Amid the ongoing market recovery, Shiba Inu (SHIB), the world’s largest crypto meme coin, is poised for massive upside momentum. The potential reasons for this bullish speculation include recent SHIB transactions from exchanges to wallets, ongoing consolidation following a breakout, and the presidential inauguration.

Crypto Whale Moves 8.18 Trillion SHIB Meme Coin

Today, January 7, 2024, blockchain transaction tracker Whale Alert posted on X (formerly Twitter) that a crypto whale transferred a significant 8.18 trillion SHIB meme coins, worth $195.1 million, from Crypto.com to an unknown wallet. The substantial amount of meme coins was transferred in five separate transactions of equal value.

Industry experts speculate that this transaction may be a potential accumulation, which could create significant buying pressure on SHIB and lead to a notable rally in the meme coin.

Shiba Inu (SHIB) Technical Analysis and Upcoming Level

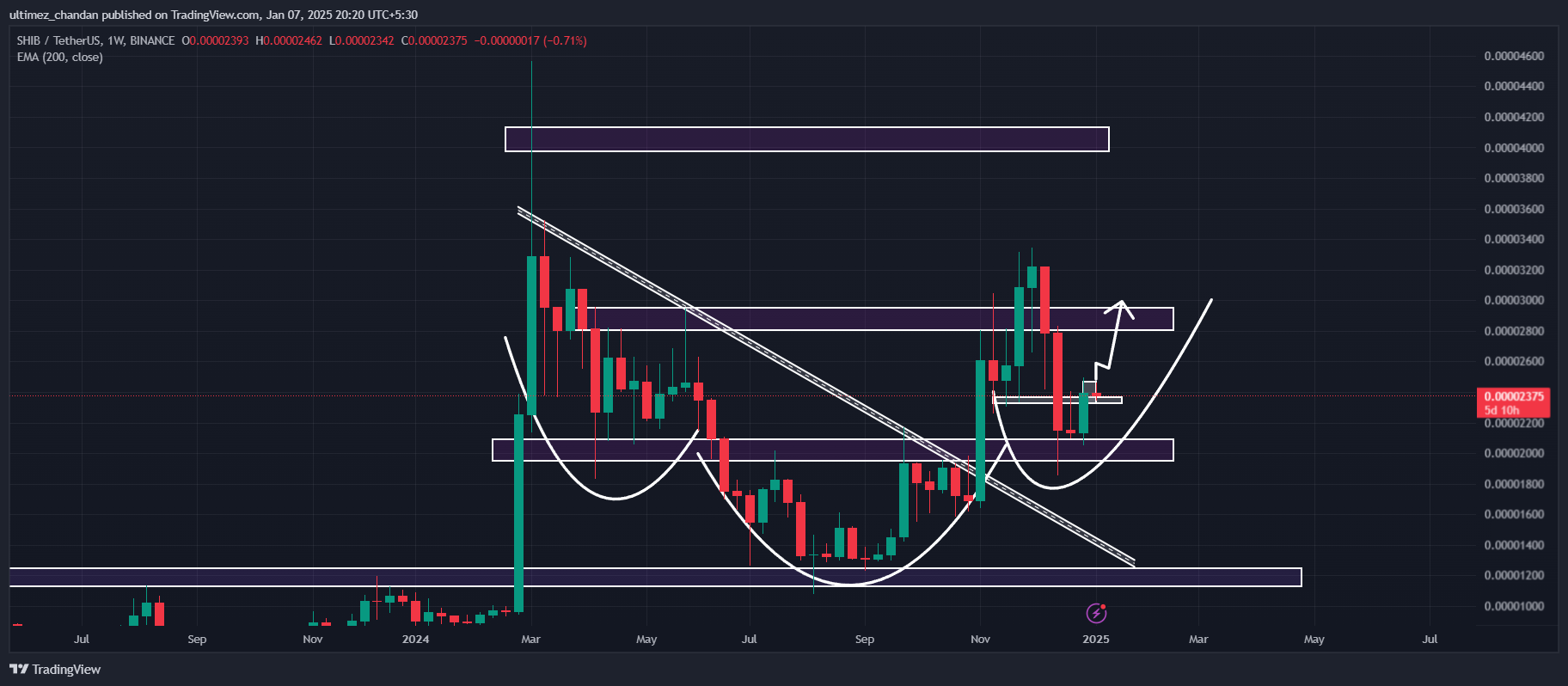

According to expert technical analysis, SHIB has been consolidating in a tight range between $0.00002327 and $0.00002465 for the last four trading days. However, this consolidation on SHIB’s daily chart follows the breakout of a bullish double-bottom price action pattern.

Additionally, on the weekly time frame, SHIB appears to be forming a bullish inverted head and shoulders price action pattern, having already formed a head and one shoulder and is now in the process of forming the second shoulder.

SHIB Price Prediction

If this happens, we may witness significant upside momentum. Based on the recent price action and historical trends, if SHIB breaks the ongoing consolidation and closes a daily candle above the $0.000025 mark, there is a strong possibility it could soar by 60% to reach the $0.000039 level.

On the positive side, SHIB’s Relative Strength Index (RSI) currently stands well below the overbought zone, indicating that the meme coin has the potential for a significant rally in the coming days.

Current Price Momentum

At press time, SHIB is trading near $0.0000238 and hasn’t witnessed any major price changes. However, during the same period, its trading volume increased by 21%, indicating heightened participation from traders and investors compared to the previous day.

coinpedia.org

coinpedia.org