Main Takeaways

Thanks to Binance Research, you can take advantage of industry-grade analyses of the processes shaping Web3. By sharing these insights, we hope to empower our community with the latest knowledge from the field of crypto research.

This blog explores key Web3 developments in December 2024 to provide an overview of the ecosystem’s current state. We analyze the performance of crypto, DeFi, and NFT markets before previewing major events to look out for in January 2025.

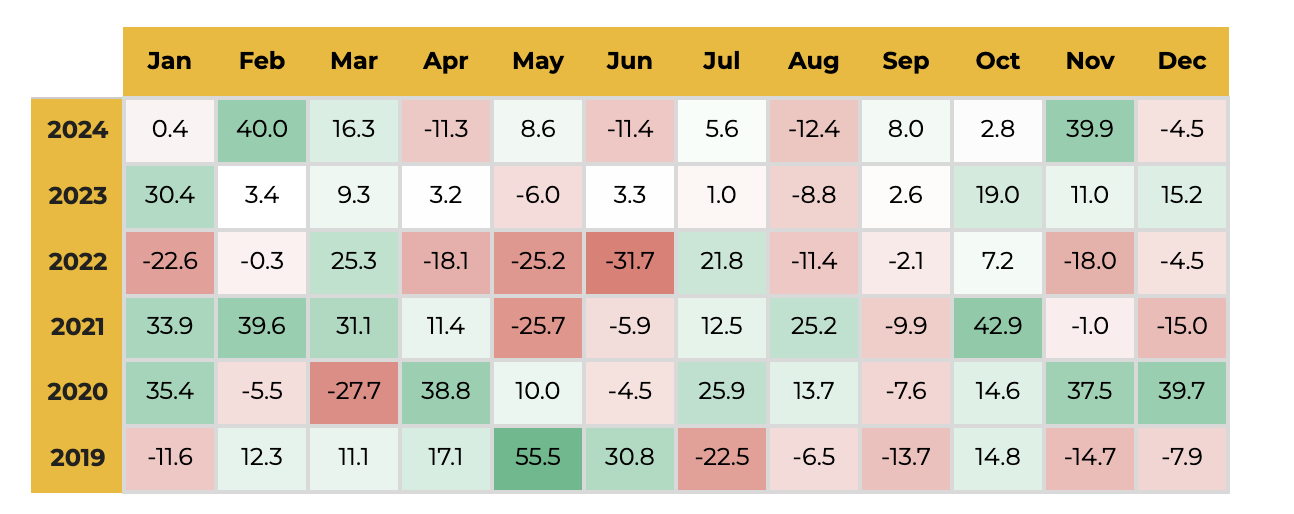

Crypto Market Performance in December 2024

In December 2024, the cryptocurrency market experienced a significant surge, reaching an all-time high capitalization of $3.91 trillion on December 17. This rally was fueled by regulatory optimism lingering from November and increasing institutional adoption. Bitcoin led the charge, hitting a record price of $108,000, driven by MicroStrategy's inclusion in the Nasdaq 100 amid its continued BTC acquisitions. Speculation about the U.S. potentially adopting bitcoin as a strategic reserve asset further bolstered BTC’s dominance, prompting a shift of capital from altcoins to BTC. However, the rally lost steam later in the month when the Federal Reserve announced a reduction in its planned 2025 rate cuts, scaling back from four to two, despite a 0.25% cut in December. The announcement triggered a sharp market correction, erasing $500 billion from the total crypto market cap.

