$FARTCOIN has surged by 27% in the past 24 hours, reaching a new all-time high of $1.36. However, the rally has prompted increased profit-taking, as investors capitalize on recent gains.

This selling pressure could be a significant barrier, preventing the $FARTCOIN price from breaking through its previous peak. This analysis explains why.

$FARTCOIN’s Double-Digit Rally Faces Risk

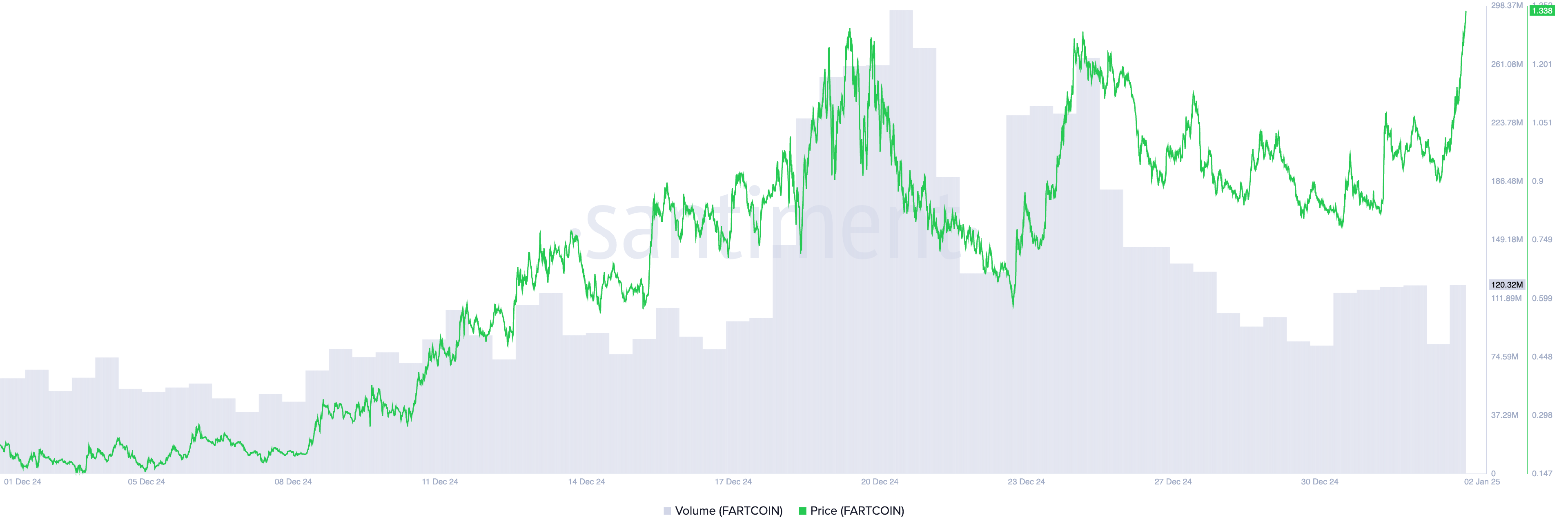

While $FARTCOIN’s price has spiked double-digits over the past 24 hours, its trading volume has plummeted, creating a negative price/trading volume divergence.

When an asset’s price rallies while trading volume drops, it indicates a lack of broad participation among traders. This scenario often raises concerns about the rally’s sustainability, as low volume can signal weaker market conviction. Without strong buying activity, $FARTCOIN’s price increase may be vulnerable to reversal if selling pressure emerges.

