Raoul Pal’s “Banana Zone” theory offers a strategic lens to understand cryptocurrency price movements and market phases. $XRP and $XLM serve as prime examples of how altcoins navigate these phases, showcasing market rivalry and dynamics. This article explores the implications of the Banana Zone, $XRP’s market performance, and its competition with $XLM as they vie for dominance in blockchain payments.

1- The Banana Zone and Its Implications for Altcoins

The “Banana Zone,” coined by crypto expert Raoul Pal, outlines a roadmap for cryptocurrency price cycles, offering investors a guide to market behavior. This concept is particularly relevant to altcoins, which often exhibit dramatic price movements in these phases:

Phase 1: Breakout and Consolidation

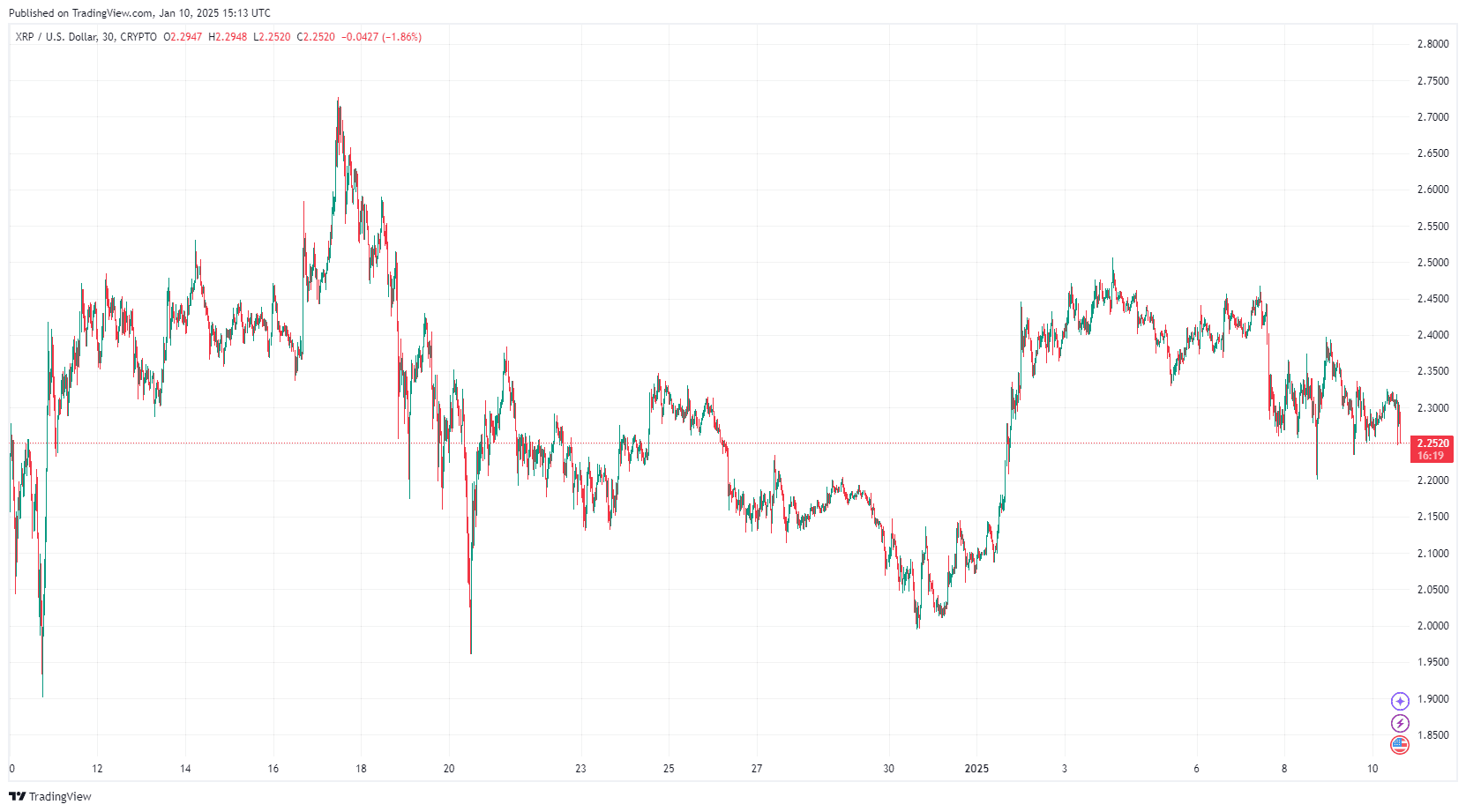

The initial breakout phase, marked by rapid price surges, transitions into a consolidation period. $XRP exemplifies this phase, maintaining stability above $2.20 despite recent market fluctuations. Pal compares this stage to the crypto market’s behavior in 2016-2017, suggesting a period of accumulation before the next big move.

