As the White House prepares for a new administration, industry experts show optimism over a friendlier approach to digital assets in the United States. They expect to see more regulatory clarity and a welcoming environment for crypto innovation.

In an interview with BeInCrypto, Aaron Basi, head of product at IoTeX, said that this new chapter in US crypto policy will be a catalyst for other nations to follow its lead and embrace the industry.

Crypto Industry Remains Eager

As Donald Trump prepares for a second term in office, the president-elect has already taken several measures to reassure the industry that he will make the US “the crypto capital of the planet,” as he said during his campaign trail.

Those measures included several key appointments. In early December, Trump named David Sacks as the White House’s “crypto czar.” A seasoned entrepreneur and investor with over two decades of experience in Silicon Valley, Sacks is expected to bring extensive experience to this role.

Trump also picked Paul Atkins, a cryptocurrency advocate, to replace Gary Gensler as Chair of the Securities and Exchange Commission (SEC). Crypto advocates celebrated the move, while the market reacted with immediate gains.

To lead the Council of Economic Advisors (CEA), Trump picked Stephen Miran, a former Treasury official during his first administration. Miran, a vocal advocate for cryptocurrency, has previously called for regulatory reforms in the United States.

“For years, the US was seen as a risky place for crypto businesses due to its patchy and often contradictory regulations. But as the regulatory environment improves, it’s going to send a clear message: the US is open for crypto innovation,” Aaron Basi told BeInCrypto.

As such, the crypto industry awaits this transition with high expectations.