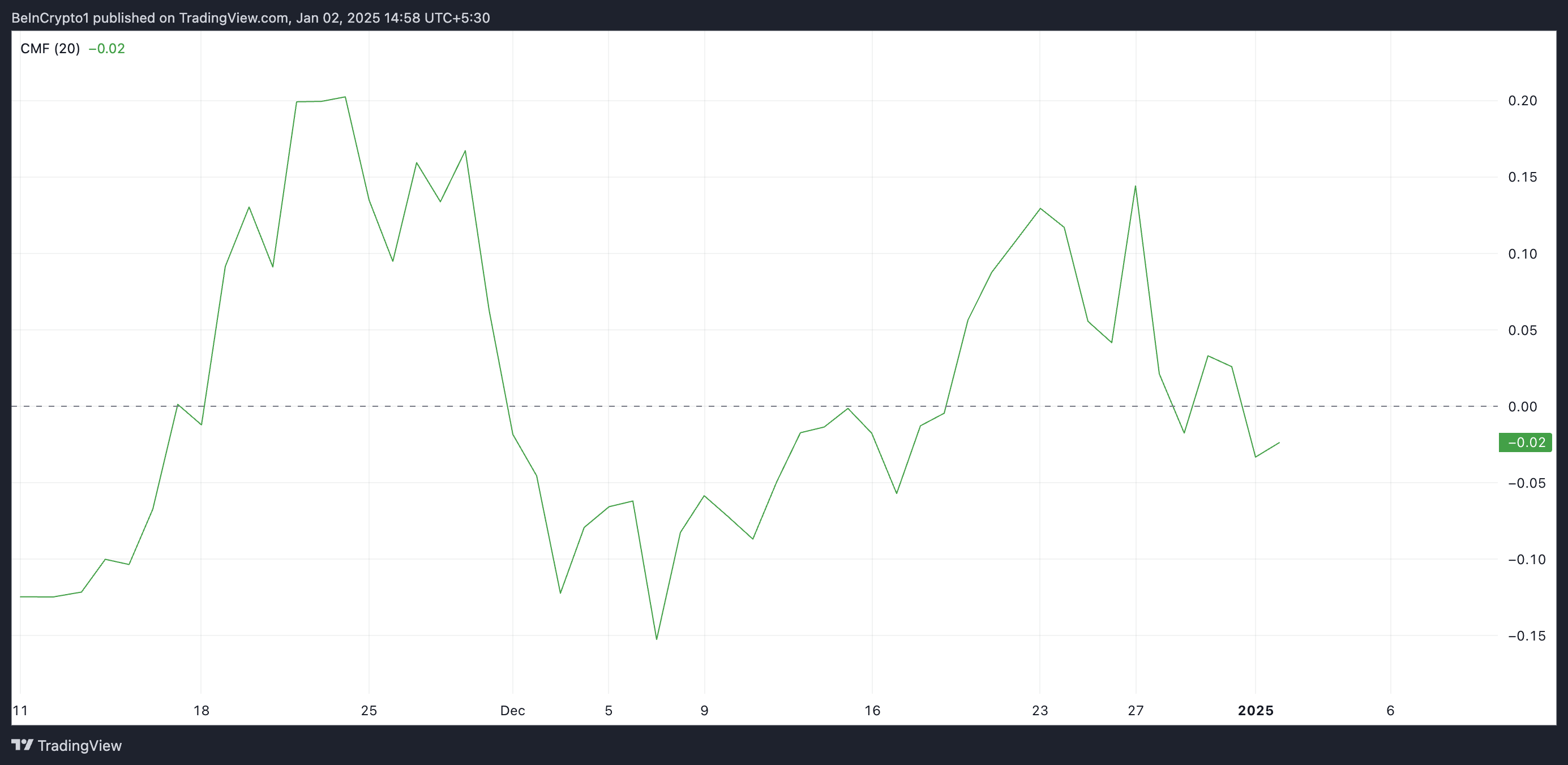

Notably, the meme coin’s negative Chaikin Money Flow (CMF) confirms that selling activity is already underway as traders take advantage of the price hike. As of this writing, this is at -0.02.

The CMF indicator measures the flow of money into and out of an asset. When its value is negative during a price rally, a bearish divergence is created.

This divergence suggests that despite the rising prices, selling pressure is dominating the market. It signals a lack of conviction behind the rally, hinting at weakness. If the negative CMF persists, it raises the risk of a price reversal, as strong inflows of capital may not support the rally.

$FARTCOIN Price Prediction: Is the Meme Coin Poised for a New Peak?

$FARTCOIN risks shedding its recent gains if selling pressure strengthens further. In that case, the meme coin will witness a pullback to $0.56.

If that support level fails to hold, $FARTCOIN’s price may dip further to $0.44. On the other hand, if the uptrend persists, the $FARTCOIN token price may climb to a new peak.

beincrypto.com

beincrypto.com