Litecoin ($LTC) has formed a critical three-black crow candlestick pattern on the daily chart, signaling a likely bearish reversal after its recent bullish rally. This pattern, characterized by three consecutive bearish candles with minimal lower wicks, reflects strong selling momentum and often serves as an early indicator of further downside.

Historical data suggests that this formation is 65-70% likely to lead to continued bearish price action, especially when supported by additional technical signals. One such signal is the rejection from the $129 resistance zone, which aligns closely with the upper boundary of $LTC’s re-accumulation range.

This zone has consistently acted as a supply area, reinforcing bearish sentiment. Currently, the $LTC token is trading near the lower boundary of the re-accumulation zone, defined between $128 and $111. A breakdown below this range would signal a loss of bullish momentum, increasing the probability of a retest of the critical $100 support level.

Despite the $100 zone being a key focus for traders, the cryptocurrency still trades above its 50-day moving average at $110.98, which serves as immediate support. However, a decisive break and daily close below this level could indicate a mid-term momentum shift, with the 50-day MA transitioning into dynamic resistance.

If this scenario unfolds, the $100 level would become the primary focus, given its historical importance as a strong accumulation zone. This level also aligns with the 100-day MA, further solidifying its reputation as a critical safety net against deeper declines.

$LTC’s On-Chain Data Hints at $100 Retest

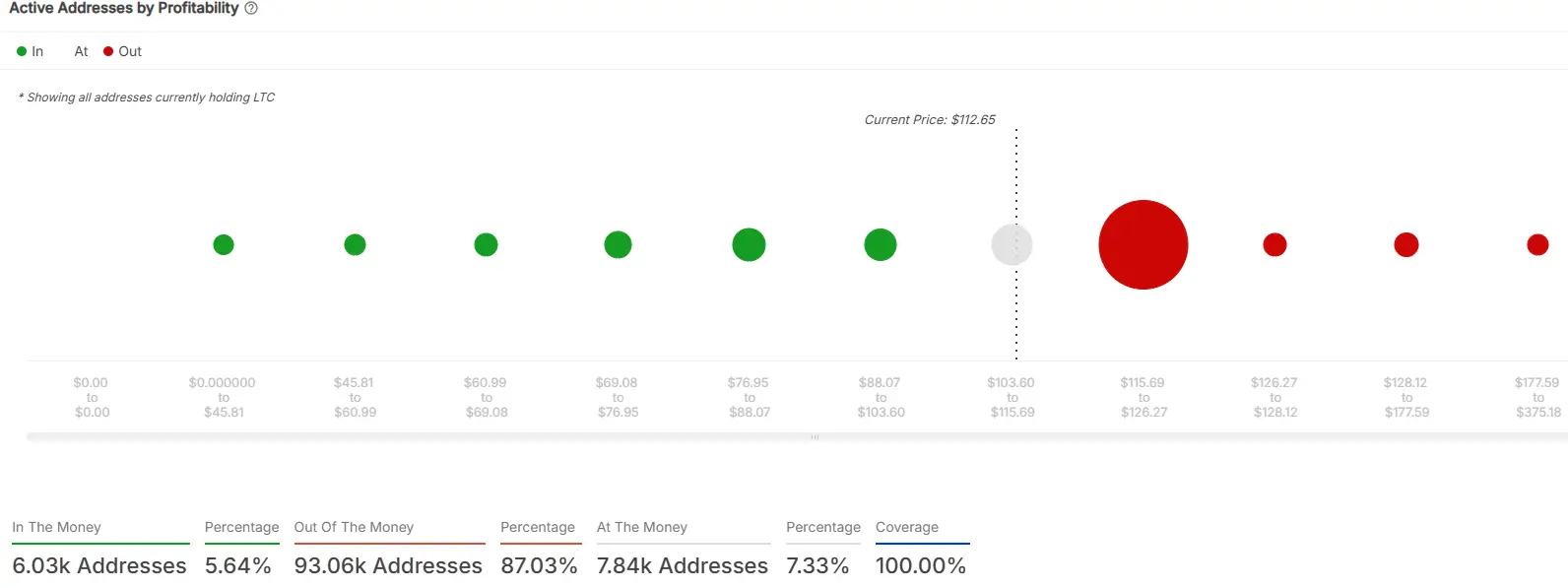

The on-chain data further supports a bearish outlook for Litecoin cryptocurrency, with active addresses by profitability and whale/investor concentration metrics highlighting growing selling pressure and limited market confidence. These factors indicate a likely retest of the critical $100 support zone.