Monthly crypto market capitalization decreased by 4.5% in December

Source: CoinGeckoAs of December 31, 2024

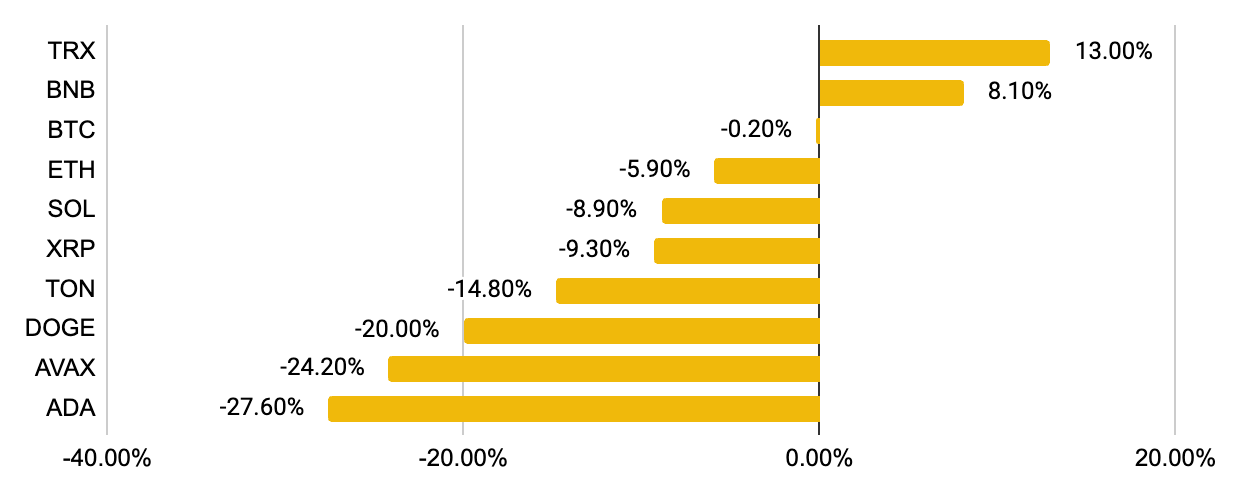

Monthly price performance of the top 10 coins by market capitalization

Source: CoinMarketCapAs of December 31, 2024

In December 2024, TRX led the market with a 13% gain, driven by record-breaking network fees of $240 million in November and increased activity. Justin Sun’s appointment as an advisor to World Liberty Financial (WLFI) and his $30 million token investment added to the momentum. BNB rose 8.1%, bolstered by PancakeSwap’s launch of SpringBoard, a no-code token platform, and the introduction of the Osprey BNB Chain Trust, the first U.S. BNB-based public fund. BNB Chain's 2024 Annual Report further highlighted its focus on multichain strategies and AI integration.

BTC and ETH saw early gains, with bitcoin surpassing $100,000 and ether benefiting from BlackRock’s $3.5 billion investment and WLFI’s ETH acquisition. Bitcoin’s rise was fueled by regulatory optimism and MicroStrategy’s Nasdaq 100 inclusion. However, both assets faced late-month corrections, with BTC down 0.2% and ether falling 5.9%, as market adjustments followed the Federal Reserve’s cautious rate outlook.

DOGE and SOL were among the biggest losers. DOGE plunged 20% after a critical vulnerability, “DogeReaper,” caused a 69% drop in active nodes, exposing network weaknesses. SOL declined 8.9%, reflecting reduced DeFi interest, a 4.5% drop in total value locked (TVL), and shrinking on-chain activity. Despite promising developments, XRP fell 9.3%, as market-wide pressures overshadowed its ecosystem growth, including a stablecoin launch and institutional adoption efforts.

Decentralized Finance (DeFi)

In December, the DeFi sector’s aggregate total value locked (TVL) declined by 1.6%, driven largely by falling crypto asset prices rather than significant capital outflows. Projects like Hyperliquid saw major impacts, including a $1 billion outflow and a 20% drop in its token value, amid concerns over North Korean hacking activity flagged by security experts. Solana faced one of the steepest declines, with its TVL dropping by $1.1 billion (12%) to $8.01 billion, alongside a 28% drop in SOL’s price and reduced network activity. Key platforms like Jito suffered significant losses, contributing to broader concerns about Solana's future.

On the other hand, certain sectors and ecosystems saw substantial growth. The real-world-asset (RWA) sector hit a record $8.2 billion in TVL, with rapid gains from platforms like Usual and Hashnote, which accounted for over 35% of the sector’s value. Sui’s DeFi ecosystem also reached new heights, with its TVL climbing to $1.8 billion, led by significant growth in lending protocols like Suilend and NAVI. This reflects a strong and growing interest in decentralized finance solutions, despite mixed performance across other DeFi protocols.

