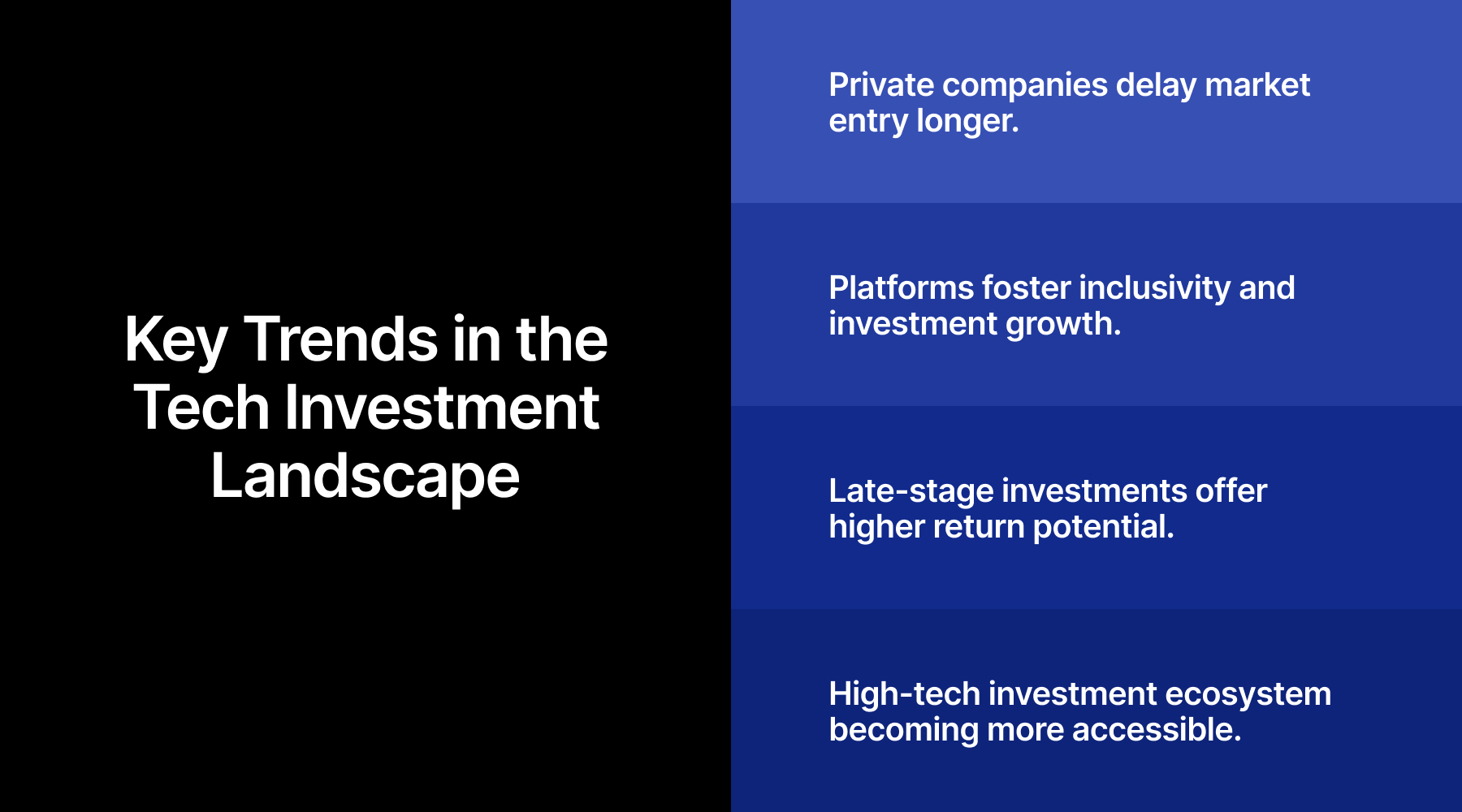

The high-tech investment ecosystem is undergoing a significant shift. What was once the exclusive domain of institutional investors and venture capitalists is now becoming increasingly accessible. Two major forces are driving this transformation: the emergence of digital platforms and the generational shift among investors.

