XRP and Dogecoin futures funding rates indicate that the altcoins might sustain the ongoing recovery push.

The crypto market appears to have regained its momentum with the turn of the new year. Among the top gainers have been XRP and Dogecoin (DOGE), with nearly 20% and 26% gains, respectively, over the past seven days alone.

Despite this strong momentum, futures market data suggests things could just be warming up.

Funding Rates Lagging Behind

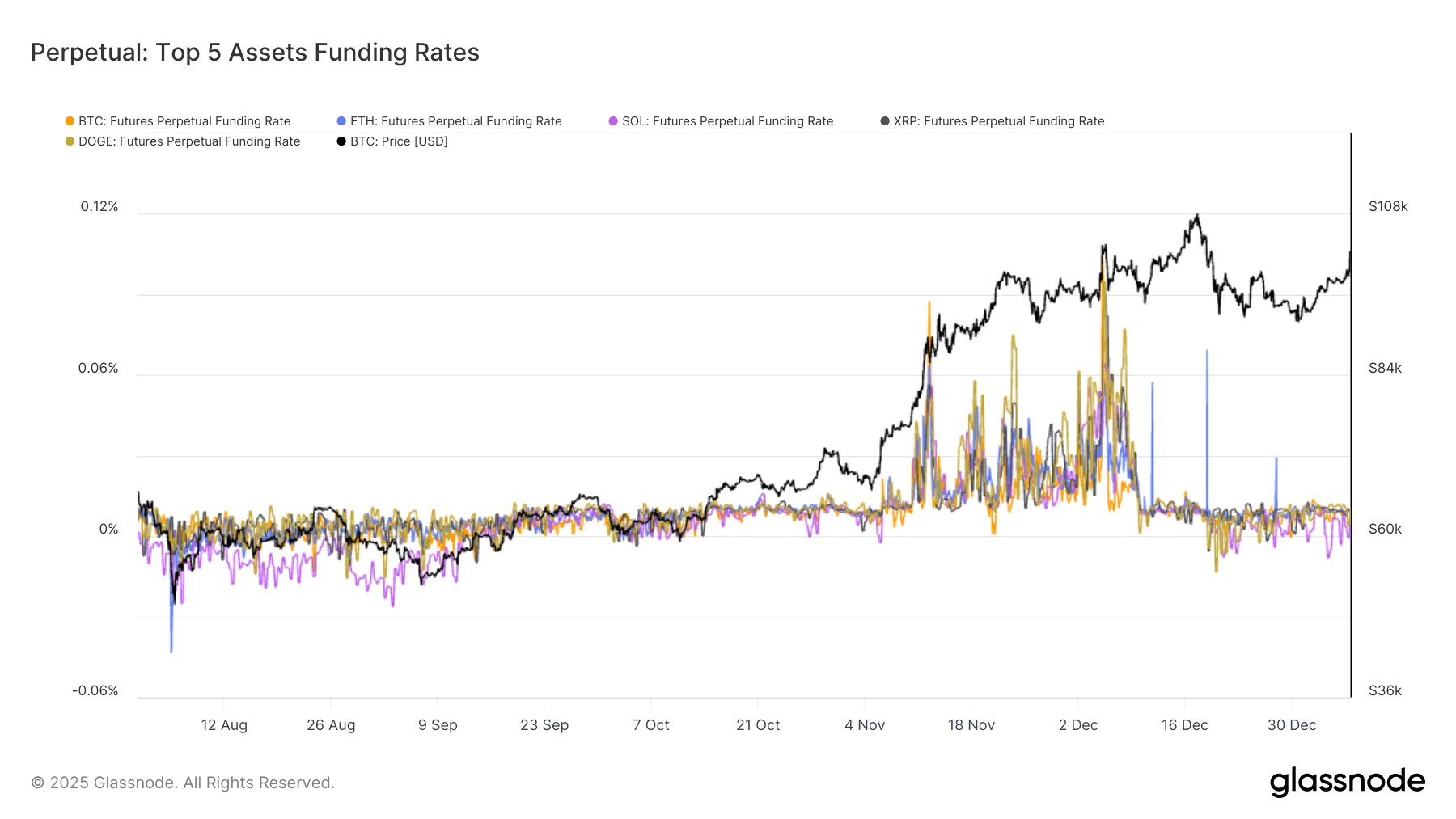

XRP and Dogecoin perpetual market funding rates are lagging behind their recent price momentum. This is according to data from Glassnode shared on Monday, January 6.

Glassnode highlighted that despite the recent price momentum, funding rates for market leaders like XRP and DOGE have failed to turn significantly positive and instead remain neutral.

Funding rates refer to the periodic payment made between traders to keep the price of a perpetual contract close to the spot market price. This periodic payment can often be used to gauge sentiment and leverage in the markets.

Positive funding rates signal significantly bullish market sentiment as it means the perpetual contract price is higher than the spot market price, and long traders are willing to pay short traders to hold their position. The same applies in the reverse.

Neutral funding rates, however, suggest that this fee exchanged between traders is close to zero, reflecting a balanced or cautious market environment. For XRP and DOGE, Glassnode data reveals that funding rates remain at 0.01% and 0.011%, respectively, despite their recent price rallies.

The neutral funding rates suggest that the recent rally is not driven by excessive leverage which could make it more sustainable.

At the same time, it could also mean that traders are buying shorts to bet against the rally, which could lead to a short squeeze under extreme conditions, all of which Glassnode considers bullish for XRP and DOGE.

Meanwhile, XRP and DOGE are not the only assets currently experiencing this phenomenon. Glassnode data shows funding rates for Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) are also neutral at 0.009%, 0.01%, and 0.006%, respectively, despite price gains in the past week.

How High Can XRP and Dogecoin (DOGE) Go?

Several analysts have offered their views on the immediate targets for XRP and DOGE amid the recent rally.

XRP

Amid XRP’s recent rally, prominent crypto analyst Ali Martinez has disclosed that the asset’s supertrend indicator has presented a buy signal on the 12-hour candle chart. The supertrend indicator is used to identify market trends and potential entry and exit points. It works by factoring the asset’s volatility and closing price within a particular period.

As highlighted by Martinez, the last time this indicator offered a buy signal was in November 2024, heralding a 470% surge in XRP’s price from $0.5 to $2.9. Replicating this price movement could set a $13.85 price target for the asset from its current price of about $2.43.

Meanwhile, veteran commodities trader Peter Brandt has tipped XRP’s market cap to hit $500 billion in the next few weeks. This could equate to a $8.7 XRP price with the current circulating supply of about 57.4 billion coins.

Dogecoin (DOGE)

Amid the current DOGE rally, prominent crypto analyst “Hov” has asserted that the meme coin could be headed towards $0.42 and eventually $0.64, citing an Elliot Wave analysis. At the time of writing, DOGE is exchanging hands for about $0.39.

Still, Ali Martinez has warned of a potential price correction, citing a TD Sequential sell signal on DOGE’s daily candle chart.

thecryptobasic.com

thecryptobasic.com