Phase 2: Altcoin Season (Banana Singularity)

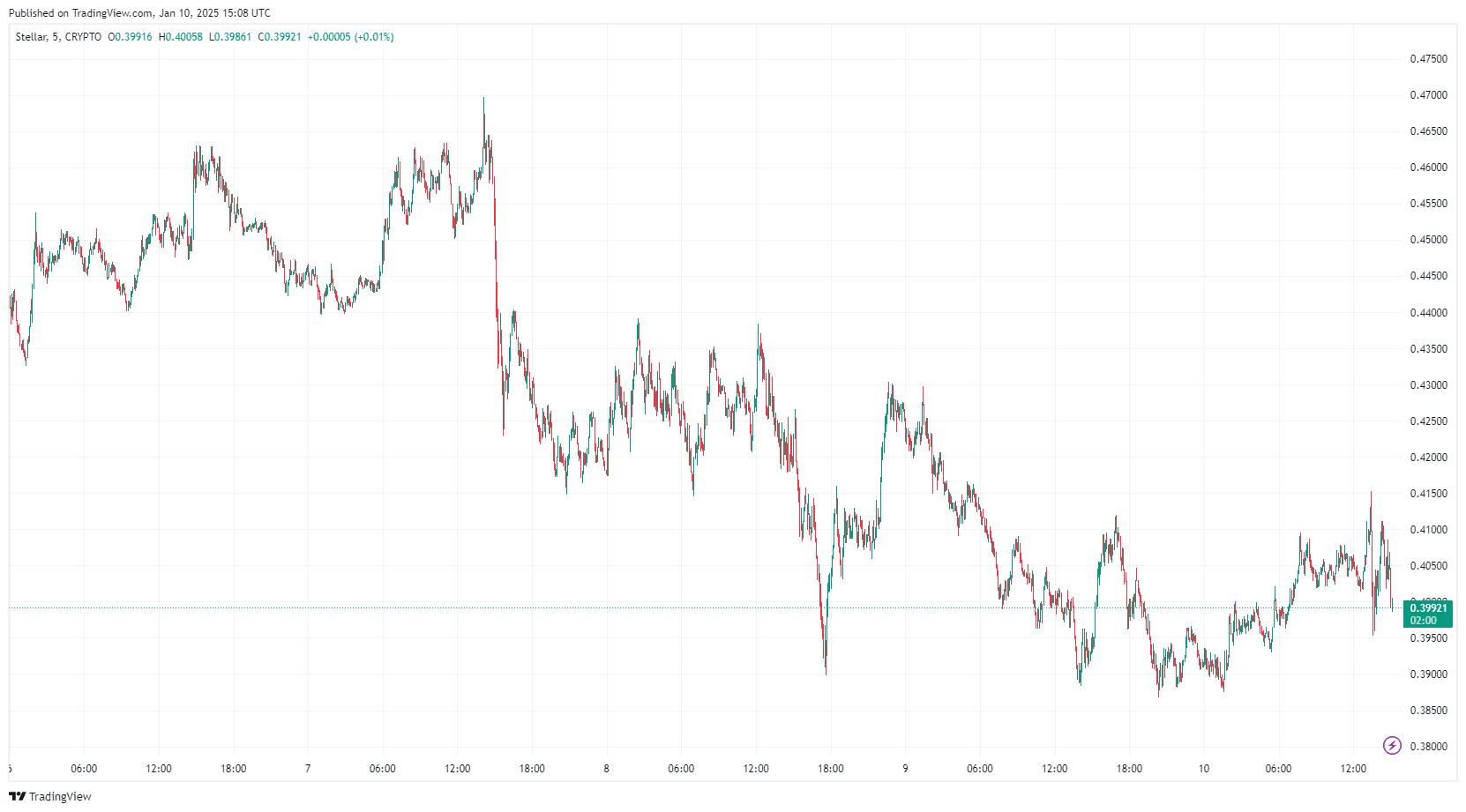

In this phase, altcoins experience widespread upward movement. $XLM’s recent 20% surge in early January highlights this dynamic. However, the subsequent correction, wiping out half of the gains, underscores the volatility characteristic of altcoin seasons.

Phase 3: Concentration Phase

This final phase sees core market winners, such as $XRP, reaching new highs. $XRP’s resilience, even amidst broader market consolidation, positions it as a leading contender at this stage.

The Banana Zone framework not only helps explain the current state of the market but also sets expectations for altcoins like $XRP and $XLM, which are navigating these cycles with distinct strategies.

