XRP has been consolidating for over a month following a significant rally, with technical analysis suggesting that the cryptocurrency may soon test key resistance levels, paving the way for a potential breakout.

Notably, an analysis by RLinda highlights that XRP is forming a symmetrical triangle pattern, a technical setup often indicating a continuation of the prevailing trend.

Technical analysis — A bullish breakout in the making

RLinda’s analysis highlights that XRP’s symmetrical triangle pattern indicates a consolidation phase where the market is building momentum.

Buyers have been aggressively defending support zones, particularly in the $2.337 to $2.50 range. This zone, situated near the triangle’s resistance, indicates that the market is gaining strength to challenge and potentially break through the $2.50 resistance level.

A successful breakout above $2.50 could confirm the start of the realization phase, setting XRP on a trajectory toward higher price targets

XRP key levels to watch

RLinda’s analysis points to XRP’s key levels, which will play a significant role in shaping its next major move. The $2.50 resistance is particularly significant, as a breakout above this level could accelerate upward momentum.

If breached, XRP may climb toward the next targets of $2.73 and $3.05. On the downside, support levels at $2.337, $2.20, and $2 provide a strong base, with $2.337 acting as a key defense zone.

However, failure to hold this support could result in extended consolidation, delaying any upward momentum and keeping XRP within its current range.

Market fundamentals boost optimism

Ripple’s prospects are gaining traction as the anticipated departure of SEC Chair Gary Gensler under the incoming Trump administration sparks optimism for a more crypto-friendly regulatory environment.

Ripple CEO Brad Garlinghouse has dubbed 2025 the start of a “Trump bull market,” attributing the administration’s pro-crypto stance to renewed market optimism.

This “Trump effect” is already energizing the broader cryptocurrency market, with XRP emerging as a standout performer.

According to data from CoinShares, XRP recorded $5.7 million in inflows last week, outpacing Bitcoin (BTC) which showed a $25 million outflow, and Ethereum’s (ETH) modest $2 million inflow.

Additionally, broader market dynamics, including Bitcoin’s ongoing rally, are creating a favorable environment for XRP. These factors and the technical setup point to a strong potential for an upward breakout.

XRP price analysis

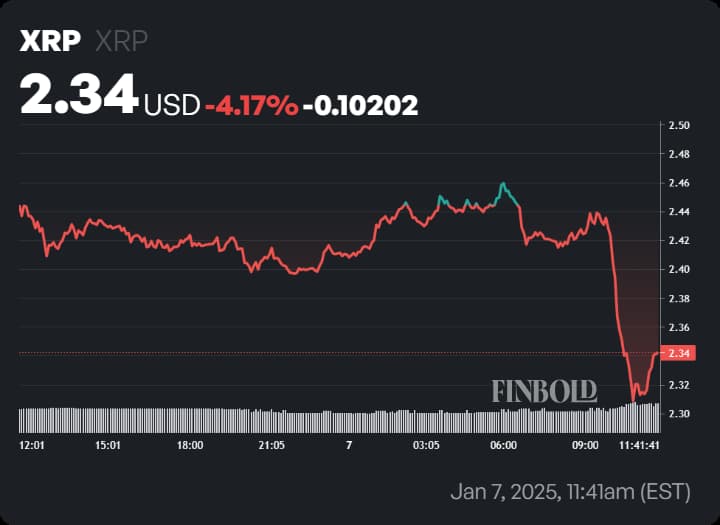

At press time, XRP was trading at $2.34, reflecting a one-day drop of over 4%. However, on the weekly chart, the token has gained 9% as it continues to navigate market volatility.

While regulatory developments bring optimism for the long-term outlook, the token’s near-term trajectory appears cautiously bullish.

Key market dynamics and supply-side factors continue to add layers of complexity to XRP’s performance, making its next moves critical for traders and investors alike.

Featured image via Shutterstock

finbold.com

finbold.com