Ripple (XRP) experienced a 4% decline after an anticipated rally lost momentum. The asset had broken above a significant descending trendline, sparking trader optimism. However, it failed to sustain gains above the $2.50 resistance level, retreating toward $2.40.

Over the weekend, XRP surged 10% after breaking out of a symmetrical triangle pattern formed between early December and early January. This breakout initially signaled a potential bullish trend.

However, the rally quickly lost momentum, indicating insufficient buying pressure to maintain upward movement. The inability to close above the $2.50 resistance has weakened bullish sentiment, making XRP more susceptible to selling pressure.

Key support levels lie at the $2.30 mark, aligning with the 50-day exponential moving average (EMA). A drop below this support could lead to further declines toward $1.69 or even $1.20. The Relative Strength Index (RSI) stands neutral at approximately 57 as bears and bulls fight for positions to reduce liquidations.

CPI data and outcomes that could move the crypto market this week

This week, several key inflation reports are scheduled in the United States, which could influence central bank monetary policy. The December Producer Price Index (PPI), reflecting input prices for producers and manufacturers, is set for release on Tuesday.

The data measures the costs of producing consumer goods, directly affecting retail pricing and serving as an indicator of inflationary pressures. Additionally, December’s Core Consumer Price Index (CPI), measuring the average change over time in prices paid by consumers for goods and services, is due on Wednesday.

According to the global financial markets tracker The Kobeissi Letter, these reports are the final set of inflation data before the Federal Reserve’s meeting on January 29. If CPI data exceed expectations, the Fed could be prompted to reconsider its monetary policy stance, potentially impacting high-risk assets like cryptocurrencies.

The cryptocurrency market faced a significant downturn over the past week, with over $300 billion exiting the digital asset sector. Similar to the previous week, the crypto market is yet to trace back steps to November 2024’s bullish run. According to Coingecko updates, the global crypto market cap stands at $3.33 trillion, a ~4.18% downtick in the last day.

Bitcoin’s recent performance shows a downward trend. The asset’s price is currently at $92,912, a 0.95% decrease from the previous close.

Ethereum mirrored the downward movement, rising above $3,300 before falling back to the $3,200 level, a 14% weekly decline. Major altcoins BNB, Solana, Dogecoin, Cardano, TRON, Avalanche, and Sui also traded in the red.

Gold, Bitcoin break S&P500 pattern, insurance stocks plummet

According to the Kobeissi Letter, the correlation coefficient between gold and the S&P 500 reached a record 0.91 in 2024, indicating that these assets moved in tandem 91% of the time. Market analysts denote that this has never happened before, as historically, gold and the S&P 500 have often been negatively correlated.

This has NEVER happened before:

— The Kobeissi Letter (@KobeissiLetter) January 12, 2025

The correlation coefficient between Gold and the S&P 500 reached a record 0.91 in 2024.

This means that Gold and the S&P 500 were moving in TANDEM 91% of the time.

Why is the world's $18 trillion "safety trade" rising with stocks?

(a thread)

