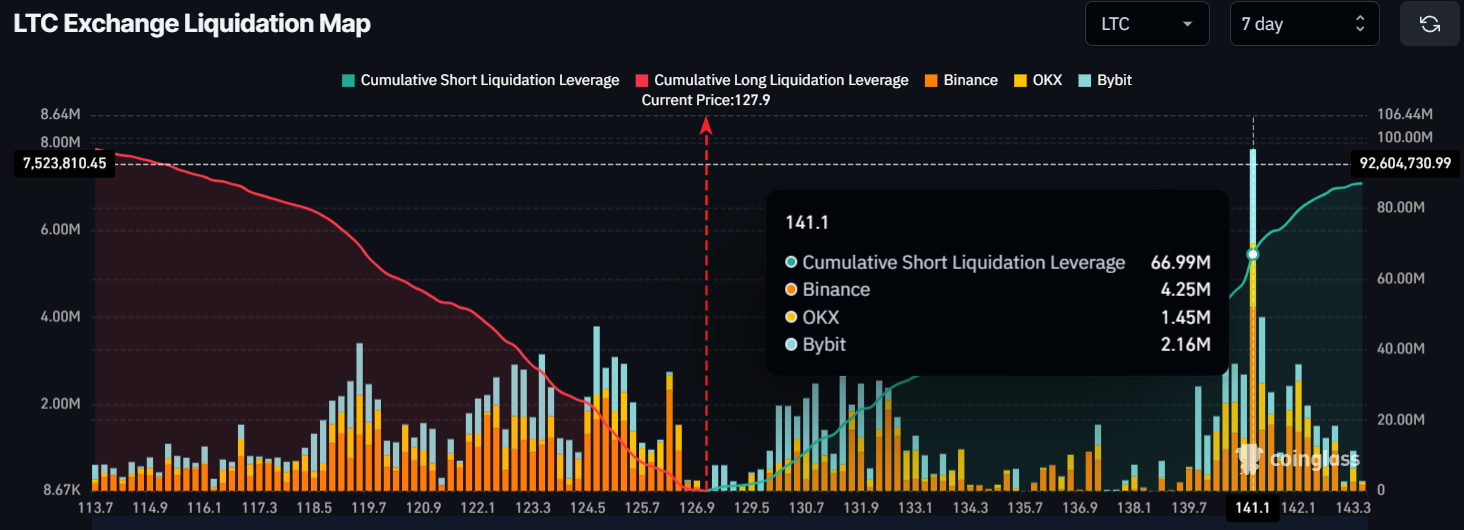

When examining the current market sentiment and price at the reversal level, intraday traders appear to be betting on the bearish side, as reported by the on-chain analytics firm Coinglass.

Data from the exchange liquidation map shows that traders betting on the short side are over-leveraged at the $141.5 level and have built $67 million worth of short positions in the past week. Meanwhile, traders betting on the long side seem exhausted, having built only $21 million worth of long positions.

These over-leveraged positions reflect the sentiment of both short and long traders, as some believe the price won’t break above that level. If it does, these positions will be liquidated.

Despite $LTC’s bearish outlook, investors and long-term holders seem to be accumulating the token. Data from spot inflow/outflow reveals that exchanges have witnessed an outflow of $9.41 million worth of $LTC tokens in the past 24 hours, indicating potential accumulation.

When combining these on-chain metrics with technical analysis, it appears that short-term players are bearish, expecting the price to decline in the coming days. Meanwhile, long-term holders seem to be taking advantage of the price drop and are significantly accumulating the token.

coinpedia.org

coinpedia.org