Blockchain.com, the famous multifunctional platform that offers a wide range of services focused on the crypto world, has just published its “2024 Year-End Report”.

Within the report, we find various reflections on the state of the crypto industry, on the major market trends, and on the milestones achieved by the company in the past year.

Let’s see everything in detail

Summary

Blockchain.com: the trends and the dominant narratives of 2024

According to Blockchain.com, 2024 was a highly transformative year for the entire crypto industry.

In the last 12 months, we have witnessed strong changes in the blockchain world, both from a macroeconomic perspective and from a more technical viewpoint.

Among the pivot events that have sparked the most interest and participation from the public, we first find the approval of exchange-traded funds for BTC and ETH.

The introduction of regulated exchanges for the first two cryptocurrencies was a step of strong institutional adoption, making the entire technological sector more mainstream.

Precisely thanks to the positive push from the spot ETFs, for Bitcoin one of the most significant speculative targets in its entire history was reached, namely reaching 100,000 dollars.

To also highlight the positive impact on the market triggered by the expansive monetary policies of the FED, which in 2024 initiated a path of cutting federal rates.

Another significant moment for the sector, especially for the DeFi segment, is represented by the resignation of the head of the SEC Gary Gensler.

After the victory of Donald Trump in the USA elections, the pressures on Gensler were so strong that the anti-crypto politician was forced to abandon his valuable position, removing a significant factor of oppression on crypto companies.

The scenario of crypto regulation in the USA has also gone through two historic rulings against two key figures in this sector.

First with Sam Bankman Fried, sentenced to 25 years in prison for the FTX fraud, then with Changpeng Zhao, sentenced to 4 months and the payment of a fine of 4 billion dollars for violating money laundering laws.

On a more technical front, Blockchain.com finally notes how 2024 was the year of the halving for Bitcoin as well as the year of the important software update Dencun for Ethereum.

All these events have contributed to transforming the cryptocurrency market, making it more involved in a regulated institutional life, and more resilient to attacks from external detractors.

The expanded presence of Blockchain.com in the crypto world

The year 2024 was a very positive one also for Blockchain.com itself, which has repeatedly emphasized its solid presence in the crypto universe.

The cryptocurrency services company, standing since as far back as 2011, has seized the opportunity to strengthen its brand within a sector that seems to embrace more and more players.

In particular in the last year Blockchain.com has participated in and co-sponsored over 30 events worldwide.

His name has been recurring in a wide range of web3 events across a myriad of cities located in America and in Asia.

Among the major ones, we find: Dubai, Singapore, Miami, Dallas, New York, London, Hong Kong, Bangkok, Paris, Brussels, and Denver.

The most significant events were: the North American Blockchain Summit 2024, the Quantum Miami 2024, the Thailand Blockchain Week, and the Stanford Blockchain Week.

Great participation for Blockchain.com also as a sponsor of events not focused on the crypto theme, such as sports ones.

For 2025 the company is even aiming for greater dynamism, aiming to be present at a large number of private and public initiatives.

In addition to the classic industry events, there is also talk of boxing matches, music concerts, themed dinners, and other curated gatherings.

The ultimate goal is to make the name of Blockchain.com resonate in all occasions where there is the possibility of obtaining significant engagement and to get people talking about it.

Year of growth for spot and options trading desks

In addition to the multiple networking opportunities encountered by Blockchain.com in 2024, we must necessarily mention the progress recorded by the trading desks of the platform.

For those who do not know, the platform manages trading desks where users can rely on to execute their cryptographic operations, on spot and options markets.

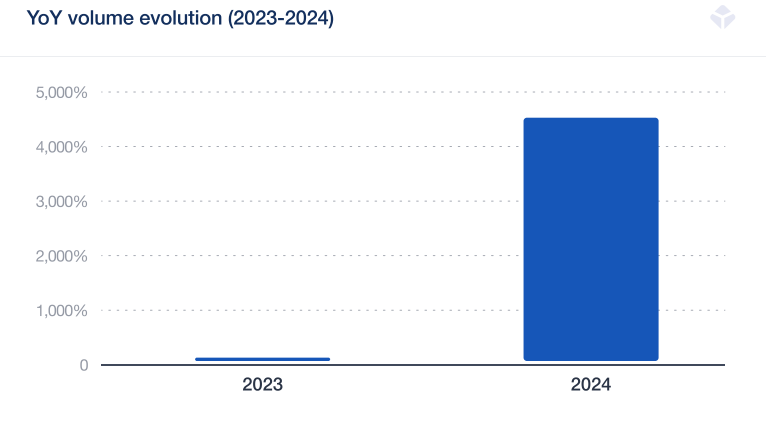

Regarding the options desk, we report a year of impressive growth where volumes have increased by 47 times compared to 2023.

This growth was driven by a two-way flow for much of 2024, as traders had great opportunities in both bull and bear markets.

To highlight also the positive impact of the USA elections; which with Trump’s victory in November brought a great boost in buying volumes, followed by the wide positioning of the following month.

Obviously most of the flows are denominated in Bitcoin, reflecting the speculative interest of investors in the records set by the cryptocurrency during the year.

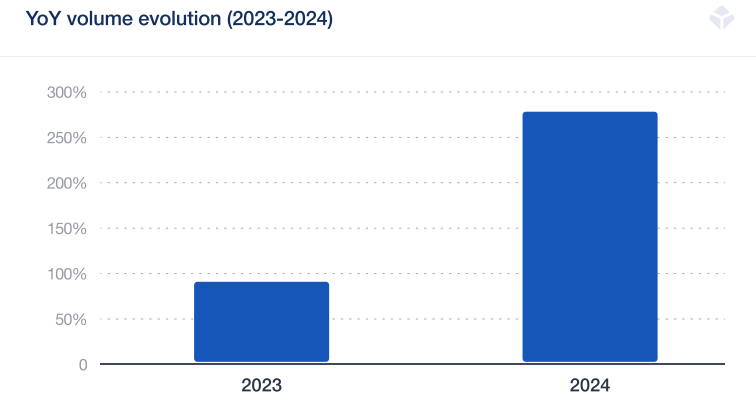

Also on the desk spot front, Blockchain.com observed strong growth numbers, especially for the first half of 2024.

According to the data, the spot volumes on the platform were greater by 2.8 times compared to the previous year, reflecting a strong bull momentum.

This growth has been driven by an expanding customer base and deeper engagement with existing relationships.

The approval of spot Bitcoin ETFs in January and the subsequent halving in May were fundamental factors that increased the trading base of users, who positioned themselves spot in the first months of the year.

The altcoin, on the other hand, represented 34% of the traded volume during the period, a fairly high figure that must, however, be compared with the higher numbers of 2023, highlighting a 44% year-on-year decrease.

BTC and ETH have achieved a significant increase in holdings, with a trend opposite to that of altcoins.

This data reflects a scenario in which altcoin traders move to more specialized platforms, such as memecoin launchpad or DeFi applications.

On the contrary, more traditional investors, who prefer to stick to the top coins of the crypto market, favor more institutionalized trading desks like that of Blockchain.com.

en.cryptonomist.ch

en.cryptonomist.ch