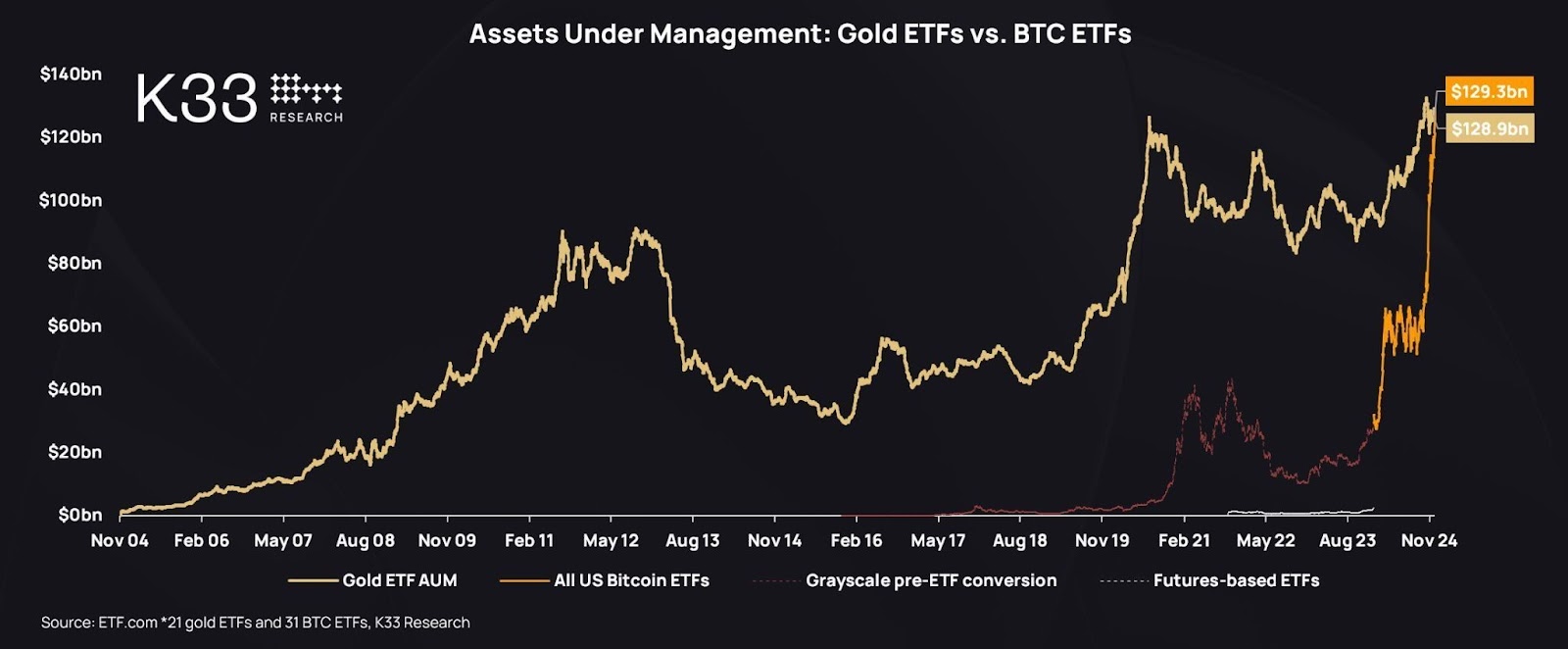

Bitcoin and gold, traditionally viewed as competing “safety” assets, both broke their inverse relationship with the S&P 500. Assets under management (AUM) in Bitcoin and gold exchange-traded funds (ETFs) collectively reached approximately $130 billion by year-end, highlighting their growing appeal among investors.

Over the last year, Bitcoin has significantly outperformed gold, with returns exceeding 110%, compared to gold’s 30% return during the same period. Since the start of 2025, however, gold investors have collected more returns than BTC enthusiasts, owing to the current broader crypto market’s struggles.

Meanwhile, the ongoing wildfires in Los Angeles, CA, have led to substantial economic losses, with insurance claims estimated between $10 billion and $20 billion. This has resulted in a sharp decline in insurance stocks as companies face significant payouts.

Insurance stocks are set to collapse:

— The Kobeissi Letter (@KobeissiLetter) January 12, 2025

LA wildfires have officially spread over 40,000 acres with insurance losses crossing $20 billion.

Since the market closed on Friday, estimated damages have TRIPLED to $150 billion.

Could this cause an economic ripple effect?

(a thread) pic.twitter.com/08ymnjYPUQ

Shares from companies like Mercury General fell by nearly 20% amid concerns over exposure to wildfire-related claims. The financial strain on insurers may force investors to look towards alternative investment avenues, including cryptocurrencies, which are decentralized and not directly affected by such localized events.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan

cryptopolitan.com

cryptopolitan.com