Fartcoin (FART) has emerged as one of the most talked-about assets in the cryptocurrency market, primarily due to its explosive rally and subsequent correction. Traders and investors are keen to understand how far this token can go and what factors will influence its price trajectory.

In this comprehensive analysis, we’ll dive deep into Fartcoin’s recent performance, technical indicators, and market sentiment. We’ll also outline key trading strategies to help you navigate this volatile asset.

Fartcoin Price Prediction: Setting the Stage

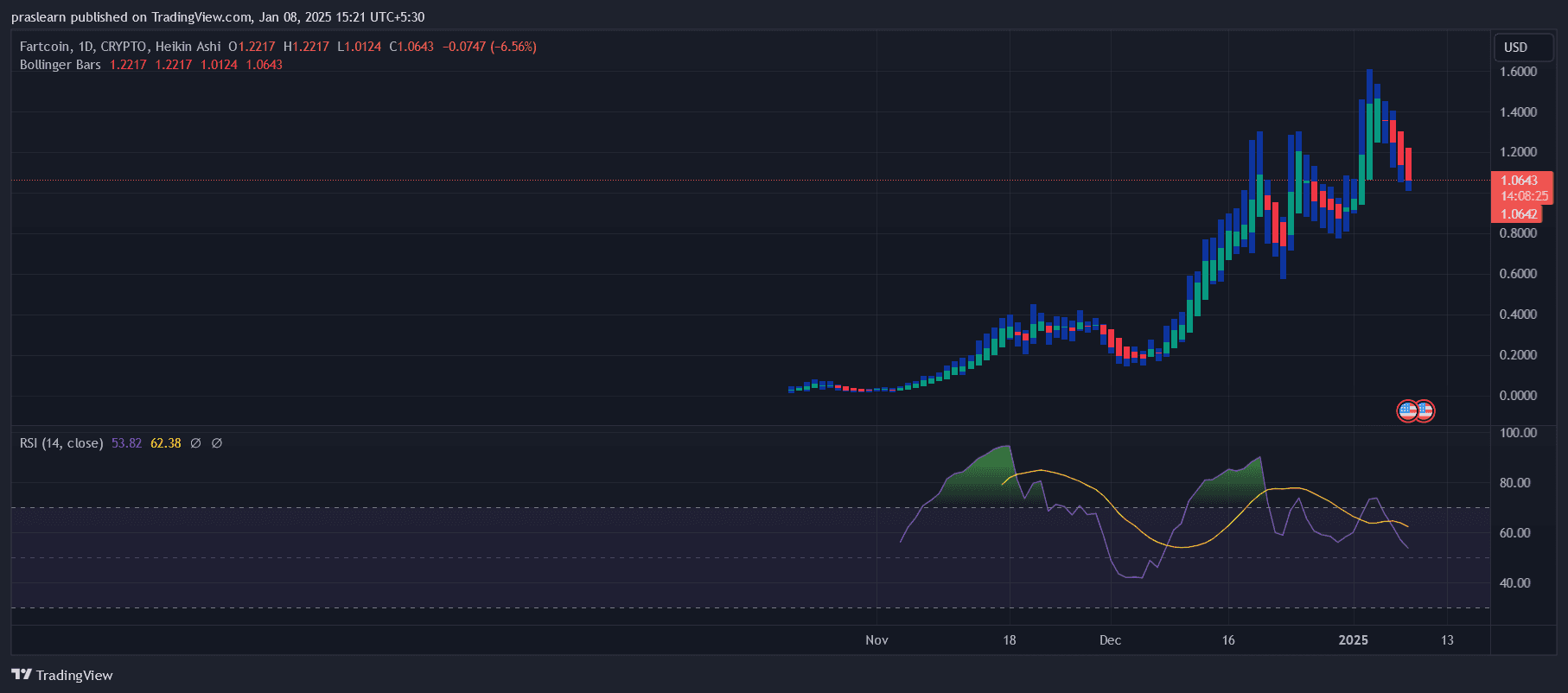

As of today, Fartcoin is trading at $1.0643, experiencing a 6.56% drop in the last 24 hours. Despite the pullback, the coin has shown remarkable growth over the past few months, rallying from under $0.20 to a high of $1.60.

This correction phase is typical after parabolic rallies as early investors take profits, creating opportunities for new entrants. Fartcoin’s technical setup now suggests that it is in a consolidation phase, potentially building momentum for its next big move.

Technical Analysis: A Closer Look at the Chart

1. Bollinger Bands: Gauging Volatility

Bollinger Bands are a widely used indicator that helps measure volatility and identify overbought or oversold conditions:

- Current Observation: Fartcoin is trading near the lower Bollinger Band, indicating it may be oversold.

