Solana recently experienced a notable price correction, briefly falling below $170. However, the altcoin is showing signs of recovery, reclaiming the $200 level as support.

The key question now is whether profit-taking will hinder its upward momentum or if long-term investors can sustain the recovery.

Solana Investors Are Expected To Comeback

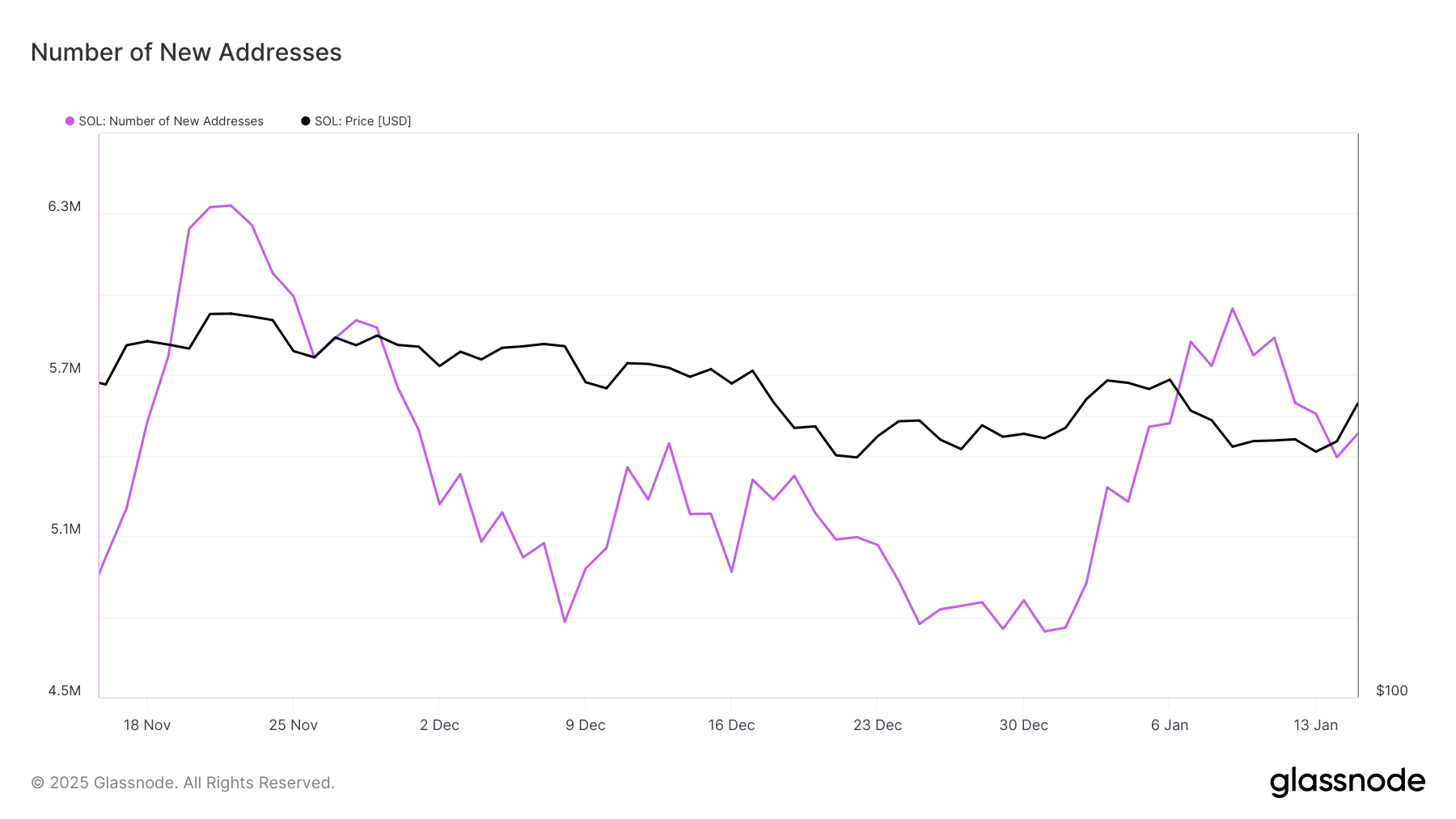

The network recorded a loss of 500,000 new investors over the past ten days as Solana’s price corrected. New investors are identified by unique addresses conducting transactions on the network for the first time. This metric is crucial for gauging the cryptocurrency’s traction and could improve as Solana’s price stabilizes.

A price recovery often re-engages new investors, bolstering market sentiment. As Solana maintains its upward trajectory, increased participation from first-time investors could strengthen its position, ensuring the recovery gains momentum.

