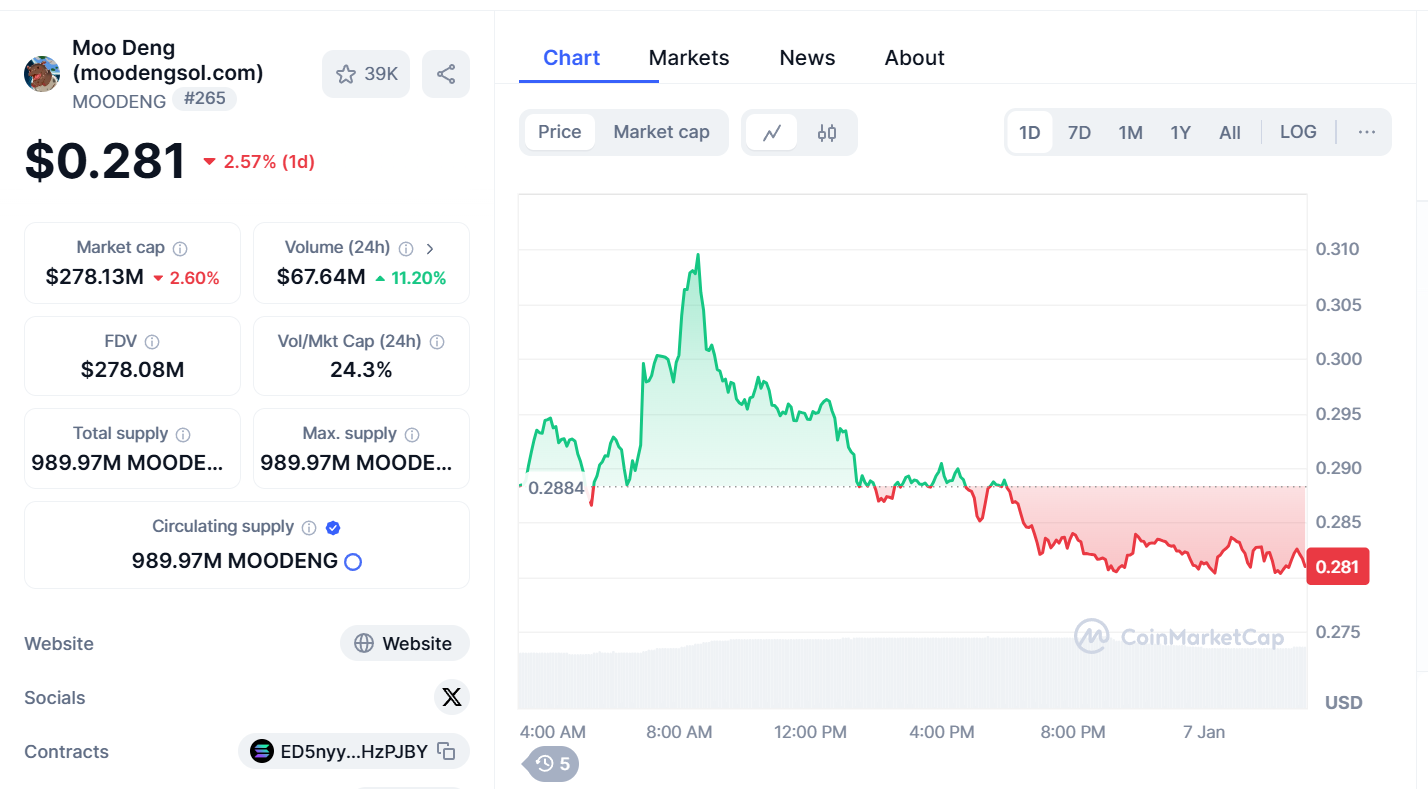

MOODENG saw its price dip by 2.57% to $0.281, reflecting a mixed day of trading activity. Despite the decline, trading volume rose by 11.20%, reaching $67.64 million, indicating strong market engagement.

The token’s current performance highlights ongoing resistance near key levels, alongside steady buyer accumulation.

Price Movement and Key Support Levels

MOODENG started the day trading at $0.2884, rose to almost $0.310 in the course of the day, before the bears took charge. It was observed that the price declined throughout the day because the $0.310 level acted as a strong resistance point.

This selling pressure is near this level shows the lack of zeal in the market to move higher without a stronger bullish force.

However, the $0.280 level has been the key support area of interest as buyers target to prevent further decline in price. This level corresponds to recent lows and is the most important indicator of short-term market sentiment. If the price moves below $0.280, the price may continue the bearish move towards the next support at $0.275.

Accumulation and Breakout Potential

As for analysts NatalDormer and VipRoseTr, the promising sign of MOODENG is that it has recently bounced back from a descending wedge pattern. This technical formation, depicted by diverging lower trends, is a common reversal pattern usually accompanied by upward moves.

The breakout is further validated by accumulation near key Fibonacci retracement levels, particularly between the 0.382 and 0.618 levels.

These are regions widely perceived to offer protection to price as it builds up the momentum to move to even more impressive heights. This is a perfect accumulation stage informing investors that the buyers are positioning themselves for the next leg up. This happens as price actively trying to break through the resistance.

Fibonacci levels and Price Targets

The Fibonacci retracement tool gives information on the possible future direction of the price of MOODENG. Specifically, the price has rebounded from the 0.382 level. It is considered as the key area that can serve as a trigger for the further growth. This bounce could signal more upside for the asset in the short term.

#MOODENG 💰 #MOODENG

— Natalie Dormer (@NatalDormer) January 6, 2025

The perfect bullish setup in the market right now 🐃

Breakout of a descending wedge and accumulation at the Fibonacci levels – the next move is up!

Send it 📈

🎯1 Target: $0.49175

🎯2 Target: $0.64771

🎯3 Target: $0.80234#MOODENGUSDT

Visit… pic.twitter.com/lidJznAbpu

Three crucial targets have been identified by the analysts for MOODENG, all of which correspond to the Fibonacci extension levels. The first target set at $0.49175 finds support from the 0.236 Fibonacci extension. This level is the next significant barrier to the upside and marks a significant achievement in the asset’s rebound.

The second target at $0.64771 indicates the further rise of the bulls. Such a level would suggest an improvement trend and the confidence of the buyer, reaching this level. It also defines a higher resistance level that can be used for the further price consolidation tests.

The final target is set at $0.80234. This level indicates a full rebound in the business and if reached, signifies that buyers are very much in the driving seat. It marks the end of the rally and indicates that once MOODENG is out of the consolidation mode, there could be a substantial upside.

Analysts’ Perspective on MOODENG

NatalDormer and VipRoseTr think that MOODENG has a very bullish technical development. The breakout from descending wedge paired with the accumulation zone near fib levels shows that the token is prepared for the next move up.

However, given strong volume and accumulation, MOODENG is ready for its next leg of up move and could very well reach the analysts set targets.

thecoinrepublic.com

thecoinrepublic.com