The profitability chart, for instance, reveals that 87.03% of $LTC addresses are currently out of the money, with only 5.64% in profit. This imbalance reflects significant unrealized losses, which could increase selling pressure as the token’s prices fall.

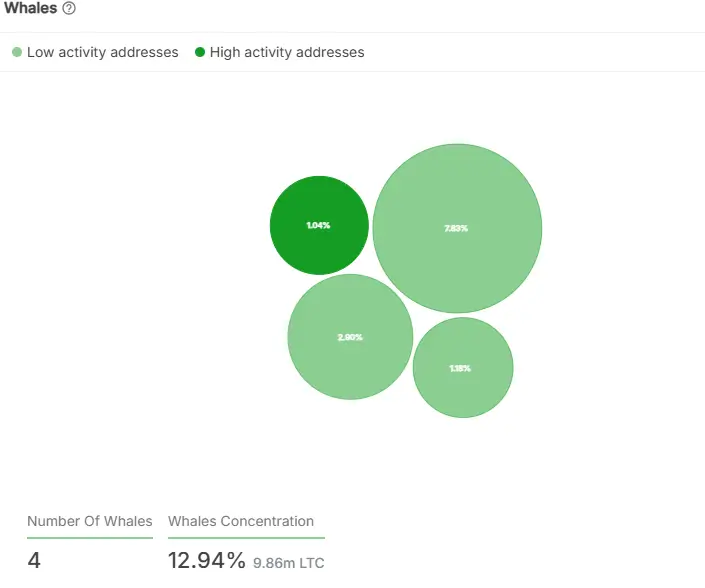

Additionally, the 7.33% of addresses “at the money,” positioned between $103.60 and $115.69, remain vulnerable to capitulation if the cryptocurrency breaches the lower boundary of this range. Such a scenario would accelerate downward momentum toward $100. Whale activity data further reinforces the bearish narrative. Four whale accounts control 12.94% of Litecoin’s supply, totaling 9.86 million $LTC tokens.

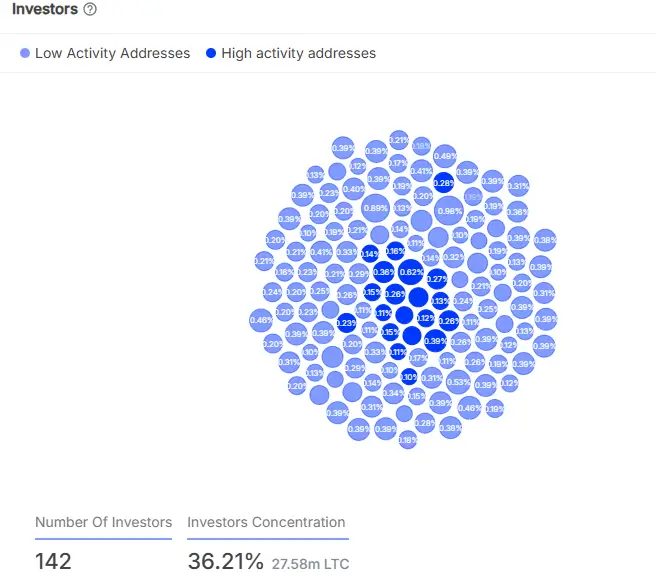

However, their limited activity at current price levels suggests hesitation, reflecting a lack of confidence in the short-term outlook. Without intervention from these key players, the market remains exposed to continued downside pressure. Investor concentration data adds to the cautious sentiment. While 142 key investor addresses hold 36.21% of the token’s supply (27.58 million $LTC), a significant proportion are low-activity addresses, highlighting limited engagement.

This lack of activity suggests that investors are waiting for lower price levels before accumulating further, aligning with the potential for the cryptocurrency to retest the $100 level—a historical accumulation zone that may attract renewed interest.

cryptonewsz.com

cryptonewsz.com