Hyperliquid ($HYPE) price is attempting to recover as market activity stabilizes following a turbulent December. $HYPE is up from oversold RSI levels, currently at 44.4, suggesting potential consolidation in the short term.

The platform’s daily flows, which hit a negative record of -$243 million on December 23, have since balanced between -$18 million and $28 million, reflecting a more stable market sentiment. With key resistance at $28.95 and support at $22, the coming days will likely determine whether $HYPE can sustain its recovery or face a further decline.

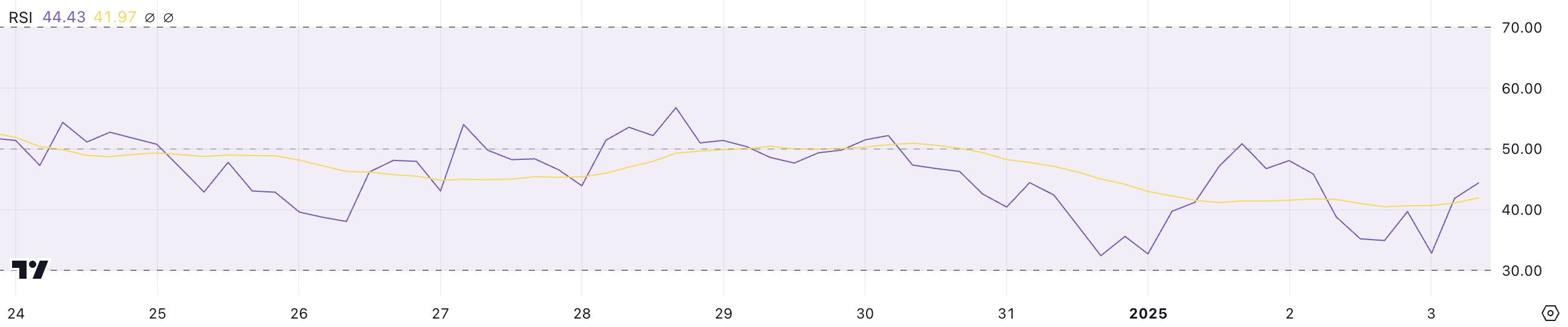

$HYPE RSI Has Been Neutral Since December 15

$HYPE, one of the biggest airdrops of 2024, currently shows its Relative Strength Index (RSI) at 44.4, reflecting a notable increase from 32.8 in recent days. The RSI, a widely used momentum indicator, measures the speed and magnitude of price movements on a scale from 0 to 100.

Values below 30 indicate oversold conditions, suggesting a potential price rebound, while values above 70 signify overbought conditions, often pointing to a possible correction. With an RSI of 44.4, $HYPE remains in the neutral zone, indicating a balance between buying and selling pressure.

Since December 15, Hyperliquid RSI has consistently hovered in the neutral range, reflecting a lack of strong momentum in either direction. This neutral positioning suggests that $HYPE may continue to consolidate in the short term unless a significant shift in market sentiment occurs.

While the recent uptick in RSI indicates a slight increase in buying pressure, it remains below the critical threshold of 50, signaling that bullish momentum is still subdued. For $HYPE to gain stronger upward momentum, its RSI would need to break into more bullish territory above 50, potentially driving further price action.