What a Strategic Bitcoin Reserve Could Mean for the United States

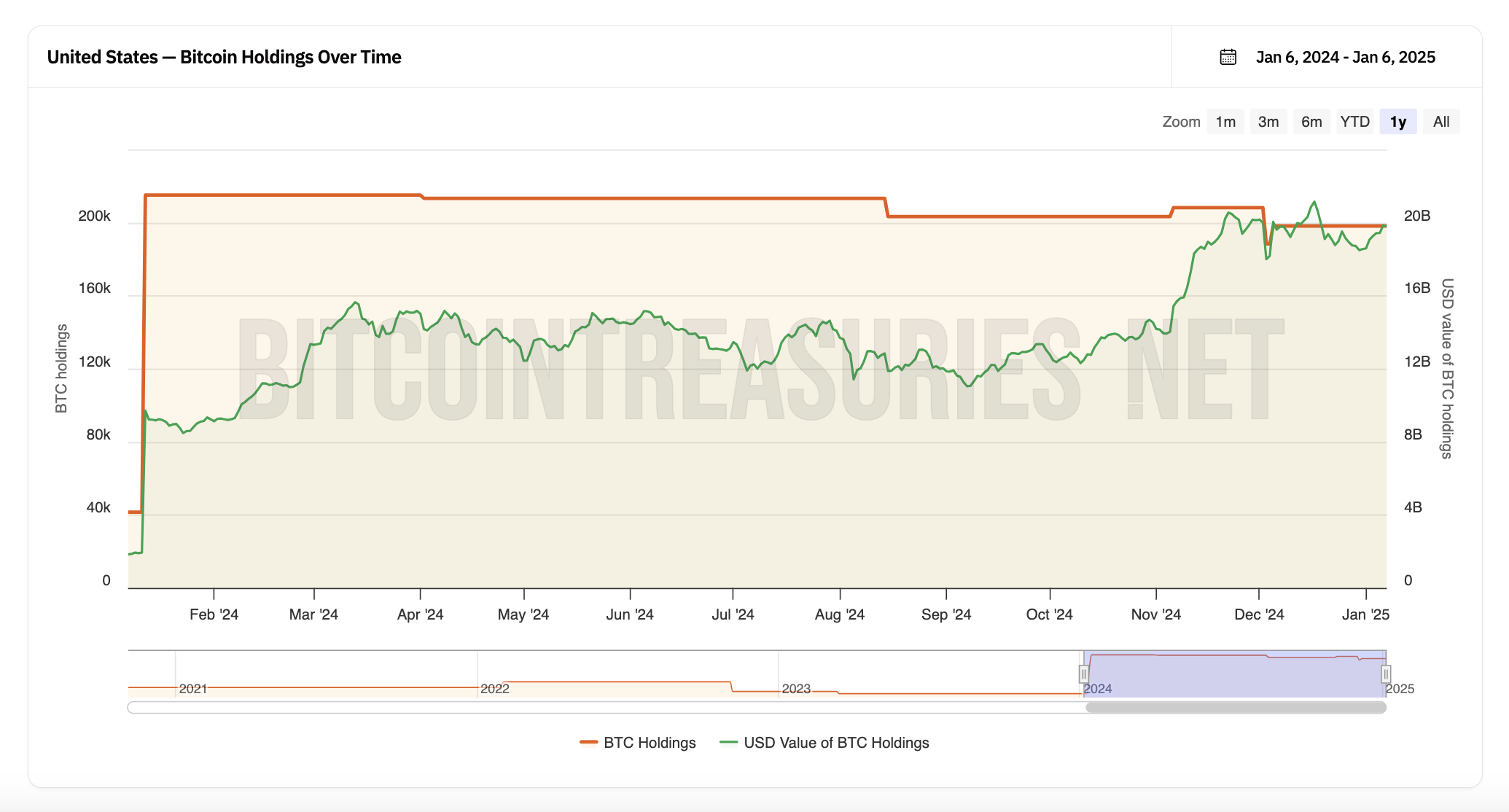

The creation of a strategic Bitcoin reserve was among Trump’s promises during the electoral process.

“It will be the policy of my administration…to keep 100% of all the Bitcoin the US government currently holds or acquires into the future. This will serve in effect as the core of the strategic national bitcoin stockpile…It’s been taken away from you,” Trump said at the Bitcoin 2024 conference in Nashville.

Reserve supporters argue that Bitcoin, dubbed as “digital gold,” can be used to assert the United States’ financial supremacy in terms of ownership over the world’s strongest digital asset.

Proponents also maintain that Bitcoin can serve as a hedge against inflation and currency devaluation. On the other hand, critics caution against the risks associated with its volatility and regulatory challenges.

Once thought unattainable under Gary Gensler, the idea of a Bitcoin reserve under a Trump presidency isn’t as far-fetched. But it also raises concerns, said Basi.

“The impact on the market would be massive. First, it would drive up institutional adoption even further as companies and countries scramble to follow the US’s lead. The move would likely reduce Bitcoin’s availability on the open market, potentially leading to price surges due to increased scarcity. On the flip side, it could introduce concerns over government control of Bitcoin and how this aligns with its decentralized ethos. People might wonder: is Bitcoin truly “of the people” if it’s sitting in government vaults?” he said.

Certain lawmakers have already introduced legislation to create state-backed Bitcoin reserves. However, how quickly Trump can enact that change at the federal level remains uncertain.

Concerns over the Centralization of Bitcoin

Talks of creating a strategic Bitcoin reserve spark debates concerning Bitcoin’s inherent decentralized nature and whether or not it will remain compatible under government adoption.

“This is a tricky one. On one hand, increased institutional adoption is a good thing—it brings more stability, liquidity, and legitimacy to the market. On the other hand, it does raise concerns about centralization. When large institutions or governments hold massive amounts of Bitcoin, they gain a lot of influence over the market, which could go against Bitcoin’s decentralized ethos,” Basi said.

If a government adopts Bitcoin as a reserve asset, a series of scenarios could play out. Bitcoin’s value could become pegged to other existing assets, such as the US dollar or gold.

This potential interdependency could limit Bitcoin’s ability to function as a truly decentralized asset. Central authorities could also manipulate Bitcoin by controlling its supply and demand to achieve specific macroeconomic objectives.

What would remain unmanipulatable, however, is Bitcoin’s network itself.

“The protocol, mining distribution, and community governance are all designed to prevent any single entity from taking control. The real risk is more about perception and access. If too much Bitcoin is locked up by institutions, it could limit opportunities for retail investors and smaller players to participate meaningfully. The challenge will be finding a balance—welcoming institutional interest while ensuring that Bitcoin remains accessible to everyone,” Basi told BeInCrypto.

While institutional adoption brings stability and legitimacy to Bitcoin, it also raises concerns about centralization. This, in turn, highlights the need for a responsible approach that preserves crypto’s inherently decentralized nature.

Increased Opportunities for Altcoins

As the crypto industry prepares for a more proactive approach to digital assets, Basi expects institutional interest to extend beyond Bitcoin and reach different altcoins.

Given that Bitcoin is the most established digital asset, traditional institutions consider it to be the safest entry point into the crypto industry. But as adoption grows, interest in other assets will too.

“Take Solana, for example. Its focus on scalability and low transaction costs has made it a favorite for decentralized finance (DeFi) projects. Then there’s XRP, which is tackling the massive cross-border payments industry,” Basi said.

Part of what makes a digital asset strong is the utility that it can provide. Many crypto projects have proven their utility by showing how they can be used in real-world use cases. Basi referred to Decentralized Physical Infrastructure Networks (DePINs) as a clear example.

DePINs leverage blockchain technology by using smart contracts to automate resource distribution and tokenization to incentivize participation. This model prioritizes decentralization by employing a distributed network where infrastructure is collectively owned and operated.

Several DePin projects exist in the United States and abroad. They address issues in different sectors, such as the telecommunications industry, water supply management, energy grids, and wireless connectivity.

