The price of $SUI has been on an upward trajectory since the start of 2025, gaining significant traction on the daily charts.

This momentum has brought the altcoin close to forming a new all-time high ($ATH), fueled by traders injecting fresh capital into the asset, signaling growing confidence.

$SUI Traders Are Bullish

The Open Interest for $SUI has doubled in just nine days, surging from $679 million to $1.26 billion. This sharp rise highlights the enthusiasm among traders, many of whom are optimistic about the asset achieving a new $ATH. The increasing capital inflows into $SUI suggest unrelenting support driven by expectations of substantial returns.

This heightened interest could significantly benefit $SUI’s price in the coming days. The traders’ confidence reflects a broader belief in the asset’s potential, providing a strong foundation for continued bullish momentum as $SUI edges closer to its $ATH.

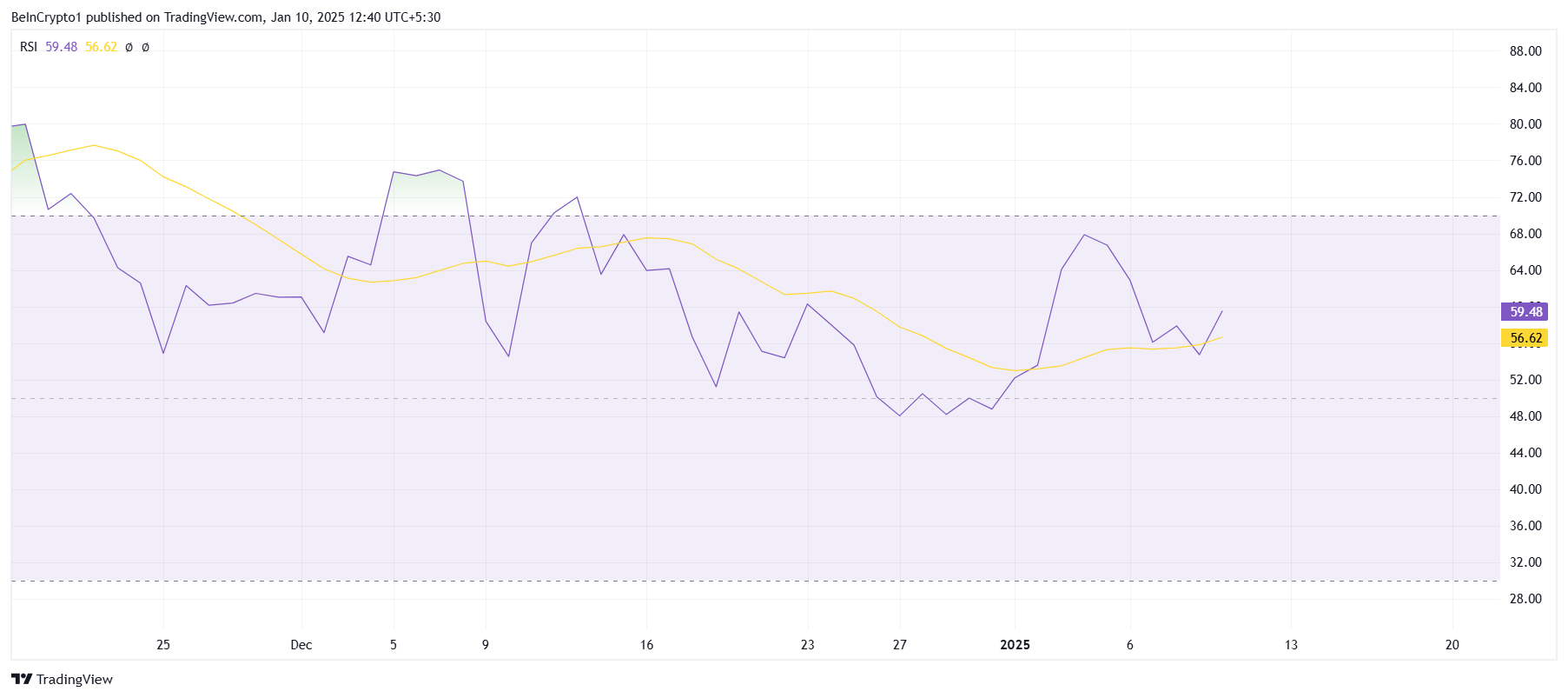

Technical indicators support the bullish sentiment for $SUI, with the Relative Strength Index (RSI) holding firm in the bullish zone. Over the past few days, the RSI has remained above the neutral line of 50.0, a signal that momentum is favoring buyers over sellers.

This sustained bullish sentiment could serve as a catalyst for further price growth. As long as the RSI stays above the neutral threshold, $SUI is well-positioned to capitalize on its rising momentum, attracting even more traders and investors to the asset.

$SUI Price Prediction: A New High Ahead

$SUI is currently less than 6% away from breaking its existing $ATH of $5.36. The altcoin has shown resilience by bouncing off the support level of $4.79, suggesting that the uptrend may persist if bullish factors continue to hold.

If current conditions remain favorable, $SUI’s price could breach its $ATH and chart new highs, rewarding its investors. However, broader market conditions will play a crucial role in determining the sustainability of this rally.

Conversely, a shift in market sentiment could lead to a bearish outcome. If $SUI loses its footing and falls through the support level at $4.79, it may decline further to $4.05, negating the bullish outlook and dampening traders’ optimism.

beincrypto.com

beincrypto.com