2- $XRP vs. $XLM: A Rivalry in the Banana Zone

The competition between $XRP and $XLM exemplifies the dynamics of the Banana Zone, with both tokens aiming to capitalize on their unique strengths in blockchain payments:

$XRP’s Institutional Edge: Designed for large-scale financial institutions, $XRP has carved out a niche in cross-border payments. Its ability to maintain price levels and outperform $XLM highlights its strength as a market leader.

$XLM’s Individual Focus: While $XRP targets banks and corporations, $XLM focuses on providing financial solutions for individuals. This difference in strategy has fueled their rivalry, with each token striving to outperform the other.

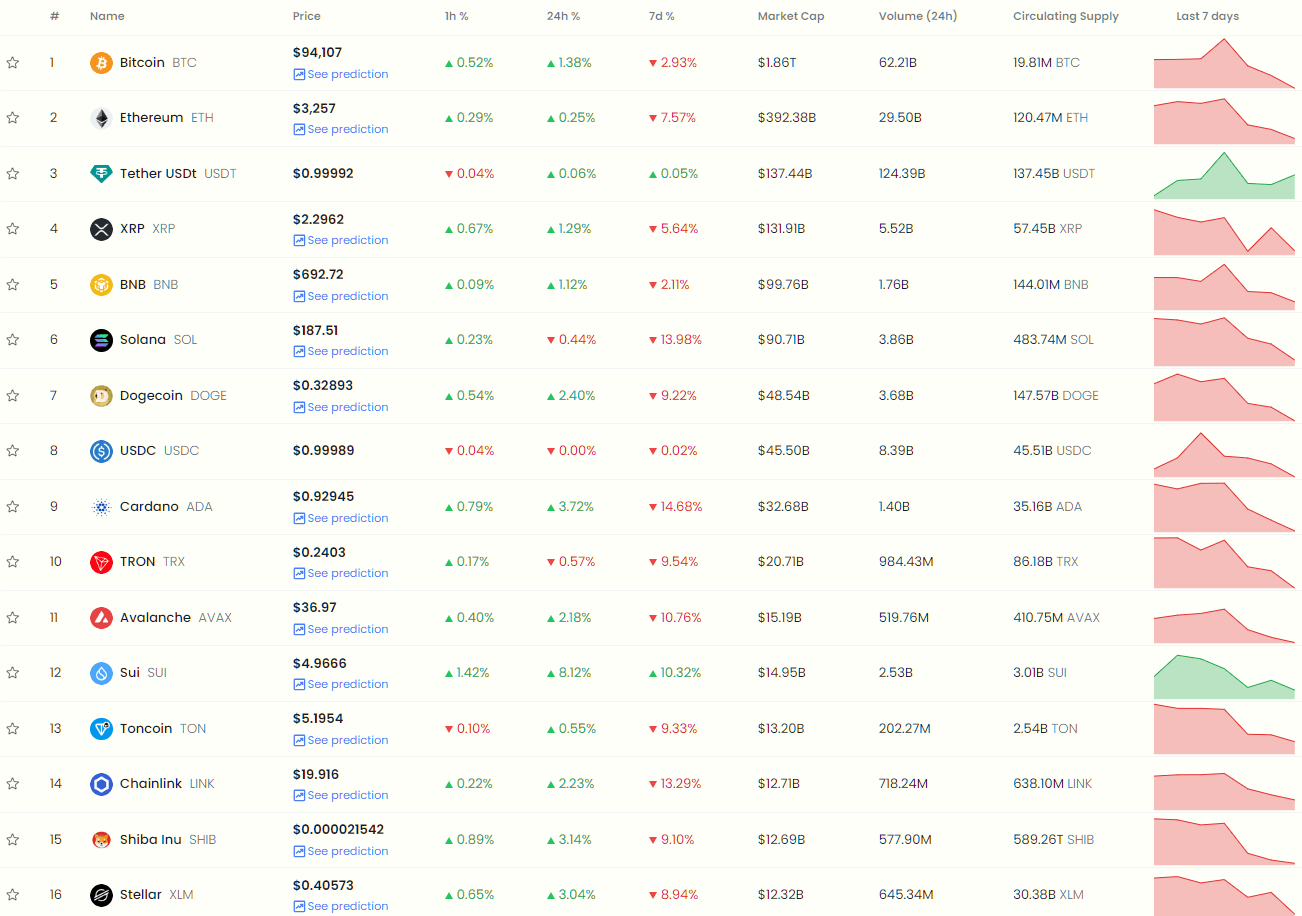

Recent performance data reflects this competition:

- $XLM surged 20% in early January, demonstrating its potential during the Banana Zone’s altcoin season. However, its failure to hold above the 200-day moving average against $XRP resulted in a 10% drop, now valuing 1 $XLM at 0.17 $XRP.

- $XRP, meanwhile, continues to consolidate and hold ground above $2.20, reflecting a strong foundation even under market pressure.