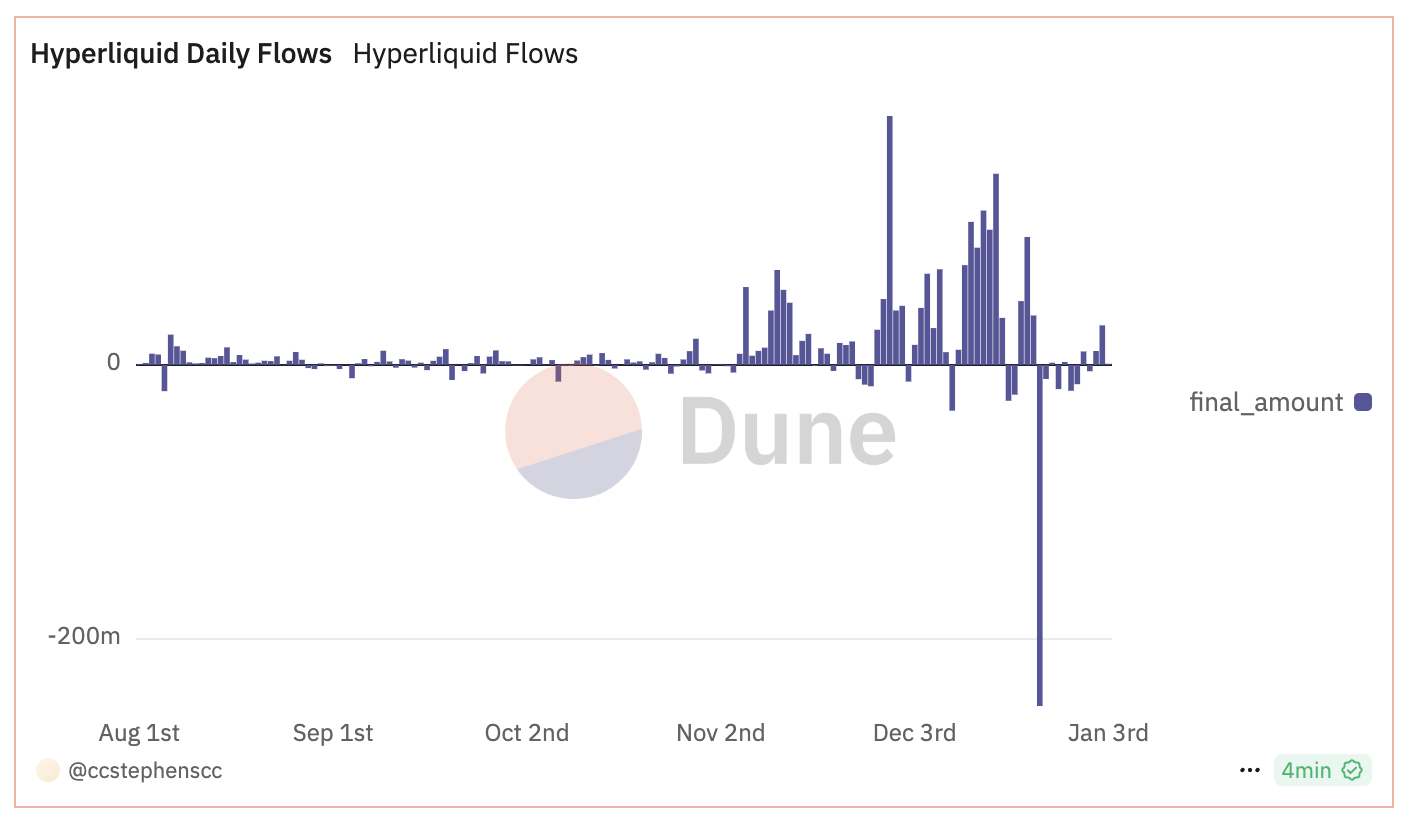

Hyperliquid Flows Reached a Negative Record

Hyperliquid reached an impressive record of $181 million in flows on November 29, 2024, reflecting significant trading activity and investor interest. Following this peak, the platform experienced fluctuating flows, with a consistent streak of positive daily flows exceeding $70 million between December 11 and December 16.

These flows are a measure of the net capital entering or exiting the platform, providing insights into market sentiment and liquidity. Positive flows typically indicate growing interest and confidence, supporting price stability or growth.

However, on December 23, Hyperliquid recorded a sharp outflow of -$243 million, marking a negative milestone. Since then, flows have stabilized, fluctuating between -$18 million and $28 million. This stabilization suggests that market sentiment is balancing after the significant outflows, with neither strong accumulation nor intense selling pressure dominating.

In the short term, this could mean that $HYPE price may consolidate as the market seeks equilibrium. Further upward movement in flows could reignite bullish momentum, while persistent negative flows might signal a potential downside risk.

$HYPE Price Prediction: Will the Downtrend Continue?

$HYPE price is currently attempting to reverse its recent downtrend and regain upward momentum. If the recovery continues, the price could test the resistance at $28.95, showing the previous rise wasn’t fueled just because of the airdrop.

A successful breakout above this level could pave the way for further gains. The next targets, $31.40 and $35.20, signal a stronger bullish phase.

Conversely, if the downtrend persists and selling pressure intensifies, $HYPE may test its immediate support at $22.00. Should this support fail to hold, the price could decline further to $14.99, marking a significant 37% correction.

beincrypto.com

beincrypto.com