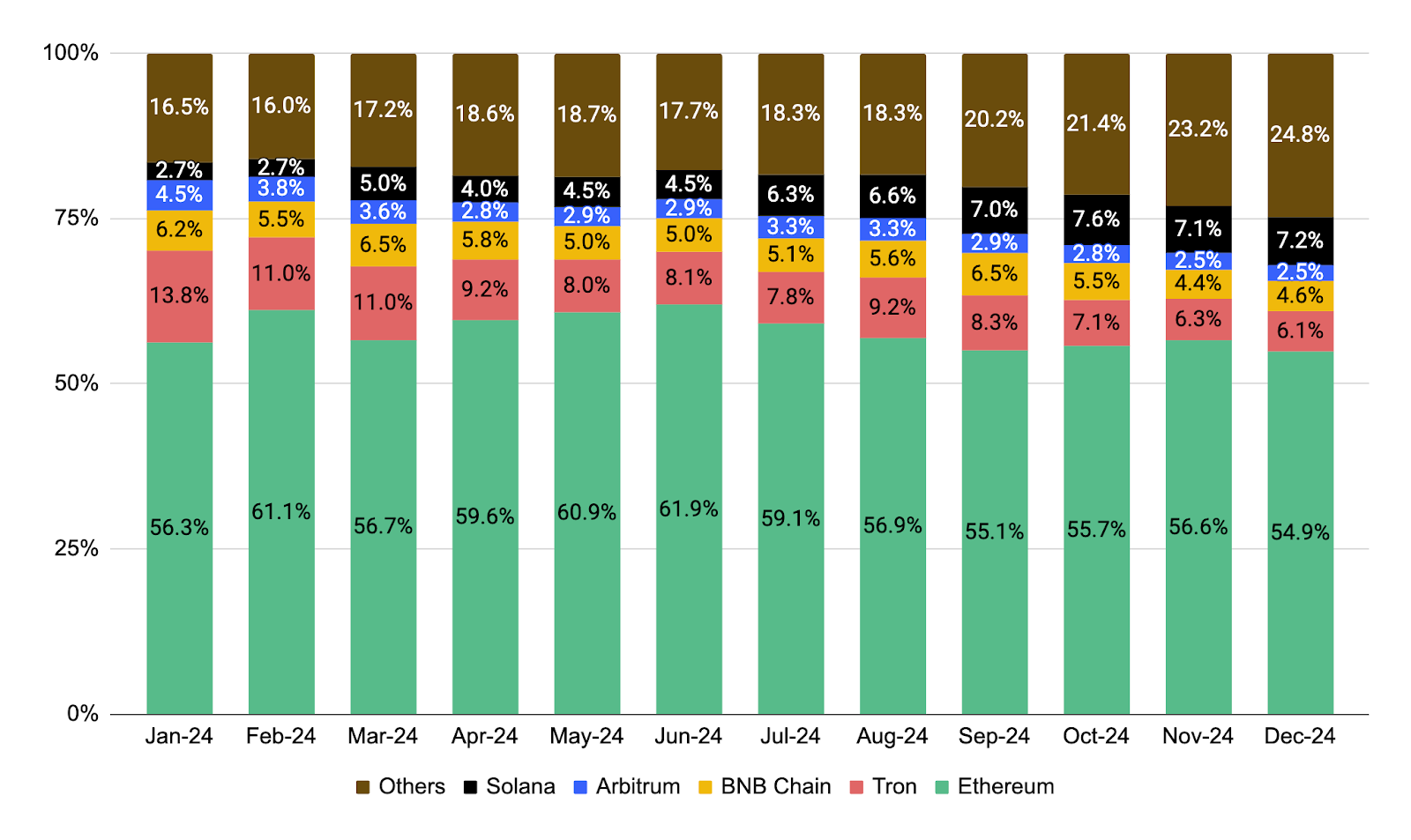

TVL share of top blockchains

Source: DeFiLlamaAs of December 31, 2024

Source: DeFiLlamaAs of December 31, 2024

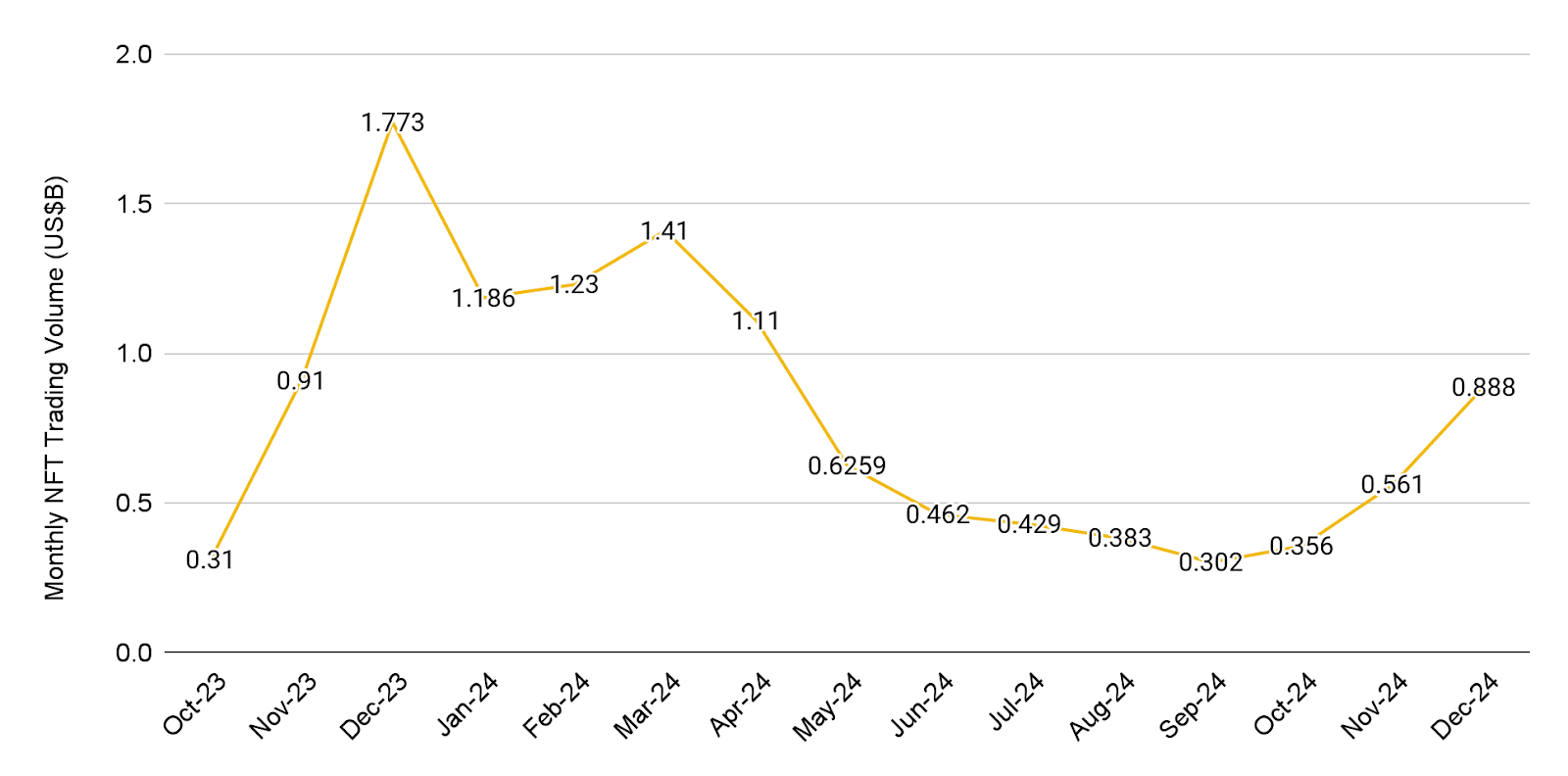

Non-Fungible Tokens (NFTs)

Monthly NFT trading volume

Source: CryptoSlam As of December 31, 2024

In December, the NFT market experienced a notable surge in total sales volume, with Ethereum-based NFTs leading the way at $888.2 million. This growth reflects a consolidation trend, as fewer participants are driving higher-value transactions, bolstered by institutional investments like Andreessen Horowitz’s partnership with OpenSea to support creators. The rise of native token drops from NFT platforms added new incentives, fueling market activity. Pudgy Penguins stood out with a 141.4% increase in volume, driven by the launch of its $PENGU token, which boosted community engagement and elevated its floor price to over $100,000, making it the second-most valuable NFT collection. However, post-airdrop adjustments saw the floor price dip from a peak of nearly 35 ETH to 17 ETH. In contrast, legacy collections like Bored Ape Yacht Club and CryptoPunks experienced significant sales declines of 45.5% and 58.8%, respectively.

Bitcoin NFTs faced a 22.0% drop in volume, despite gains in specific projects like Quantum Cats (+87.8%) and NatCats (+109.7%). Market volatility and reduced returns among the Top 10 Bitcoin NFT projects highlighted growing fluctuations. Meanwhile, other chains struggled, with Solana’s sales volume plunging 47.0%, Polygon’s slipping 4.7%, and BNB Chain suffering a sharp 73.3% decline. These trends indicate a growing divide in performance across chains, with Ethereum consolidating its dominance while other ecosystems face challenges in sustaining momentum.

Upcoming Events and Token Unlocks

To help users stay updated on the latest Web3 news, the Binance Research team has summarized notable events and token unlocks for the month to come. Keep an eye on these upcoming developments in the blockchain space.