“Speaking about some of these incredible use cases left a lasting impression on Capitol Hill. Many see crypto and think of the scams that have been out there but don’t even realize the real businesses being built. Businesses that genuinely make lives better, for example, reduced food prices in the case of GEODNET or better health outcomes in the case of CUDIS,” Basi told BeInCrypto.

While the perception of cryptocurrencies evolves, institutions recognize their potential beyond speculative investments. This growing recognition will likely drive increased diversification.

Crypto-Friendly Environment to Attract Foreign Interest

As the United States adopts a more proactive approach to cryptocurrency, foreign companies will seize the opportunity to enter the market.

“Foreign companies are eager to tap into the US market because it’s a goldmine of opportunities. The consumer base is huge, venture capital funding is plentiful, and the tech infrastructure is unmatched,” Basi said.

During Biden’s administration, many cryptocurrency companies explored plans to expand internationally amid the SEC’s implementation of stringent regulatory requirements.

In September 2023, San Francisco-based fintech firm Ripple announced that more than 80% of crypto hiring within the cross-border payment company would be done overseas.

Earlier that year, CoinBase CEO Brian Armstrong said the cryptocurrency exchange had secured a license to operate in Bermuda. Armstrong added that the US needs regulatory clarity to prevent firms from developing in “offshore havens.”

“A more crypto-friendly US also gives these companies access to partnerships with big brands and institutional players that are often headquartered in the States. If the rules are clear, foreign firms won’t hesitate to dive in, creating a competitive and dynamic crypto ecosystem,” Basi added.

In order for the US to cement a leading role in the crypto industry, policymakers will need to send clear messages on the topic of regulations.

The Possibility of a Global Domino Effect

According to Basi, the United States’ adoption of an inviting regulatory framework for cryptocurrency companies will create a ripple effect in other countries.

“The US is a trendsetter in global financial policy, and when it acts, other countries take notice. If the US shows that pro-crypto regulations drive economic growth, innovation, and even national security benefits, it’ll push other countries to follow suit. It’s a domino effect—once the US moves, others won’t want to be left behind, especially if it means missing out on the economic opportunities that crypto brings,” he said.

As it is, countries across the globe have already taken initiatives to make themselves attractive options for crypto companies seeking operations abroad.

“Regions like Europe are already working on their crypto regulations, and they might accelerate those efforts to stay competitive. Emerging markets, especially in Asia and Latin America, could also seize the moment to position themselves as crypto hubs by offering even friendlier regulatory environments,” Basi added.

On December 30, the European Union established the Markets in Crypto Assets (MiCA) framework. This legislation serves as a unified rulebook for crypto firms operating in the region. A Crypto Asset Service Provider (CASP) license issued by one EU member state permits companies to extend their services across the bloc.

In December, Argentine President Javier Milei outlined key policy initiatives for 2025, emphasizing free currency circulation and pro-crypto regulation. The new policies under consideration would allow Argentines to conduct transactions in any currency they prefer, including Bitcoin.

Several other countries, including the United Arab Emirates, South Korea, Brazil, and El Salvador, have already implemented similar frameworks.

The Question Surrounding China and Russia

With the United States opening its arms to asset diversification, the question arises around whether China and Russia will also follow suit.

In China, cryptocurrencies are viewed as a threat to the nation’s financial stability. The country made repeated headlines for its strict approach to regulating commercial crypto activities.

Recently, China’s foreign exchange regulator introduced new laws requiring banks to flag risky transactions, including those involving cryptocurrencies.

“With China, things are never straightforward. Their crypto ban has always been more about controlling the market than outright rejecting it. They’ve invested heavily in blockchain technology and are pioneering their digital yuan project, which shows they’re not anti-crypto—they’re anti-crypto they can’t control,” Basi told BeInCrypto.

Russia, on the other hand, seems to be warming up to crypto activities. Two weeks ago, Russian companies started using Bitcoin and other digital currencies for cross-border payments following new laws enabling such transactions.

Vladimir Putin’s government said it considered Bitcoin a valid instrument for avoiding international sanctions and engaging in real-time cross-border trading. In 2024, the country legalized cryptocurrency usage in foreign trade and introduced measures to support Bitcoin mining.

According to Basi, Russia’s approach to cryptocurrency may also influence China’s outlook.

“If countries like Russia, which historically hasn’t been too crypto-friendly, start to embrace the industry, China might feel pressured to adapt. They could loosen their ban on certain types of crypto activities, especially if they see strategic benefits like enhancing cross-border trade or reducing reliance on the US dollar. While a full reversal of the ban is unlikely, China could take steps to integrate crypto into its economy on its own terms,” he explained.

Only time will tell how the two countries will react to a more crypto-friendly adoption in the United States.

beincrypto.com

beincrypto.com