Quant ($QNT) crypto is showing signs of significant bullish momentum, with technical analysis indicating a potential breakout, according to analyst VipRoseTr. The cryptocurrency has completed a harmonic pattern and is bouncing off key support zones, suggesting the start of a sustained rally.

“$QNT just completed a harmonic pattern and is bouncing off key support zones.” wrote VipRoseTr.

Fibonacci levels highlight $148.1, $187.1, and $223.3 as critical resistance targets for $QNT, with the possibility of an explosive run beyond $223.3.

VipRoseTr emphasizes that recent retracements have created lucrative buying opportunities for Quant. The harmonic pattern, a recognized indicator of trend reversals, has been confirmed as $QNT rebounded from the $95-$100 support zone, coinciding with the 0.786 Fibonacci retracement level.

This key support level has historically acted as a launchpad for upward moves, making the current setup particularly compelling for traders.

Support and Resistance Levels Critical for Price Action

From the chart analysis, there are several support and resistance levels that have been identified as key for $QNT’s next trend. The $95-$100 level is considered as a key support level, which prevents the price from falling down and indicates the price range.

At the same time, the price range from $113 to $117 acts as the short-term support level, which holds the price during the temporary pullbacks during the day.

On the resistance side, $148.1 is the main level that the traders should focus on. It is the first significant level the since the beginning of the year, it coincides with the 0.236 Fibonacci level. The next major level at $187.1 which is the 0.382 Fibonacci extension will become the focus once this resistance is broken.

Ultimately, $223.3 serves as both a psychological and technical level, with VipRoseTr indicating that a breakout above this level could lead to further price gains.

The breakout from a descending channel also confirms the bullish sentiment for Quant crypto. This pattern reversal indicates that buyers are regaining confidence. More strength is gradually mounting that may lead to a sustained advance.

Quant Crypto Price Analysis and Market Standing

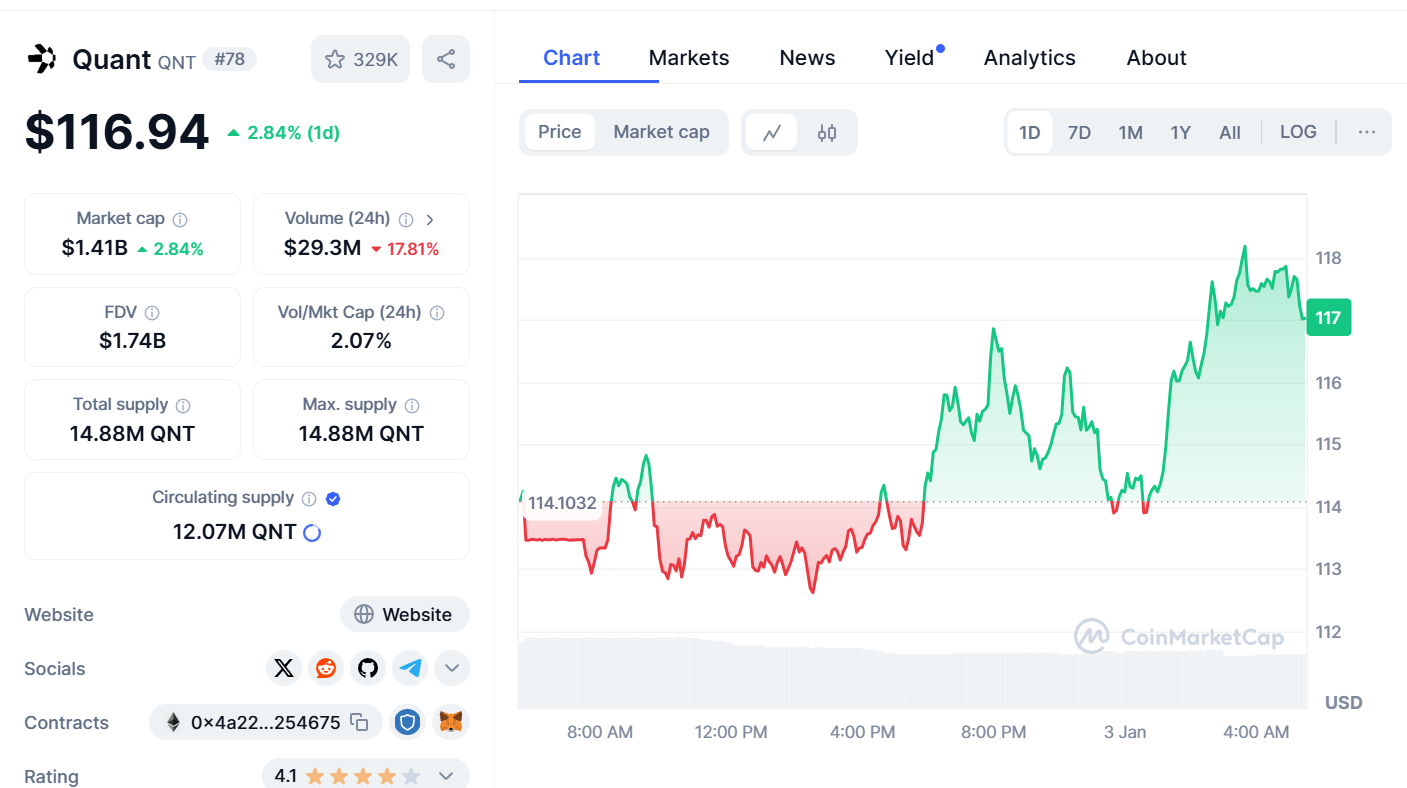

Quant crypto market performance in the last 24 hours shows that there is increased confidence among investors. As of this writing, the token is hovering around $116.94 with a 2.84% surge.

The coin has been oscillating between $114.10 and $117.00, which can only suggest that buyers are back in the game.

Quant’s market capitalization has also been on the rise to $1.41 billion. This is a 2.84% change showing that many investors still have confidence in Quant.

Nevertheless, trading volume remains fairly high as the 24-hour trading volume has dropped by 17.81% to $29.3 million. Nevertheless, the price increase over the past few days points to good demand and sustained bullish outlook.

As of writing this, 81% of the total supply of Quant is in circulation making it a low supply asset. Such scarcity factor may replenish the price appreciation during bull runs, thus magnifying the effect of positive market sentiment.

Bullish and Bearish Outlooks for $QNT

If the bulls break past the first resistance at $117, $QNT may surge towards $120, an important psychological level.

However, strengthening momentum and increased trading volume are expected to drive further gains. Price levels of $148.1 and $187.1 as key intermediate targets. If the price touches and breaks through $223.3, it could spark a massive rise that VipRoseTr pointed out.

To the downside, a break below $114 might lead to a retracement to the $110 level. A further reduction in trading volume could weaken buyer interest and result in support and resistance within a lower range.

thecoinrepublic.com

thecoinrepublic.com