Recent research conducted by Catalyst Investors’ Club found that over 70% of European accredited tech investors now belong to Generation X and Millennials (Gen X/Y). Half of these investors have already explored online co-investment platforms, signalling a clear appetite for innovative, streamlined ways to engage in high-potential opportunities. This marks a pivotal moment for the democratisation of late-stage private investments.

Traditionally, accessing late-stage rounds in high-growth companies required deep networks and significant capital—reality that excluded many accredited investors. Today, digital platforms are bridging this gap, offering a gateway to opportunities that were once the domain of large funds.

Understanding the New Frontier

This shift is not without its challenges. While digital platforms promise broader access, they also necessitate enhanced diligence and transparency to ensure investor confidence. For investors, understanding how to evaluate opportunities in this developing landscape is critical. High-tech investments, particularly in sectors like AI, health tech, and climate tech, are characterised by rapid innovation cycles and complex risk profiles.

Platforms addressing these needs are increasingly employing sophisticated vetting processes and leveraging AI-driven tools to assist investors in making>

𝐀𝐫𝐭𝐢𝐟𝐢𝐜𝐢𝐚𝐥 𝐒𝐮𝐩𝐞𝐫𝐢𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 (𝐀𝐒𝐈) 𝐬𝐭𝐚𝐧𝐝𝐬 𝐚𝐬 𝐨𝐧𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐦𝐨𝐬𝐭 𝐚𝐦𝐛𝐢𝐭𝐢𝐨𝐮𝐬 𝐟𝐫𝐨𝐧𝐭𝐢𝐞𝐫𝐬 𝐢𝐧 𝐡𝐮𝐦𝐚𝐧 𝐢𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧. During the 8th Future Investment Initiative (FII) in Riyadh, SoftBank CEO Masayoshi Son… pic.twitter.com/PRolZAxMre

— Alvin Foo (@alvinfoo) December 27, 2024

The Power of Late-Stage Investments

Private companies are staying private longer, delaying public market entry and retaining significant value creation within their late-stage growth phases. Investors who can access these rounds are positioned to capture outsized returns—an opportunity that was historically limited to large institutional players.

Moreover, late-stage investments often involve mature companies with established product-market fit, robust revenue streams, and experienced leadership. These characteristics make them particularly appealing to investors seeking to balance growth potential with relative risk mitigation.

Advanced technologies are critical to stopping climate change—and the drive to develop and scale them is accelerating. Here are five themes that could attract $2 trillion of annual investment.

— A Better Innovation (@ABetterInnovat1) December 27, 2024

Source @McKinsey Link https://t.co/bxmhZBtlix? rt @antgrasso #Sustainability #ESG pic.twitter.com/fCzg3kUsWy

Efficiency Meets Opportunity

The integration of digital platforms into the investment process has revolutionised efficiency. Investors can now review detailed metrics, evaluate terms, and execute investments—all from their devices. This ease of access contrasts sharply with the time-intensive processes of traditional private equity and venture capital, opening the door to a new cohort of sophisticated investors.

Beyond convenience, the use of AI and data analytics is enabling platforms to identify market trends and assess risks with exceptional precision. These advancements are empowering investors to navigate complex opportunities and position themselves strategically within the high-tech investment landscape.

Building Tech Ecosystems is key to unlocking Europe's deep tech growth potential.

— Peter van Sabben (@sabben) December 27, 2024

While widely acknowledged, governments and public-private organizations still need to take this opportunity more seriously.

The power law and unicorn flywheel remain the most effective ways to… pic.twitter.com/G6TfnRkTIt

A New Phase of Accessibility and Growth

The evolution of high-tech investments is more than just a shift in access—it’s a redefinition of who can participate and how value is created. As the industry moves toward greater inclusivity and efficiency, the role of platforms will be pivotal in shaping the future of private investments.

By aligning with trusted lead investors, embracing technological advancements, and fostering transparent ecosystems, the next wave of high-tech investment platforms has the potential to drive growth—not just for individual portfolios, but for the broader innovation economy.

financemagnates.com

financemagnates.com