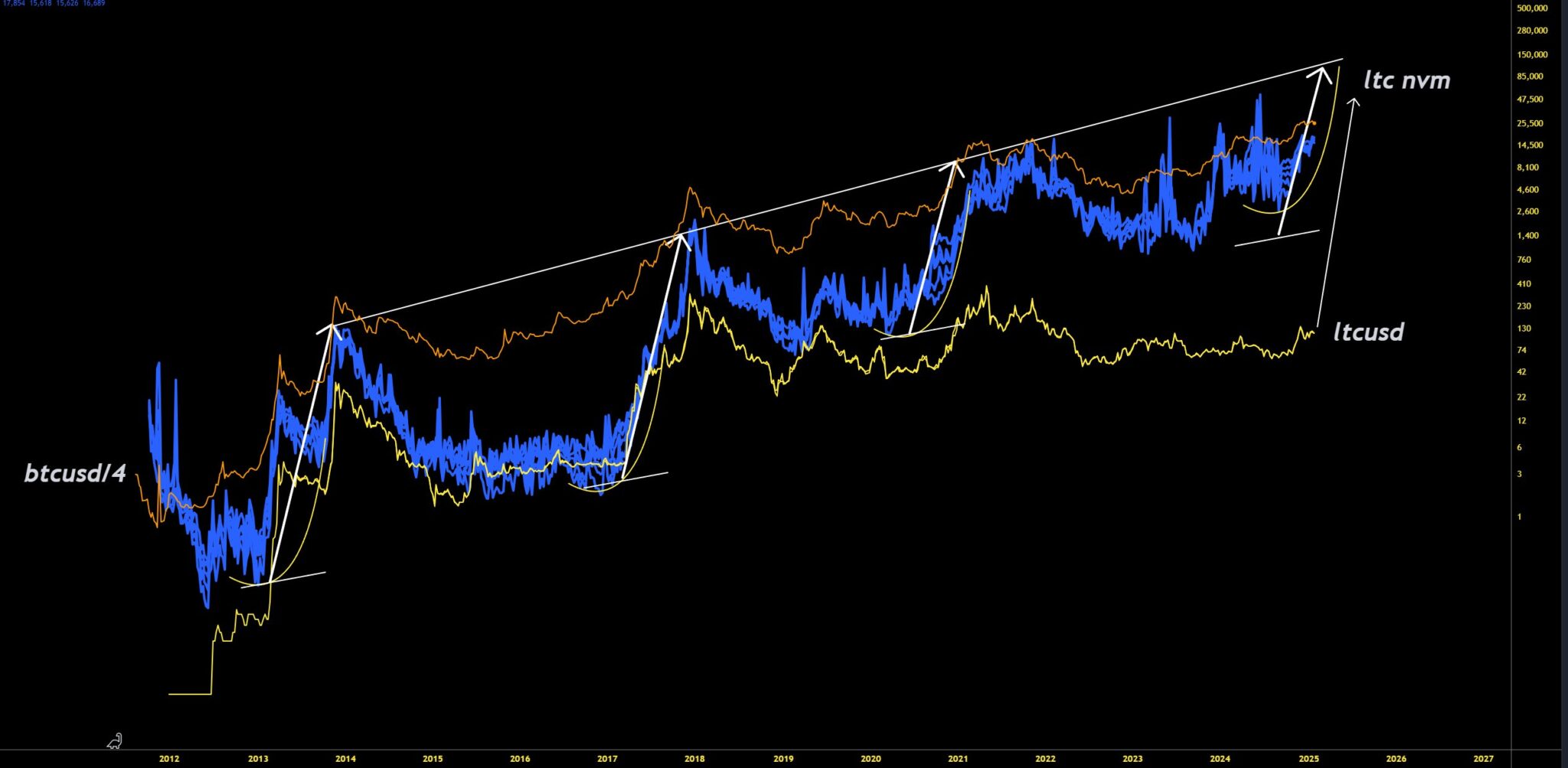

Litecoin ($LTC) price action lagged two cycles but eventually went vertical to catch up. The chart confirmed repeated delayed surges before massive breakouts.

In 2013, $LTC surged from $2 to $50 after consolidation. In 2017, it rose from $4 to $410, again following a delayed pattern. The 2021 peak at $410 underperformed previous cycles but still aligned with historical trends.

Currently, $LTC consolidates around $74, signaling accumulation before a breakout. If history repeats, $LTC could first test $230, then $760, before exceeding $2,600 long-term.

Short-term, price movement suggested increasing momentum. The accumulation phase hinted at an impending strong rally.

If cycles remained consistent, Litecoin would surpass expectations and outpace market predictions in the next bullish move.