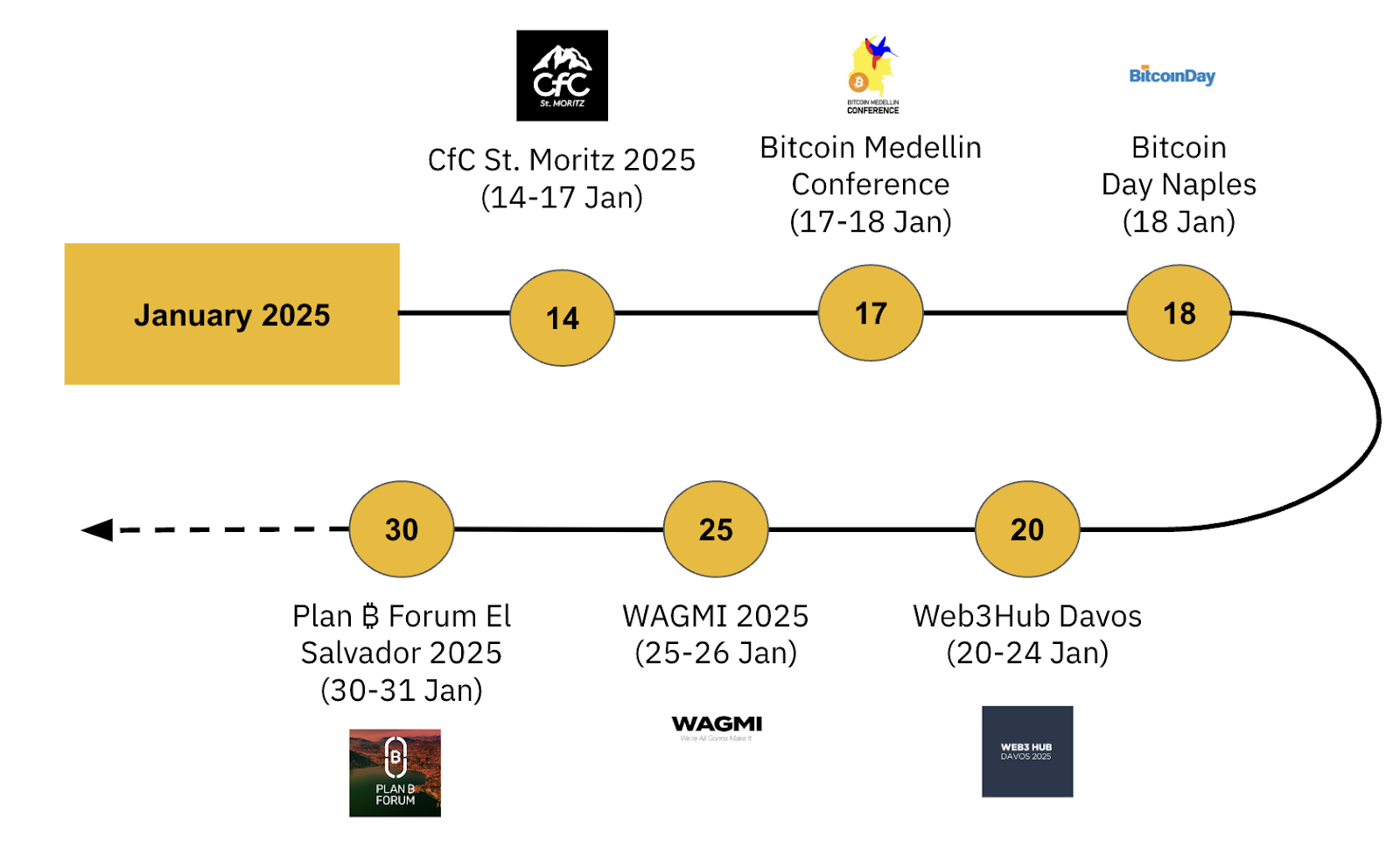

Notable Events in January 2025

Source: Itez, Binance Research

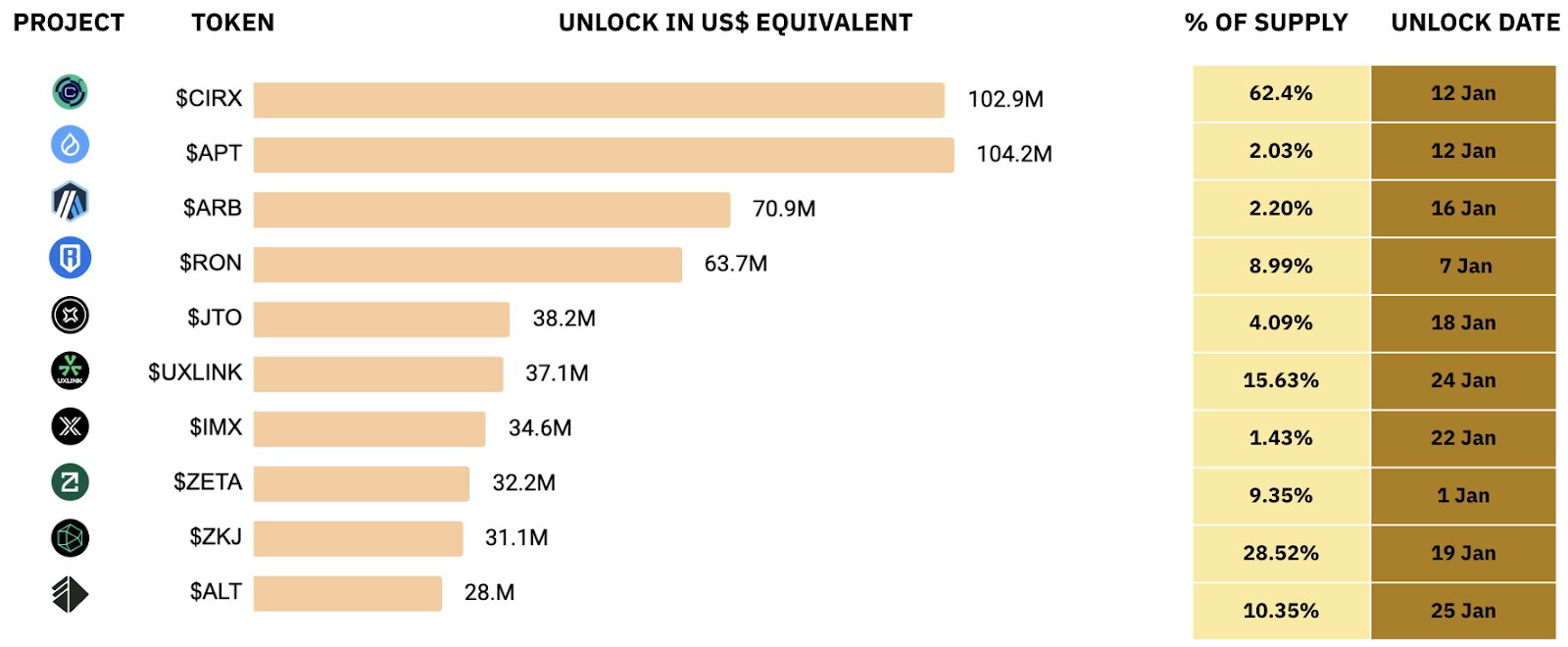

Largest token unlocks in US$ terms

Source: CryptoRank, Binance Research

Binance Research

The Binance Research team is committed to delivering objective, independent, and comprehensive analyses of the crypto space. We publish insightful takes on Web3 topics, including but not limited to the crypto ecosystem, blockchain applications, and the latest market developments.

This article is only a snapshot of the full report, which contains further analyses of the most important charts from the past month. The full report also dives into further details about BTC being the seventh largest global asset by market capitalization, Ethena’s synthetic dollar, USDe surpassing USDS to be the third-largest stablecoin, decentralized spot and perpetual volumes crossing all-time highs, and the continuing popularity of AI agents in the crypto world.

Read the full version of this Binance Research report here.

Further Reading

-

Binance Research: Key Trends in Crypto – December 2024

-

Binance Research: Key Trends in Crypto – November 2024

-

Binance Research: Exploring the Future of AI Agents in Crypto

Disclaimer: This material is prepared by Binance Research and is not intended to be relied upon as a forecast or investment advice and is not a recommendation, offer, or solicitation to buy or sell any securities or cryptocurrencies or to adopt any investment strategy. The use of terminology and the views expressed are intended to promote understanding and the responsible development of the sector and should not be interpreted as definitive legal views or those of Binance. The opinions expressed are as of the date shown above and are the opinions of the writer; they may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Binance Research to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given, and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Binance. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, cryptocurrencies, or any investment strategy, nor shall any securities or cryptocurrency be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase, or sale would be unlawful under the laws of such jurisdiction. Investment involves risks.

binance.com

binance.com