- Implication: A reversal could be on the horizon if the price breaks above the middle band ($1.22). On the other hand, a break below the lower band could signal further downside.

What to Watch For:

- A close above the midline ($1.22) would confirm bullish momentum and open the door to testing the recent high of $1.60.

- A break below $1.00 would indicate increased selling pressure, possibly leading to a retest of $0.80.

2. Relative Strength Index (RSI): Momentum Analysis

The RSI is a momentum oscillator that measures the speed and magnitude of price movements:

- Current RSI: 53.82, which is in the neutral zone (neither overbought nor oversold).

- Interpretation: The RSI recently rebounded from oversold levels, suggesting a shift in momentum. However, it has not yet crossed the bullish threshold of 60, which would signal strong upward momentum.

What to Watch For:

- If RSI climbs above 60, it would indicate renewed buying interest, supporting a bullish breakout.

- A drop below 40 would confirm bearish momentum and signal further downside.

3. Key Support and Resistance Levels

Identifying key price levels helps traders plan entries and exits:

-

Support Levels:

- $1.00: A psychological level and the lower Bollinger Band boundary.

- $0.80: A strong demand zone from the November rally.

- $0.60: A major accumulation base during earlier price consolidations.

-

Resistance Levels:

- $1.22: The Bollinger Band midline and the first hurdle for a bullish breakout.

- $1.60: The recent swing high and a critical level to watch for continuation.

- $2.00: A psychological level and potential target in a strong bullish scenario.

What Lies Ahead?

Bullish Scenario: The Path to $2.00 and Beyond

In a bullish scenario, Fartcoin breaks above $1.22 with strong volume. This would trigger a rally toward the recent high of $1.60. If $1.60 is breached, the coin could enter a new phase of price discovery, with potential targets at:

- $2.00: A key psychological level.

- $2.50: A Fibonacci extension level derived from the prior rally.

Catalysts for Bullish Momentum:

- A breakout above $1.22 confirms renewed buying pressure.

- Increased trading volume supports the move, indicating strong market interest.

- Broader market sentiment, including bullish trends in Bitcoin and Ethereum, can lift altcoins like Fartcoin.

Bearish Scenario: Retesting Lower Levels

If Fartcoin fails to hold the $1.00 support, it could trigger a sell-off, driving the price down to:

- $0.80: A strong demand zone where buyers are likely to step in.

- $0.60: The accumulation base from earlier consolidations.

Risks to Watch:

- A close below $1.00 on strong selling volume would invalidate the bullish setup.

- Negative macroeconomic factors or bearish trends in the broader crypto market could amplify downside risks.

Trading Strategies: Maximize Gains, Minimize Risks

1. Breakout Strategy

This strategy involves capitalizing on upward momentum:

- Entry Point: Buy when the price breaks above $1.22 with a daily candle close and increased volume.

- Take Profit: Set targets at $1.60 and $2.00.

- Stop Loss: Place it slightly below $1.20 to limit losses if the breakout fails.

2. Range Trading

This strategy works well in periods of consolidation:

- Entry Point: Buy near $1.00 during pullbacks.

- Exit Point: Sell near $1.22 for short-term profits.

- Stop Loss: Below $0.95 to manage downside risk.

3. Dip Buying for Long-Term Investors

For long-term investors, accumulating at major support levels can yield significant returns:

- Entry Point: Accumulate at $0.80 or $0.60 if the price corrects further.

- Take Profit: Target $1.22, $1.60, and $2.00 for mid- to long-term gains.

- Stop Loss: Below $0.58 to avoid prolonged downside exposure.

4. Risk-Averse Approach

For conservative traders who prefer to wait for clear trends:

- Strategy: Wait for a confirmed breakout above $1.60 before entering the market.

- Target: $2.00 and beyond.

- Stop Loss: Set at $1.50 to protect your capital.

Fundamental Drivers to Watch

While technical analysis is essential, market fundamentals play a critical role in price movements. Keep an eye on:

- Market Sentiment: News about Fartcoin’s ecosystem or partnerships could drive speculative interest.

- Broader Crypto Trends: Bitcoin’s dominance and Ethereum’s performance often set the tone for altcoins.

- Trading Volume: Increasing buy-side volume near key levels indicates stronger price action.

How High Can Fartcoin Go?

Fartcoin’s price trajectory depends on its ability to sustain above $1.00 and break the $1.22 resistance. In a bullish scenario, the coin could retest its recent high of $1.60 and aim for $2.00 or $2.50. However, failure to hold $1.00 may result in corrections toward $0.80 or $0.60, where buyers are likely to accumulate.

Key Takeaway: Fartcoin’s high volatility makes it both a lucrative and risky investment. Traders should remain vigilant, use appropriate stop-loss levels, and monitor technical and fundamental indicators for confirmation.

cryptoticker.io

cryptoticker.io