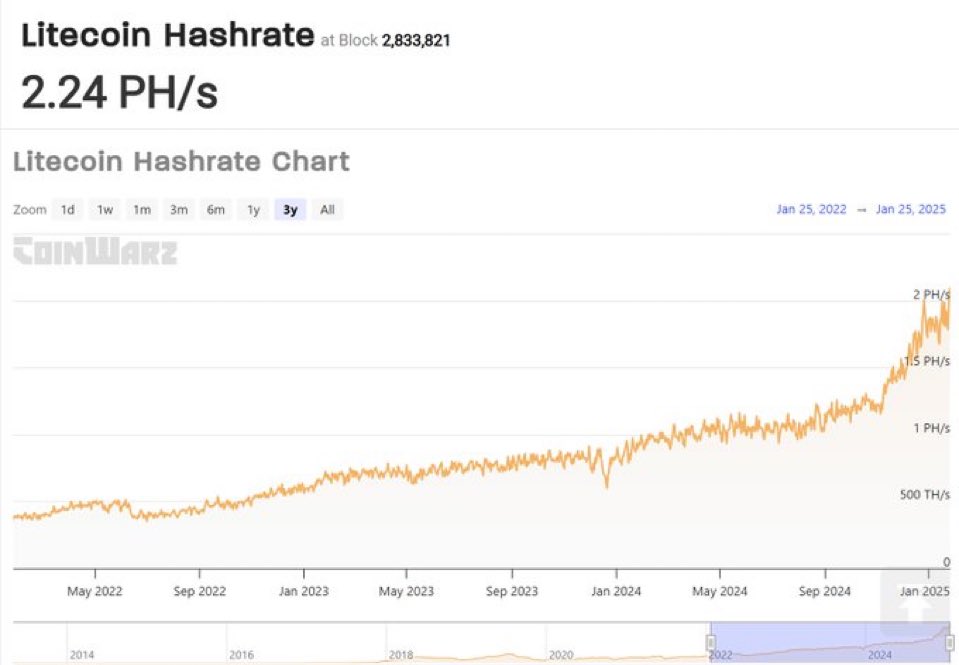

Litecoin Price Surges as Hashrate Hits $ATH, ETF Speculation rises

Litecoin’s hashrate peaked at 2.24 PH/s, marking an all-time high ($ATH) which was a show of steady growth since early 2022, accelerating in late 2024.

The hashrate surpassed 1 PH/s by mid-2023, then surged past 1.5 PH/s in late 2024.

This sharp increase indicated greater mining participation and network security along with enhanced miner trust.

Higher hashrate is often correlated with price gains. $LTC recently recovered from declines, and a rising hashrate signaled miner confidence.

ETF speculation fueled bullish sentiment. If institutional interest grew, $LTC price could stabilize above resistance levels.

The final approval of an ETF would generate immediate market accessibility to Litecoin which could sustain ongoing price growth.

In the short term, price volatility remained likely as investors reacted to ETF developments. Long-term, sustained hashrate growth suggested robust network health, attracting investors.

If momentum persisted, $LTC could benefit from mainstream adoption, pushing it toward stronger price appreciation.

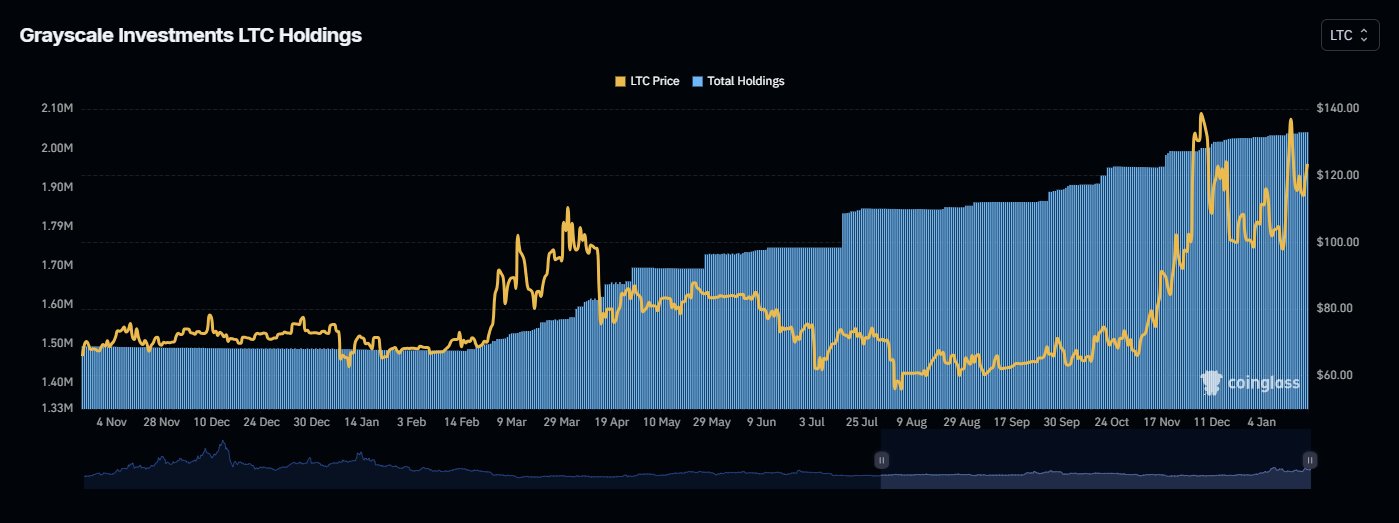

Grayscales $LTC total holding has sharply increased since 2024 February

Grayscale’s $LTC holdings rose from 1.4M in February 2024 to over 2.1M by January 2025.

This accumulation signaled strong institutional confidence in Litecoin. The holdings surpassed 1.6M in March, reaching 1.9M by mid-2024.

The buying pattern at Grayscale followed consistent accumulation stages until price spikes occurred.

Spikes increased steadily step by step in a way that resembled institutional buying behaviors from previous periods.

The trend accelerated in October, leading to all-time highs in December. Litecoin’s price reacted positively, climbing from $60 in September to $140 in December before stabilizing around $120.

This sharp increase coincided with rising institutional interest. In the short term, price fluctuations remained possible as ETF speculation influenced investor sentiment.

A successful ETF launch could push $LTC beyond $140.

Long-term, continued Grayscale accumulation could solidify Litecoin’s status as a key institutional asset.

If demand persisted, $LTC could achieve sustained higher valuations and broader market adoption, reinforcing its relevance in crypto markets.

This showed direct relationship between distribution increases and value appreciation. Insufficient accumulation examinations showed Litecoin’s capacity to maintain elevated price levels.

Prior markets have indicated Litecoin prices would surpass $150 when demand maintained its current levels.

Long-term institutional investors showed their confidence in Litecoin’s future through continuous growth in their holdings.

thecoinrepublic.com

thecoinrepublic.com