The rivalry between $XRP and $XLM showcases how altcoins can leverage the Banana Zone phases, with $XRP emerging as a frontrunner due to its institutional backing and market resilience.

3- What’s Next for $XRP?

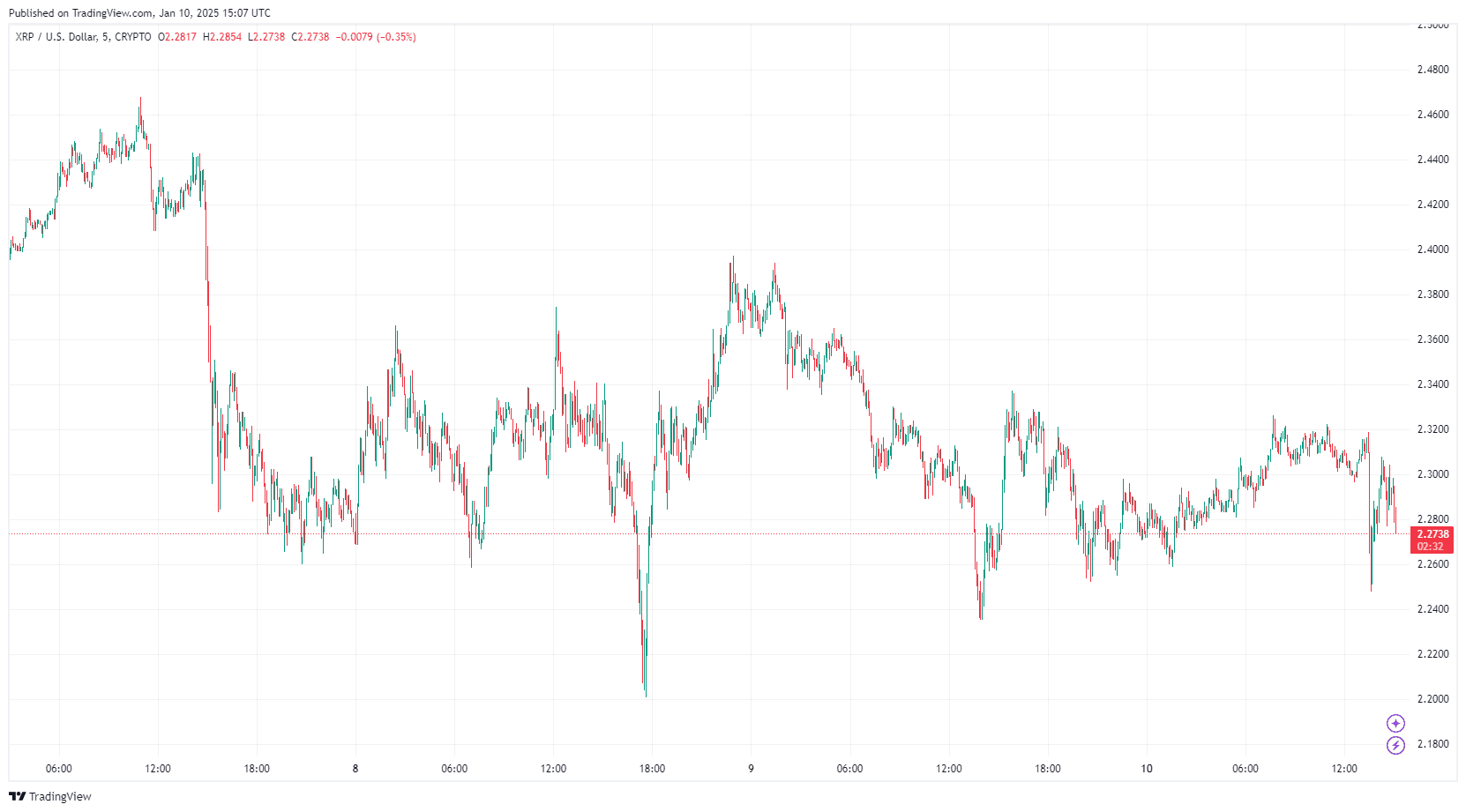

As $XRP approaches a critical SEC appeal in five days, its price dynamics are poised for potential volatility. Key technical levels to watch include:

- Resistance Levels: $2.320 and $2.350, with a breakout potentially pushing $XRP toward $2.40 and $2.50.

- Support Levels: Immediate support at $2.250 and stronger support at $2.220. A breach below these levels could lead to a deeper correction.

Indicators such as the RSI remaining above 50 and a steady MACD signal suggest a possible bullish breakout. However, the outcome of the SEC appeal will be pivotal in shaping $XRP’s trajectory.

cryptoticker.io

cryptoticker.io