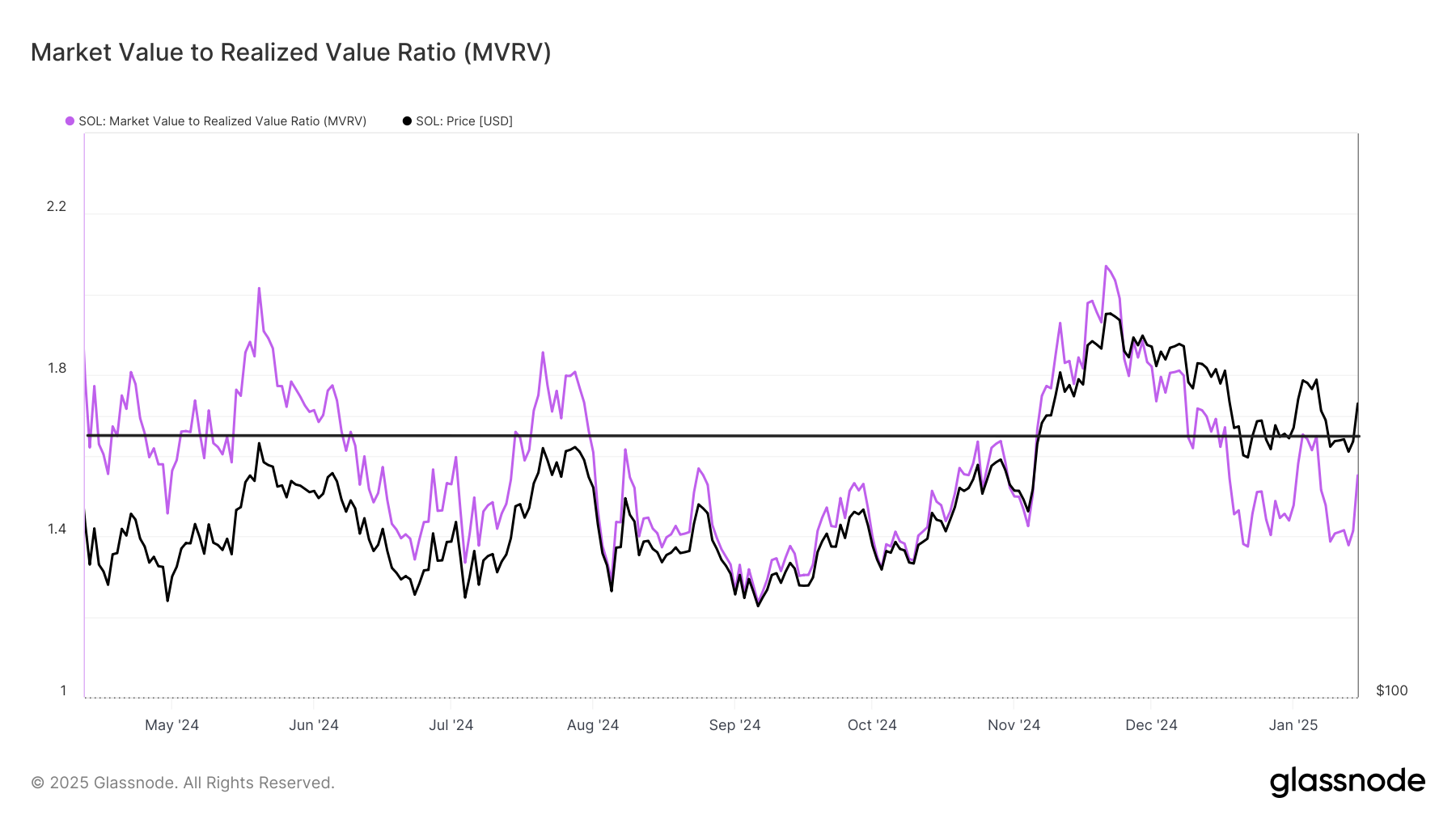

The MVRV (Market Value to Realized Value) Ratio for Solana is rising sharply, approaching the danger zone threshold of 1.65. Historically, when the MVRV surpasses this level, it signals heightened profit-taking activity, often leading to price reversals. Earlier this month, a similar pattern triggered a downturn.

The current rise in MVRV suggests that short-term profit-taking could threaten Solana’s recovery. Investors securing gains could increase selling pressure, making it essential for long-term holders to maintain their positions to counteract a potential pullback.

SOL Price Prediction: Keeping Support Intact

Solana is trading at $202, holding above the critical support level of $201 after an 8% rise in the last 24 hours. This recovery marks a significant milestone in its attempt to regain bullish momentum.

The next challenge for Solana lies at the $221 barrier, which has resisted upward movement for nearly a month. If new investors return and offset profit-taking, Solana could breach this resistance. Achieving this would pave the way for a rise to $245, reinforcing the altcoin’s bullish outlook.

However, should short-term holders move to sell their holdings, Solana risks losing the $201 support level. Falling below this mark would invalidate the bullish scenario, potentially driving the price down to $183. This emphasizes the need for sustained market support to secure continued recovery.

beincrypto.com

beincrypto.com