KuCoin Token has emerged as the top performer in the cryptocurrency market, with a 3% surge over the past 24 hours. This price hike has triggered substantial profits for a segment of its short-term holders (STHs).

However, the very nature of these investors, who typically aim to capitalize on quick price movements, poses a potential threat to the sustainability of $KCS’s recent gains. This analysis details why.

Short-Term Holders Put KuCoin Token at Risk

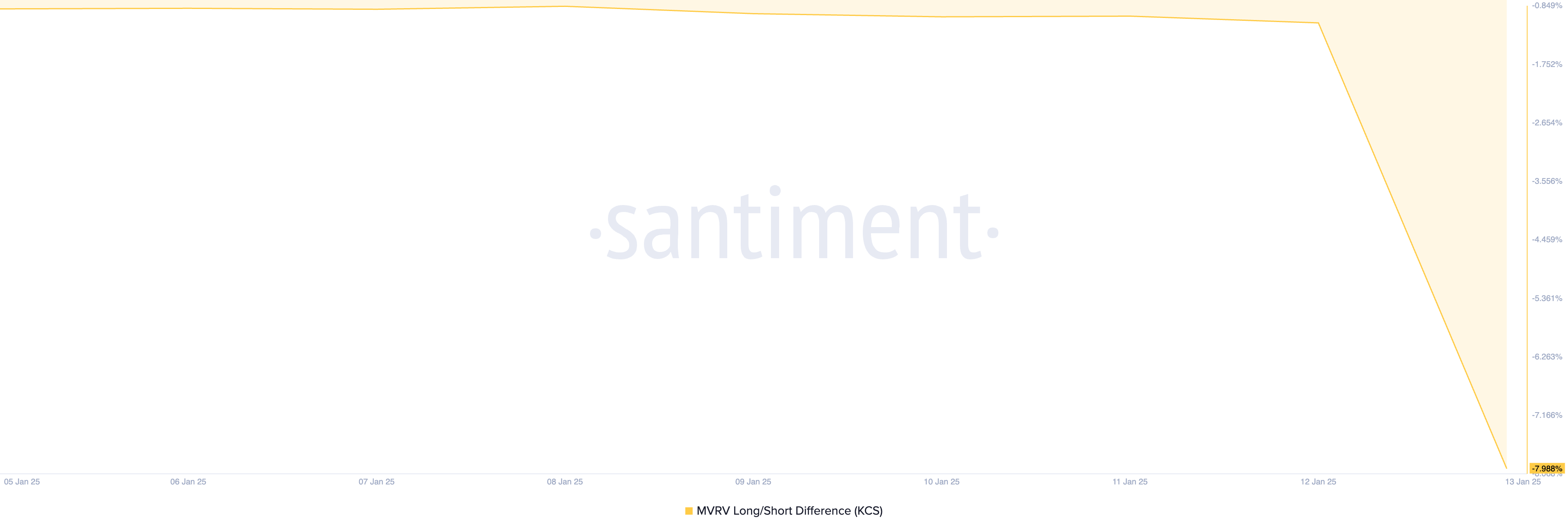

$KCS has noted a 376% uptick in its trading volume over the past 24 hours, pushing its price up 3% during that period. Due to this hike, many $KCS STHs are now in profit, reflected by the readings from its MVRV Long/Short Difference. As of this writing, this sits at a 30-day low of -7.98%.

An asset’s MVRV Long/Short Difference measures the relative profitability between its long-term and short-term holders. When the metric’s value is positive, it suggests that its long-term holders are more profitable, indicating bullish sentiment and potential for further price appreciation.

On the other hand, as with $KCS, a negative difference suggests that Short-Term Holders (STHs) are more profitable, signaling bearish sentiment and the potential for a price drop. These investors, who typically hold assets for shorter periods, are more likely to sell their tokens during short-term price fluctuations to secure profits.

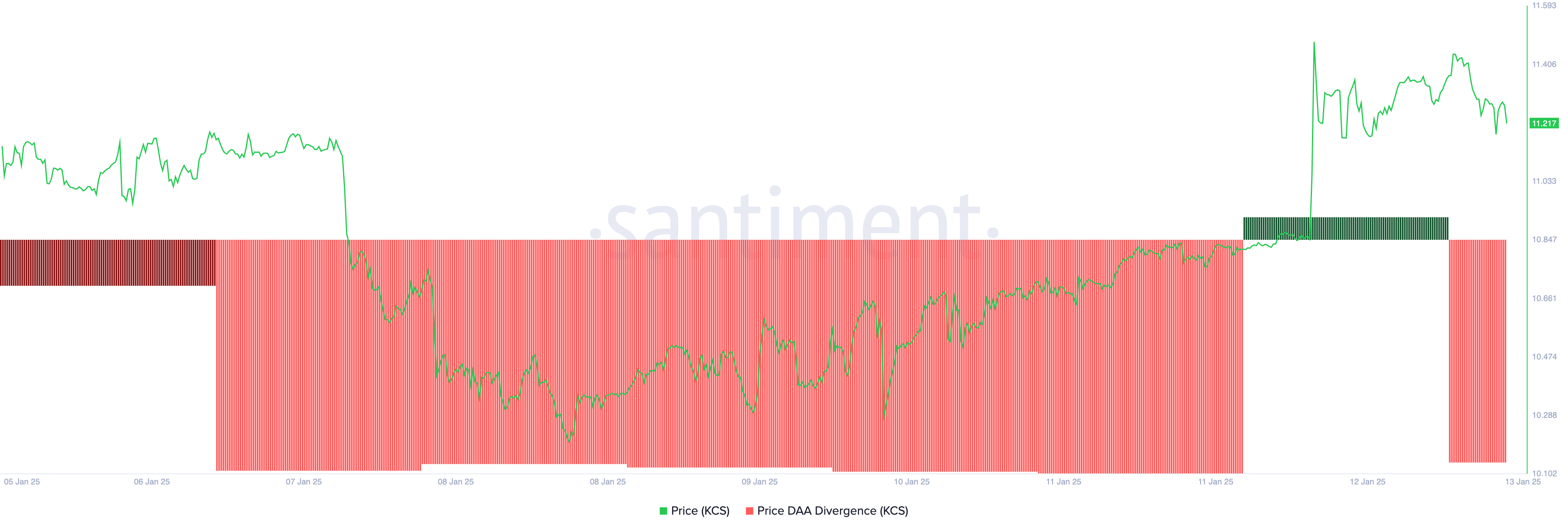

Moreover, despite $KCS’s price hike, its Price DAA (Daily Active Addresses) Divergence indicator has only flashed sell signals today.

This suggests that while the price is climbing, network activity does not support the rally, hinting at underlying weakness. If this trend persists as speculative traders take profits, a $KCS price reversal is imminent.

$KCS Price Prediction: Bearish Divergence Points to Potential Reversal

An assessment of the $KCS/USD one-day chart shows the potential formation of a bearish divergence between the altcoin’s price and its Chaikin Money Flow (CMF). At press time, this indicator is in a downward trend at 0.01 and is poised to fall below the zero line.

An asset’s CMF measures money flow into and out of its market. When it declines during a price rally like this, a bearish divergence is formed. This divergence signals that selling pressure is increasing, potentially undermining the sustainability of the upward momentum.

If $KCS’ CMF slips below zero, confirming the strengthening selloffs, its price will reverse its current trend and fall to $10.15.

However, if buying pressure increases, this bearish outlook would be invalidated. In that scenario, $KCS’ price could breach resistance at $11.42 and climb toward $13.82.

beincrypto.com

beincrypto.com