SPX has extended its gains and risen by another 15% on Monday. This double-digit price hike has made it the market’s top gainer over the past 24 hours.

However, the growing bearish sentiment surrounding the cryptocurrency raises concerns about a potential price correction in the coming days.

SPX6900 Sees Surge in Short Bets

Since January 1, the SPX6900 price has been on an impressive streak, setting new all-time highs daily. On January 5, the token’s price climbed to a new all-time high of $1.56. With a 15% gain in the past 24 hours, SPX may seem poised to extend its gains.

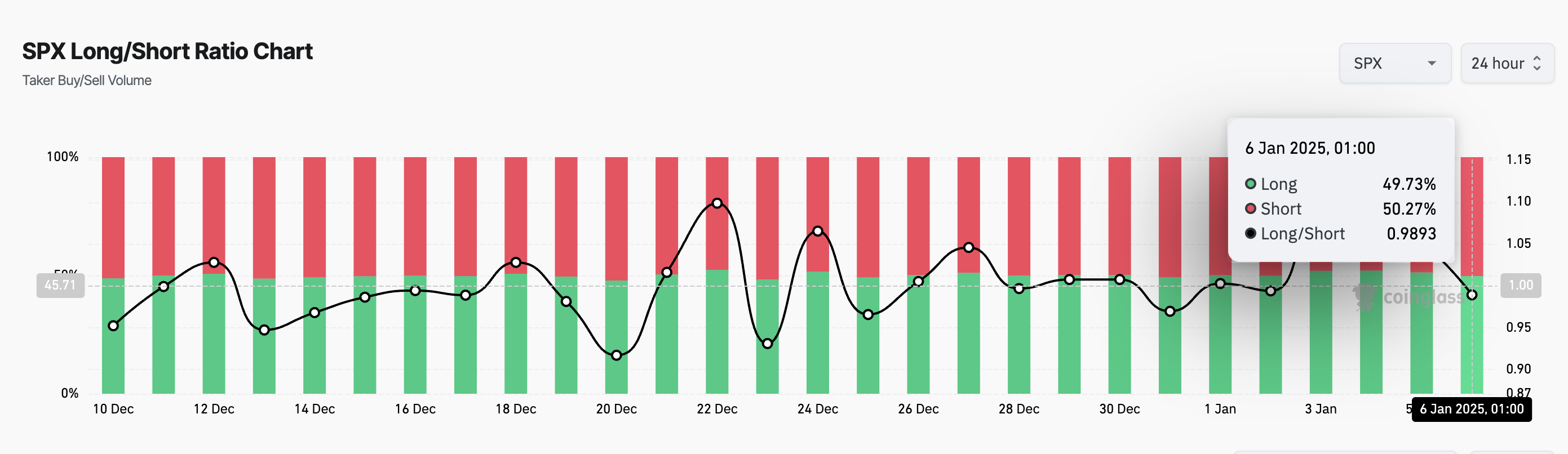

However, the growing bearish sentiment toward the altcoin could create roadblocks in the short term. Despite its price hike, SPX futures traders have begun placing short bets in anticipation of a price dip. This is reflected in its Long/Short Ratio, which is 0.98 at press time.

An asset’s Long/Short Ratio compares the number of its long (buy) positions to short (sell) positions in a market. As with SPX, when its value is below one, more traders are betting on the price falling (shorting) rather than rising. If short sellers continue to dominate, this can create downward pressure on the price.

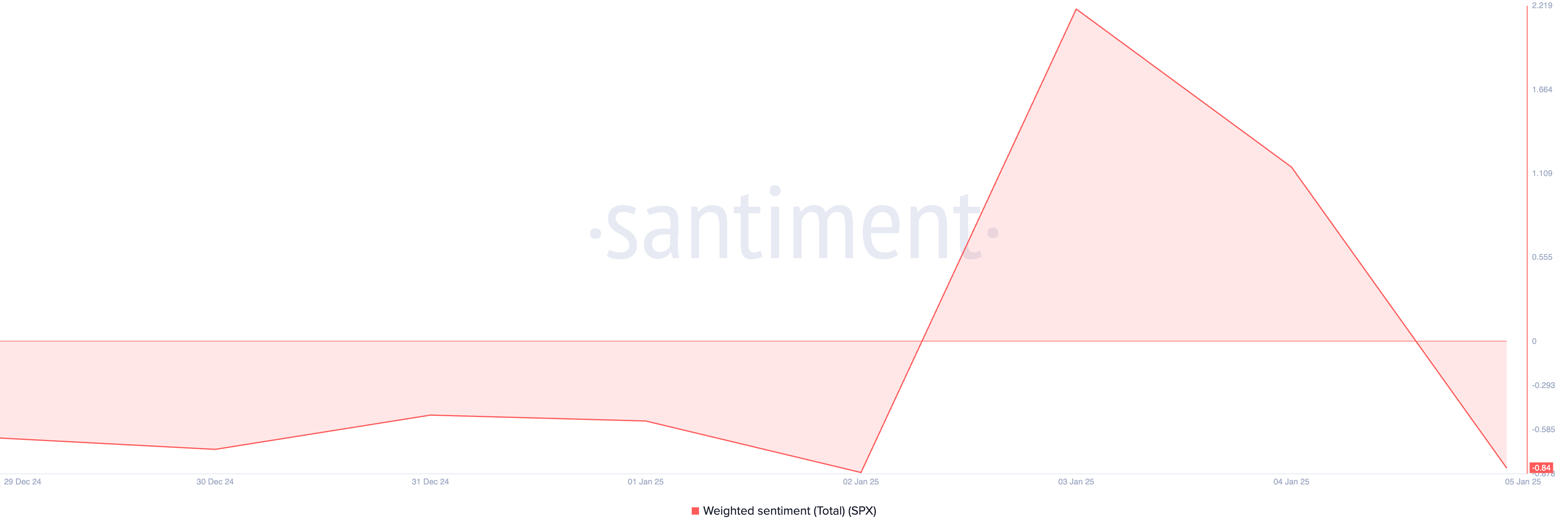

Notably, SPX’s weighted sentiment, which measures the overall positive or negative sentiment towards it, confirms this growing bearish bias. At press time, this is -0.84.

A value below one indicates a negative bias in the sentiment surrounding the asset. It means there are significantly more negative mentions than positive mentions, which may impact the asset’s price.

SPX Price Prediction: Correction or New High?

On the daily chart, SPX is overbought, as reflected by its Relative Strength Index (RSI), which is at 79.33 as of this writing.

The RSI indicator measures an asset’s oversold and overbought market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. Conversely, values below 30 suggest that the asset is oversold and may witness a rebound.

At 79.33, SPX’s RSI indicates that it is heavily overbought, suggesting a potential price correction or reversal may be imminent. If this happens, its price may dip to $1.18.

On the other hand, if the uptrend continues, the SPX6900 price could touch a new all-time high, potentially triggering a short squeeze.

beincrypto.com

beincrypto.com