The total cryptocurrency market cap (TOTAL) and Bitcoin (BTC) experienced a sharp decline over the last 24 hours as the crypto market responded to shifts in macroeconomic conditions. A sudden rise in the 10-year US Treasury yield, coupled with anticipation surrounding the upcoming Nonfarm Payroll (NFP) report, significantly impacted market sentiment. Among altcoins, Celestia (TIA) emerged as the day’s worst performer, leading the downward trend.

In the news today:

- A US judge has paused the Coinbase vs. SEC case, granting the exchange permission to appeal on whether its digital assets qualify as securities. The appeal seeks clarity on applying the Howey test to Coinbase’s asset transactions.

- Czech National Bank Governor Aleš Michl suggested Bitcoin could diversify the country’s foreign exchange reserves, though not as a major investment. Any decision would require board approval, with future exploration of cryptocurrency diversification possible.

The Crypto Market Fell Sharply

The total crypto market cap dropped by $227 billion in the last 24 hours, settling at $3.28 trillion. This level is a critical support floor, and holding above it is essential to prevent further losses in the cryptocurrency market.

If the $3.28 trillion support fails to hold, TOTAL risks a deeper decline, potentially reaching $3.16 trillion. This would further erode investor confidence, emphasizing the importance of maintaining current levels to stabilize market sentiment.

However, a successful bounce from $3.28 trillion could pave the way for TOTAL to reclaim $3.49 trillion as a support level. This recovery would restore optimism in the market, reversing today’s losses and reinforcing bullish momentum.

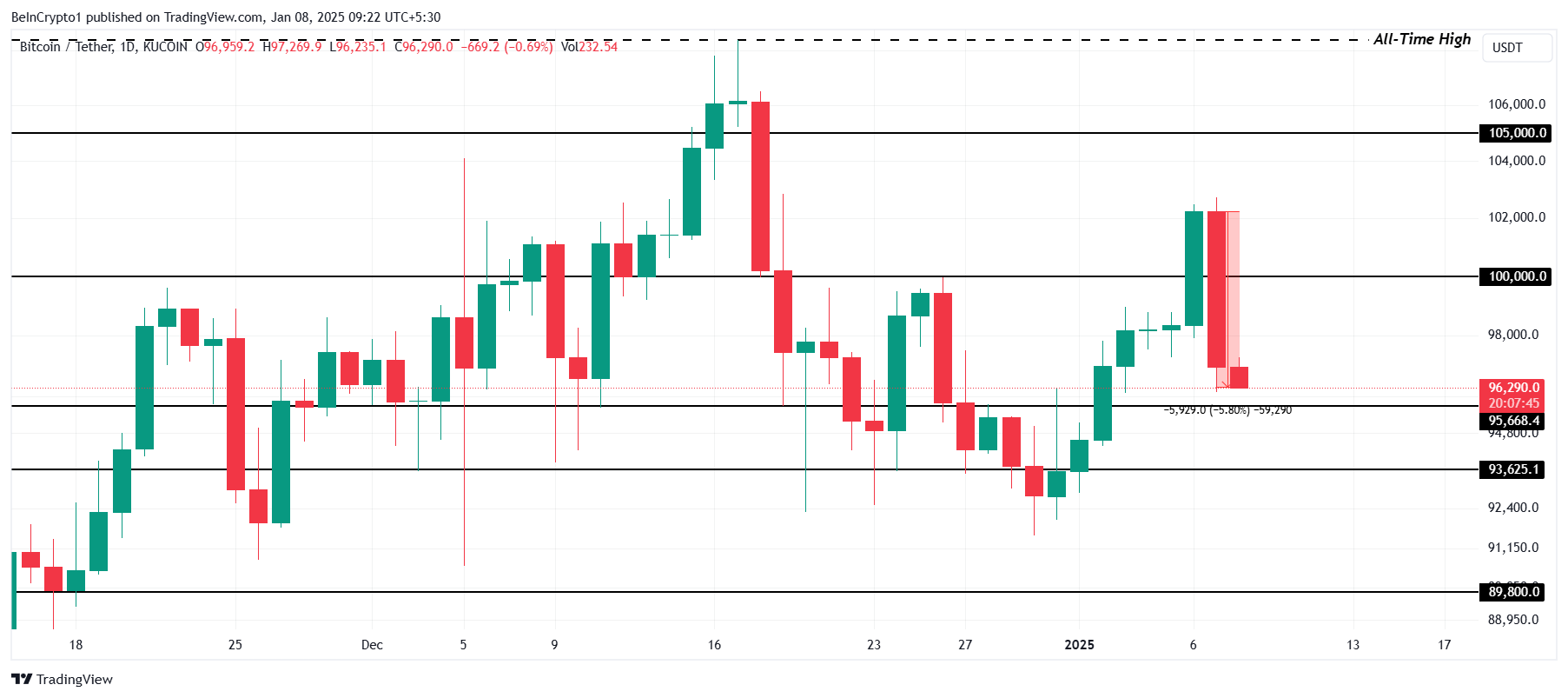

Bitcoin Falls Below $100,000

Bitcoin’s price declined by 5.8% over the last 24 hours, falling from $102,000 to $96,290. This drawdown highlights the ongoing volatility in the market, causing concern among investors while maintaining Bitcoin’s resilience above critical levels.

Currently, BTC is holding above the $95,668 support level, a pivotal threshold for avoiding further losses. If this support is breached, Bitcoin could experience a deeper correction, potentially falling to $93,625.

Conversely, a recovery to $100,000 remains the primary target for bullish investors. Achieving this would require sustained momentum, signaling renewed confidence in Bitcoin’s ability to maintain its uptrend.

Celestia Loses Recent Gains

TIA recorded a steep 14% decline, becoming the worst-performing cryptocurrency of the day. This sharp drop caused the altcoin to lose its critical support level at $5.0. Trading at $4.7, TIA reflects the broader crypto market’s bearish trend, raising concerns about further price erosion.

If TIA maintains its position above $4.5, it could stage a recovery towards $5.0, potentially reclaiming lost ground. However, a failure to hold this support could lead to a deeper correction, driving TIA’s price down to $3.8. Such a scenario would amplify the bearish sentiment among investors.

Conversely, reclaiming the $5.0 support would invalidate the negative trend, enabling TIA to chart a recovery towards $6.0. Achieving this milestone would signal renewed bullish momentum and restore investor confidence, positioning the altcoin for further growth.

beincrypto.com

beincrypto.com